Daily Market Outlook - Tuesday, Jan. 28

Image Source: Pixabay

The widely held narrative of US exceptionalism that drove Wall Street to repeated record highs, thanks to the dominance of America's unparalleled technology firms, is now facing uncertainty and may not be as indestructible as once believed. The cost-effective AI model from Chinese startup DeepSeek led to a massive loss of nearly $600 billion in market value for leading chipmaker Nvidia on Monday, casting doubt on the stability of the two-year boom in AI investments. This unprecedented drop in value for a single company in just one day has sent shockwaves through the market. DeepSeek's claim of achieving comparable AI performance in the U.S. with significantly fewer resources has rattled various industries, triggering a widespread sell-off impacting data centers, cable manufacturers, energy suppliers, and a multitude of AI-related businesses. U.S. President Donald Trump highlighted that the technological advancements by Chinese startup DeepSeek should be a wake-up call for American businesses, emphasizing the importance of recognizing China's swift progress in artificial intelligence. Trump, speaking from Florida, commented that the emergence of DeepSeek's AI from a Chinese company signals the need for heightened competitiveness within American industries. Trump announced his intention to impose tariffs on imported computer chips, pharmaceuticals, and steel to encourage domestic production. This statement follows a day after the U.S. and Colombia stepped back from the edge of a trade conflict on Sunday, as the White House revealed that the South American country had consented to accept military aircraft transporting deported migrants, Trump's renewed emphasis on tariff’s saw demand for the dollar overnight.

In the Asia trading session, Nasdaq futures and Nvidia shares remained steady in after-hours trading. China, Taiwan, and South Korea markets were closed for a holiday, while Hong Kong's trading was shortened ahead of the Lunar New Year, shifting focus to Japan. Nvidia supplier Advantest's shares plummeted by 11%, marking a nearly 20% decline over two days, while Furukawa Electric, which experienced a tripling in value last year, saw a similar downturn this week. In the U.S., Boeing, General Motors, and Starbucks are expected to release their reports today, with upcoming earnings reports from Meta, Microsoft, and Tesla scheduled for Wednesday. Analysts believe that DeepSeek's pricing surpasses that of its competitors, potentially prompting some companies to scale back their AI investment plans. Moreover, policy meetings are anticipated this week in both the U.S. and Europe. Following Monday's market slump, traders are expecting an additional 9 basis points of easing from the Federal Reserve, and a rate cut in Europe on Thursday is almost entirely predicted.

This morning, the UK’s ONS will publish national population projections this morning, which are important for policy planning and the BoE's supply-side assessment of the UK economy. While these projections may not be formally included in the MPC's February modelling, they will inform risk biases. The key focus for inflation and policy is spare capacity, with the November MPR indicating no spare capacity in 2024 and 2025, followed by a slight excess supply in 2026. Given recent demand weakness, any potential supply downgrade is expected to be less than the demand hit, potentially creating spare capacity sooner and helping to moderate medium-term inflation projections. Additionally, today’s data slates sees the European Central Bank's Villeroy, Cipollone, Lagarde scheduled, along with the release of U.S. durable goods and consumer confidence data.

Overnight Newswire Updates of Note

- Trump Vows Tariffs ‘Much Bigger’ Than 2.5% On Key Areas

- SAP Sees Higher Operating Profit In 2025

- German Leftist Leader Vows To Block Higher Defence Spending

- EU And Nato Take Vow Of Silence On Greenland

- UK Competition Agency Will Make ‘Rapid Decisions’, New Chair Says

- Wall Street’s AI ‘Bubble’ Echoes Dotcom Excesses, Ray Dalio Warns

- Bitcoin Rebounds After DeepSeek AI Disruption Fears

- Yuan Investors On Edge As China’s Holiday May Spur Volatility

- MidEast Becomes Fastest-Growing Renewables Market Outside China

- Rare China Support Shows Developer Vanke May Be Too Big To Fail

- BoJ Watchers Think Next Interest Rate Hike Will Be In Six Months

- Australian Business Conditions Lift In December Driven By Retail

- New Zealand Filled-Jobs Recovery Points To Labour Market Revival

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0335 (950M), 1.0350 (443M), 1.0375-80 (730M), 1.0400 (1.1BLN)

