Daily Market Outlook - Tuesday, Nov. 11

Image Source: Unsplash

Traders on Wall Street moved into riskier market sectors, causing a rise in stocks along with Bitcoin as the US Senate pushed forward legislation to end the record-long government shutdown, alleviating a major economic obstacle. Bonds weakened during this period. The increased risk appetite drove the S&P 500 up by 1.5%, with technology stocks, which faced the most significant declines recently, spearheading the equity market rally. Treasuries declined as the demand for safety diminished, and the dollar lagged behind most of its major counterparts. However, the global stock market rally, fuelled by hopes of a resolution to the US government shutdown, hit a snag in Asia as fresh concerns over trade tensions emerged. Reports suggesting that China intends to tighten rare earth exports to the US dampened earlier optimism. MSCI’s Asia-Pacific index flipped from early gains to a 0.3% decline, with Chinese markets bearing the brunt of the downturn. The nation’s primary benchmark dropped by 0.9%, while US equity futures dipped 0.16% following Monday’s robust performance in the S&P 500. The mood shifted after the *Wall Street Journal* revealed that China plans to expedite export approvals for most rare earth producers but exclude companies tied to the US military. This decision reignited fears of escalating trade tensions between the two largest economies, despite ongoing progress toward resolving Washington’s historic government shutdown. Meanwhile, in Japan, a 30-year bond auction saw weaker-than-average demand, as investors grew cautious amid renewed discussions surrounding Prime Minister Sanae Takaichi’s fiscal policies.

This morning's ONS labour market report delivers a clear takeaway: those betting on a Bank of England (BoE) rate cut in December are likely feeling more confident than their counterparts. While private sector average earnings excluding bonuses matched the BoE’s November Monetary Policy Report forecast at 4.2% (3-month/year), the broader economy's pay growth rate of 4.8% for Q3 fell 0.2 percentage points below expectations. Adding to this, the HMRC median pay growth indicator for October took a sharp dive, landing at just 3.1% year-on-year.

On the employment front, the data paints a less-than-rosy picture. The LFS survey for Q3 and the HMRC report for October both showed declines, with employment figures dropping by 22,000 (3-month/3-month) and 32,000 (month-on-month), respectively. The latter also included a downward revision for the previous month. Meanwhile, the unemployment rate climbed by 0.2 percentage points to 5.0% in Q3. While the volatility linked to small sample sizes in this survey is worth noting, it’s significant that for two consecutive months, the single-month unemployment estimate has exceeded 5%. This raises the possibility of a further increase in the headline unemployment rate when the next report comes out, particularly as a lower, more favorable single-month figure drops out of the calculation.For market watchers, this report is likely to bolster the view that Governor Andrew Bailey is making progress on bringing inflation under control, potentially paving the way for a December rate cut.

Overnight Headlines

- US Sen Passes Funding Deal As Shutdown Nears End, House Still To Act

- Trump Says Close To India Trade Deal To Cut Tariffs

- Switzerland Nears Tariff-Cut Deal With US After Business Pressure

- EU To Launch New Intelligence Unit Under Von Der Leyen

- Merz Accused Of Diverting Debt From Investment To Welfare, Tax Cuts

- Senators Unveil Draft Crypto Bill Giving CFTC Oversight Powers

- China-US Tariff Pause Brings Temporary Relief To Global Port Flows

- China Gains In Asia Great Game Are ‘Undeniable,’ Biden Official Says

- JPMorgan Forecasts Gold Above $5,000 By 2026 On Global Risks

- CoreWeave Reports Doubling Of Revenue On AI Demand Surge

- Intel’s Top AI Executive Departs For OpenAI

- Sony Lifts Profit Outlook As Anime Division Outperforms

- SoftBank Backs Move To Oust GoTo CEO, Paves Way For Grab Deal

- Japan Earnings Surpass Expectations, Fueling Further Rally

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1525 (286M), 1.1580-90 (414M)

- EUR/GBP: 0.8785 (250M), 0.8835 (280M)

- GBP/USD: 1.3150 (318M), 1.3300 (363M)

- AUD/USD: 0.6450 (550M), 0.6495 (362M), 0.6550 (500M)

- USD/JPY: 153.30-35 (305M), 155.50 (240M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

