Daily Market Outlook - Tuesday, July 30

Image Source: Pixabay

Asian stock markets are trading mostly lower on Tuesday, as investors remain cautious ahead of key central bank policy meetings and upcoming earnings reports from major tech companies.

Europe is set to receive preliminary GDP data, a 0.2% quarter-on-quarter expansion in Q2 GDP for the euro area is consensus. The euro area PMI has historically been a reliable GDP indicator, and the Q2 readings were somewhat stronger despite a slight dip in the July flash estimate. Forecasters see a slightly higher chance of an upside surprise. However, the 0.2% growth appears modest compared to the 0.7% non-annualized US GDP growth. The July flash PMIs also showed further divergence between the US and euro area. Spain and Germany's July inflation estimates are due today, with the euro area aggregate due tomorrow. Expect the headline and core inflation rates to decrease by 0.2% and 0.3% month-on-month, respectively. Despite core goods likely driving the decline, the market is slightly more skeptical about an ECB rate cut in September than a Fed rate cut.

Oil prices have dropped to a seven-week low, with demand-related concerns currently outweighing concerns about the risk of the conflict in Gaza spreading to Lebanon as tensions rise between Israel and the Iranian-backed Lebanese movement Hezbollah.

Earnings reports from Microsoft and AMD will be closely watched, as investors seek clues on appropriate valuations after a recent tech-sector rout. In Europe, results from companies like BP, Rio Tinto, Airbus, and L'Oreal could provide insights into economic conditions along the supply chain.

The main events this week are the central bank policy meetings, and market moves are likely to be limited until those are concluded. After a benign June inflation report, investors expect the Federal Reserve to lay the groundwork for a September rate cut at its policy meeting on Wednesday. The Bank of Japan's policy decision on Wednesday is also closely watched, with sources indicating that a rate hike will be discussed and a plan to roughly halve its bond purchases in the coming years may be unveiled. The Bank of England is set to meet on Thursday, with markets pricing in a roughly 40% chance of a 25 basis point rate cut.

Overnight Newswire Updates of Note

- US Treasury expects to borrow $740 billion in third quarter

- BOJ to debate rate hike timing as Fed opens door to cuts

- Chief Cabinet Secretary Hayashi – Expects BOJ to closely coordinate with government

- Japan seeks brokerages to market JGBs abroad, Nikkei reports

- UK house prices expected to rise over second half of year – Zoopla

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800-10 (520M), 1.0875 (1BLN), 1.0895 (739M)

- USD/CHF: 0.8905 (248M). EUR/CHF: 0.9495-00 (740M), 0.9700 (609M)

- EUR/GBP: 0.8450 (2.3BLN). GBP/USD: 1.2820-30 (324M)

- AUD/USD: 0.6575 (774M), 0.6620 (356M), 0.6650-60 (755M), 0.6675 (311M)

- AUD/NZD: 1.1135 (364M), 1.1150 (720M)

- USD/CAD: 1.3825 (567M), 1.3875-80 (733M)

- USD/JPY: 153.50-55 (1BLN), 154.40-50 (1.4BLN), 155.00 (3.6BLN)

- EUR/JPY: 165.25 (275M)

- Month-end FX flows are expected to be weak to neutral, according to various bank models. Barclays anticipates weak USD demand against major currencies, while Credit Agricole forecasts neutral USD but potential EUR buying from corporate flows.

CFTC Data As Of 23/7/24

- Equity fund managers cut S&P 500 CME net long position by 2,812 contracts to 994,529

- Equity fund speculators trim S&P 500 CME net short position by 89,786 contracts to 280,356

