Daily Market Outlook - Tuesday, April 8

Image Source: Pixabay

Stocks in Asia bounced back after suffering historic losses, with Japan at the forefront of the recovery due to positive sentiment about its potential prioritization in US trade talks. Following a steep selloff on Monday, Treasuries also saw an uptick. Key indices in Japan soared over 5%, mirroring the rise in futures markets in the US and Europe. Markets in Hong Kong and China experienced gains after state-sponsored funds intervened to buy assets and the central bank offered loans aimed at market stabilization. Oil prices increased, and gold gained value after a four-day downturn. The Dollar weakened against major currencies. Volatility has surged, with global equity markets losing $10 trillion since the US announced extensive tariffs last week. With rising worries about a global recession and a worsening trade conflict, investors are searching for any signs of relief. Currently, President Trump has warned of imposing additional 50% tariffs on China while still leaving the door open for further discussions. Japanese stocks saw an increase after Trump designated two cabinet officials to initiate bilateral trade talks following a conversation with Prime Minister Ishiba. Japan seems to be receiving preferential treatment over other US trade allies in tariff negotiations, placing Tokyo ahead of numerous nations looking to decrease their tax burdens.

European investors, still reeling from a nearly 12% drop in their regional stock benchmark over three days, are now seeing a futures market that indicates more than a 3% increase. What's going on? President Donald Trump remains steadfast in his criticism of perceived trade imbalances, even intensifying his stance against China by threatening to impose additional tariffs of 50%, which would push the total well over 100%. Wall Street didn’t exactly shine, but a flat close would have been a welcome reprieve following a 10% decline in the past two days. The most notable aspect of Monday's trading was the volatility, with the VIX fear gauge rising above 60 for only the second time since the pandemic began. All of this brings up questions about the sustainability of the market's rebound, and even a 3% recovery in the STOXX 600 wouldn't sufficiently compensate for the steep losses since Trump announced his "Liberation Day" tariffs last Wednesday.

One of the initial indications that Trump's tariffs might actually just be the beginning of talks is that Treasury Secretary Scott Bessent is heading a team to discuss trade with Tokyo in the near future. Simultaneously, there is a clear variation across different regions. Japan's stock market has surged by 6%, which starkly contrasts with a 5% decline in Taiwan, where a 32% tariff is imposed and the economy depends significantly on chip exports. Asian emerging markets have suffered some of the most severe tariff rates set by Trump, resulting in ongoing stock market declines. Thailand's index has hit a five-year low, and after a week-long break, Indonesia faced a 9% drop in its market and an all-time low for its currency, the rupiah.

Overnight Newswire Updates of Note

- Brussels Eyes 25pc Tariffs In Response To Trump

- Fed Goolsbee: Firms Fear Tariff-Driven Inflation Surge

- Donald Trump Announces ‘Very High Level’ Talks With Iran

- Israel Vows To Ax Trade Deficit In Bid To Lift US Tariffs

- Israeli PM: Will Work To Get Rid Of Trade Deficit With US

- Rattled Wall St Donors Enlist Lawmakers On Tariffs

- Trsy Bessent: Everything Is On Negotiating Table With Tariffs

- Trump Keeps Investors On Edge With Clashing Tariff Comments

- Trump: 'Not Pausing” Tariffs Before This Week's Rollout

- Trump Threatens Additional 50 Per Cent Tariffs On China

- China Vows To ‘Fight To The End’ If US Insists On New Tariffs

- Aussie Westpac Consumers Sentiment Hit By Tariff Turmoil

- Softbank Group To Raise Record $4B From Retail Bond

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0850 (1.5BLN), 1.0875-80 (820M), 1.0900 (742M), 1.0925 (626M)

- 1.0950 (567M), 1.0965 (502M), 1.1000 (570M), 1.1050 (954M), 1.1065 (712M)

- USD/CHF: 0.8700 (225M)

- GBP/USD: 1.2785 (260M), 1.2800-10 (430M)

- EUR/GBP: 0.8500 (714M), 0.8600 (300M), 0.8620-25 (350M)

- AUD/USD: 0.6000-05 (475M), 0.6020 (376M), 0.6095 (495M)

- USD/CAD: 142.00 (350M), 1.4255 (335M)

- USD/JPY: 147.00-15 (1.5BLN), 149.00 (1BLN), 149.50 (470M), 149.90 (620M)

- EUR/JPY: 162.40 (370M)

CFTC Data As Of 4/4/25

- British pound net long position is 34,626 contracts.

- Euro net long position is 51,835 contracts

- Japanese yen net long position is 121,774 contracts

- Bitcoin net long position is 491 contracts

- Swiss franc posts net short position of -42,764 contracts

- Speculators trim CBOT US Treasury bonds futures net short position by 5,627 contracts to 32,648

- Speculators increase CBOT US Ultrabond Treasury futures net short position by 21.663 contracts to 254,029

- Speculators increase CBOT US 2-Year Treasury futures net short position by 44,805 contracts to 1,226,391

- Speculators increase CBOT US 10-Year Treasury futures net short position by 53,173 contracts to 863,263

- Speculators increase CBOT US 5-Year Treasury futures net short position by 121,590 contracts to 2,021,677

- Fund Managers cut S&P 500 CME net long position by 37,007 contracts to 878,833

- Equity Fund Speculators increase S&P 500 CME net short position by 28,330 contracts to 265,197

Technical & Trade Views

SP500 Pivot 5790

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 5245 target 5400

- Below 4951 target 4755

(Click on image to enlarge)

