Daily Market Outlook - Tuesday, Oct. 7

Image Source: Unsplash

Asian markets printed new record highs, primarily driven by technology stocks and the election of Japan’s first female prime minister, considered to be a pro-stimulus advocate, which has further fuelled the rally. The MSCI Asia Pacific Index rose, setting another record, with chipmakers and tech companies leading the gains following Advanced Micro Devices Inc.'s landmark agreement with OpenAI. Gold prices also saw an increase, reaching record levels with futures touching $4000 as investors sought refuge amid rising political tensions in the US and Europe, however, profit taking has emerged with Gold retreating $25 from the overnight highs. Japanese stocks continued their upward trajectory after Sanae Takaichi's almost assured path to the prime ministership led to a decline in the yen and a rise in long-term bond yields. Declines in Japanese bond futures moderated following a successful 30-year debt auction. Globally, stock markets have consistently achieved new all-time highs despite concerns about a potential US government shutdown and France's deepening political issues. This environment has prompted investors to seek alternatives like gold and Bitcoin, both of which are at record levels. Additionally, a surge in AI-linked collaborations among chipmakers has driven stock prices up, raising bubble concerns reminiscent of the dot-com bubble of the late 1990s. Tech stocks remain a crucial driver of global gains, with the recent AMD-OpenAI partnership being the latest in a series of significant data centre initiatives this year. This follows Nvidia Corp.'s announcement last month of plans to invest as much as $100 billion in OpenAI to meet the growing demand for AI computing infrastructure. With markets in China and Hong Kong closed on Tuesday, attention turned to Japan. Takaichi's victory energised markets on Monday, leading to a surge in stocks amid expectations of increased fiscal stimulus, while currencies and bonds weakened. The yen hovered near the critical 150-per-dollar mark, a significant psychological milestone, as options traders became the least bullish on the currency in over three years, anticipating continued depreciation under the new government.

Politics continues to stoke the fires of fiscal uncertainty, particularly following Japan's recent leadership changes. The ruling Liberal Democratic Party (LDP) has chosen the pro-stimulus and monetary dove Sanae Takaichi as its new party leader. This decision may partly reflect a reaction to the shift towards right-wing parties such as the Sanseito and DPP in the Upper House elections, with Takaichi bringing a more nationalistic flavor to the party. Markets are now anticipating relatively higher levels of government spending under Takaichi's leadership. There is a renewed reluctance from the Bank of Japan (BoJ) to raise policy rates, with the probability of an October hike plummeting from 60% last week to just 20%. In France, Prime Minister Sebastien Lecornu's resignation after only 27 days has complicated the political landscape. This abrupt change has stalled progress on the budget and raises the risk that President Macron will need to call fresh legislative elections to resolve the current impasse, potentially paving the way for a Rassemblement National government. These developments have understandably heightened fiscal anxiety, leading to a renewed rise in domestic bond yields. The impact isn't limited to Japan and France; there are spillover effects into other fiscally challenged sovereigns, including UK gilts. The situation in the UK is particularly precarious, as the government is currently engaged in discussions with the Office for Budget Responsibility (OBR) regarding its economic assumptions. An anticipated downward revision to productivity forecasts could exacerbate the effects of current budget slippage, recent U-turns on spending cuts, and new spending demands. Elevated bond yields further complicate the fiscal landscape, making the projected fiscal hole of “only £30 billion” increasingly seem like the best-case scenario. The political shifts in Japan and France are creating a ripple effect, increasing fiscal tension globally. As governments grapple with rising bond yields and budgetary constraints, the outlook for fiscal policy remains uncertain, with potential implications for economic stability in these regions.

Today's calendar highlights include several key economic events and speeches that could influence market sentiment. France will release its trade data, providing insights into the country's trade balance and overall economic health, which is crucial for understanding export and import dynamics. Canada will report the Ivey Purchasing Managers Index (PMI), an important indicator of economic activity reflecting the purchasing trends of Canadian businesses. Several Federal Reserve officials will be speaking today, including Raphael Bostic, President of the Atlanta Fed; Michelle Bowman, Federal Reserve Governor; Lisa D. Cook, Federal Reserve Governor; and Neel Kashkari, President of the Minneapolis Fed. Their remarks may provide insights into the Fed's monetary policy outlook and economic conditions. Additionally, European Central Bank officials will also be speaking, with Joachim Nagel, President of the Bundesbank, and Christine Lagarde, President of the European Central Bank. Their speeches will be closely watched for signals regarding the ECB’s policy direction and economic assessments.

Overnight Headlines

- Gold Nears $4,000 On US Shutdown Fears, French Political Crisis

- Citadel’s Griffin Calls Gold Rush ‘Concerning’ Signal

- PM Starmer Leads UK Business Delegation To India To Tout Trade Pact

- Trump: ‘Sort Of’ Made Decision On Supplying Tomahawks To Ukraine

- EU To Curb Russian Diplomats’ Travel Amid Spy Concerns

- Ford Supplier Fire Expected To Disrupt Business For Months

- Rheinmetall Rival Slams ‘Direct Award’ To German Arms Group

- Restructuring Grp AlixPartners Shelves Plan To Sell Stake In Business

- AppLovin Probed By US SEC Over Data-Collection Practices

- OpenAI Deal Raises Stakes For AMD’s Race Against Nvidia

- Musk Names Former Morgan Stanley Banker As xAI CFO

- Qualtrics To Acquire Press Ganey Forsta In $6.75B Deal

- Japan’s Household Spending Rises More Than Expected In August

- Australia Consumer Sentiment Hits 6-Month Low, Job Ads Slide

- New Zealand Firms’ Gloomy Outlook Raises Recession Risk

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 149.00 (214M), 149.25 (684M), 149.65-75 (1.4BLN)

