Daily Market Outlook - Monday, Jan. 27

Image Source: Unsplash

On Monday, there was a decline in Nasdaq futures and a decrease in technology stocks in Japan, as investor confidence wavered following the introduction of a cost-effective Chinese artificial intelligence model, DeepSeek. This development sparked concerns about the profitability of AI and the industry's heavy reliance on advanced chips. Nasdaq 100 futures experienced a 2.85% drop, while S&P 500 futures also faced a decline. In Tokyo, shares of Advantest, a Nvidia supplier, took a drastic tumble of 8.5%. The emergence of DeepSeek, a startup offering a free assistant that utilizes affordable chips and requires less data, has injected a fresh element into the market. This new development challenges the prevailing notion that AI advancements would drive demand across the supply chain, impacting chip manufacturers and data centres. The disruption caused by DeepSeek's innovative approach has prompted a revaluation of expectations surrounding the future of AI and its implications for the technology sector. The small startup in Hangzhou behind DeeepSeek remains shrouded in mystery, yet their assistant managed to surpass the competition, ChatGPT, and claim the top spot as the highest-rated free app on Apple's App Store in the United States on Monday. Notably, researchers at DeepSeek recently published a paper stating that their DeepSeek-V3 model, launched on January 10, utilized Nvidia's H800 chips for training, coming at a cost of under $6 million. It is worth mentioning that the H800 chips, while not the most advanced option available, were initially developed as a lower-capacity alternative to navigate sales restrictions imposed on China. Subsequently, they were prohibited due to U.S. sanctions.

Trump stirred up currency markets by imposing punitive tariffs and sanctions on Colombia for rejecting military planes carrying deported migrants. However, the situation quickly changed course when Bogota ultimately agreed to comply with all of Trump's demands. While Colombia's peso remained stable during Asian trading hours, Mexico's currency experienced a 1.2% drop, while Canada's loonie saw a 0.3% decline. Additionally, the offshore yuan depreciated by 0.4%.

In stark contrast to his forceful approach on immigration issues, Trump's stance towards China has been more tempered. Despite threats to impose 10% tariffs from February 1 onwards, this figure is notably lower than the 60% tariffs pledged during his campaign and even less than the 25% tariffs potentially facing Canada and Mexico on the same date. This shift in tactics perhaps reflects Trump's improved relationship with Xi Jinping, as he expressed a preference to avoid tariffs in his interactions with Beijing following a positive conversation with China's leader earlier in the month.

Regarding the potential impact of DeepSeek on technology stocks, the extent of its threat to U.S. competitors remains uncertain. However, market players appear inclined to sell off shares now and await a clearer evaluation of the situation. With four of the Magnificent Seven preparing to release their financial results this week—Apple, Microsoft, Meta Platforms (the parent company of Facebook), and Tesla—the rise of DeepSeek may increase interest in Big Tech's quarterly performance, profitability and AI expenditure. In addition, a number of central banks around the world are expected to make policy announcements in the next few days, including the Federal Reserve on Wednesday and the European Central Bank the day after.

Overnight Newswire Updates of Note

- Bitcoin’s Sharp Descent Sparks $132M In Liquidations, Amid Volatility

- German Ifo Morale Set To Continue Lower After Economy Weakens

- WH: Colombia To Accept Deportees After Trump Tariff Standoff

- Fixed Income Investors Seek Ways To Navigate A Trump Presidency

- UK Banks Clash With BoE Over Rules On Loss-Absorbing Debt

- Global Investors Unfazed By PBoC’s Warnings On Chinese Bonds

- China's Jan Non-Manufacturing Activity Growth Slows

- China's Industrial Profits Fall 3.3% In 2024, Third Year In The Red

- BoJ May Revert To Fuzzy Communication After Fed-Style Clarity On Rates

- Asia Tech Stocks Fall As DeepSeek Sows Doubts About AI Spending

- Wall Street Bets Tesla’s 2025 Sales Will Miss Elon Musk’s Target

- VW Mull Chinese Rivals Taking Over Excess Production Lines In Europe

- Dollar Starts Week On Front Foot After Trump’s Colombia Tariffs

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0400 (1.2BLN), 1.0425-30 (895M), 1.0440-45 (1.8BLN)

- 1.0460 (1BLN), 1.0500-05 (1.1BLN)

- USD/CHF: 0.9055 (346M)

- EUR/GBP: 0.8350 (314M)

- AUD/USD: 0.6200-15 (497M), 0.6300 (962M) , 0.6375 (501M)

- EUR/AUD: 1.6700 (337M)

- USD/CAD: 1.4275-85 (1BLN), 1.4450 (324M), 1.4550-60 (911M)

- USD/JPY: 155.00 (1BLN), 155.25 (375M), 155.95-156.00 (2.1BLN)

- EUR/JPY: 163.00 (1BLN), 166.00 (1BLN)

CFTC Data As Of 24/1/25

This summary provides an overview of the trading positions held by equity fund managers and speculators in various futures markets as of the reporting period ending January 21:

1. Currencies (Net Short Positions):**

- **Euro**: **-62,486** contracts (significant bearish sentiment).

