Daily Market Outlook - Tuesday, June 3

Image Source: Pixabay

US equity-index futures declined following a late rally in the S&P 500 on Monday, as investors anticipated updates on trade negotiations between President Trump and China's Xi. Contracts for the S&P 500 and Nasdaq 100 fell, while those for European equities remained stable. The Dollar strengthened against all of its Group-of-10 peers. Asian markets showed little change overall, although Hong Kong gained ground due to potential stimulus measures. Treasuries remained steady after a successful auction of Japanese government bonds, which saw strong demand. The offshore Yuan moved closer to its onshore equivalent as the US called for discussions between Trump and Xi. In the meantime, China's manufacturing sector experienced its most significant downturn since September 2022. In another development, Russia and Ukraine wrapped up a second round of talks in Istanbul, which did not advance peace negotiations but did lay the groundwork for a new prisoner exchange. Regarding commodities, oil prices rose for a second consecutive day as a weaker Dollar made goods priced in the currency more appealing, while geopolitical tensions raised concerns over possible supply reductions from Russia and Iran. Gold prices fell by 0.5% on Monday as trade anxieties pushed investors towards safe-haven assets.

For UK rates market participants, Mann’s speech on QT is pivotal. She challenges the BoE’s view that QT operates passively, questioning if larger Bank Rate cuts are needed to counter QT's tightening effect. While her conclusion is nuanced and leans against significant cuts, her remarks spark debate on QT’s impact ahead of the September MPC vote. Mann highlights the differing dynamics of QT during rate hikes versus cuts, though her stance may not reflect the entire Committee. Notably, her reference to the Market Participants’ Survey (£75bn QT consensus) suggests careful consideration. Markets sense that some active QT will continue next year as the BoE transitions to a repo-focused balance sheet. The gilt supply calendar for July-September highlights a shift toward shorter average maturities in new issuance. Only three long-dated (>15yr) conventional auctions are scheduled, down from the usual five, while short-dated (<7yr) auctions increase to seven, compared to five or six previously. Within sectors, average maturities are also shortening, with the overall average maturity of gilt supply projected to fall below ten years next quarter—the first time this century. The DMO emphasised this strategy shift in an FT article, signalling a clear message to the market. However, the steep curve reflects market caution about potential upward revisions to overall supply later this year.

On Tuesday, the main event for Europe will be the release of euro zone inflation statistics for May, which precedes an anticipated interest rate reduction by the European Central Bank (ECB) later in the week. It is expected that consumer price inflation has decreased to an annual rate of 2.0% from April's unexpectedly high rate of 2.2%. However, investors will be focused on the implications of this data for the ECB's future rate path. The ECB is widely expected to lower its rates by a quarter point to 2.0% on Thursday, but traders are sensing that there may be a pause afterward as the economy performs better than expected and concerns about long-term inflation begin to re-emerge. Stateside US durable goods orders and job openings are the main macro prints; Fed speakers include Fed’s Goolsbee, Cook & Logan.

Overnight Headlines

- Fed’s Goolsbee: Rate Cuts Still Likely If Tariff Dust Settles

- BoE’s Mann: QT Impact Must Be Reconsidered Amid Rate Cuts

- BoJ May End Bond Purchase Cuts Next Fiscal Year

- Yen Weakens On Possible Dovish Signs In BoJ Gov Ueda’s Comments

- RBA Opted For Smaller Rate Cut To Preserve Policy Predictability

- RBA’s Hunter Sees US Tariffs Dragging On Australian Growth, Jobs

- Saudi Aramco Raises $5B In Bond Sale As Oil Prices Weigh

- Oil Climbs As Geopolitical Risk Outweighs OPEC+ Output Boost

- EU Warns It Could Accelerate Retaliatory Measures Over Trump Tariffs

- Trump Tariffs Deal Major Blow To EU Steelmakers, Salzgitter Warns

- Senate To Review Trump’s ‘Revenge’ Tax Bill As Wall Street Worries

- China’s Manufacturing PMI Tumbles Into Contraction As Orders Drop

- China’s New Trade Negotiator Is Ready To Play Hardball

- UK To Strengthen Nuclear Deterrence In New Defence Strategy

- Musk’s xAI Seeks $113B Valuation Via $5B Debt Sale

- Microsoft, Disney Confirm New Round Of Layoffs Across Units

- Snowflake To Acquire Crunchy Data For $250M

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1300-10 (1.12BLN), 1.1325-30 (419M), 1.1340-50 (4.2BLN)

- 1.1365-75 (530M), 1.1395-00 (2.1BLN), 1.1420 (358M), 1.1450 (1.0BLN)

- USD/JPY: (401M), 142.00 (385M), 143.00 (629M), 142.25-35 (212M)

- 143.50 (264M)

- USD/CHF: 0.8175 (530M), 0.8230 (682M)

- GBP/USD: 1.3550-60 (390M). EUR/GBP: 0.8370 (366M)

- AUD/USD: 0.6400 (411M), 0.6415-20 (1.21BLN), 0.6450 (350M)

- 0.6500-10 (1.6BLN), 0.6535 (373M)

- NZD/USD: 0.5900 (260M), 0.6100 (375M)

- AUD/NZD: 1.0790 (209M), 1.0900 (218M)

- USD/CAD: 1.3600 (200M), 1.3700 (1.1BLN), 1.3785 (200M)

- USD/ZAR: 17.6860 (300M)

CFTC Data As Of 30/5/25

- The net long position in Japanese yen stands at 164,012 contracts, while the euro net long position is at 79,474 contracts. The British pound holds a net long position of 35,379 contracts. Conversely, the Swiss franc indicates a net short position of -25,483 contracts, and Bitcoin shows a net short position of -2,274 contracts.