- 150.00 (797M), 150.15-25 (255M), 150.60 (533M), 151.00-05 (908M)

- EUR/JPY: 173.00 (565M), 174.50 (340M)

- USD/CHF: 0.7935-40 (500M), 0.8000 (600M)

- GBP/USD: 1.3265 (200M), 1.3300 (383M). EUR/GBP: 0.8670 (266M)

- 0.8690-00 (300M). USD/ZAR: 17.2060 (225M), 17.40 (171M)

- AUD/USD: 0.6500-10 (753M), 0.6525-35 (659M), 0.6675 (438M)

- 0.6690-00 (745M),. NZD/USD: 0.5770-75 (330M), 0.5810 (428M)

- 0.5820-30 (455M). AUD/NZD: 1.1325-30 (335M)

- USD/CAD: 1.3825 (258M), 1.4000 (275M)

CFTC Positions as of the Week Ending 3/10/25

-

Special Announcement. October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

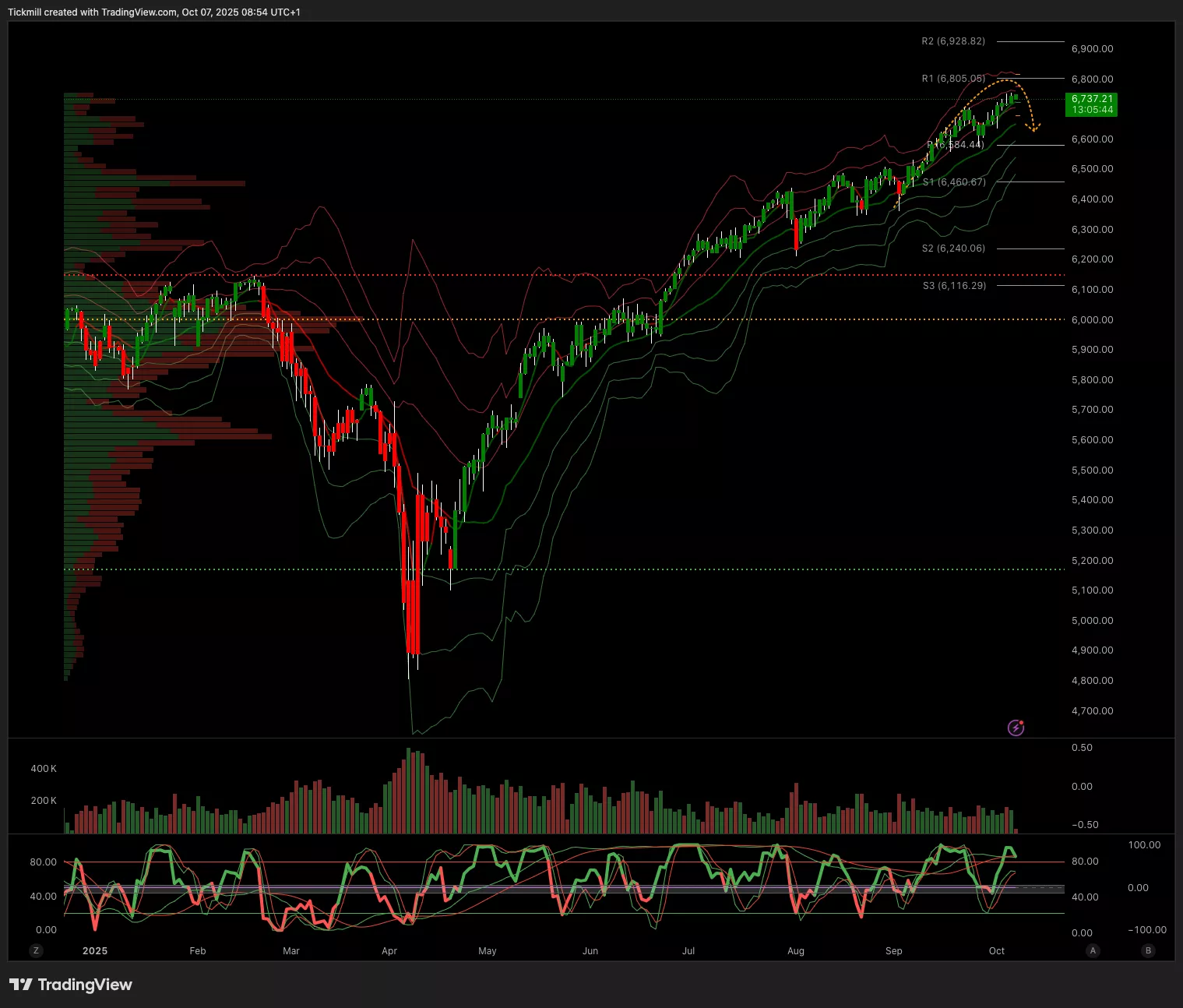

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6800

- Below 6700 Target 6630

(Click on image to enlarge)

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.1650

- Above 1.1750 Target 1.1850

(Click on image to enlarge)

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.34 Target 1.3330

- Above 1.35 Target 1.3580

(Click on image to enlarge)

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.4690 Target 1.46

- Above 1.49 Target 1.51

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3900 Target 4000

- Below 3850 Target 3770

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 122k Target 126k

- Below 122k Target 120k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Monday, Oct. 6

Daily Market Outlook - Friday, Oct. 3

Daily Market Outlook - Thursday, Oct. 2