Daily Market Outlook - Friday, Oct. 3

Image Source: Pixabay

The global stock market rally has continued for a sixth consecutive day, fuelled by enthusiasm around AI technology, with futures suggesting further increases are on the horizon. MSCI's world index gained 0.1%, and a technology equity benchmark reached a record high, driven by advancements from Japanese firms. Hitachi saw its biggest rise since April following a collaboration with OpenAI, while Fujitsu's stock climbed over 5% after a partnership with Nvidia. Asian shares rose, with futures predicting more gains for the S&P 500 and Nasdaq 100, both of which finished at record levels. The Yen weakened against the Dollar as Bank of Japan Governor Ueda reaffirmed the institution's longstanding position on interest rates. Ueda did not provide clear hints regarding the potential for a rate increase during the upcoming board meeting. Recently, market expectations for a rate hike have escalated, with two board members dissenting against the decision to keep the current settings during the last meeting, while a dovish member highlighted the growing necessity for policy adjustments in a recent address. Gold is set to achieve its seventh consecutive weekly gain, while oil is heading for its steepest weekly decline since late June in anticipation of an OPEC+ meeting expected to lead to the revival of more idled barrels.

The US government shutdown may delay the September payrolls report, but recent private sector data indicate a continued "soft patch" in the job market. The JOLTS survey shows tougher conditions, with a slight increase in job openings but weak hiring, downward revisions to quits, and elevated layoffs. ADP data, often criticised for its predictive value, reflects a negative trend, reporting a loss of 32,000 jobs in September, missing the expected gain of 50,000, and revising August's figure from 54,000 to a loss of 3,000. This marks three negative monthly reports out of the last four, primarily affecting small and medium-sized firms, which typically signal downturns. Survey data also appears weak, with the manufacturing ISM employment index at 45.3, indicating contraction for eight consecutive months. If the services index mirrors this trend on Friday (it was at 46.5 last month), it would mark four months of decline. The only positive note is a 25.8% year-over-year decrease in Challenger job cuts, although this figure is highly volatile. Overall, the absence of the payrolls report may feel like a temporary reprieve, as its accuracy is no better than these other measures, which will only be fully understood after significant revisions over time.

Governor Bailey is set to speak today amid a divide on the Monetary Policy Committee (MPC) between those concerned about persistent inflation and others noting a weakening labour market. The Bank of England’s September Decision Maker Panel survey indicates that actual and expected employment levels are largely flat. However, the key issue remains that both realised and anticipated price increases are significantly above the inflation target. Recent survey data shows a slight increase in price rises reported by firms for their products, and expected price changes for the coming year are only marginally lower. Until there is a clear trend where firms project lower price increases than those realised over the past year, it seems unlikely that the hawkish members of the MPC will ease their stance or support rate cuts.

The US data flow is uncertain due to the government shutdown, which has temporarily closed public statistics offices. Even if operations resume quickly, disruptions to the regular data calendar are expected, leading to a period of catch-up for at least several weeks.

The Fed minutes are still set to be released and are anticipated to be significant. Market participants will closely analyze discussions about potential rate cuts, particularly how members weighed labor versus inflation data, the reliability of the dot plot guidance, and the influence of Trump’s appointee Miran on the board.

In the UK, the upcoming calendar is relatively low-key, with the RICS survey on Thursday and the REC jobs report on Friday being the main highlights.

In Europe, attention will be on German economic indicators, including September factory orders on Tuesday, industrial production data on Wednesday, and trade figures on Thursday. Additionally, strong Japanese labor earnings data on Wednesday could provide insights for the Bank of Japan regarding wage persistence, potentially pushing the committee toward a rate hike later this month.

The Reserve Bank of New Zealand is expected to announce another rate cut on Wednesday, with market expectations split between a 50 basis point cut and a quarter-point reduction.

