Daily Market Outlook - Tuesday, June 10

Image Source: Pixabay

Asian stocks pared their early gains, as US equity-index futures turned from up to flat in overnight trade, stocks in mainland China and Hong Kong also declined, while the dollar edged up as the second day of US-China negotiations approached. Asia’s regional stock index rose by 0.2%, retreating from an earlier peak of 0.7%. The discussions are set to resume in London later on Tuesday. Although no major breakthroughs were reported after the first day of talks, US officials expressed optimism about the progress. With a critical inflation report due on Wednesday and the Federal Reserve entering its blackout period ahead of the June 18 interest rate decision, investors are assessing potential catalysts that could propel the S&P 500 to a new record high after its 20% rally from April lows.US Commerce Secretary Howard Lutnick characterised the talks between Washington and Beijing as "fruitful," while Treasury Secretary Scott Bessent described them as a "good meeting." “We are doing well with China. China’s not easy,” President Donald Trump remarked at the White House on Monday. “I’m only receiving positive feedback.” According to a US official, discussions will extend into a second day, focusing on reducing tensions over technology and rare earth element trade. Advisors are scheduled to reconvene at 10 a.m. in London on Tuesday, the official confirmed.

China's May trade data highlights tariff impacts, showing a 34.5% y/y drop in exports to the US, with year-to-date shipments 9.4% below 2024 levels. Despite disrupted cross-Pacific trade and minimal US inventory building, reduced tariffs (now 30%) have slightly improved port traffic. However, US purchasers face challenges in sourcing substitutes. Meanwhile, China’s total exports rose 4.5% y/y, driven by strong demand from Asia and Europe, reaching near-record highs. This positions China strongly in US-China trade talks, as Chinese firms easily find alternative markets, unlike US importers struggling to replace Chinese goods cost-effectively.

The global healthcare industry faced significant upheaval as vaccine sceptic U.S. Health Secretary Robert F. Kennedy Jr. abruptly dismissed the entire panel of vaccine specialists at the U.S. Centres for Disease Control and Prevention. This decision is likely to pose challenges for pharmaceutical companies such as GSK, Sanofi, AstraZeneca, Moderna, and BioNTech, potentially causing delays in vaccine approvals. Meanwhile, advertising agencies also came under heightened scrutiny. According to the Wall Street Journal, the U.S. Federal Trade Commission has requested information from leading firms in the sector, including Omnicom, WPP, Dentsu, Interpublic Group, and Publicis Groupe, over alleged antitrust violations, particularly concerning the coordination of platform boycotts.

The latest UK labour market report showed softness. Despite national living wage pressures, pay growth decelerated faster than expected, with average weekly earnings at 5.3% 3m y/y (vs. 5.5% forecast). While this eases BoE price risk concerns, it stems from a slowing labour market impacted by regulated pay and NI tax changes. Employment rose by 89k in 3m/3m to April, but the unemployment rate hit a cycle high of 4.6%. May payroll employment fell by 109k (-20k forecast), with April revised down to -55k from -33k, marking a 0.9% y/y drop (-274k vs. May 2024).

Today's macro highlights include: Eurozone Sentix Survey, US NFIB Small Business Optimism Report, and speeches from ECB officials Villeroy, Rehn, and Holzman.

Overnight Headlines

- ECB’s Holzmann: Rate Pause Until Autumn Makes Sense

- BoJ’s Ueda Comments Weaken Yen; Ex-Official Hints Slower Bond Taper

- US-China Trade Talks Continue In London As Tariff Deadline Looms

- US May Exhaust Debt-Ceiling Measures By Mid-August, CBO Warns

- Apple Expands ChatGPT Deal, Offers Developers AI Model Access

- Wall Str, Main Str Push To Rethink Foreign Tax Rules In US Budget Bill

- China Taps $1.5T Fund To Ramp Up Housing Market Support

- UK Retail Sales Slow In May, Casting Doubt On Consumer Resilience

- Barclays Cuts More Than 200 Investment Bank Jobs To Reduce Costs

- Canada To Boost Defense Spending, PM Carney Rules Out Tax Hikes

- US Deploys Marines To LA As Trump Backs Arrest Of California Governor

- OpenAI’s Forecasted Subscription Revenue Doubles To $10B

- US Asks Appeals Court To Extend Trump-Era Tariffs

- Australia Business Conditions Flat In May As Retail Margins Squeezed

- Taiwan Exports Surge To Near 15-Year High Amid Tariff Uncertainty

- Gold Prices Mixed As Traders Track US-China Trade Talks

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1300 (1.1BLN), 1.1320 (778M), 1.1340 (375M), 1.1360 (414M)

- 1.1370-75 (1.1BLN), 1.1385 (543M), 1.1400-10 (2.2BLN), 1.1425 (1.3BLN)

- 1.1450-55 (690M), 1.1500 (367M)

- USD/CHF: 0.8210 (300M)

- EUR/GBP: 0.8445-50 (428M). GBP/USD: 1.3500-15 (445M)

- AUD/USD: 0.6420 (941M), 0.6460 (618M), 0.6500 (212M)

- 0.6565 (310M), 0.6585-0.6600 (828M)

