Daily Market Outlook - Monday, Nov. 10

Image Source: Pexels

Stocks rallied while Treasuries took a hit as hopes for a resolution to the longest U.S. government shutdown lifted market sentiment following a rollercoaster week marked by concerns over inflated artificial intelligence valuations. The MSCI Asia Pacific Index climbed, with gainers outnumbering losers by more than two to one. Technology stocks spearheaded the recovery in Asia, with chipmakers like Taiwan Semiconductor Manufacturing and SK Hynix among the standout performers. Tech has remained in the spotlight after the Nasdaq 100 endured its sharpest weekly decline since early April. U.S. and European equity futures also advanced after the Senate made progress on a critical procedural step toward reopening the government. A group of moderate Democrats broke ranks to support the measure, signalling growing bipartisan momentum to end the historic shutdown. Investors embraced risk across various asset classes. Commodities like gold, silver, copper, and soybeans posted gains, while cryptocurrencies also joined the rally. Bond markets saw a selloff across the curve, driving 10-year Treasury yields up nearly four basis points to 4.13%. Meanwhile, the yen slipped 0.3% against the dollar. Resolving the shutdown would restore access to crucial economic data, including employment and inflation figures, giving investors a clearer lens into the Federal Reserve’s policy outlook. While optimism surrounding a deal has buoyed markets, traders remain cautious after last week’s steep decline in tech stocks reignited worries about overheated valuations. The Senate voted 60–40 to advance the bill, but the final vote and House approval are still pending before it can land on President Donald Trump’s desk for his signature. Timing remains uncertain as procedural hurdles persist, and House leaders have promised lawmakers two days' notice before reconvening. Once the government is back up and running, investors anticipate regaining clarity on economic trends after weeks of relying on fragmented private data. Last week’s mixed signals—weak job cuts data paired with hawkish comments from Fed officials—left markets unsure whether a December rate cut remains in play.

The week ahead promises to be UK-focused, with key updates on labour and wage data arriving on Tuesday. Previously, PAYE figures hinted at a rebound in private sector hiring, but overall conditions remain tepid. A further uptick in the unemployment rate is expected as hiring struggles to keep pace with labour supply. Wage growth appears to be moderating, with survey data reflecting this trend. While public sector pay has kept headline figures elevated, some normalization seems overdue. On Thursday, attention shifts to the quarterly and monthly GDP releases. Weak performances in July and August suggest slower growth for the quarter, aligning with the BoE’s downgraded 0.2% q/q forecast in its Monetary Policy Report, driven entirely by September's activity. Manufacturing continues to weigh on growth, while consumption and services provide some lift. Productivity challenges are set to persist. Wrapping up the week, Friday’s REC jobs report will shed more light on the labour market dynamics. Across the Eurozone, second-tier data takes the stage. The Sentix (Monday) and ZEW (Tuesday) surveys offer insights into economic sentiment, while Thursday brings the ECB's updated economic bulletin. The week concludes with Q3 GDP and employment figures on Friday, alongside final country-level CPI data trickling in throughout the week.

In the US, the calendar remains sparse due to the government shutdown, leaving NFIB small business confidence (Tuesday) as the standout event.

On the central bank front, BoE hawks dominate the UK speaker schedule, with Lombardelli and Pill speaking on Monday and Wednesday, and Greene appearing on Tuesday and Thursday. The ECB also features a steady stream of speakers, with Schnabel (Wednesday) and Lane (Friday) likely to draw the most attention. From the Fed, policy-relevant commentary is expected from Williams and Bostic (Wednesday) and Musalem (Thursday).

On the corporate earnings front, with nearly 90% of S&P 500 companies having reported already, US markets will focus on results from Cisco, Walt Disney, and Applied Materials. In Europe, major names such as Siemens, Deutsche Telekom, and Enel will release their earnings reports. Meanwhile, in Asia, highlights include Tencent and JD.com in China, along with SoftBank and Sony in Japan.

Overnight Headlines

- US Sen Strike Deal In First Step To Ending Government Shutdown

- Fed’s Williams: Next Rate Decision A ‘Balancing Act’

- ECB To Launch Race For Top Jobs As Lagarde Era Winds Down

- Von Der Leyen Dodged UK PM’s Request Amid Budget Payment Tensions

- BoJ Debated Near-Term Hike As Oct Meeting Shows Hawkish Shift

- Japan PM Signals Watered-Down Fiscal Goal To Boost Growth

- China Suspends Ban On Exports Of Gallium, Germanium, Antimony To US

- China CPI Unexpectedly Rise In Oct, Deflationary Pressures Ease

- Trump’s $2K Tariff ‘Dividend’ Gains Traction, May Come Via Tax Cuts

- Goldman Sees US Investors Flocking To Japan As Nikkei Surges

- Visa, Mastercard Near Merchants Deal Threatens Rewards

- Pfizer And Metsera Reach Biotech Deal Expected To Top $10B

- Kyiv Strikes Russian Energy Assets Amid Power Grid Assault

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1475 (2.4BLN), 1.1500 (1.6BLN), 1.1520-25 (553M), 1.1600 (822M)