Despite the data uncertainties, several key speakers are scheduled: Fed officials Bostic, Miran, Barr, and Goolsbee, along with Bailey (Monday evening) and Pill (Wednesday) from the BoE, and Lane, Nagel, Villeroy, and Kazaks from the ECB.

Overnight Headlines

- Bank Of Japan Still On Path To More Rate Hikes, Governor Says

- Japan’s Jobless Rate Edges Up To 2.6%, Highest In Over A Year

- Fed’s Goolsbee Says US Economy Still Growing ‘Pretty Solidly’

- Delays To Trump’s UAE Chips Deal Frustrate Nvidia’s Jensen Huang

- Prolonged US Government Shutdown Could Raise Market Risks

- Trump Explores Bailout Of At Least $10B For US Farmers

- US Bank Reserves Drop Below $3T Again, Raising Liquidity Concerns

- Tesla Record Deliveries Beats, But EV Demand Concerns Linger

- Wall Street Buys Trump Tariff Refund Rights From Strained Importers

- Applied Materials Warns Of $600M Revenue Hit From US Export Rule

- Amazon Delivery Drone Collision Near Phoenix Under FAA, NTSB Probe

- EU Plans To Hand Deripaska-linked Assets To Raiffeisen

- Shadow Chancellor Underlines Tory Commitment To ‘Fiscal Responsibility’

- Green Leader Calls For BoE To End Interest Pay To Commercial Banks

- UBS Gaining Support For Compromise On Swiss Capital Rules

- Deutsche Bank Needs Germany’s Fiscal Bazooka To Have Perfect Aim

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1675-80 (770M), 1.1700 (2.3BLN), 1.1730 (651M)

- 1.1750-60 (777M), 1.1800 (1.6BLN)

- USD/CHF: 0.7945 (410M), 0.7995 (320M)

- EUR/GBP: 0.8700 (225M), 0.8800-05 (1.4BLN)

- GBP/USD: 1.3400 (202M), 1.3425 (200M), 1.3450 (186M), 1.3475 (182M)

- AUD/USD: 0.6540-50 (1.6BLN), 0.6600 (2.1BLN)

- USD/CAD: 1.3950-55 (351M), 1.3965-75 (693M)

- USD/JPY: 147.00 (1.4BLN), 147.20-25 (500M), 148.00 (1.4BLN)

- EUR/JPY: 173.50 (304M)

CFTC Positions as of the Week Ending 26/9/25

- Speculators trim CBOT US Treasury bonds futures net short position by 15,347 contracts to 78,791

- Speculators trim CBOT US Ultrabond Treasury futures net short position by 7,408 contracts to 270,759

- Speculators increase CBOT US 10-year Treasury futures net short position by 24,817 contracts to 844,116

- Speculators increase CBOT US 5-year Treasury futures net short position by 16,670 contracts to 2,453,444

- Speculators trim CBOT US 2-year Treasury futures net short position by 103,272 contracts to 1,300,198

- Equity fund managers raise S&P 500 CME net long position by 20,454 contracts to 912,089

- Equity fund speculators trim S&P 500 CME net short position by 31,451 contracts to 443,946

- Japanese yen net long position is 79,500 contracts

- Euro net long position is 114,345 contracts

- British pound net short position is -1,964 contracts

- Swiss franc posts net short position of -23,018 contracts

- Bitcoin net long position is 79 contracts.

