Daily Market Outlook - Tuesday, Nov. 12

Image Source: Unsplash

Asian stocks declined while the dollar remained at four-month highs on Tuesday, but the focus was on bitcoin, which reached a record high driven by investor bets on assets expected to benefit from Donald Trump's election win. Investors anticipate Trump's second term will bring tax cuts and looser regulations, boosting the world's largest cryptocurrency, bitcoin, to an all-time high of $89,657. However, the threat of potential tariffs from the new White House administration has put pressure on the euro, which touched near seven-month lows overnight. The dollar is expected to benefit from policies that will likely keep U.S. interest rates relatively higher for longer. The Republican Party's decisive win removes the uncertainty of a contested U.S. election outcome, but the medium-term outlook could become more complex if Trump pursues aggressive tariff hikes, which could fuel inflation and impact the Federal Reserve's rate-cutting plans. Asian stocks, including Taiwan and South Korean shares, declined, with chip stocks in the region also reeling after the U.S. ordered Taiwan Semiconductor Manufacturing Company to stop supplying certain chips to China. In the commodities market, oil prices have declined as China's stimulus plan and concerns over oversupply have dampened market sentiment in recent sessions.

On the macro side, investors will be closely watching the U.S. consumer price inflation data on Wednesday, and a series of Federal Reserve speakers, including Fed Chair Jerome Powell, are scheduled to speak this week. Markets are currently pricing in an 87% chance of the Fed cutting rates by 25 basis points in December.

The performance of short-dated government bond yields in the UK and Germany shows a significant disparity in market rate expectations since the US election. Schatz yields are 111 basis points lower than the ECB depo rate, suggesting more rate cuts are likely. The incoming US administration may impose tariffs on European industrial exports, and the fall of the German coalition government has negatively impacted public opinion. The impact of tariffs is likely less severe in the UK due to its smaller manufacturing industry. The BoE's latest meeting did not reverse post-Budget market expectations for a more gradual path of rate decreases, with the 2-year gilt yield only about 50 basis points below the bank rate. This discrepancy between the BoE and ECB's short-term expectations and the actual policy rate is unprecedented, and there will probably be some reconvergence over time.

Overnight Newswire Updates of Note

- German ZEW To Edge Higher; Politics Could Reverse Forecasts

- Amazon Steps Up Effort To Build AI Chips That Can Rival Nvidia

- China Plans To Slash Homebuying Taxes In Fiscal Stimulus Push

- China Tech Stocks Need Earnings Boost Amid Trump, Macro Threats

- Japan To Roll Out $65B In Support For Chips, AI

- Japan’s Ishiba Hangs On As PM, Will Lead Minority Government

- Japan's Tamaki Aims To Unleash Yellen-Inspired Economic Boom

- Decision Desk HQ Projects Republicans With 220 Seat Majority

- Bond Investors Set Up For Jump In Yields With Focus On Trump

- Treasury Yields Are Red Flag For Markets’ Trump Euphoria

- LNG Exports Could Prove Crucial Bargaining Chip In US-EU Trade Talks

- UK Plans Trial To Issue Blockchain-based Gilts Within Two Years

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0600 (1.8BLN), 1.0625 (1.1BLN), 1.0665-75 (818M)

- 1.0725 (2.3BLN), 1.0740-50 (3.3BLN)

- USD/CHF: 0.8750 (654M), 0.8800 (843M)

- GBP/USD: 1.2780-85 (310M), 1.3000 (411M). EUR/GBP: 0.8300 (301M)

- AUD/USD: 0.6500 (238M), 0.6600-05 (277M), 0.6650 (479M)

- USD/CAD: 1.3900 (515M)

- USD/JPY: 153.50-65 (585M), 154.35-50 (444M), 155.00 (1.1BLN)

- AUD/JPY: 100.00 (245M), 100.45 (279M), 101.00 (290M)

CFTC Data As Of 8/11/24

- USD net spec G10 long -$0.31bn

- EUR +1.04% in period; specs +26.7k contracts now -21.7k

- JPY -1.19%; specs sell 19.4k contracts now -44.2k; US-JP rate divergence

- GBP +0.2%; specs sell 21.3k contracts long cut to 45.1k

- CAD -0.63%; specs sell 7.7k contracts; BoC rate well below Fed in 2025

- AUD +1.14%; specs +3.5k contracts now +31k; RBA seen as more hawkish c.bank

- BTC -4.37% in period; specs +412 contracts, now -1,457

- Equity fund speculators trim S&P 500 CME net short position by 97,351 contracts to 194,685