- 1.1625-30 (744M)

- EUR/GBP: 0.8780 (300M), 0.8825 (540M)

- GBP/USD: 1.3100 (320M), 1.3345-50 (670M)

- AUD/USD: 0.6460 (594M), 0.6560 (447M), 0.6610-20 (1.5BLN)

- USD/CAD: 1.4100-10 (940M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

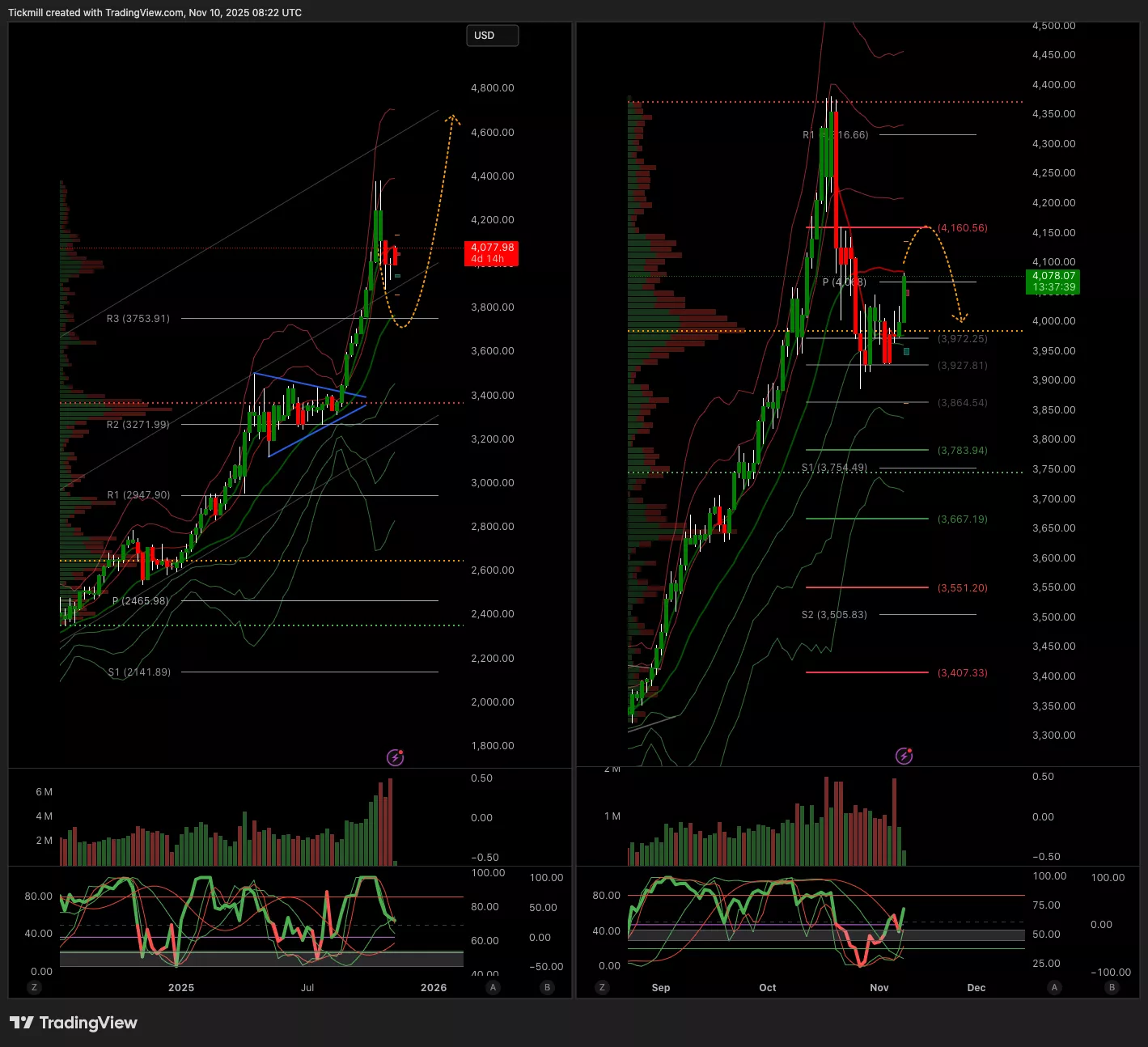

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6788 Target 6850

- Below 6751 Target 6630

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1534 Target 1.1650

- Below 1.1512 Target 1.14

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3087 Target 1.3265