Technical & Trade Views

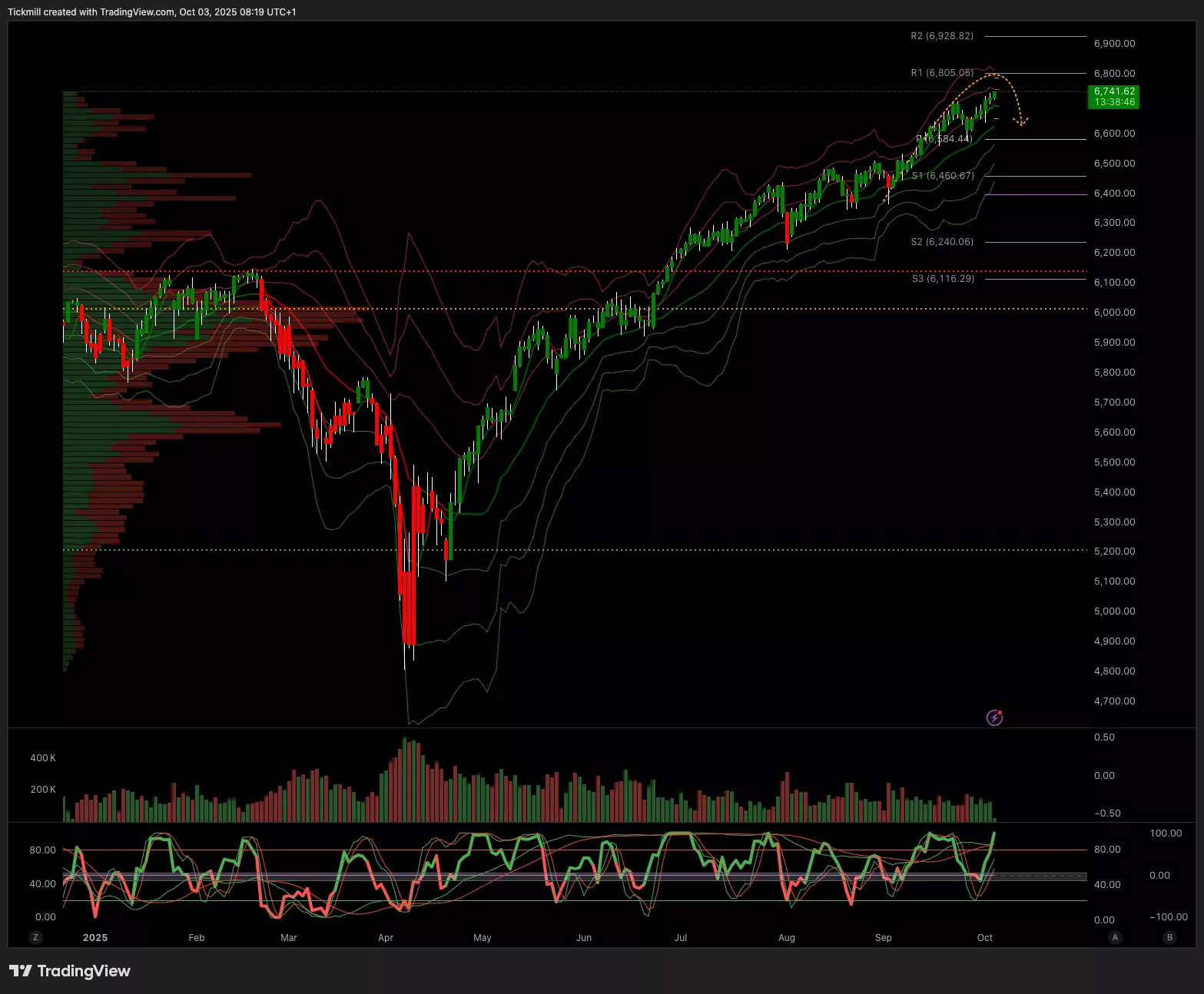

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6800

- Below 6600 Target 6500

(Click on image to enlarge)

