Daily Market Outlook - Wednesday, July 2

Image Source: Pixabay

Stocks remained within a narrow range as investors refrained from increasing their positions in anticipation of the US June payroll data set to be released on Thursday. Japanese stocks fell following President Donald Trump’s recent tariff threats. Futures for the S&P 500 rose, while a broad index of Asian stocks remained unchanged, recovering most of their earlier declines. The Nikkei-225 Stock Average declined by 0.2% after Trump indicated he might raise tariffs on Japan and criticised the country for not accepting US rice exports. The dollar index moved closer to a three-year low established on Tuesday. Investors are paying close attention to economic indicators and escalating trade tensions, particularly following Trump's announcement that he would not postpone the July 9 deadline for implementing increased tariffs on trading partners. Stock markets, which previously reacted sharply to trade news, now seem to perceive minimal risk, with equity indexes hovering near record highs. This stability is likely influenced by expectations that Trump may extend the tariff deadline, given his history of initially threatening and ultimately backing down. The June employment report, scheduled for release on Thursday due to the July 4 holiday on Friday, is anticipated to reveal a slowdown in job growth to approximately 110,000 new positions, down from 139,000 the previous month, according to economists. The unemployment rate is expected to rise slightly to 4.3%. For the Federal Reserve, which is seeking more insight into the potential inflation effects of tariffs, any significant decline in the labour market could increase the pressure on officials to reduce interest rates.

Preliminary June Eurozone inflation aligned with expectations, with the headline HICP measure easing to 2.0% year-on-year and core inflation holding steady at 2.3%. While these figures may not reflect significant change, they support the ECB’s trajectory toward achieving its inflation targets in the latter half of the year. Additionally, the latest consumer survey indicated a slowdown in inflation expectations—12-month projections fell to 2.8% from 3.1%, and 3-year projections edged down to 2.4% from 2.5%—accompanied by tempered assumptions for wage growth. With an appreciating euro and a decline in energy prices, the overall environment remains tilted toward disinflation. The immediate risk appears more likely to be an undershoot of the inflation target rather than an overshoot. However, challenges persist. External uncertainties, particularly unresolved tariff issues, remain elevated. Although these are unlikely to pose a direct inflationary threat, as seen in the U.S., central bankers tend to act based on tangible outcomes rather than theoretical risks. Meanwhile, hawkish policymakers have expressed concern over more expansionary fiscal measures, even when these are investment- or supply-side-focused. Such concerns appear to lack sufficient weight to disrupt the majority consensus within the Governing Council. Considering the balance of risks, there appears to be room for further policy easing after the summer.

Domestically yesterday, the OBR released its Forecast Evaluation Report, acknowledging that it had consistently overestimated real GDP growth at the five-year horizon by an average of 0.7 percentage points per year. Notably, the only instances of underestimating growth at this horizon occurred during the pandemic years, a period marked by exceptional uncertainty. This pattern underscores the view that the OBR’s medium-term GDP forecasts have exhibited a persistent upside bias. The report also mentioned that the OBR will undertake its annual ‘supply stocktake’ over the summer, which includes research into the potential output forecast—a critical factor in shaping medium-term GDP projections. Consequently, there is a significant risk that reflecting on the findings of the Forecast Evaluation Report could lead to a downward revision of optimistic growth forecasts. As previously highlighted, the OBR itself has admitted that fiscal headroom is so narrow that even a modest shock of 0.1 percentage points per year to GDP could eliminate it entirely. Compounding this issue, the government has recently made further concessions to backbenchers in terms of spending cuts, heightening the likelihood of additional tax increases in the Autumn Budget. Such measures may be necessary to restore a buffer against the fiscal rule, given the precarious state of fiscal headroom.

Overnight Headlines

- EU Blocks Britain’s Attempts To Join Pan-European Trading Bloc

- Trump: Israel Agrees To 60-Day Gaza Ceasefire Proposal

- Trump: Won’t Extend July 9 Deadline, Doubts Japan Deal

- Fed Rate Cut Bets Rise After Powell Doesn’t Rule Out July

- US Treasury Bessent: Fed Could Lower Rates By September

- US Banks Announce $50B+ In Payouts After Fed Stress Test

- Nasdaq Beats NYSE In H1 IPO Listings On Blockbuster Deals

- JPMorgan Chase Approves $50B Buyback, Raises Dividend

- Tesla Shares Drop On Trump-Musk Feud Ahead Of Q2 Deliveries

- Constellation Brands Misses Quarterly Estimates Amid Tariff Woes

- Centene Withdraws 2025 Guidance, Shares Plunge

- Warner Music To Cut Jobs In $300M Cost Plan

- Intralot To Acquire Bally’s Interactive In $3.18B Deal

- Alibaba Expands AI Cloud Services In Malaysia, Philippines

- China Uses Special Bonds To Buy Unsold Homes, Repay Debts

- Australian Retail Sales Miss Estimates, Adding To Rate-Cut Case

FX Options Expiries For 10am New York Cut

- (1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1700 (2.6BLN), 1.1725 (1.6BLN), 1.1775 (1.4BLN), 1.1785-90 (1BLN)