- Equity fund managers cut S&P 500 CME net long position by 52,438 contracts to 992,952

- Speculators trim CBOT US 10-year Treasury futures net short position by 82,913 contracts to 818,270

Technical & Trade Views

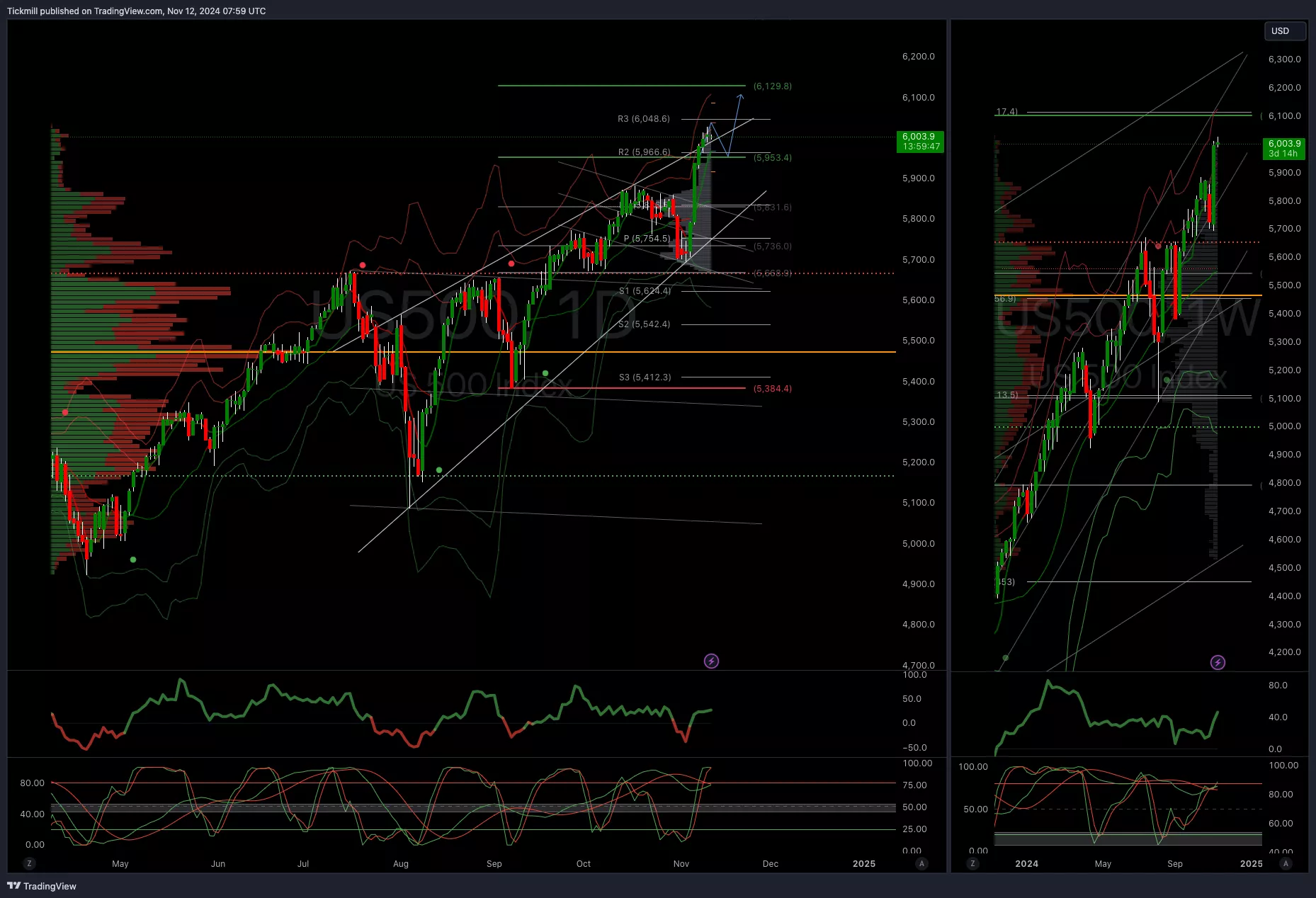

SP500 Bullish Above Bearish Below 5960

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 5550 opens 5820

- Primary support 5800

- Primary objective 6100

(Click on image to enlarge)

EURUSD Bullish Above Bearish Below 1.0810

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.09 opens 1.0950

- Primary resistance 1.0950

- Primary objective 1.06

(Click on image to enlarge)

GBPUSD Bullish Above Bearish Below 1.3050

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 1.29 opens 1.27

- Primary resistance 1.3050

- Primary objective 1.27

(Click on image to enlarge)