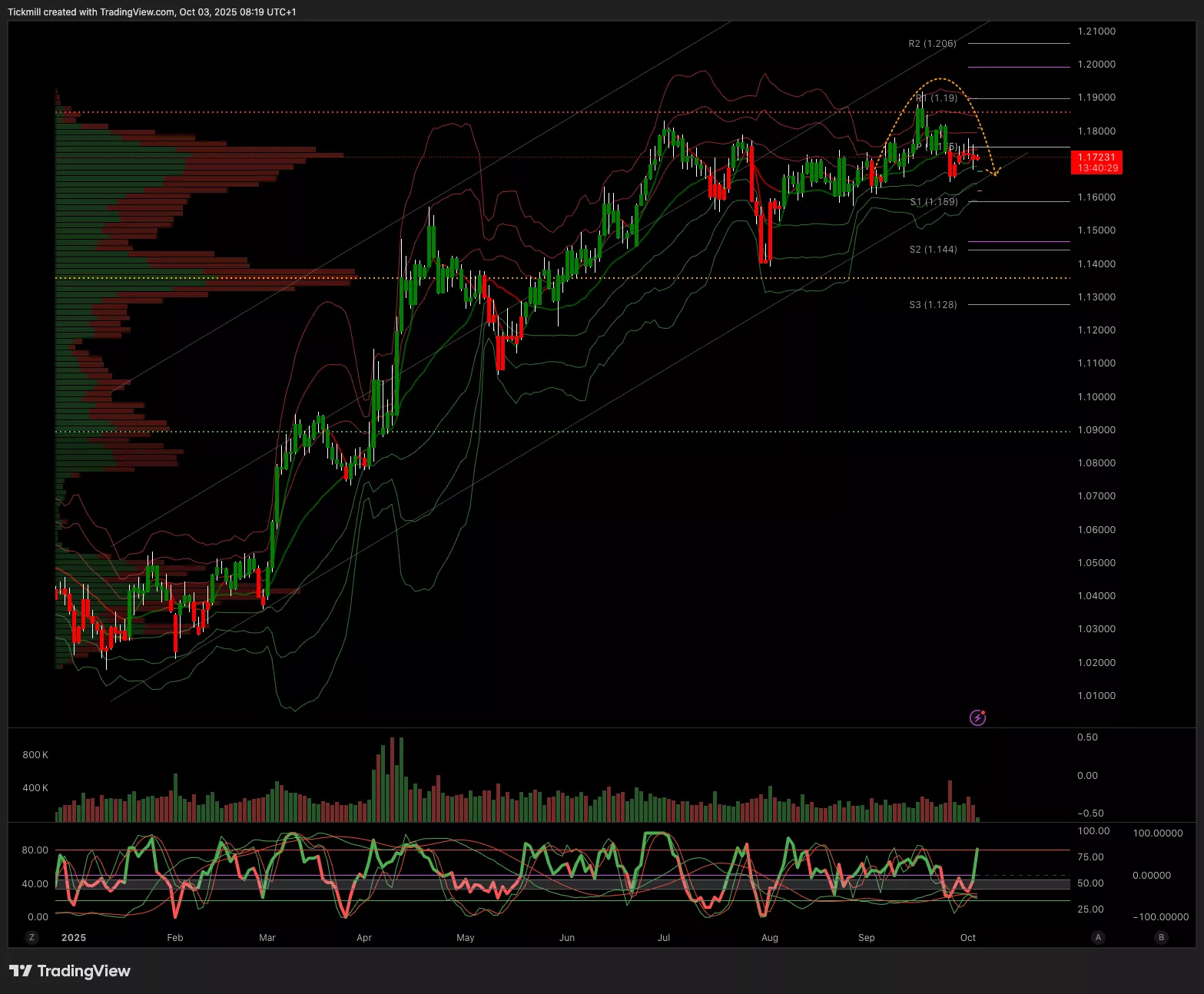

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.15

- Above 1.18 Target 1.1910

(Click on image to enlarge)