- 1.1795-1.1800 (3.4BLN), 1.1825 (860M), 1.1900 (1.1BLN)

- USD/CHF: 0.7925 (480M), 0.7990 (260M), 0.8050 (200M)

- GBP/USD: 1.3650 (200M), 1.3750 (194M), 1.3950 (236M)

- EUR/GBP: 0.8600 (251M)

- AUD/USD: 0.6550 (806M), 0.6750 (1.6BLN). NZD/USD: 0.6100 (372M)

- USD/CAD: 1.3625 (450M), 1.3675-80 (352M), 1.3745-50 (401M), 1.3800 (1BLN)

- USD/JPY: 142.00 (651M), 142.75 (360M), 143.00 (555M), 143.50 (305M)

- 144.00 (598M), 144.75 (716M)

CFTC Positions as of the Week Ending June 27th

- Speculators have raised the net short position in CBOT US 5-year Treasury futures by 20,348 contracts, reaching 2,463,629. They have also reduced the net short position in CBOT US 10-year Treasury futures by 72,768 contracts, bringing it down to 680,131. The net short position for CBOT US 2-year Treasury futures has increased by 63,807 contracts, totaling 1,230,204. In CBOT US UltraBond Treasury futures, the net short position is up by 19,812 contracts, now at 209,526. Additionally, the net short position for CBOT US Treasury bonds futures has increased by 27,610 contracts, amounting to 101,785.

- Equity fund speculators have decreased their net short position in the S&P 500 CME by 50,029 contracts to 269,039, and equity fund managers have lowered their net long position by 1,646 contracts to 841,226.

- The net FX long positions: Japanese yen at 132,277 contracts, Euro at 111,135 contracts, British pound at 34,395 contracts, while the Swiss franc has a net short position of -20,944 contracts and Bitcoin holds a net short position of -2,161 contracts.

Technical & Trade Views

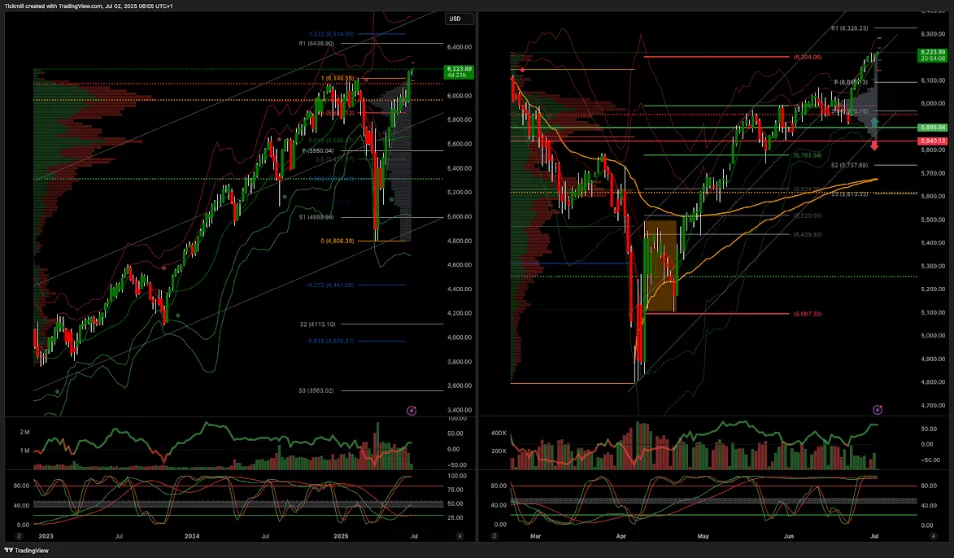

- SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5700

(Click on image to enlarge)

- EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

- GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

.webp)