- **Japanese Yen**: **-14,673** contracts (moderate bearish stance).

- **Swiss Franc**: **-41,837** contracts (notable bearish sentiment).

- **British Pound**: **-8,257** contracts (marginal bearish positioning).

2. Bitcoin (Net Long Position):**

- **BTC**: **+739** contracts (mild bullish positioning in the futures market, reflecting growing optimism).

3. Equities (S&P 500 CME Futures):**

- **Equity Fund Managers (Long)**: Increased net long position by **+7,931 contracts** to a total of **+931,930 contracts**, signaling continued optimism.

- **Equity Fund Speculators (Short)**: Expanded net short position by **+88,671 contracts** to a total of **-399,756 contracts**, highlighting growing speculative bearish bets.

4. Treasuries (CBOT Futures):**

**Long Positions:**

- **US Treasury Bonds (30-year)**: Net long position grew by **+24,404 contracts** to **+24,456**, reflecting a more bullish outlook on long-term bonds.

**Short Positions:**

- **US Ultrabond (long-term Treasuries)**: Net short position decreased (trimmed) by **-12,434 contracts** to **-229,988**, indicating less bearish sentiment.

- **2-Year Treasury Futures**: Net short position trimmed by **-82,829 contracts** to **-1,174,377**, showing a reduction in bearish sentiment on short-dated bonds.

- **5-Year Treasury Futures**: Net short position increased by **+18,570 contracts** to **-1,796,191**, reflecting stronger bearish sentiment for mid-duration bonds.

- **10-Year Treasury Futures**: Net short position increased by **+12,310 contracts** to **-580,245**, indicating growing bearish sentiment for this maturity segment.

**Key Takeaways:**

1. **Currencies**: Persistent bearish sentiment dominates, particularly for the **euro** and **Swiss franc**, with speculative shorts significantly outweighing longs.

2. **Bitcoin**: A small but positive net long position reflects a bullish tilt.

3. **Equities**:

- Fund managers are steadfastly **bullish** on the S&P 500, while speculators maintain a growing **bearish stance**, signaling a potential divergence of sentiment.

4. **Treasuries**:

- **Long-duration bonds** (30-year) saw increased long positions, indicating optimism in long-term fixed income.

- **Shorter and mid-duration bonds** (e.g., 5-year, 2-year) retain heavy net short positions, reflecting expectations of rising interest rates or bearish bond sentiment.

Overall, bullish interest in long bonds and equity fund managers’ sustained optimism, while speculative shorts dominate in currencies and some Treasury maturities.

