FTSE In The Green, After Strong Weekly Reversal Signal

Image Source: Unsplash

The FTSE 100 in London edged up on Monday, driven by increases in energy stocks and optimism among investors regarding potential interest rate cuts in the U.S. and the UK. However, gains were limited by weakness in Pearson. The blue-chip FTSE 100 index rose by 0.11%, reaching its highest level since early June, while the mid-cap FTSE 250 remained flat after reaching a two-year high on Friday. Energy shares saw a 1.5% increase, propelled by rising oil prices due to concerns about escalating tensions in the Middle East. Both Shell and BP gained over 1%. Precious metal and industrial metal miners also saw slight gains of 0.4% and 0.7% respectively, while personal care, drug, and grocery shares fell by 1.4%, mainly due to a 9.2% drop in Reckitt Benckiser's stock. Reckitt, the maker of the Enfamil formula, traded at its lowest level since 2013. The company is on track for its largest daily decline since March if current losses continue. This comes after a jury ruled that Abbott Laboratories' specialised formula for premature infants caused a dangerous bowel disease in an Illinois girl, resulting in a $495 million damages payment for the healthcare company. Close to 1,000 lawsuits have been filed against Abbott Laboratories, Reckitt Benckiser, or both in federal or state courts. Analysts at Jefferies believe that this verdict is likely to negatively impact the risk for both companies. Meanwhile, analysts at J.P. Morgan predict that the settlement amount for similar cases could range from $150-300k, potentially leading to a total settlement of $500 million to $1.5 billion as more cases are filed. As of the last closing, Reckitt Benckiser's stock is down nearly 18% year-to-date.

Pearson Plc, a leading education, assessment, and certifications company based in the UK, experienced a 7% decline in sales, totaling 1.75 billion pounds ($2.26 billion) in the first half of the year. This resulted in a 4.2% drop in the company's stock, causing it to be among the top percentage losers on the FTSE 100 index. Despite this, the adjusted operating profit remained flat at 250 million pounds year-on-year. The company reported a 2% decline in sales in the Higher Education business and a 1% decline in the Virtual Schools division. Additionally, Pearson Test of English division volumes fell by 10% due to decreases in the English High Stakes testing market, attributed to stricter policies around international study and migration. Despite these challenges, the stock has seen a 4% increase year-to-date.

Overall, global sentiment improved after a rebound in tech shares on Wall Street and a US inflation report that supported expectations of a September interest rate cut. This week, all eyes will be on the US Federal Reserve's rate decision on Wednesday, with investors anticipating a dovish stance. Additionally, the Bank of England's monetary policy decision on Thursday and the upcoming quarterly earnings reports from major US tech companies will be closely watched.

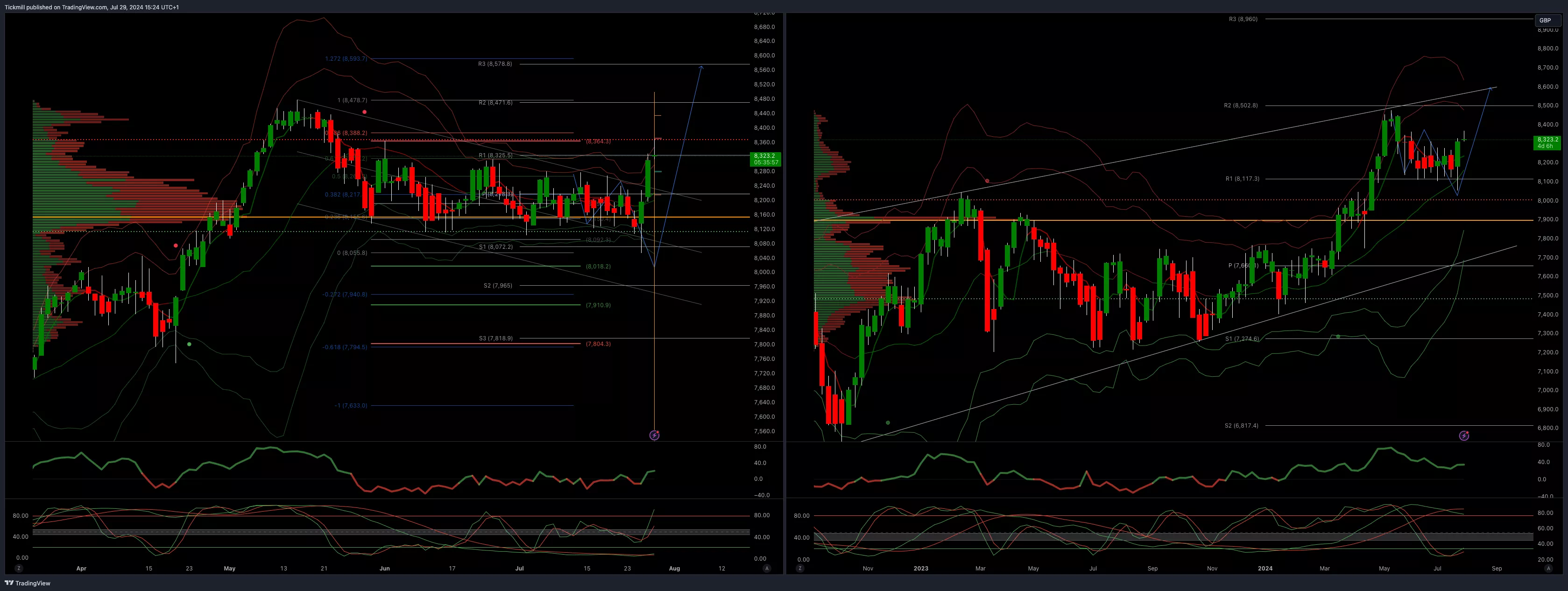

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8225

- Primary support 8000

- Primary objective 8593

- DailyVWAP Bullish

- Weekly VWAP bullish

(Click on image to enlarge)

More By This Author:

FTSE Reverses Early Losses After Printing Three Month Lows…BuySP500 Daily Trade Plan - Thursday, July 25

Daily Market Outlook - Thursday, July 25