Daily Market Outlook - Tuesday, Nov. 18

Photo by Jakub Żerdzicki on Unsplash

Stocks took a hit, and Bitcoin plunged to its lowest print in seven months as investors shied away from risk amid a pivotal week, with Nvidia’s earnings and the much-awaited US jobs report stealing the spotlight. Global markets edged closer to a one-month low, while Asia’s benchmark index dropped 2.1%, breaking below its 50-day moving average for the first time since April—an ominous signal for chart watchers. Bitcoin has plunged below 90k, intensifying a month-long downturn that has wiped out its gains for 2025 and shaken confidence across the digital asset market. The world’s largest cryptocurrency slid by as much as 2.4% during Asia trading hours, continuing its descent from an all-time high of over 126k reached in early October. The last time Bitcoin dipped below this level was in April, when it nosedived to a low of 74k following President Donald Trump’s announcement of his initial tariff plans, which rattled global financial markets. Futures tied to the S&P 500, Nasdaq 100, and major European indices pointed to further losses ahead. Investors flocked to safer assets like bonds, driving the 10-year Treasury yield down three basis points to roughly 4.11%. This shift reflected growing jitters over lofty valuations in AI-related stocks, with Nvidia’s earnings on Wednesday expected to set the tone for tech shares. Attention will then turn to Thursday’s delayed September jobs report, which could offer clues about the Federal Reserve’s next move on interest rates. In the US, traders are growing increasingly cautious as the selloff picks up steam. Monday’s losses extended the S&P 500’s decline from its late-October peak to 3.2%, with the index closing below its 50-day moving average for the first time in 139 trading days. This rare streak coming to an end has sparked fears of a more significant correction—potentially 10% or more. Meanwhile, the dollar continued to hold firm at recent highs. Gold slipped for the fourth straight session, hovering just above $4,000 an ounce as hopes for an imminent Fed rate cut faded—a scenario that often weighs on the appeal of non-yielding assets like gold.

Governor Waller’s overnight speech, titled “The Case for Continuing Rate Cuts,” clarified his stance, yet market expectations for the December FOMC rate decision remain highly uncertain, now resembling a coin toss compared to the ~70% probability seen recently. The mixed signals from Fed speakers appear to be dampening risk assets, with the S&P 500 closing below its 50-day moving average yesterday for the first time since April. For FOMC members who disagree with Waller, survey data indicating persistent inflationary pressures will heavily influence near-term decisions. Notably, yesterday’s Empire Manufacturing Survey revealed that input prices remain stubbornly high, contrasting with the prices firms receive for their output. If firms perceive demand as strong, output prices could rise in tandem with input costs. Conversely, weaker demand could lead to margin compression, signalling a more dovish outlook. Some Fed officials may argue that this uncertainty is unlikely to be resolved within the next month. Additionally, potential announcements from the White House regarding the next Fed Chair could shift focus away from the uncertainty surrounding the December rate decision, easing the current drag on market sentiment.

UK market watchers anticipate gilt issuance to rise by £10bn to £309.1bn. Despite this, the fast pace of gilt sales suggests the target is achievable, potentially allowing six planned auctions to be cancelled to prevent overfunding. This year's gilt supply arithmetic is unlikely to burden the market. Over the five-year horizon, fiscal gaps are expected to be addressed through higher tax revenues, signalling a tighter Budget compared to last year. While the Budget carries risks for market participants due to policy trade-offs, political challenges are more likely to emerge post-event rather than on Budget day.

Overnight Headlines

- Fed’s Waller Backs Dec Cut As Labour Market Nears ‘Stall Speed’

- Japan PM Takaichi Eyes Corporate Tax Cuts To Spur Investment

- BoJ Chief To Meet PM Takaichi As Yen Slides, Bond Yields Surge

- Rare Earth Yttrium Surges Nearly 1,500%, Hits New Record

- Bitcoin Drops Below $90K For First Time In Seven Months

- Fear Grips Crypto Traders As Bearish Bets Target $80K

- UN Security Council Backs Trump’s Gaza Plan

- Trump Confirms Plan To Sell F-35 Jets To Saudi Arabia

- China, Germany Agree To Ease Trade Tensions, Boost Commerce

- Taiwan Commits $3B To Build ‘AI Island’

- UK Raises Bank Deposit Guarantee To £120K Amid Inflation

- Canada Avoids Snap Election As Carney’s Budget Scrapes Through

- Jeff Bezos Brings Signature Style To $6B AI Startup

- Xiaomi Becomes Worst-Performing China Tech Stock

- J&J Buys Halda Therapeutics For $3.05B To Expand Cancer Pipeline

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1500 (590M), 1.1600-05 (487M), 1.1675 (1.1BLN)