- Japanese yen net short position is -107,108 contracts

- Swiss franc posts net short position of -42,237 contracts

- British pound net long position is 142,183 contracts

- Euro net long position is 35,906 contracts

- Bitcoin net short position is -661 contracts

Technical & Trade Views

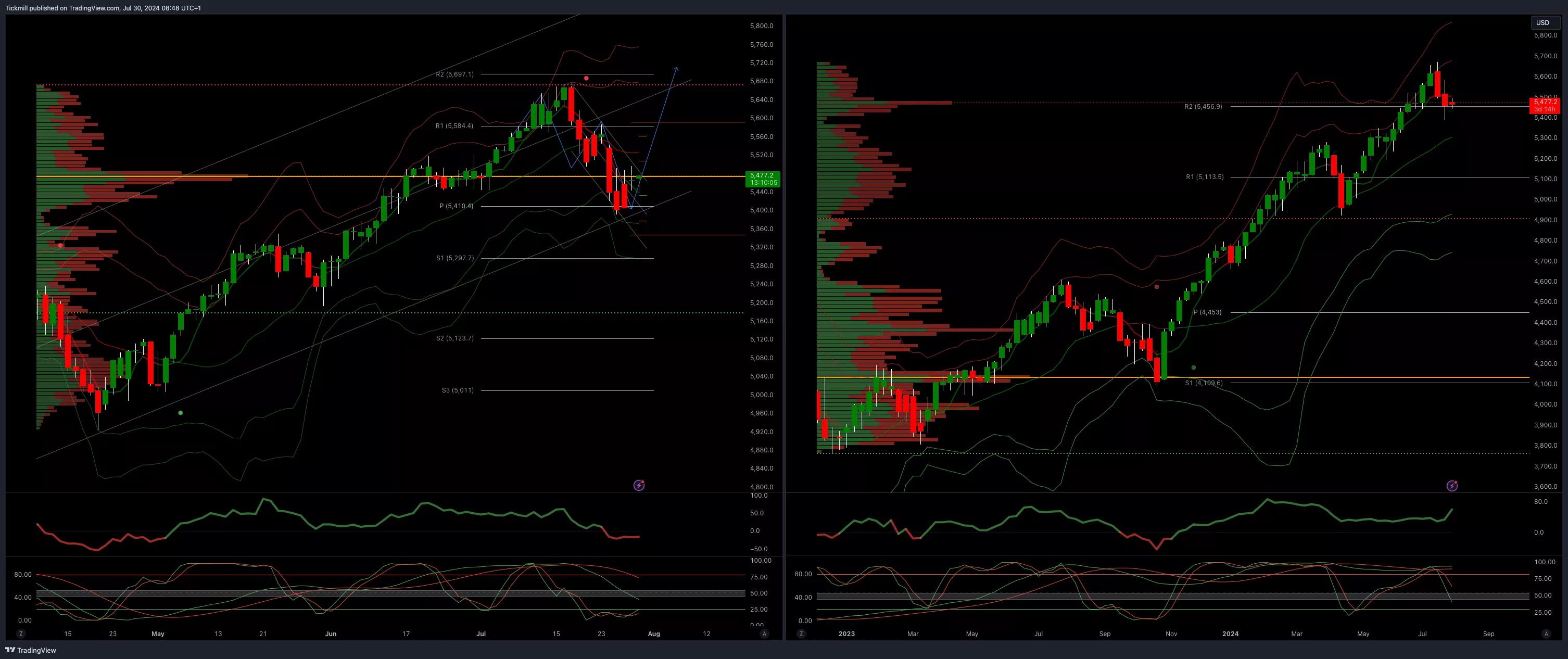

SP500 Bullish Above Bearish Below 5480

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 5475 opens 5450

- Primary support 5400

- Primary objective is 5700

(Click on image to enlarge)