- NZD/USD:0.6000-05 (285M), 0.6100 (200M), 0.6120 (260M)

- USD/CAD: 1.3695 (1.1BLN)

- USD/JPY: 143.90-144.00 (1.3BLN), 145.00 (715M)

- AUD/JPY: 95.00 (400M)

CFTC Data As Of 6/6/25

- Speculators have increased their net short position in CBOT US Treasury bonds futures by 48,483 contracts, bringing the total to 102,373. They also reduced their net short position in CBOT US Ultrabond Treasury futures by 5,029 contracts, now totaling 228,443. Additionally, there was a decrease of 64,348 contracts in the net short position for CBOT US 10-year Treasury futures, which now stands at 705,256 contracts. On the other hand, the net short position for CBOT US 5-year Treasury futures increased by 63,299 contracts to reach 2,396,536. The net short position for CBOT US 2-year Treasury futures also grew, rising by 24,022 contracts to 1,143,925.

- Equity fund managers have cut their net long position in the S&P 500 CME by 40,048 contracts, resulting in a total of 814,481 contracts. Conversely, equity fund speculators have raised their net short position on the S&P 500 CME by 27,860 contracts, now at 285,326.

- The net long position for the Japanese yen is at 151,149 contracts, while the euro has a net long position of 82,764 contracts, and the British pound holds a net long position of 35,215 contracts. The Swiss franc is currently at a net short position of -26,066 contracts, and Bitcoin has a net short position of -2,312 contracts.

Technical & Trade Views

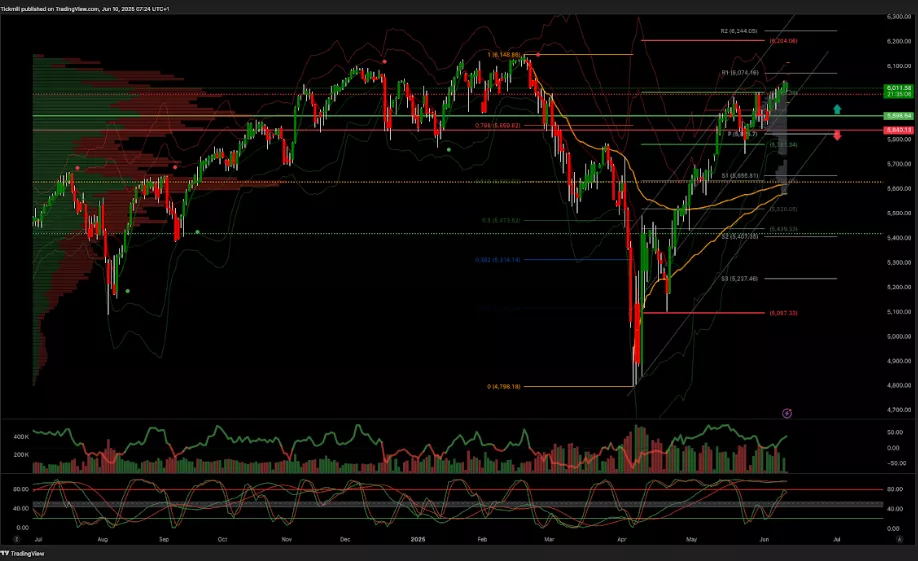

SP500 Pivot 5900

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5650

(Click on image to enlarge)

EURUSD Pivot 1.12

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

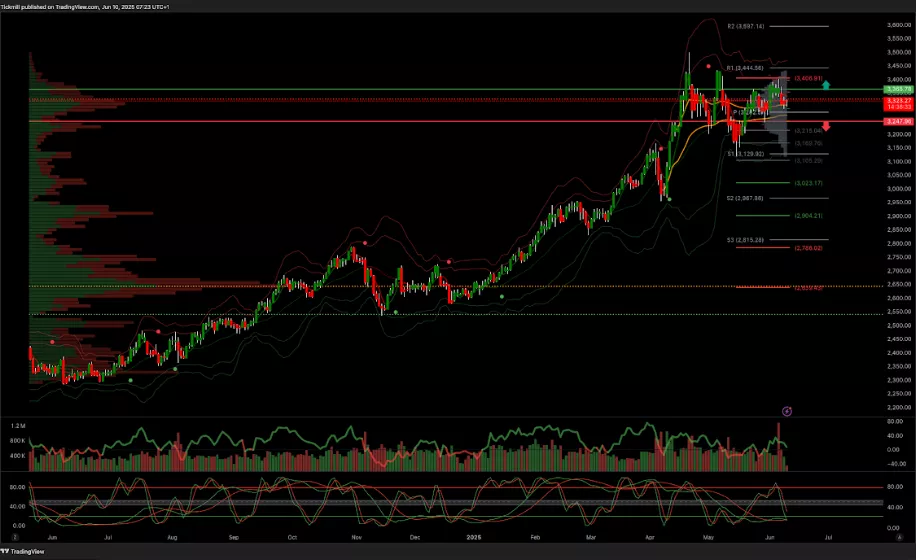

XAUUSD Pivot 3365

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Monday, June 9

S&P 500 Weekly Action Areas & Price Targets - Monday, June 9

Daily Market Outlook - Monday, June 9