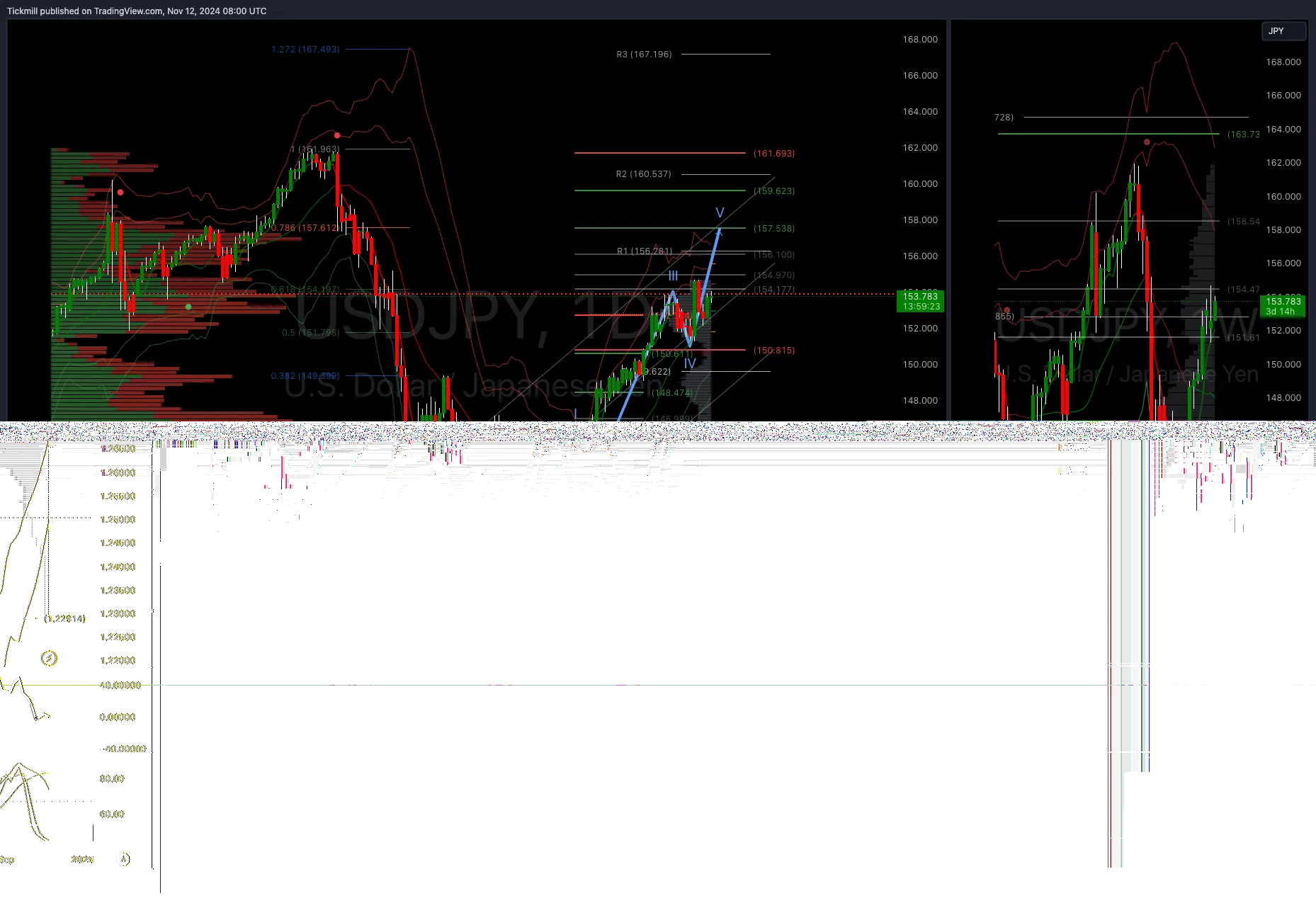

USDJPY Bullish Above Bearish Below 151

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 150 opens 148

- Primary support 148

- Primary objective is 157.50

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2600

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 2590 opens 2530

- Primary support 2600

- Primary objective is 2800

(Click on image to enlarge)

BTCUSD Bullish Above Bearish Below 84500

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 84000 opens 80000

- Primary support is 64000

- Primary objective is 100,000

(Click on image to enlarge)

More By This Author:

FTSE Snaps Four Day Losing Streak, Jobs Data Eyed

S&P 500 Weekly Action Areas & Price Objectives - Monday, Nov. 11

Daily Market Outlook - Monday, Nov. 11