Daily Market Outlook - Tuesday, Dec. 2

Image Source: Pixabay

Asian markets bounced back on Tuesday following a sharp selloff on Monday, where cryptocurrencies led the decline in global risk assets. Nearly $1 billion in leveraged cryptocurrency positions were liquidated on Monday amid another sharp price drop, fuelling further momentum in a broad market selloff. Bitcoin plunged by as much as 8% in New York, marking a nearly 30% decline since early October. Ether tumbled by as much as 10%, reflecting a 36% drop over the past seven weeks. The downturn has hit smaller, less liquid tokens even harder—assets often favoured by traders for their higher volatility and potential outperformance during rallies. A market index tracking the lower half of the largest 100 digital assets has plummeted nearly 70% this year. Japanese government bonds saw gains after a highly anticipated auction of 10-year notes attracted robust demand. The MSCI Asia-Pacific equities index climbed as much as 0.5% before paring back some of its gains. Tech-heavy markets like South Korea and Taiwan performed particularly well. Japan’s final auction of 10-year government bonds for the year garnered more demand than the 12-month average, drawing significant attention from investors. Speculation around a potential interest rate hike by the Bank of Japan (BoJ) caused a rise in yields. The Japanese Yen, which surged on Monday following hawkish remarks from BoJ Governor Kazuo Ueda, edged slightly lower against the U.S. Dollar on Tuesday. Monday marked a turbulent start to December for global markets, as cryptocurrencies experienced another sell-off and Governor Ueda’s comments heightened investor caution. The week ahead is expected to centre on central bank decisions, with the Federal Reserve meeting scheduled for December 9–10 and the BoJ set to announce its rate decision on December 19. In the commodities space, silver retreated from record highs after a six-day rally pushed it into overbought territory, according to technical indicators. Gold also saw declines, while oil prices edged higher.

Pre-budget uncertainty in October and November slowed UK credit growth, with consumer credit dipping to £1.1bn (from £1.4bn in September) and mortgage lending falling to £4.2bn (from £5.2bn). However, household credit remains close to the 12-month average. Net mortgage lending showed a slight drop in new borrowings but was offset by higher gross repayments. Mortgage approvals defied expectations, with approvals for house purchases steady at 65.0k in October (vs. 64.7k 12-month average) following earlier stamp duty changes. Household leverage continues to decline despite stable nominal credit flows. A sharper credit slowdown post-November could signal worsening economic conditions.

With much of the US data delayed due to the government shutdown, available releases draw more focus. November's manufacturing ISM index dipped 0.5 points to 48.2, reflecting a divergence: the employment index fell 2 points to 44.0, while the prices index rose 0.5 points to 58.5. Though less pronounced than earlier in the year, this gap highlights concerns about pricing power if employment weakens. The ISM services index, due tomorrow, may show an even sharper prices/employment divide. Additionally, the ADP survey is expected to show minimal private sector job growth (10k), with some predicting losses. Weak ADP data and ISM signals could strengthen the already ~90% chance of a December Fed rate cut.

Overnight Headlines

- Fed Flags Risks Tied To Office Space, Capital Planning

- Zelenskiy Praises Latest Ukraine Peace Plan, Seeks Trump Talks

- ECB Refuses To Provide Backstop For €140Bn Ukraine Loan

- Head Of UK Fiscal Watchdog Quits After Budget Leak

- UK Price Rises Ease As Retailers Roll Out Black Friday Deals

- CBI: UK Private Sector Sees Weak Growth, Gloom In Months Ahead

- US To Lower S. Korean Autos Tariffs To 15% Nov 1, Lutnick Says

- Saudi Plans To Double Japan Investments To $27B By 2030

- Japan’s 10-Year Bond Sale Demand Stronger Than 12-Month Avg

- Crypto Downturn Wipes Out Nearly $1 Billion In Levered Bets

- Morgan Stanley’s Lord Says Worst May Be Over for Korean Won

- Nvidia Takes $2 Bln Stake In Synopsys As AI Deal Spree Accelerates

- Michael Burry Says Tesla Is 'Ridiculously Overvalued,'

- Netflix Offers Mostly Cash For Warner Bros. In New Bid Round

- DeepSeek Debuts New AI Models To Rival Google And OpenAI

- Jane Street, Citadel Securities’ Trading Gains Cut Into WS Dominance

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 154.00 (485M), 154.50 (506M), 155.00 (2.92BLN)

- 155.30 (201M), 155.50 (254M), 156.00 (1.1BLN), 156.50-60 (1.1BLN)

- 157.00 (276M), 157.15-25 (978M), 157.50 (497M)

- USD/CHF: 0.8005 (308M), 08025 (275M), 0.8075 (301M)

- GBP/USD: 1.3200 (291M). EUR/GBP: 0.8725-35 (272M)

- 0.8740-50 (523M), 0.8800 (750M), 0.8830 (686M), 0.8860 (550M)

- AUD/USD: 0.6445-50 (317M), 0.6470-80 (431M), 0.6525-35 (578M)

- 0.6540-45 (268M), 0.6550-60 (727M), 0.6650 (480M)

- NZD/USD: 0.5700 (356M), 0.5740 (300M)

- USD/CAD: 1.3900-05 (240M), 1.3920-25 (440M), 1.3965-70 (570M)

- 1.4040-50 (272M), 1.4125 (278M)

- USD/ZAR: 17.06 (200M)

CFTC Positions as of the Week Ending 7/10/25

- CFTC FX positioning data backlog clears January 20. Upcoming data on December 2, 5, 9, 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

- CFTC Positions as of October 14th

- Equity fund speculators reduced their net short position in S&P 500 CME by 44,609 contracts, now standing at 413,789 contracts. Equity fund managers decreased their net long position in S&P 500 CME by 31,392 contracts, bringing the total to 913,041 contracts.