- 1.0420-30 (574M), 1.0460 (696M), 1.0500 (1.6BLN), 1.0520-30 (1.1BLN)

- USD/CHF: 0.9050-60 (335M). EUR/CHF: 0.9450 (330M)

- AUD/USD: 0.6200 (720M), 0.6280 (570M), 0.6300 (1.6BLN), 0.6310 (442M)

- NZD/USD: 0.5790 (300M). USD/CAD: 1.4500 (504M)

- USD/JPY: 155.00 (368M), 157.50 (630M)

- EUR/JPY: 159.75 (409M)

CFTC Data As Of 24/1/25

This summary provides an overview of the trading positions held by equity fund managers and speculators in various futures markets as of the reporting period ending January 21:

1. Currencies (Net Short Positions):**

- **Euro**: **-62,486** contracts (significant bearish sentiment).

- **Japanese Yen**: **-14,673** contracts (moderate bearish stance).

- **Swiss Franc**: **-41,837** contracts (notable bearish sentiment).

- **British Pound**: **-8,257** contracts (marginal bearish positioning).

2. Bitcoin (Net Long Position):**

- **BTC**: **+739** contracts (mild bullish positioning in the futures market, reflecting growing optimism).

3. Equities (S&P 500 CME Futures):**

- **Equity Fund Managers (Long)**: Increased net long position by **+7,931 contracts** to a total of **+931,930 contracts**, signaling continued optimism.

- **Equity Fund Speculators (Short)**: Expanded net short position by **+88,671 contracts** to a total of **-399,756 contracts**, highlighting growing speculative bearish bets.

4. Treasuries (CBOT Futures):**

**Long Positions:**

- **US Treasury Bonds (30-year)**: Net long position grew by **+24,404 contracts** to **+24,456**, reflecting a more bullish outlook on long-term bonds.

**Short Positions:**

- **US Ultrabond (long-term Treasuries)**: Net short position decreased (trimmed) by **-12,434 contracts** to **-229,988**, indicating less bearish sentiment.

- **2-Year Treasury Futures**: Net short position trimmed by **-82,829 contracts** to **-1,174,377**, showing a reduction in bearish sentiment on short-dated bonds.

- **5-Year Treasury Futures**: Net short position increased by **+18,570 contracts** to **-1,796,191**, reflecting stronger bearish sentiment for mid-duration bonds.

- **10-Year Treasury Futures**: Net short position increased by **+12,310 contracts** to **-580,245**, indicating growing bearish sentiment for this maturity segment.

**Key Takeaways:**

1. **Currencies**: Persistent bearish sentiment dominates, particularly for the **euro** and **Swiss franc**, with speculative shorts significantly outweighing longs.

2. **Bitcoin**: A small but positive net long position reflects a bullish tilt.

3. **Equities**:

- Fund managers are steadfastly **bullish** on the S&P 500, while speculators maintain a growing **bearish stance**, signaling a potential divergence of sentiment.

4. **Treasuries**:

- **Long-duration bonds** (30-year) saw increased long positions, indicating optimism in long-term fixed income.

- **Shorter and mid-duration bonds** (e.g., 5-year, 2-year) retain heavy net short positions, reflecting expectations of rising interest rates or bearish bond sentiment.

Overall, bullish interest in long bonds and equity fund managers’ sustained optimism, while speculative shorts dominate in currencies and some Treasury maturities.