- Equity Fund Managers have reduced their net long position in the S&P 500 CME by 17,892 contracts, bringing it down to 854,528 contracts. Moreover, Equity Fund Speculators have decreased their net short position in the S&P 500 CME by 39,763 contracts, resulting in a total of 257,465 contracts.

- Speculators have also cut their net short position in CBOT US Treasury bonds futures by 18,143 contracts, which now stands at 53,890 contracts. Similarly, CBOT US Ultrabond Treasury futures' net short position has been lowered by 12,663 contracts to 233,472 contracts. The net short position for CBOT US 2-Year Treasury futures has been trimmed by 147,428 contracts to reach 1,119,903 contracts. Additionally, the net short position for CBOT US 10-Year Treasury futures has been reduced by 81,827 contracts to 769,604 contracts. On the other hand, speculators have increased their net short position in CBOT US 5-Year Treasury futures by 57,296 contracts, leading to a total of 2,333,237 contracts.

Technical & Trade Views

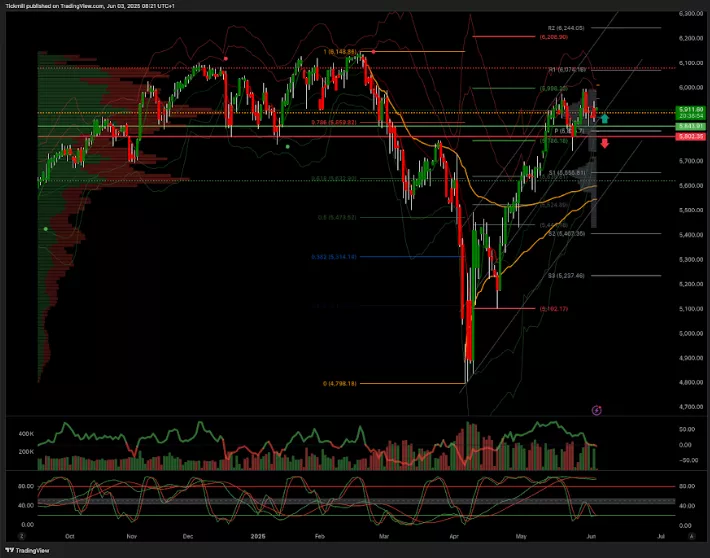

SP500 Pivot 5900

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5610

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.1060 target 1.09

(Click on image to enlarge)

GBPUSD Pivot 1.3290

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.3290 target 1.38

- Below 1.32 target 1.31

(Click on image to enlarge)

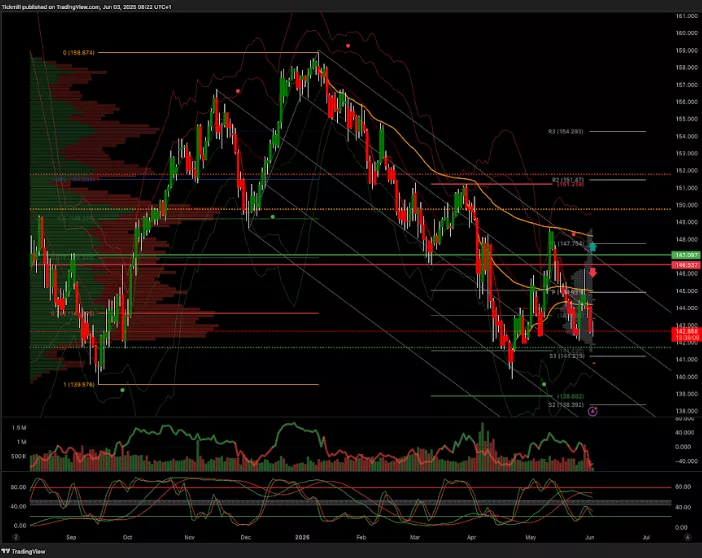

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

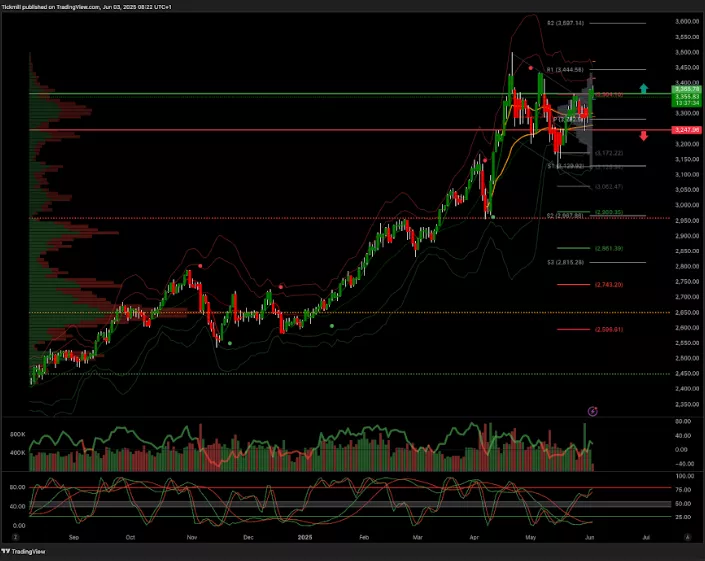

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 3400 target 3600

- Below 3365 target 2981

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, June 2

S&P 500 Weekly Action Areas & Price Targets - Monday, June 2

Daily Market Outlook - Monday, June 2