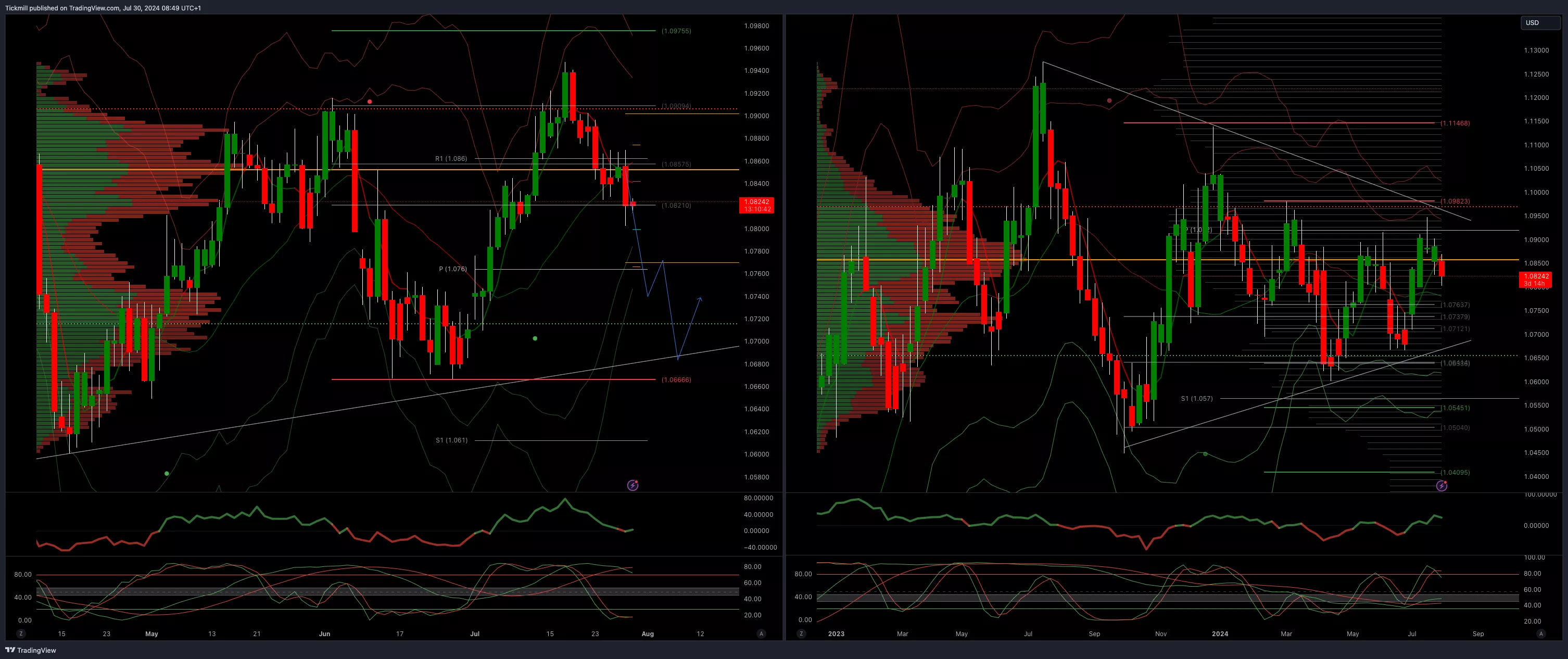

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.880 opens 1.0940

- Primary resistance 1.0981

- Primary objective is 1.07

(Click on image to enlarge)