Technical & Trade Views

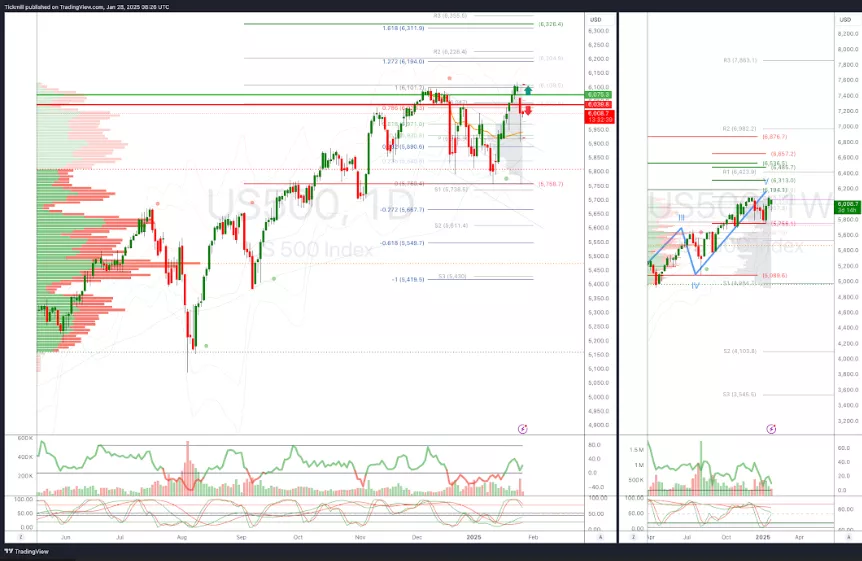

SP500 Pivot 6040

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness Into Feb 6th

- Long above 6075 target 6165

- Short Below 6045 target 5743

(Click on image to enlarge)