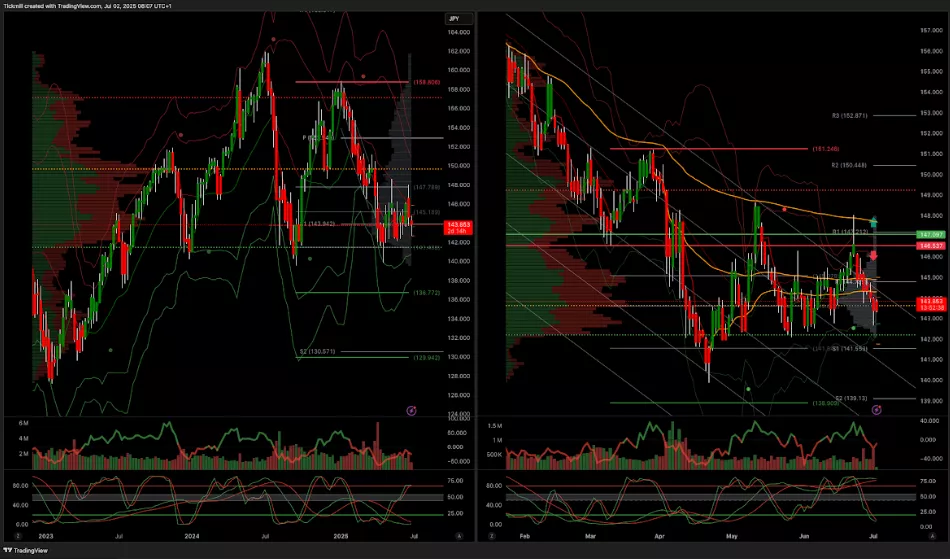

- USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

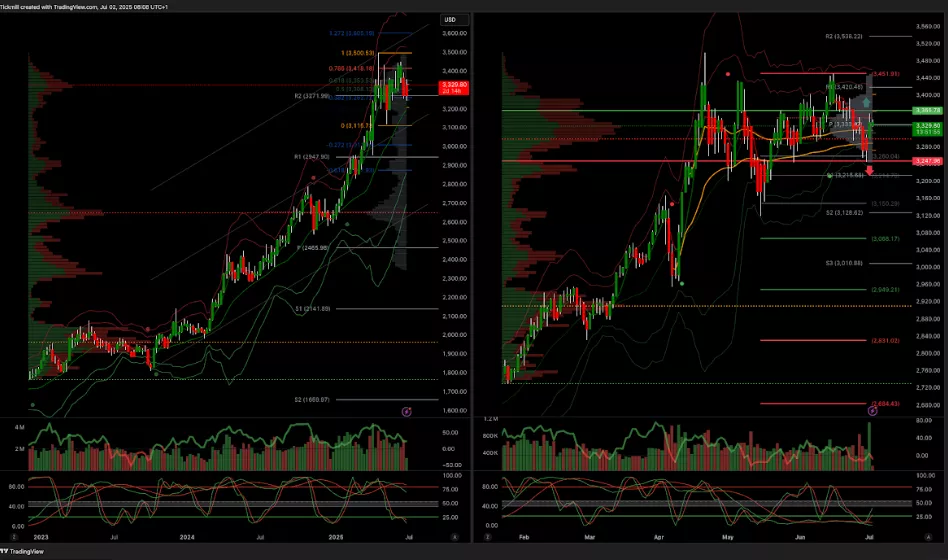

- XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

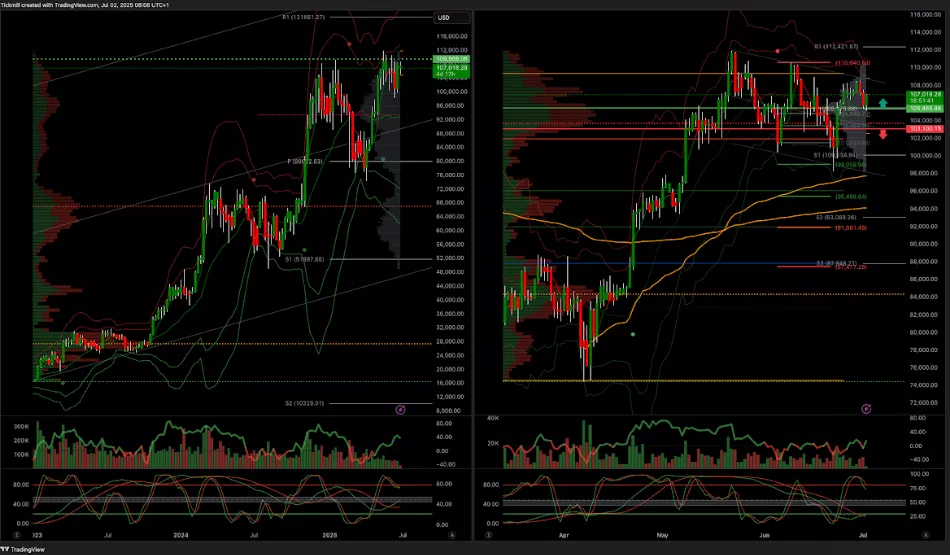

- BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, July 1

S&P 500 Weekly Action Areas & Price Targets - Monday, June 30

Daily Market Outlook - Monday, June 30