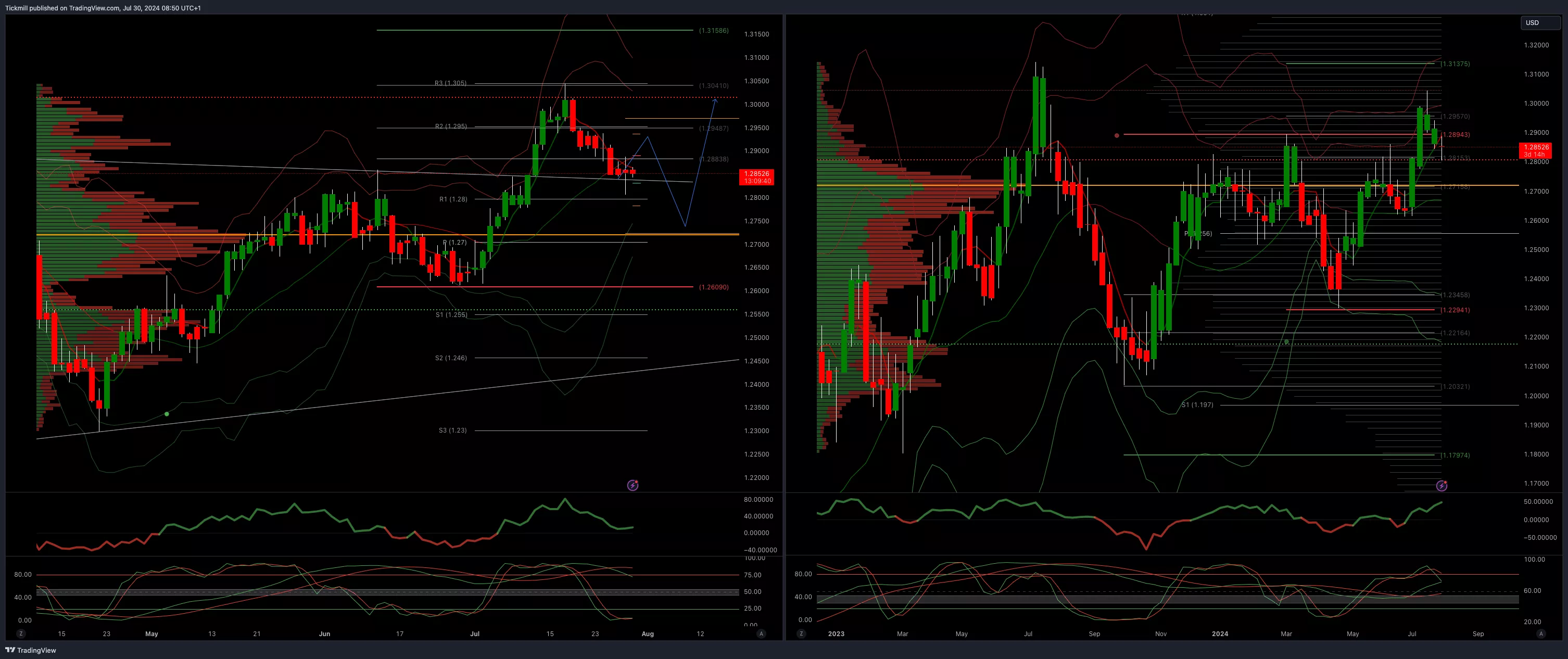

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.3137/60

(Click on image to enlarge)