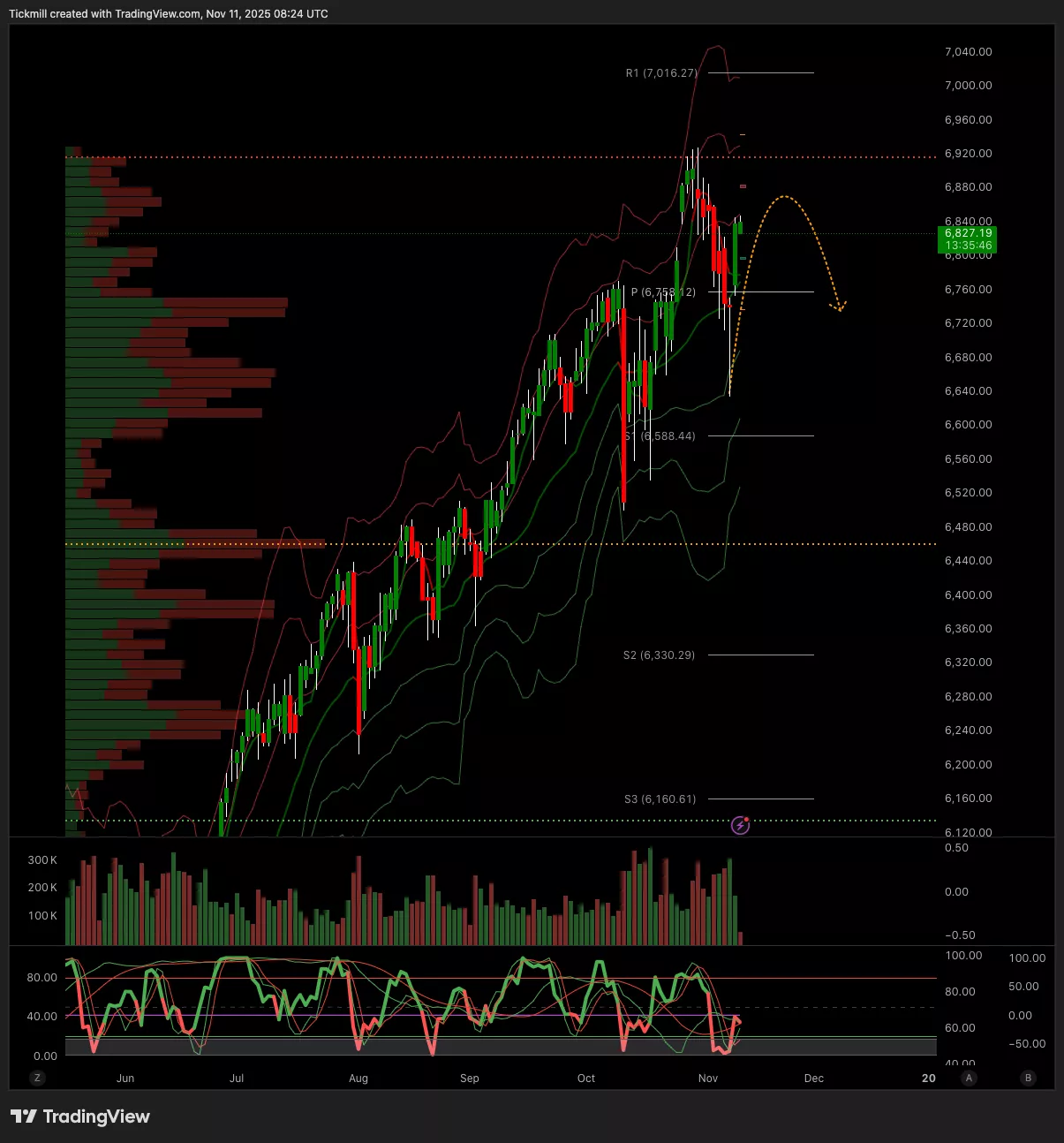

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6777 Target 6850

- Below 6769 Target 6688

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1543 Target 1.1650

- Below 1.1539 Target 1.1483

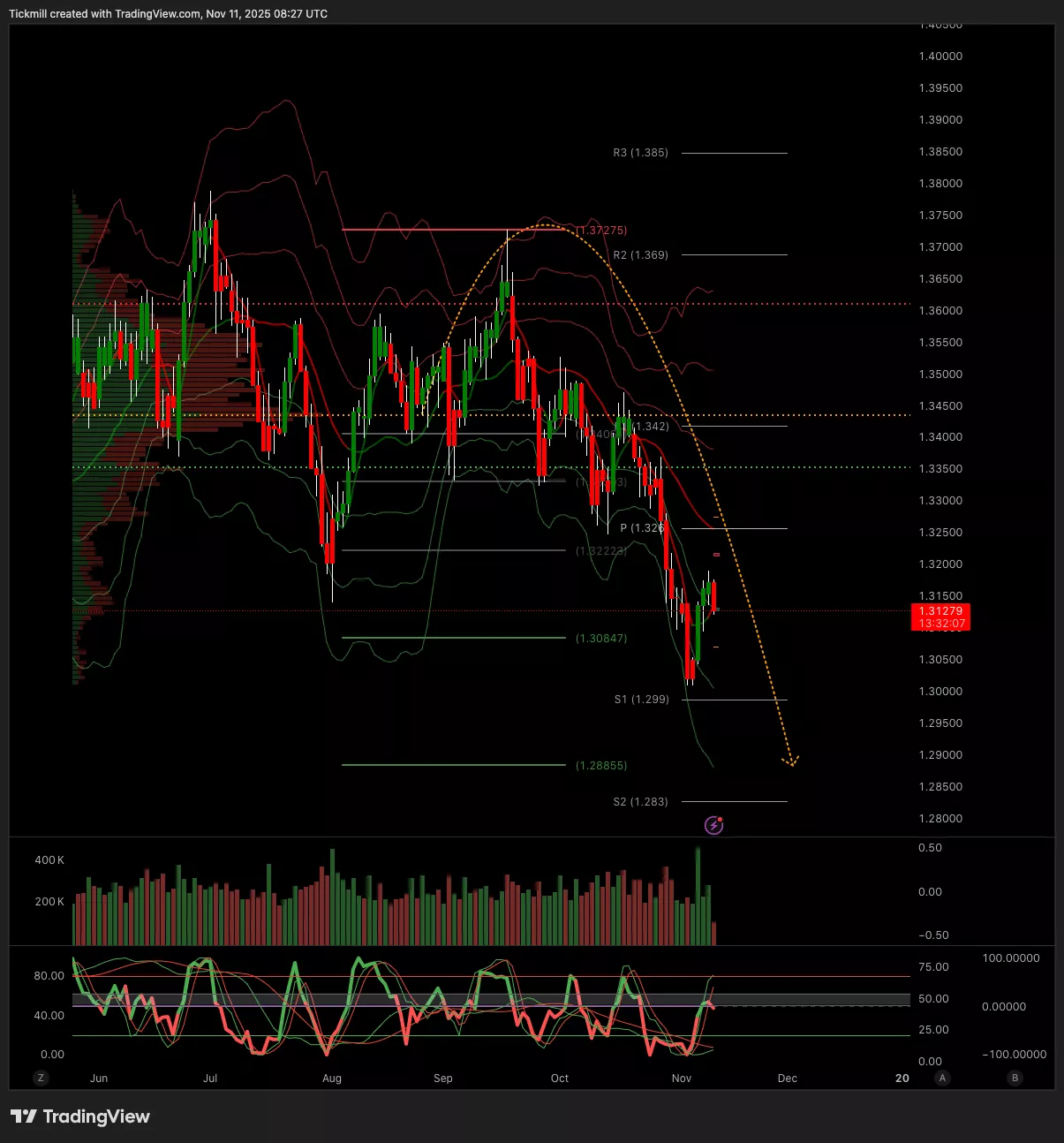

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3135 Target 1.3256

- Below 1.3130 Target 1.3005

USDJPY

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 153.98 Target 154.73

- Below 153.71 Target 152.48

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 4084 Target 4208

- Below 4019 Target 3959

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 104.1k Target 108.1k

- Below 104.k Target 102k

More By This Author:

The FTSE Finish Line - Monday, Nov. 10

Emini S&P 500 Weekly Live Market & Trade Analysis - Monday, Nov. 10

Daily Market Outlook - Monday, Nov. 10