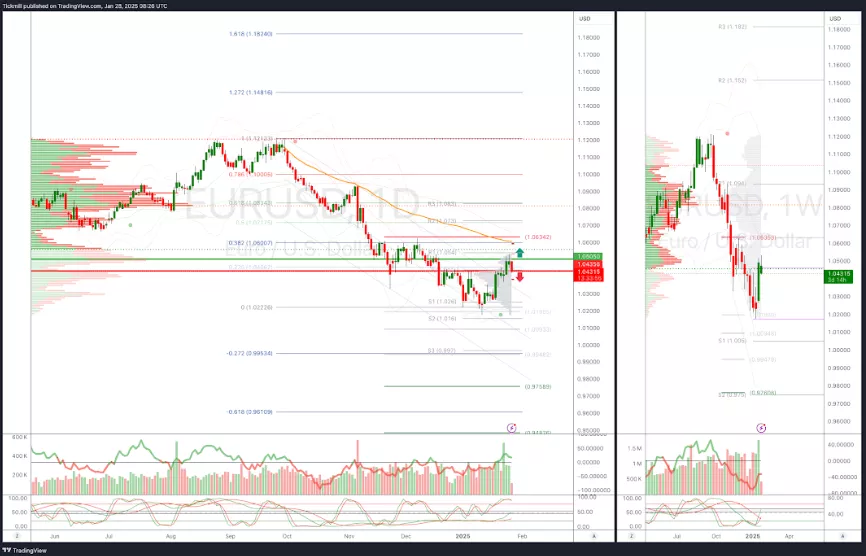

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

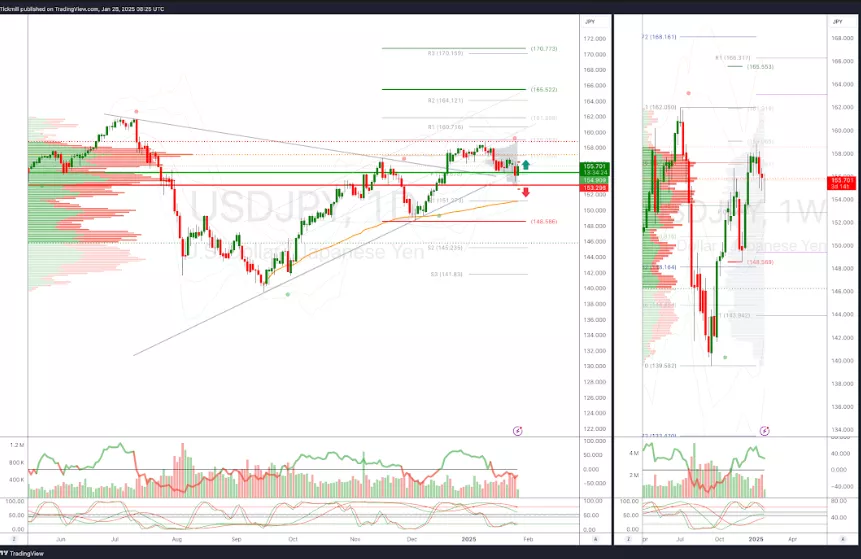

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

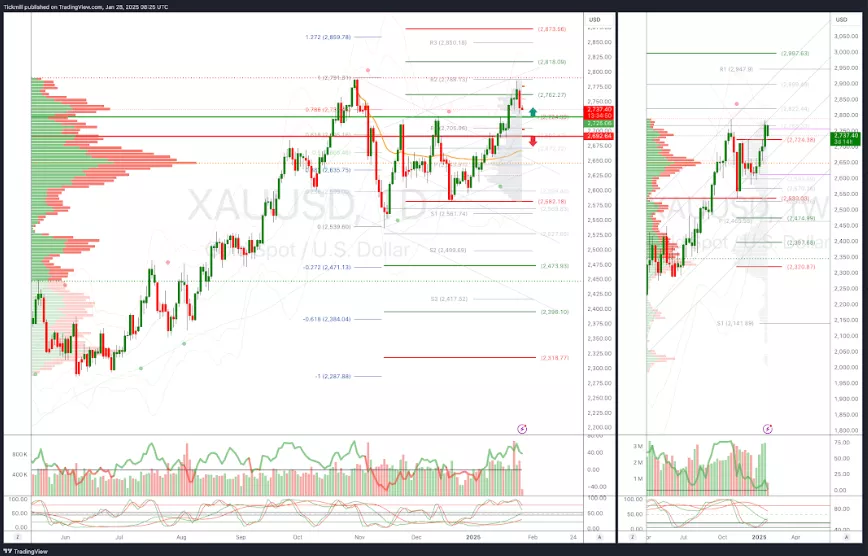

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2762

- Below 2692 target 2475

(Click on image to enlarge)

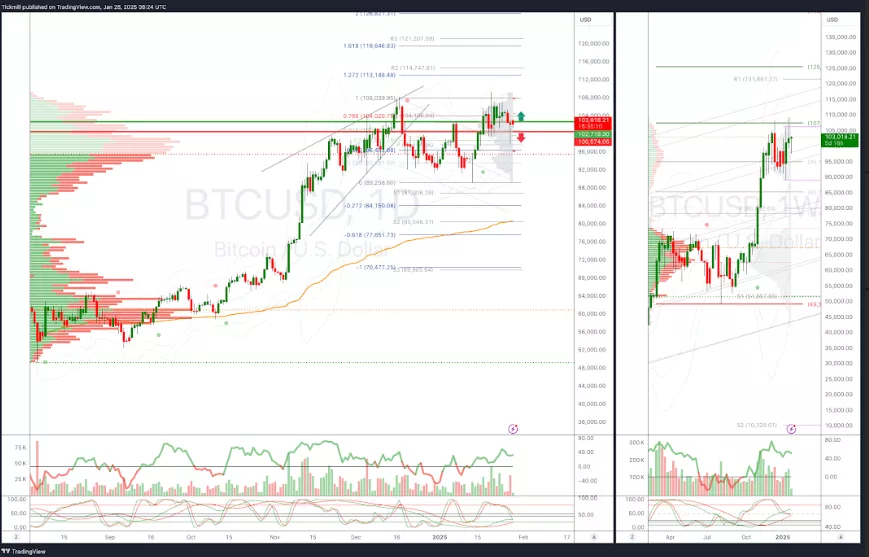

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE Heading For A Green Close After Reversing Early AI Led Losses

S&P 500 Weekly Action Areas & Price Objectives - Monday, Jan. 27

Daily Market Outlook - Monday, Jan. 27