Daily Market Outlook - Wednesday, April 23

Image Source: Pixabay

Trump's comments on China and Federal Reserve Chair Jerome Powell have temporarily boosted market sentiment. In a familiar pattern with the Trump administration, market analysis often changes from one day to the next. Today, the mood is risk-on! Trump has clarified that he 'never intended' to remove Powell from the Federal Reserve. Additionally, his approach to trade with China has softened, indicating that tariffs 'will decrease significantly but won't reach zero.' Previously, Bessent mentioned that the 145% tariffs on China were unsustainable. Adding to the positive outlook, Vice President Vance made promising remarks about a potential US-India trade agreement. In contrast to yesterday's decline in equities and the Dollar—which saw gold and the Yen rise—today's market action presents a a brighter picture. The S&P 500 has jumped over 2.5%, with futures gaining an additional ~1.5% overnight. After experiencing peak risk aversion that pushed USDJPY down to 140 yesterday, it has rebounded, briefly touching 143 in the overnight session. The bond market saw a lackluster $69 billion 2-year US Treasury auction, with the clearing rate at 3.795%, a slight increase of 0.6 basis points from the market level. However, the flattening yield curve, reducing the risk premium, has allowed US Treasuries to reflect some positive shifts observed in other asset classes. While the general improvement in sentiment is preferable to further declines, this uptick largely depends on remarks from Trump and his team, which may not provide a solid foundation for lasting market trends. A concern today is that the preliminary April PMIs might begin to reveal negative impacts on businesses due to the looming threat of additional trade barriers and high uncertainty levels.

The UK ONS released the first provisional public finance results for 2024-25, showing a budget deficit of nearly £152bn, which is £15bn higher than the recent OBR forecast. This significant discrepancy highlights challenges with the UK's public finances. Initially, market attention was on the OBR's optimistic economic outlook, but this report reveals inaccuracies even in the short-term projections. Concerns about the government's fiscal strategy will persist leading up to the Autumn Budget. The immediate market focus is the increased deficit, requiring more funding in 2025-26. The DMO plans to raise an additional £5bn by issuing more tbills, avoiding gilts due to their volatility amid global trade fluctuations. Additionally, the gilt remit has shifted towards shorter maturities to ease pressure on long-term bonds, reflecting changing demand and challenging trading conditions post-Liberation Day.

Today's macro slate sees the release of April PMIs, ongoing Spring Meetings of the IMF/World Bank, and the Fed's Beige Book. Central bank representatives speaking today include Bailey, Breeden, Pill, Knot, Villeroy, Lane, Goolsbie, Musalem, and Hammack.

Overnight Newswire Updates of Note

- Donald Trump Says He Has ‘No Intention’ Of Firing Jay Powell

- Trump Says He Won't Play Hardball With China On Trade

- Trsy Bessent Sees US-China Trade De-escalation Talks To Be 'A Slog'

- China Paper Sees Special Bonds Boosting GDP By 1.7–1.9 ppts

- China Asks Korea Not To Supply Products Using Rare Earths To US firms

- Fed’s Kugler: Tariff Impact Likely Larger Than Expected

- ECB’s Rehn Sees Tariffs Pushing Inflation Down in Short Term

- UK Chancellor To Appeal For US Deal At Trsy Meeting In Washington

- Pharma Bosses Call For Higher Drug Prices In EU To Counter Tariff

- Musk Stepping Back From Govt Work Amid Plummeting Tesla Sales

- Capital One Profit Climbs 10% As Credit-Card Spending Increases

- Intel To Announce Plans This Week To Cut More Than 20% Of Staff

- Apollo, Blackstone Lead $4B Loan For Boeing Unit Takeover

- ByteDance, Alibaba, Tencent Stockpile Billions Worth Of Nvidia Chips

- Ryanair Takes Advantage Of Oil Fall To Lock In Cheaper Fuel Costs

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1370-75 (1.8BLN), 1.1385 (538M), 1.1400 (2BLN)

- 1.1450 (440M), 1.1500-10 (1.6BLN)

- USD/CHF: 0.8000 (550M), 0.8350 (230M), 0.8450 (450M)

- GBP/USD: 1.3270 (180M), 1.3320 (268M)

- AUD/USD: 0.6290-00 (3.5BLN), 0.6310-20 (1.5BLN)