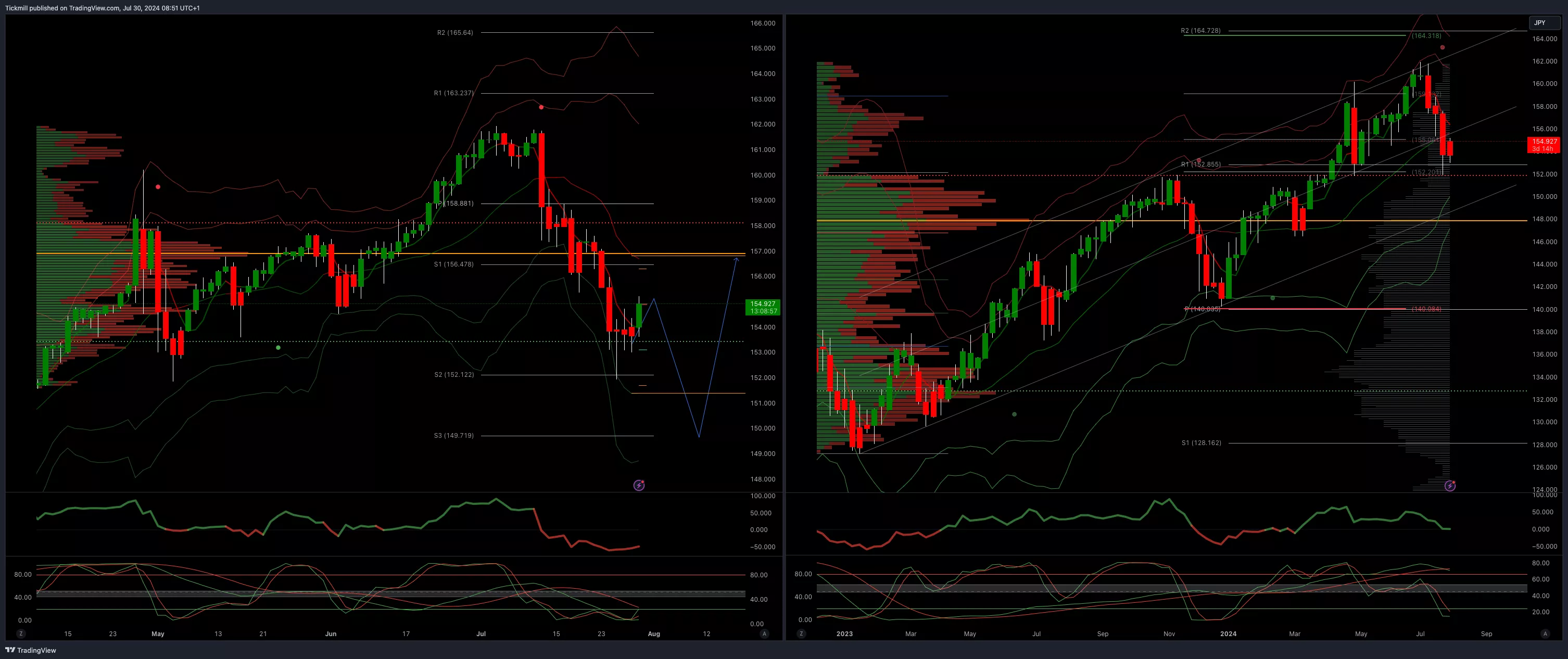

USDJPY Bullish Above Bearish Below 156

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 152 opens 148.80

- Primary support 152

- Primary objective is 148.80

(Click on image to enlarge)