EURUSD Pivot 1.0750

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.0750 target 1.11

- Below 1.0690 target 1.0550

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into late April

- Above 1.2850 target 1.32

- Below 1.2790 target 1.2660

(Click on image to enlarge)

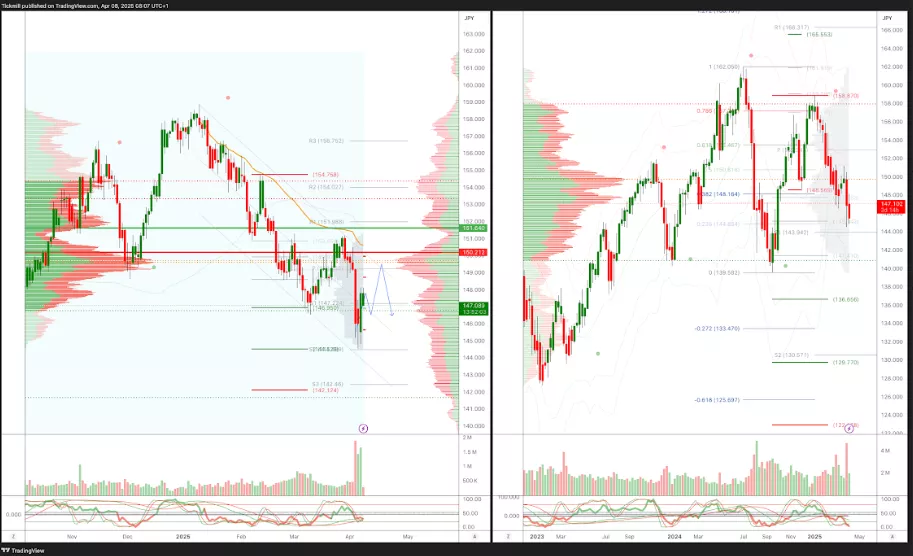

USDJPY Pivot 150.50

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.52 target 153.80

- Below 150.50 target 145

(Click on image to enlarge)

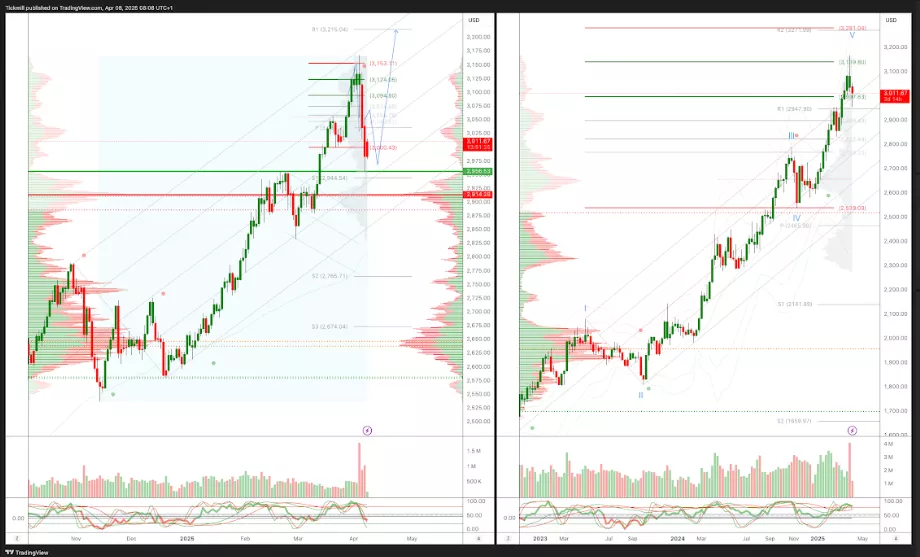

XAUUSD Pivot 2950

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 2900 target 3100

- Below 2880 target 2835

(Click on image to enlarge)

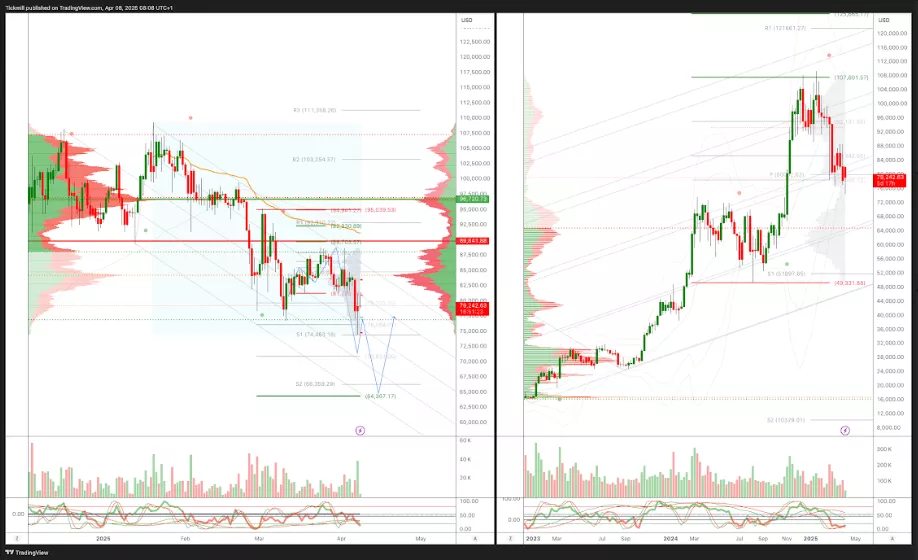

BTCUSD Pivot 90k

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, April 5

Daily Market Outlook - Friday, April 4

The FTSE Finish Line - Thursday, April 3