- 0.6350-55 (1.5BLN), 0.6375-85 (848M), 0.6400 (872M), 0.6410-15 (400M)

- NZD/USD: 0.5855 (705M)

- USD/CAD: 1.3760-70 (555M), 1.3975 (592M)

- USD/JPY: 140.00 (506M), 141.10-20 (1.1BLN), 142.00 (363M), 142.50 (500M)

- EUR/JPY: 161.55-60 (1.2BLN)

CFTC Data As Of 18/4/25

- The Euro's net long position is at 69,280 contracts, while Bitcoin holds a net long position of 586 contracts. The Japanese yen shows a strong net long position of 171,855 contracts, in contrast to the Swiss franc's net short position of 28,584 contracts. The British pound has a net long position of 6,509 contracts.

- Equity fund speculators have decreased their S&P 500 CME net short position by 47,956 contracts, lowering it to 239,649. In contrast, equity fund managers have increased their S&P 500 CME net long position by 1,812 contracts, bringing it to 805,062.

- Speculators have expanded the net short position in CBOT US 5-Year Treasury futures by 40,000 contracts to 2,061,575, while reducing the CBOT US 10-Year Treasury futures net short position by 140,715 contracts to 937,755. Additionally, the net short position for CBOT US 2-Year Treasury futures has risen by 56,664 contracts to 1,254,773. Speculators have also increased the net short position for CBOT US Ultrabond Treasury futures by 19,747 contracts to 220,057, and for CBOT US Treasury bonds futures by 82,631 contracts to 100,785.

Technical & Trade Views

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5665 target 5792

- Below 5000 target 4755

(Click on image to enlarge)