Technical & Trade Views

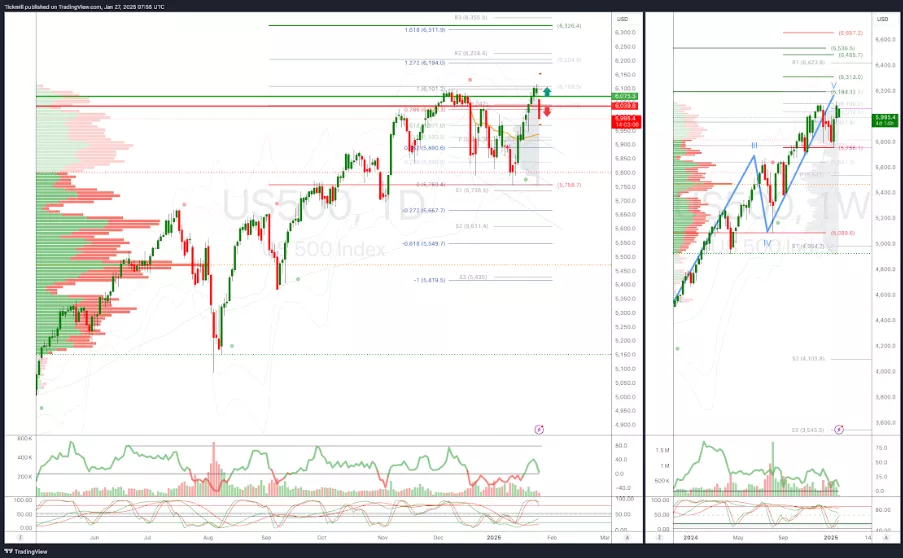

SP500 Pivot 6040

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness Into Feb 6th

- Long above 6075 target 6165

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

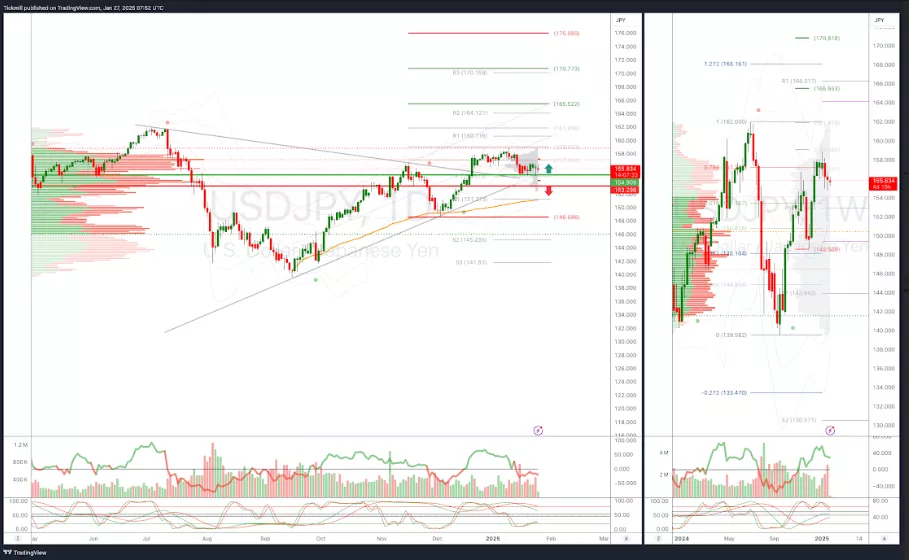

USDJPY Pivot 153.77

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bearishness into jan 23rd

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

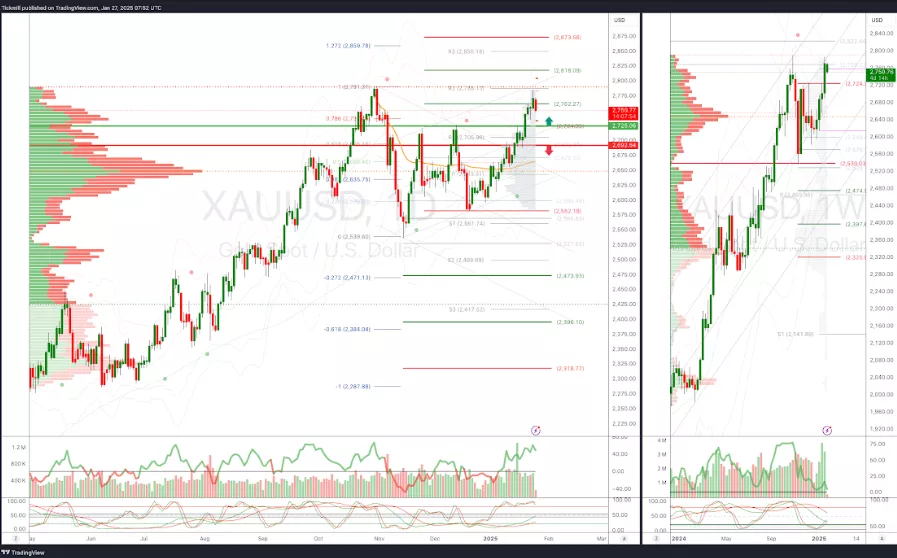

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2762

- Below 2692 target 2475

(Click on image to enlarge)

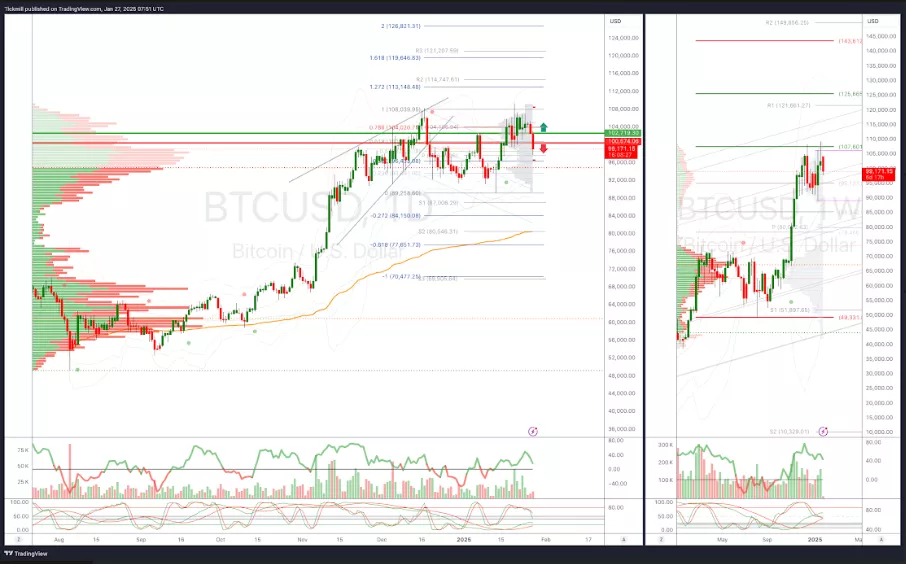

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE Retreats From Record Highs To Close In The Week In The Red

Daily Market Outlook - Friday, Jan. 24

FTSE Flip From Red To Green As Bullish Momentum Marches On