Daily Market Outlook - Friday, Nov. 7

Image Source: Pixabay

Asian markets saw a downturn on Friday, wrapping up a turbulent week marked by clashing sentiments — excitement over technological advancements clashing with rising scepticism about whether the sky-high valuations in the artificial intelligence (AI) sector can truly hold up. The MSCI Asia Pacific Index dropped 1.1%, putting it on course for its worst weekly performance since early August. Japanese tech stocks, particularly chipmakers, bore the brunt of the losses, with SoftBank being a notable drag on the market. This followed a rough session on Wall Street, where AI-heavyweights like Nvidia stumbled, and the VIX volatility index surged. Globally, the MSCI All Country World Index is poised to snap a four-week winning streak. The cautious sentiment appears likely to extend into European markets, with futures pointing to a softer start. Meanwhile, U.S. equity futures ticked up slightly. Tesla saw a 1.6% boost in after-hours trading after its shareholders approved a staggering $1 trillion compensation package for CEO Elon Musk. Investors who had fueled this year’s market rally on hopes of Federal Reserve rate cuts and AI-driven growth are now reassessing whether massive investments in computing infrastructure will deliver the expected returns. Several prominent Wall Street figures have recently adopted a more restrained outlook, warning that the market’s surge since April’s slump is being driven by an increasingly narrow group of tech giants. Federal Reserve officials also presented mixed signals. Cleveland Fed President Beth Hammack emphasised that inflation remains a more pressing concern than potential labour market weaknesses. Meanwhile, Chicago Fed President Austan Goolsbee expressed discomfort about making policy decisions without fresh inflation data due to the ongoing government shutdown. Fed Governor Michael Barr highlighted that the central bank still has work to do in controlling prices, while St. Louis Fed President Alberto Musalem warned that interest rates are nearing levels where they might stop curbing inflation. Fed Chair Jerome Powell reiterated last week that a December rate cut is "not a given," though markets are still pricing in about a 70% chance of one. Treasury yields stabilised during Asian trading hours after 10-year yields saw their sharpest one-day drop in a month, spurred by renewed hopes of rate cuts. The U.S. dollar recovered slightly after experiencing its steepest decline since mid-October. Oil prices inched up but remain on track for a second consecutive weekly loss as rising global supplies stoke fears of oversupply. Gold edged higher, hovering just below the $4,000-an-ounce mark. In China, exports took an unexpected hit in October, reflecting renewed trade tensions with the U.S. These trade challenges come at a time when the Chinese economy is showing signs of slowing down as the year approaches its end.

The 5-4 vote to maintain the Bank Rate at 4% highlights a divided MPC, split between concerns over inflation persistence and worries about downside risks to economic activity. The newly introduced format, where each MPC member provides a paragraph in the minutes to outline their individual perspective, sheds light on the decision-making dynamics. The next move appears to hinge on Bailey, who is notably inclined toward extending the cutting cycle. During the press conference, he mentioned he would be examining available data "very carefully" before the December meeting, signaling a strong likelihood of a 5-4 vote to ease rates then. Current market estimates place this probability at approximately 70%.The revamped communication format clearly emphasizes that the "Bank Rate is likely to continue on a gradual downward path," though this remains contingent on incoming data. The Budget will also play a role, despite Bailey deflecting multiple attempts by journalists to tie him directly to its implications. While the near-term messaging suggests a dovish stance and indicates the cutting cycle is not yet over, the broader outlook remains largely unchanged. The new scenario analysis does not present drastically different trajectories for interest rates, especially with CPI still nearly double the 2% target. This is not a signal for markets to price in a significantly lower terminal rate.

A UK-focused week ahead with key labour and wage data (Tue) likely showing soft conditions, rising unemployment, and moderating wage growth despite elevated public pay. GDP data (Thu) is expected to confirm slower Q3 growth, with manufacturing dragging while consumption and services provide support. Productivity weakness persists. The REC jobs report (Fri) will offer further labour market insights.

In the Eurozone, key data includes Sentix (Mon), ZEW (Tue), the ECB economic bulletin (Thu), and Q3 GDP/employment data (Fri), alongside final CPI updates. US data remains limited due to the shutdown, with only NFIB small business confidence (Tue) scheduled.

BoE hawks dominate UK speeches: Lombardelli and Pill (Mon/Wed), Greene (Tue/Thu). ECB speakers include Schnabel (Wed) and Lane (Fri). Fed speeches feature Williams, Bostic (Wed), and Musalem (Thu).

Overnight Headlines

- UK FinMin Reeves Plans To Raise Income Tax In Nov 26 Budget

- ECB’s Vujcic Says Policy In Good Place, Warns Of Market Risk

- Fed’s Hammack Leans Against More Rate Cuts Due To High Inflation

- Trump Plans One-Year Pause On Port Crane Duties, China Ship Fees

- Trump Seeks Rare Earths In Meeting With Central Asian Nations

- US To Block Nvidia’s Scaled-Back AI Chip Shipments To China

- China’s Exports Fall For First Time Since ‘Liberation Day’ Trade Tariffs

- Tesla Shareholders Approve $1T Award For Musk, If Targets Are Met

- Elon Musk Says Tesla Will Build Own Chip Fab, Eyes Intel Collaboration

- Microchip Forecasts Sales Below Estimates; Inventory Clearing Weighs

- Tencent, Hon Hai Ride AI Wave As China–US Tech Rivalry Grows

- Airbnb Sales Rise 10% As Travelers Book Vacations Further In Advance

- Expedia Raises Full-Year Outlook As Travelers Regain Confidence

- Japan PM Takaichi Fills Panel Posts With Advocates Of Big Spending

- CIA Deputy Warns Lengthy Shutdown Poses National Security Risks

- US Money Market Faces Fresh Stress Risk, Wall Street Banks Say

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1475 (290M), 1.1500 (715M), 1.1570-75 (572M)