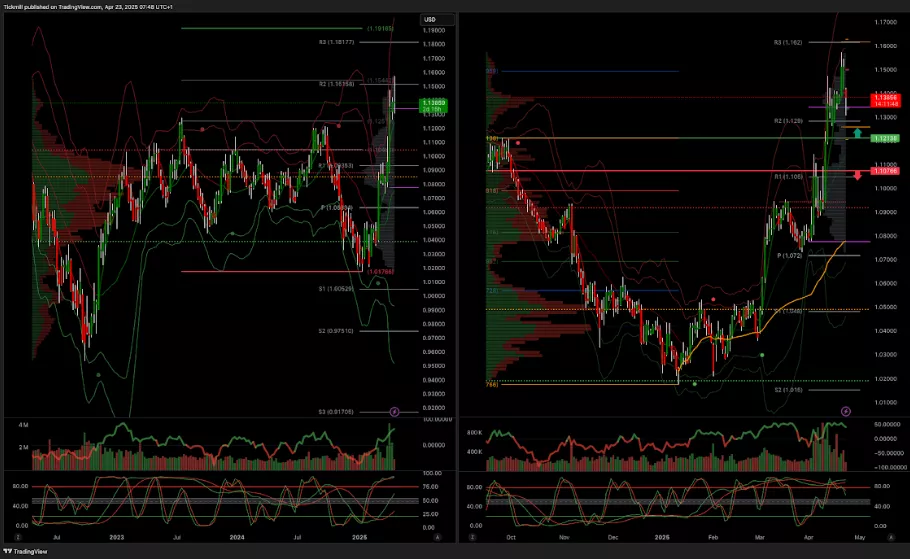

EURUSD Pivot 1.11

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

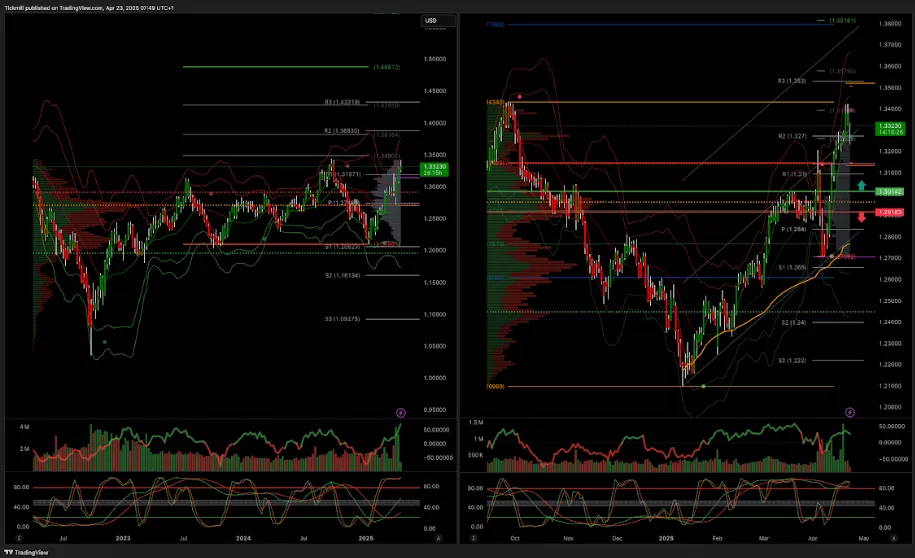

GBPUSD Pivot 1.28

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

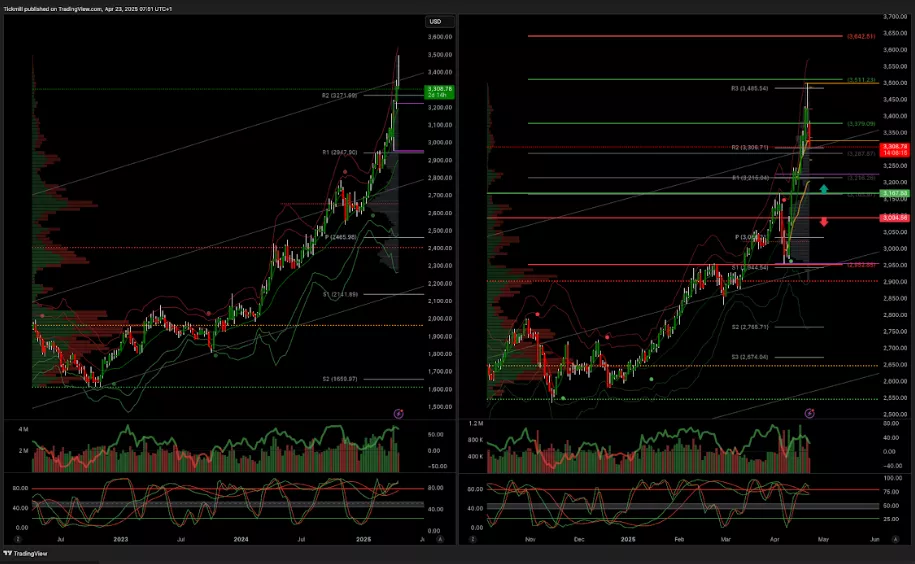

XAUUSD Pivot 3100

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into mid/late April

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

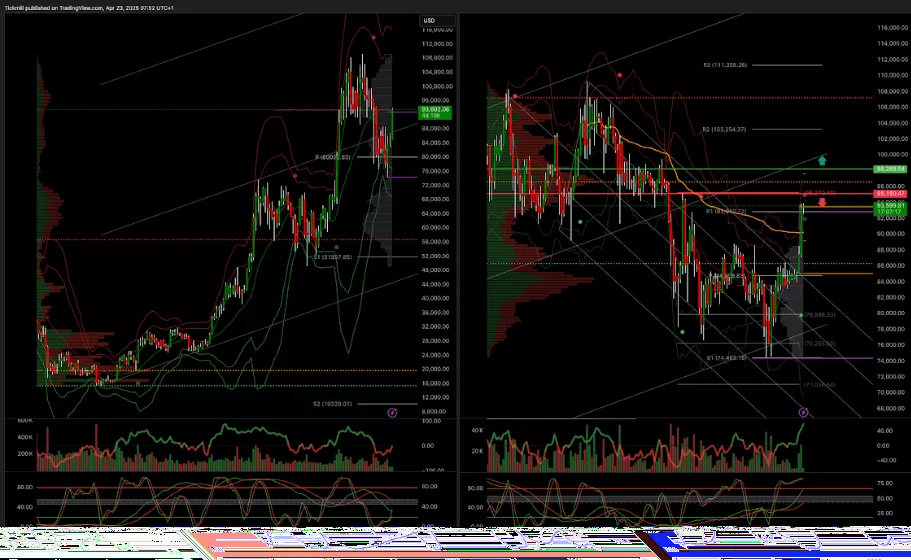

BTCUSD Pivot 90k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into mid/late April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Tuesday, April 22

S&P 500 Weekly Action Areas & Price Targets - Tuesday, April 22

Daily Market Outlook - Tuesday, April 22