- Below 1.3028 Target 1.2923

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 153.98 Target 154.73

- Below 153.71 Target 152.48

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 3980 Target 4089

- Below 3969 Target 3849

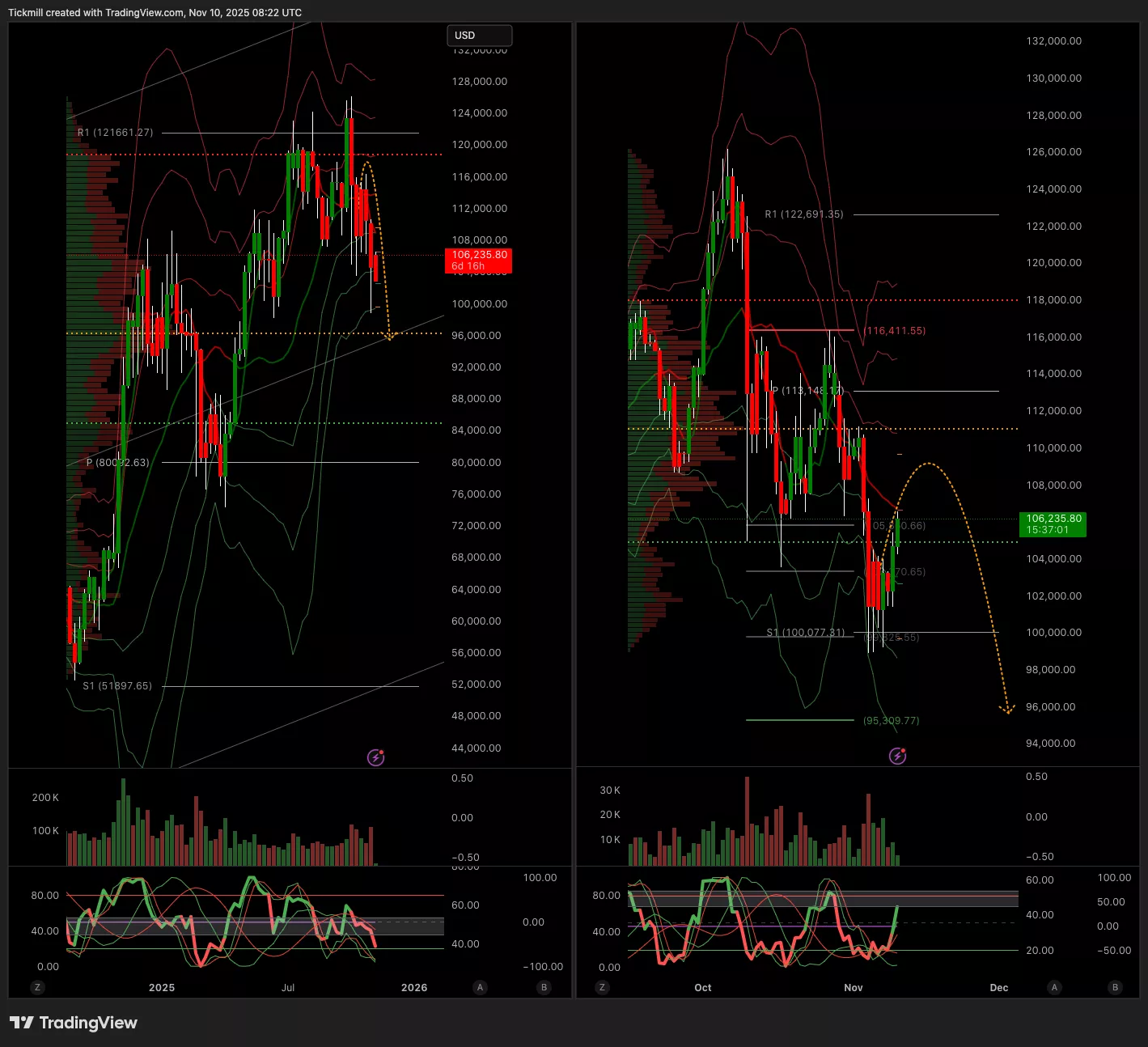

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 104.k Target 108.1k

- Below 104.k Target 97.4k

More By This Author:

The FTSE Finish Line - Friday, Nov. 7

Daily Market Outlook - Friday, Nov. 7

The FTSE Finish Line - Thursday, Nov. 6