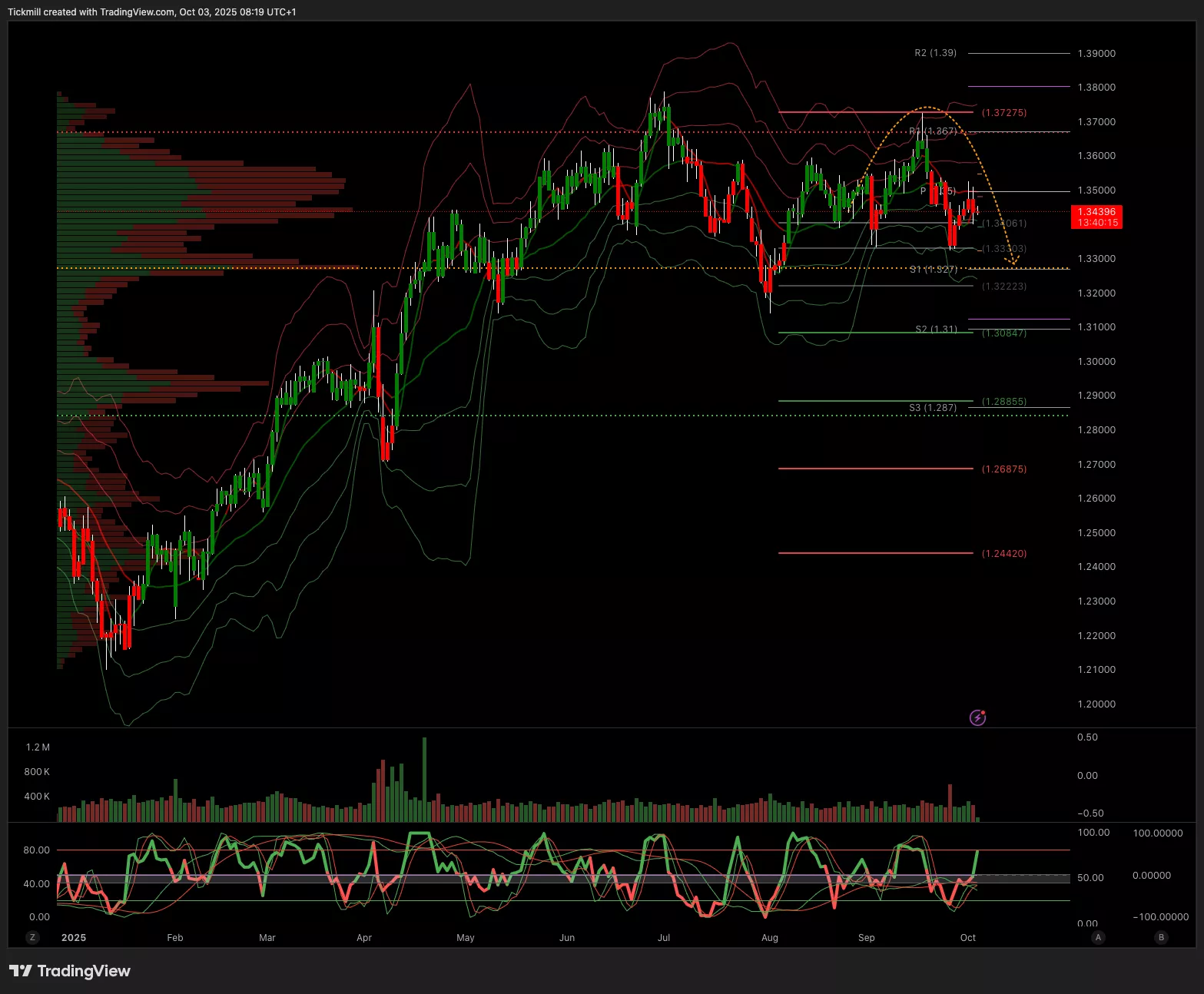

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.36 Target 1.30

- Above 1.3650 Target 1.3850

(Click on image to enlarge)

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.49 Target 1.45

- Above 1.51 Target 1.54

(Click on image to enlarge)