- 1.1600 (1.2BLN), 1.1625 (275M), 1.1695-00 (1.0BLN)

- USD/JPY: 152.90-00 (520M), 154.00 (277M)

- USD/CHF: 0.8045-50 (482M)

- GBP/USD: 1.3200 (744M), 1.3245-50 (372M)

- AUD/USD: 0.6500 (917M), 0.6515-25 (325M), 0.6540-50 (470M)

- USD/CAD: 1.3965-75 (433M), 1.3985-95 (1.03BLN), 1.4000 (451M)

- 1.4050-55 (557M), 1.4100 (838M), 1.4120-30 (280M), 1.4200 (659M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

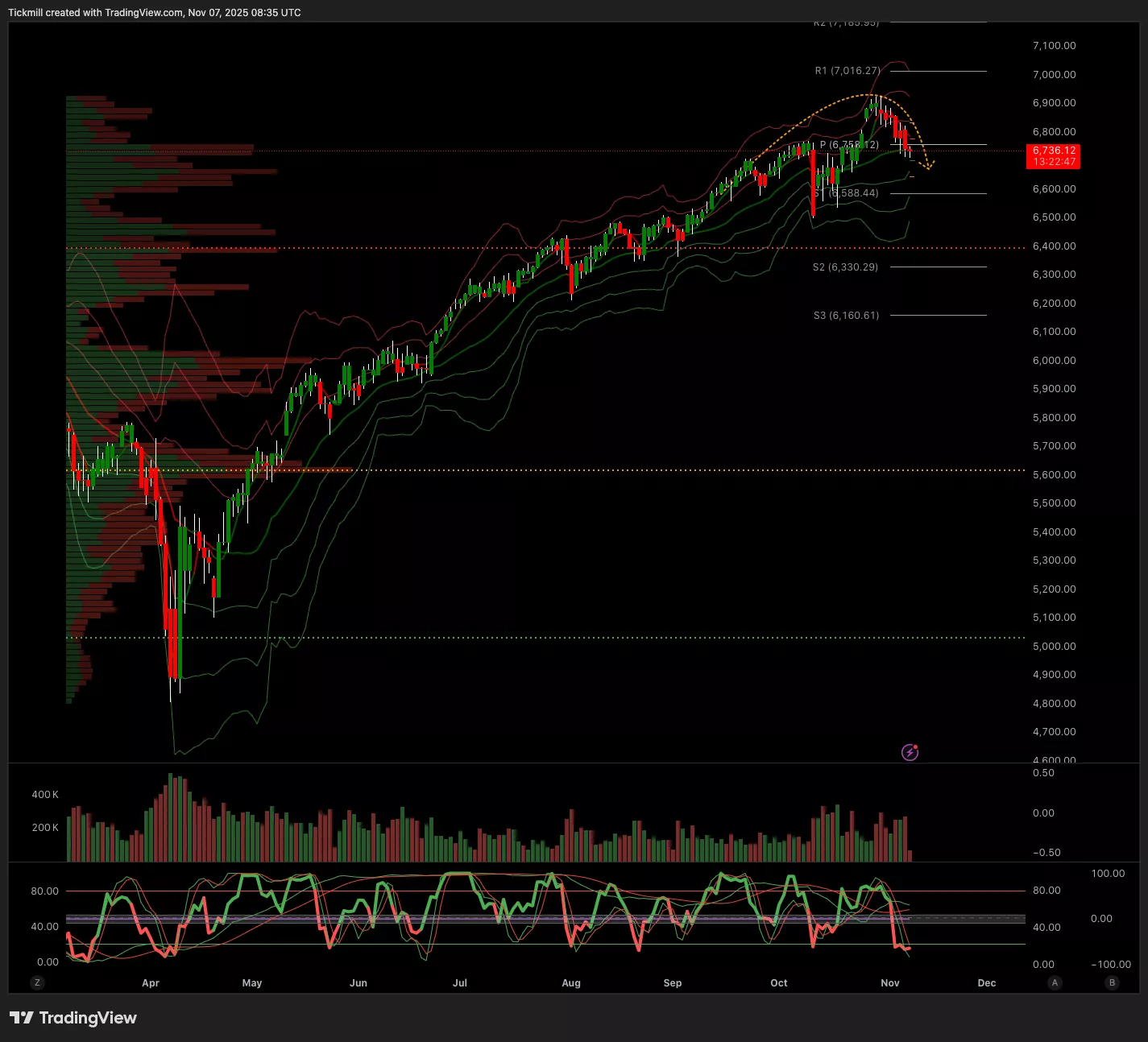

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6788 Target 6932

- Below 6751 Target 6630

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.1534 Target 1.16

- Below 1.1512 Target 1.14

GBPUSD

- Daily VWAP Bullish

- Weekly VWAP Bearish

- Above 1.3087 Target 1.3178

- Below 1.3028 Target 1.2923

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 153.98 Target 154.73

- Below 153.71Target 152.32

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 3980 Target 4089

- Below 3969 Target 3849

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 104.k Target 108.1k

- Below 104.k Target 97.4k

More By This Author:

The FTSE Finish Line - Thursday, Nov. 6

Daily Market Outlook - Thursday, Nov. 6

The FTSE Finish Line - Wednesday, Nov. 5