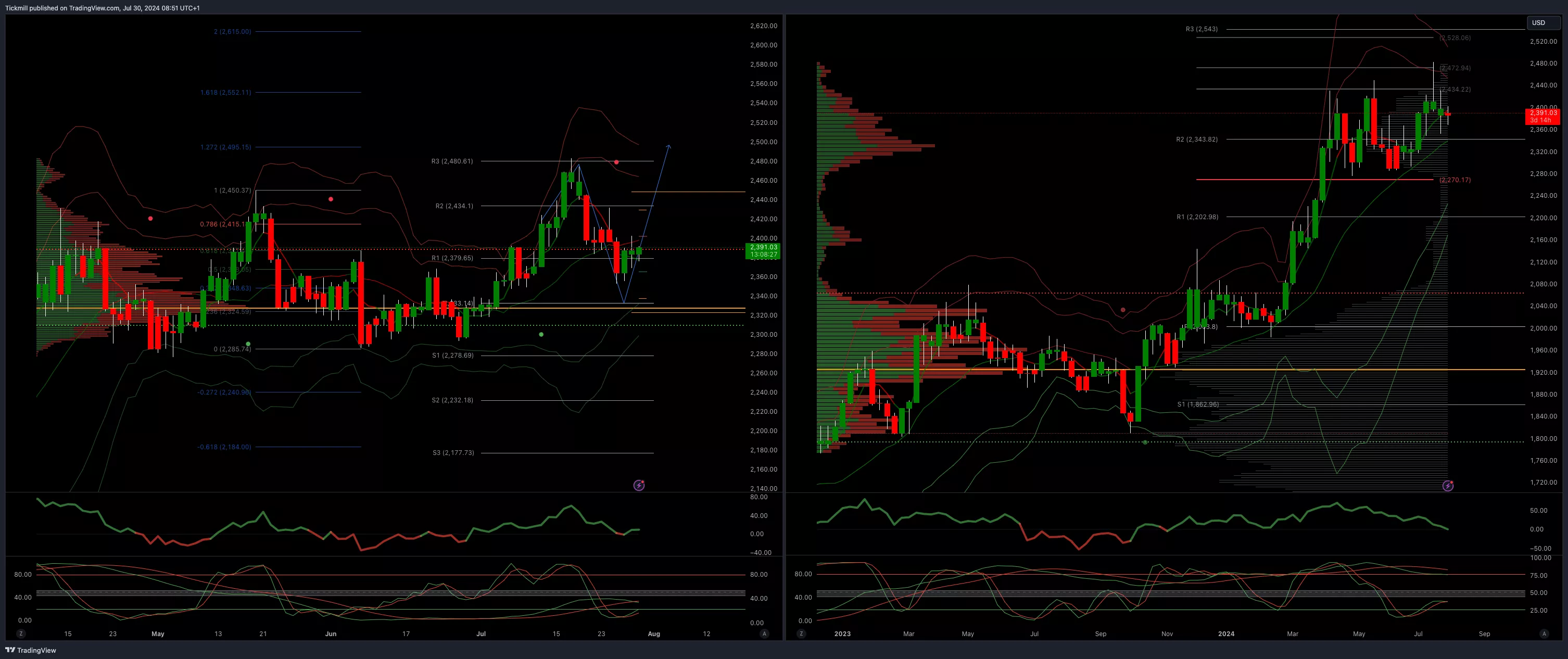

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

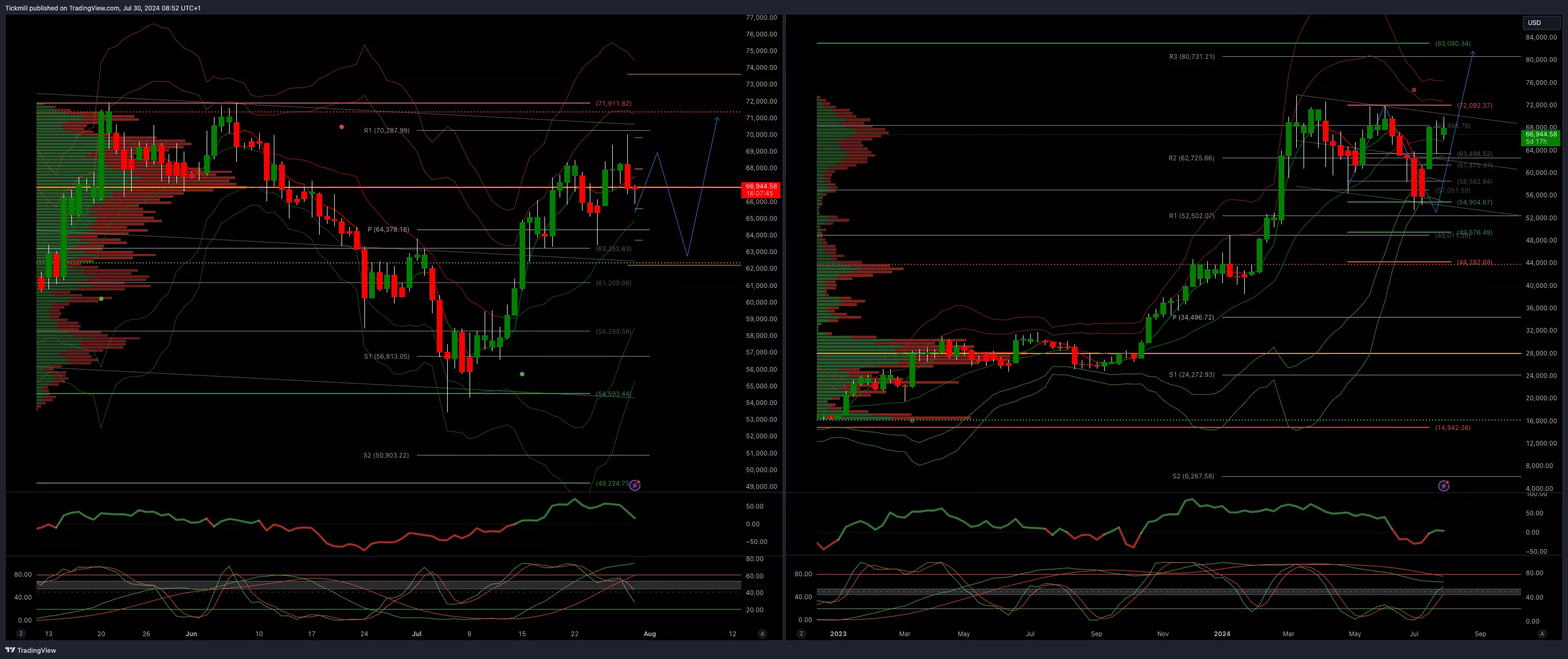

BTCUSD Bullish Above Bearish below 62000

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 67000 opens 70000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE In The Green, After Strong Weekly Reversal Signal

FTSE Reverses Early Losses After Printing Three Month Lows…Buy

SP500 Daily Trade Plan - Thursday, July 25