The FTSE Finish Line - Wednesday, Nov. 5

Image Source: Pexels

The UK's FTSE 100 edged higher on Wednesday, recovering from early losses in heavyweight banking stocks as gains in energy shares provided support. Investors kept a close watch on the Bank of England's upcoming interest rate decision and awaited more corporate earnings reports later in the week. Oil and gas stocks rose by 0.3%, buoyed by steady crude oil prices. However, banking giants like Standard Chartered and Barclays slipped around 1% each, curbing overall market progress. Precious metal miners were among the hardest hit, tumbling 2%, while the personal goods sector shone with a 1.6% rise. Looking ahead, expectations suggest the Bank of England will hold interest rates steady on Thursday. Yet, softer inflation and wage data could strengthen the case for a potential rate cut in the future.

Meanwhile, Britain’s services sector showed signs of improvement last month, with output and new orders on the rise. A survey revealed that business activity expectations for the next year reached their highest level since October 2024. The pound steadied against the dollar after a 0.9% dip in the previous session, while gilt yields presented mixed movements.

UK budget concerns resurfaced after Reeves's speech highlighted fiscal challenges. With three weeks until the budget, projections suggest a £32bn borrowing need for 2029-30, requiring significant fiscal tightening to maintain a £10bn headroom. If the target rises to a £15bn buffer, £37bn in savings would be needed. Meeting fiscal goals while honouring tax commitments remains difficult. Falling gilt yields have pressured the GBP, now weaker on a trade-weighted basis, with mixed performance against USD (+2.5%) and EUR (-1%). The upcoming fiscal event poses risks: achieving credible budget consolidation and tax measures could lower Bank Rate expectations, weakening GBP’s yield appeal. Recent exchange rate drops likely remain unaccounted for in the BoE's November projections due tomorrow.

Marks & Spencer Group shares experienced a rollercoaster session, sliding 2.5% to 374.7p and ranking among the biggest decliners in the FTSE 100 index. The company reported a 55% year-on-year drop in adjusted pre-tax profit for the first half, falling to £184.1 million ($247.08 million), largely due to a one-off cyber incident. While recovery efforts are underway, CEO warns that the retail sector continues to face "significant headwinds." Year-to-date, including the latest session's decline, the stock is down approximately 0.2%.

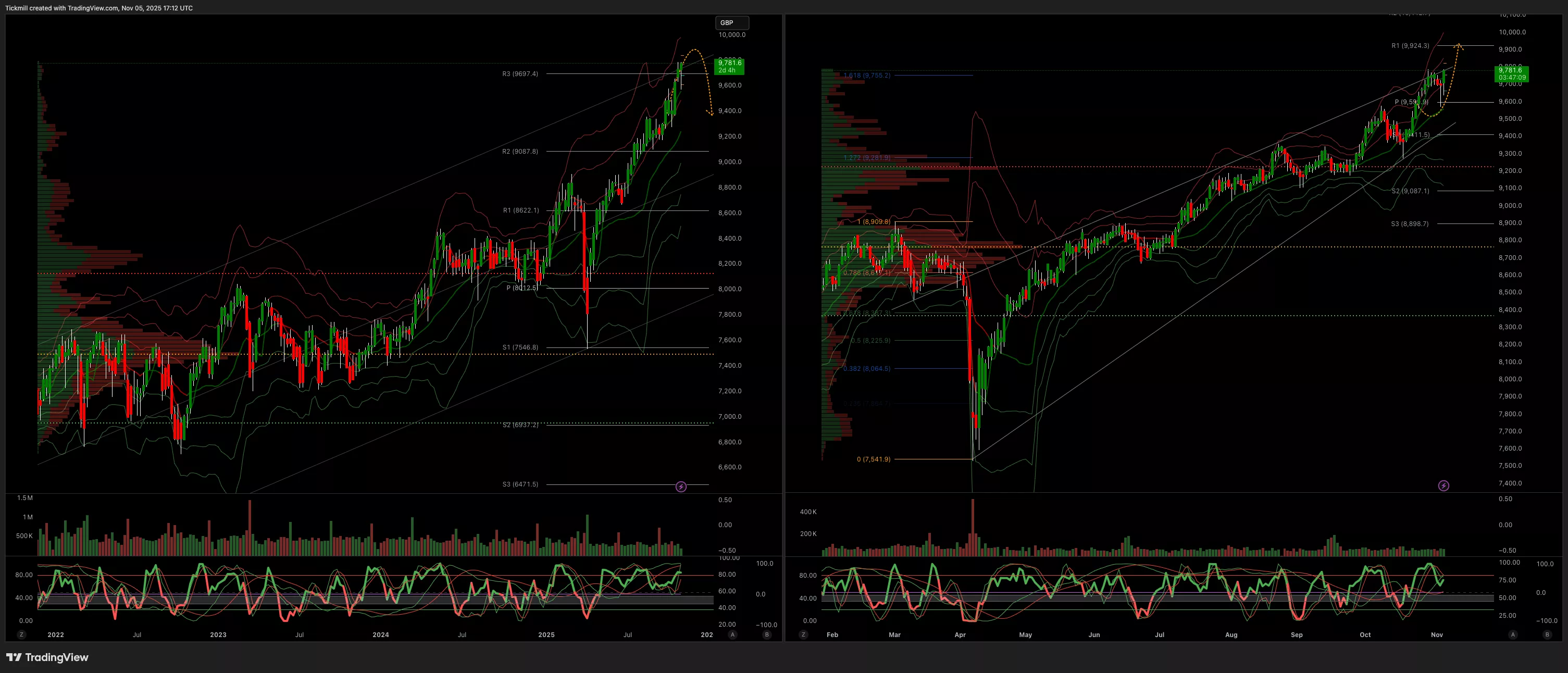

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 9737

- Primary support 9500

- Below 9737 opens 9550

- Primary objective 9873

- Daily VWAP Bearish

- Weekly VWAP Bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, Nov. 5Daily Market Outlook - Tuesday, Nov. 4

The FTSE Finish Line - Monday, Nov. 3