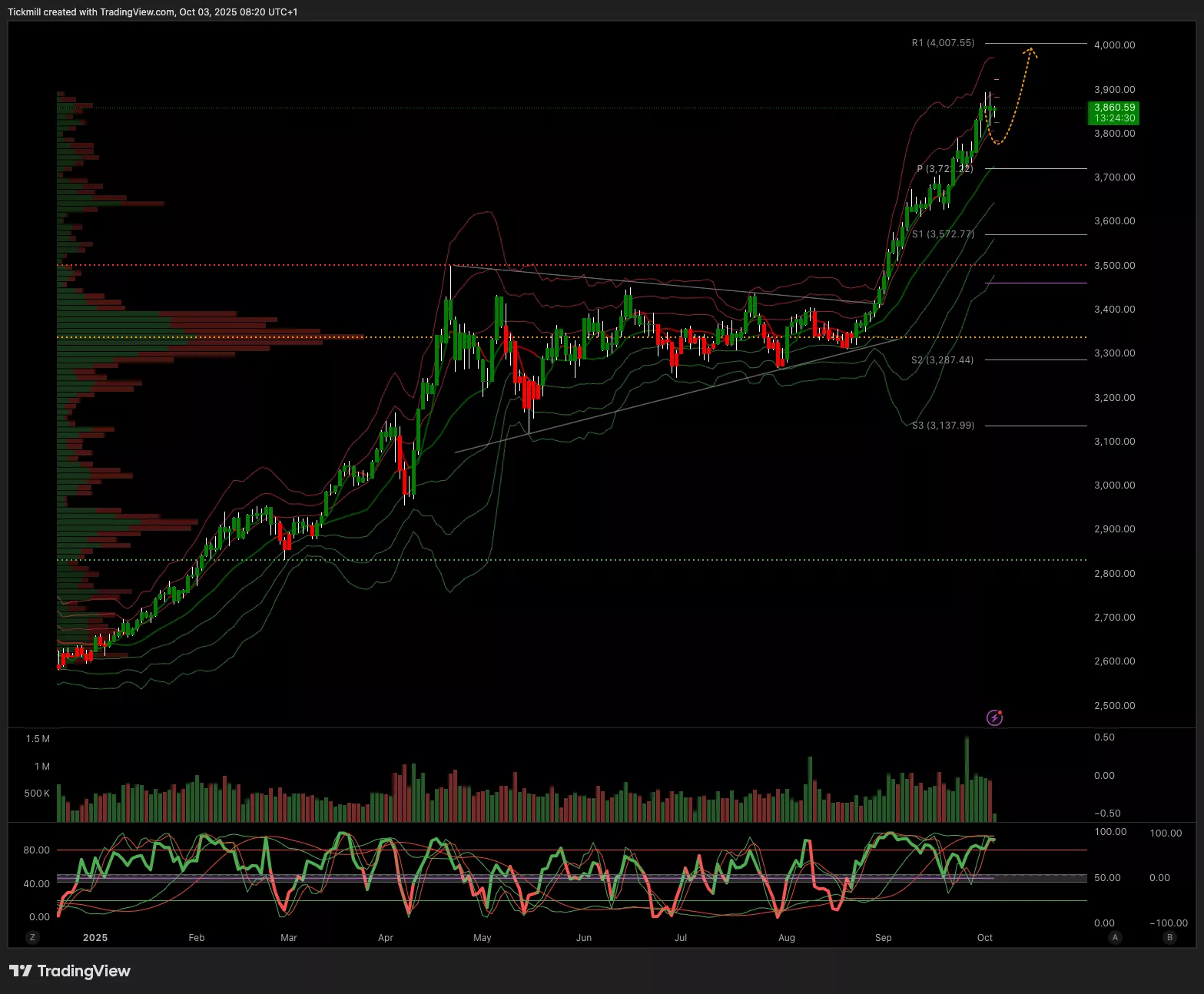

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 3600 Target 3885

- Below 3500 Target 3400

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 120k Target 122k

- Below 117k Target 115k

(Click on image to enlarge)

_638950807536952362.webp)

More By This Author:

Daily Market Outlook - Thursday, Oct. 2

The FTSE Finish Line - Wednesday, Oct. 1

The FTSE Finish Line - Tuesday, Sep. 30