The FTSE Finish Line - Tuesday, Sep. 30

Image Source: Pexels

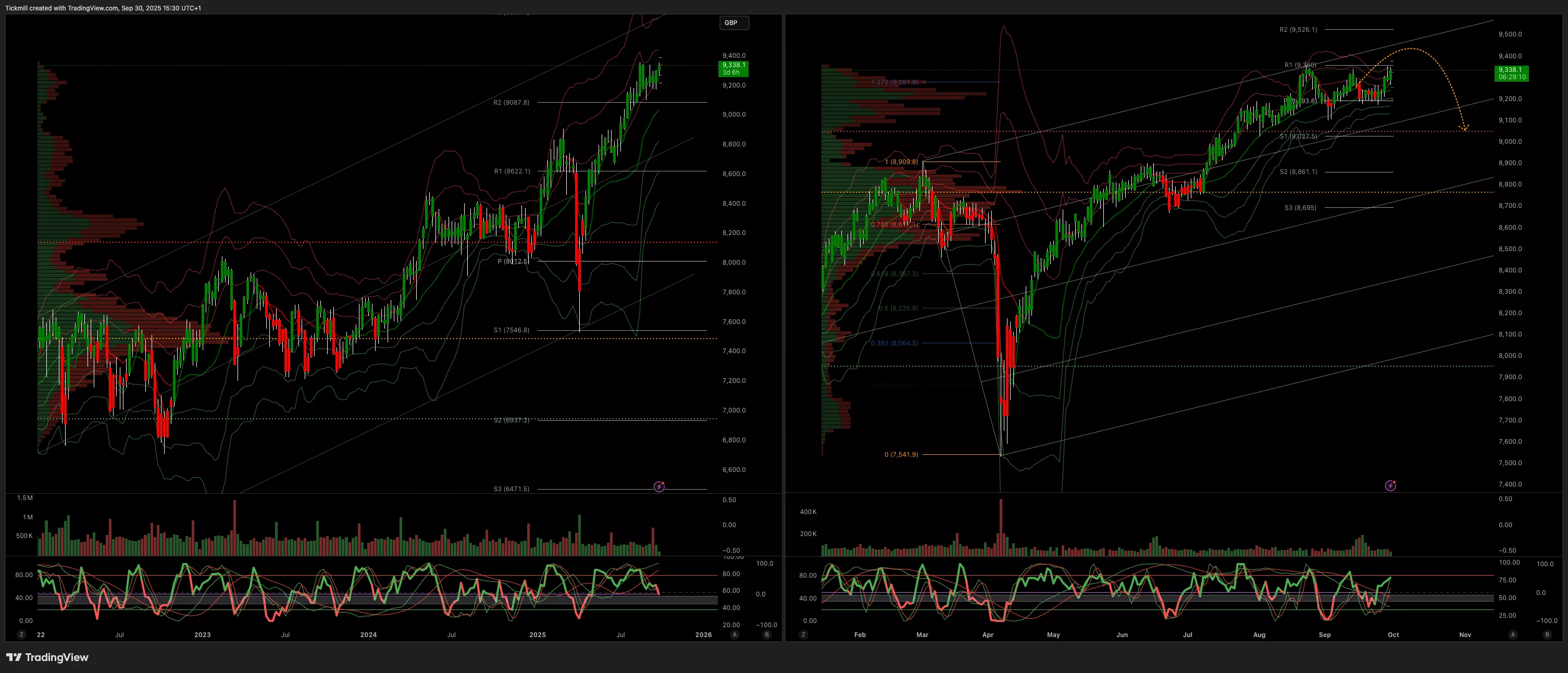

London shares remained stable on Tuesday and seemed poised to close the third quarter with gains, although ASOS fell after the fashion retailer announced a revenue alert. The UK’s globally focused FTSE 100 edged upward. Shares in financial stocks increased, with HSBC rising by 0.7%, while 3i Group and Lloyds Banking Group also experienced slight gains. Conversely, precious metal mining stocks dropped by 1.2%, leading declines in various sectors, as safe-haven prices for gold, silver, and platinum fell due to profit-taking. Nonetheless, the UK's primary indexes are set for quarterly increases, with the export-driven index poised for its largest quarterly rise since October 2022. Much of this improvement stemmed from relief following the U.S.-UK trade agreement in May, combined with anticipated interest rate cuts by the U.S. Federal Reserve. However, worries about the unstable fiscal situation domestically have driven up gilt yields earlier this month, while also capping gains in midcap stocks focused on the domestic market. Investor apprehension was evident across sectors as precious metal miners are heading for their most significant quarterly gains ever. Companies are preparing for possible tax increases in the UK government's budget in November as it looks for ways to address the public finance deficit. Overall sentiment was depressed, as Washington neared the possibility of a government shutdown.

Meanwhile, investors evaluated a revised estimate of the UK's second-quarter gross domestic product. The UK GDP figures for the second quarter may not grab headlines, but they are certainly on the radar of policymakers, especially with an Autumn Budget approaching and Labour's annual conference currently taking place. "There is no positive news for the Chancellor in this latest economic data, but there is no significantly negative news either," states Danni Hewson, head of financial analysis at AJ Bell. The data revealed that GDP growth decelerated to 0.3% from April to June, unchanged from previous ONS estimates and aligning with economists' forecasts in a Reuters poll.

Shares of bookmakers listed on the London Stock Exchange dropped as the UK government contemplates increasing taxes on gambling companies. Finance Minister Rachel Reeves indicated to ITV News on Monday that there is justification for imposing higher taxes on gambling firms. Earlier this month, over a hundred Labour MPs advocated for tax increases on these firms, referencing their comparatively lower tax rates relative to other regions. Betting company Evoke saw a decline of 1.9%, ranking among the biggest losers on London’s small-cap index, which decreased by 0.11%. Entain fell by 1.08%, while Playtech dropped by 0.94%.

Shares of Close Brothers dropped by as much as 11.5% to 439p, making the banking group's stock the second-largest decliner on the FTSE 250 midcap index, which is nearly flat. The company forecasts that its FY26 net interest margin will be slightly below 7%. It reported a statutory pre-tax loss of £122.4 million ($164.51 million) for FY25, compared to a profit of £132.7 million the previous year. The company continues to hold a £165 million provision for motor finance commissions and has added a £33 million charge for early-settlement remediation. Remarkably, the stock has nearly doubled in value this year.

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Tuesday, Sep. 30Daily Market Outlook - Monday, Sep. 29

Daily Market Outlook - Thursday, Sep. 25