- Speculators cut their net short position in CBOT US 5-year Treasury futures by 5,994 contracts, which now totals 2,261,744 contracts. Conversely, they raised their net short position in CBOT US 10-year Treasury futures by 42,839 contracts, reaching 830,797 contracts. Speculators reduced their net short position in CBOT US 2-year Treasury futures by 34,111 contracts, leaving it at 1,185,847 contracts. They also increased their net short position in CBOT US UltraBond Treasury futures by 29,953 contracts, now at 296,811 contracts. Speculators lowered their net short position in CBOT US Treasury bonds futures by 3,988 contracts, resulting in a total of 58,364 contracts.

- The net short position for Bitcoin stands at –452 contracts. The Swiss franc has a net short position of –28,206 contracts, while the British pound's net short position is –11,629 contracts. The Euro's net long position is 108,325 contracts, and the Japanese yen's net long position is 37,166 contracts.

Technical & Trade Views

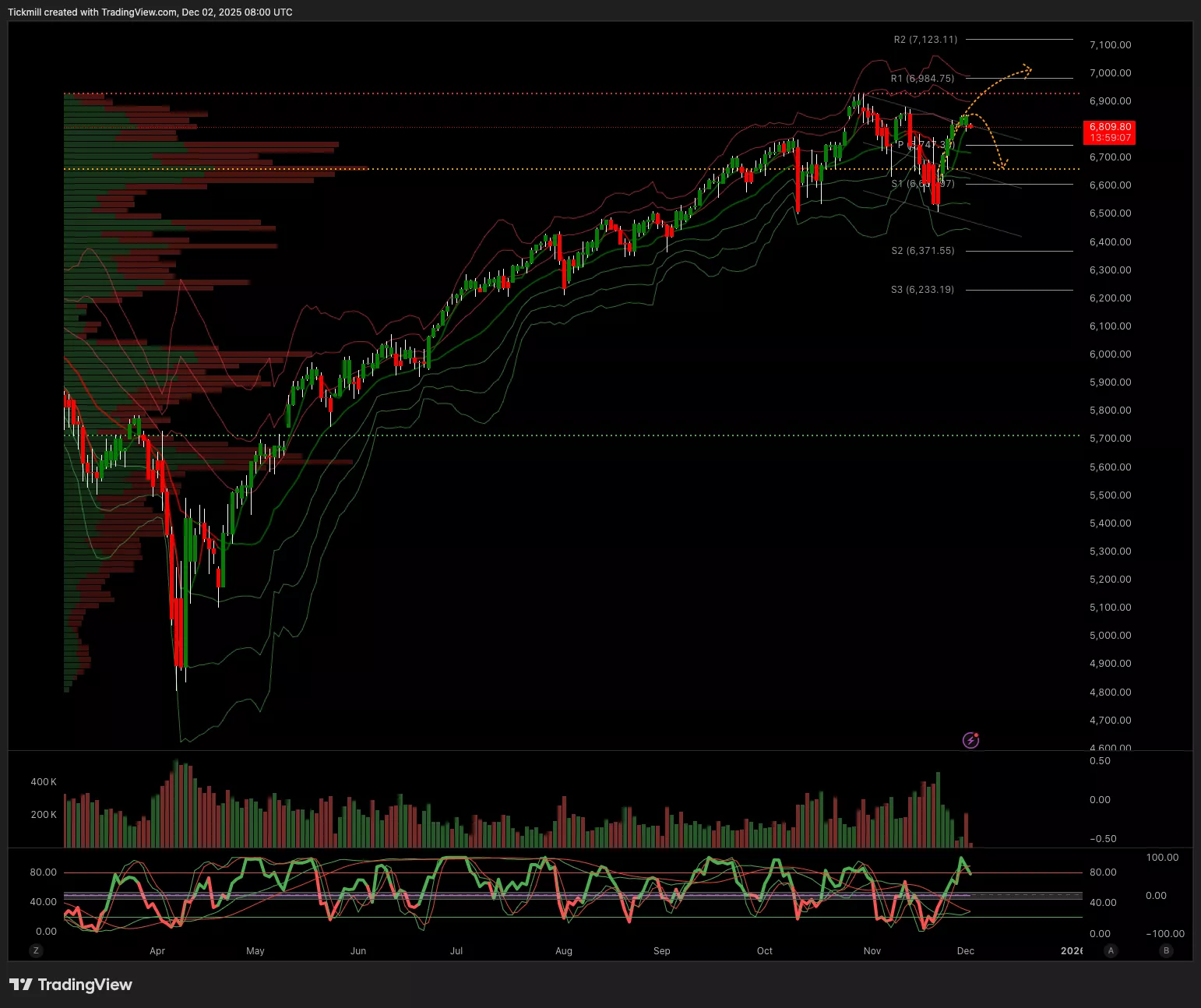

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6820 Target 6897

- Below 6718 Target 6628

EURUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 1.1598 Target 1.1688

- Below 1.1570 Target 1.1482

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 1.3275 Target 1.3337

- Below 1.3227 Target 1.3159

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 156.14 Target 157.96

- Below 155.35 Target 154.16

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4244 Target 4319

- Below 4173 Target 4094

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 90k Target 95k

- Below 86.2k Target 81.8k

More By This Author:

The FTSE Finish Line - Monday, Dec. 1

Daily Market Outlook - Monday, Dec. 1

Daily Market Outlook - Friday, Nov. 28