- USD/CHF: 0.7800 (300M), .7900 (324M)

- GBP/USD: 1.3140 (261M)

- AUD/USD: 0.6500 (1.25BLN)

- USD/CAD: 1.4050 (295M)

- USD/JPY: 154.00-10 (250M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

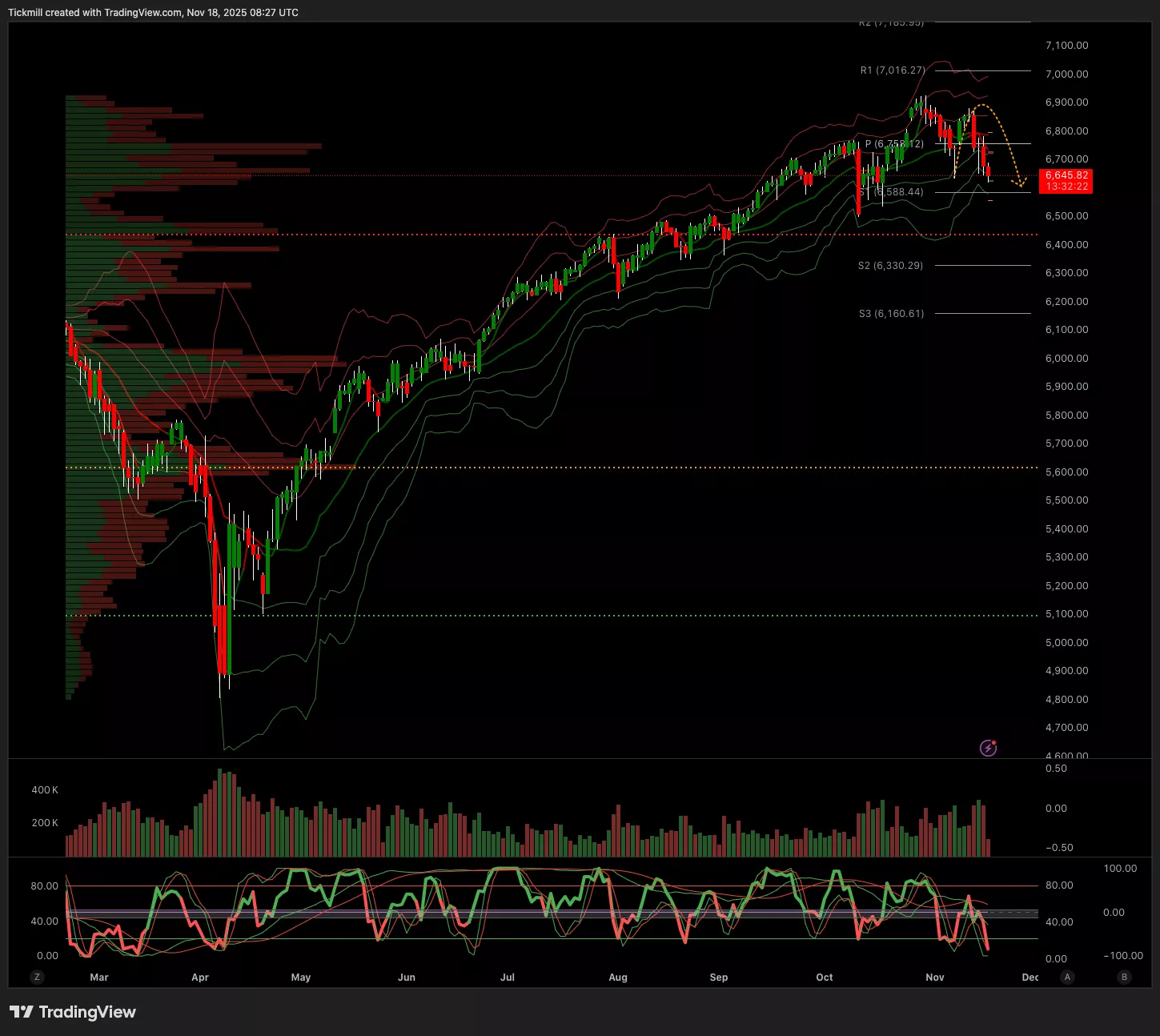

SP500

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 6788 Target 6857

- Below 6737 Target 6581

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.1613 Target 1.1679

- Below 1.1586 Target 1.1492

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3203 Target 1.3295

- Below 1.3169 Target 1.3111

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 154.50 Target 156.29

- Below 153.67 Target 152.53

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 4125 Target 4220

- Below 4057 Target 3975

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 93.5k Target 95.1k

- Below 89.5k Target 83.9k

More By This Author:

The FTSE Finish Line - Friday, Nov. 17

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 17

Daily Market Outlook - Monday, Nov. 17