Daily Market Outlook - Thursday, June 12

Image Source: Pexels

US futures and the dollar declined after President Donald Trump announced plans to establish unilateral tariff rates within two weeks, reigniting trade tensions. Safe-haven assets such as Treasuries and gold saw gains, reflecting investor caution. Contracts tied to the S&P 500 and Nasdaq 100 fell 0.3% as Trump revealed intentions to notify trading partners about new tariffs. Meanwhile, European stock futures dropped following Commerce Secretary Howard Lutnick’s remarks that the European Union might be among the last to finalise trade agreements with the US. The tariff announcement came a day after constructive talks between Chinese and US officials aimed at easing trade disputes. As the US continues discussions with nations like India and Japan to lower tariffs, some investors view Trump’s comments as a strategic move to heighten pressure during negotiations. However, uncertainty lingers over whether Trump will follow through, as his self-imposed two-week timelines often result in delays or inaction.

The dollar index fell to its lowest level since July 2023, with the yen and Swiss franc leading gains against the greenback. Asian markets remained steady. Gold prices rose for the second consecutive day, driven by increased demand for safe-haven assets, further bolstered by Trump’s tariff rhetoric. Oil prices hovered near two-month highs, approaching $70 per barrel, amid concerns over potential supply disruptions in the Middle East. This follows Iran’s threat to target US bases in the region if nuclear negotiations fail and tensions with Washington escalate.

UK's Q2 growth starts weak as services and production decline. GDP contracted by 0.3% in April (vs. expected -0.1%), driven by a sharper drop in services (-0.4%) and industrial production (-0.6%), despite strong construction (+0.9%). The three-month growth rate held at 0.7%, but year-on-year growth slowed to 0.9%, the lowest since June. This aligns with the Bank of England's forecast of 0.1% Q2 growth and reflects a softer labour market, with reduced hiring due to rising costs and global uncertainties. While inflation remains a concern, recent data suggests weakening demand supports the disinflation process, potentially justifying future monetary easing.

The May US CPI report marked the fourth consecutive decline in inflation, with headline and core inflation rising 0.1% month-over-month, below expectations. Year-over-year rates held steady at 2.35% for headline and 2.79% for core. Price pressures were mild, aided by lower energy prices, vehicle costs, transport services, and clothing. Shelter costs rose 0.3% m/m but remained manageable, with the year-over-year rate slowing. Tariff impacts were minimal, and durable goods moved out of deflation but stayed flat year-over-year. While the Fed welcomed the improving trend, uncertainties around tariff effects persist.

Today's macro slate features US Producer Price Index, initial jobless claims, the first quarter flow of funds, and discussions from ECB officials including Guindos, Panetta, and Schnabel.

Overnight Headlines

- Trump Says He Will Set Unilateral Tariff Rates Within Two Weeks

- Trsy's Bessent: Trump ‘Likely’ To Push Back July Tariff Deadline

- Fed Seen On Track To Start Cutting Rates By September

- Oil Prices Surge On Fears Of Escalation In The Middle East

- UK House Price Indicator Slides To 10-Month Low As Market Cools

- Huawei Launches Pura 80 Smartphone Series In China Comeback Bid

- G7 Tries To Avoid Trump Conflict By Scrapping Joint Communique

- EU Targets Chinese Banks Over Russian Trade Links

- Moderna Seeks Outside Investors To Fund Select Vaccine Trials

- Pentagon Launches Review Of 2021 AUKUS Submarine Deal

- Japan’s Share Buybacks Expand To Record $80B So Far In 2025

- Meta’s Zuckerberg Assembles New Superintelligence AI Team

- Funds Pile Into Southeast Asian Bonds Despite Record-Low Yields

- China Sets Six-Month Limit On Rare-Earth Export Licences

- Oracle Shares Jump After Upbeat Forecast For Cloud Division

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1435-40 (1.8BLN), 1.1450 (3.6BLN), 1.1475 (702M), 1.1500 (4.5BLN)

- 1.1525 (1.7BLN), 1.1550-60 (1.6BLN), 1.1600 (1.7BLN), 1.1595-1.1600 (2.1BLN)

- USD/CHF: 0.8100 (486M), 0.8200 (190M)

- EUR/CHF: 0.9375 (650M), 0.9440-50 (344M), 0.9470 (436M)

- EUR/GBP: 0.8480 (365M), 0.8500-05 (543M)

- GBP/USD: 1.3495 (265M), 1.3550 (402M), 1.3645 (323M)

- AUD/USD: 0.6475-85 (1.5BLN), 0.6500 (1BLN), 0.6520-30 (1.3BLN)

- 0.6550 (551M), 0.6600 (814M)

- USD/CAD: 1.3600 (340M), 1.3750 (833M)

- USD/JPY: 143.00 (1.7BLN), 143.30-40 (1BLN), 143.50-55 (1BLN), 143.85 (650M)

- 144.00 (767M), 144.70-75 (914M), 145.00 (755M), 145.40-55 (1.1BLN)

- AUD/JPY: 94.50 (400M)

CFTC Data As Of 6/6/25

- Speculators have increased their net short position in CBOT US Treasury bonds futures by 48,483 contracts, bringing the total to 102,373. They also reduced their net short position in CBOT US Ultrabond Treasury futures by 5,029 contracts, now totaling 228,443. Additionally, there was a decrease of 64,348 contracts in the net short position for CBOT US 10-year Treasury futures, which now stands at 705,256 contracts. On the other hand, the net short position for CBOT US 5-year Treasury futures increased by 63,299 contracts to reach 2,396,536. The net short position for CBOT US 2-year Treasury futures also grew, rising by 24,022 contracts to 1,143,925.

- Equity fund managers have cut their net long position in the S&P 500 CME by 40,048 contracts, resulting in a total of 814,481 contracts. Conversely, equity fund speculators have raised their net short position on the S&P 500 CME by 27,860 contracts, now at 285,326.

- The net long position for the Japanese yen is at 151,149 contracts, while the euro has a net long position of 82,764 contracts, and the British pound holds a net long position of 35,215 contracts. The Swiss franc is currently at a net short position of -26,066 contracts, and Bitcoin has a net short position of -2,312 contracts.

Technical & Trade Views

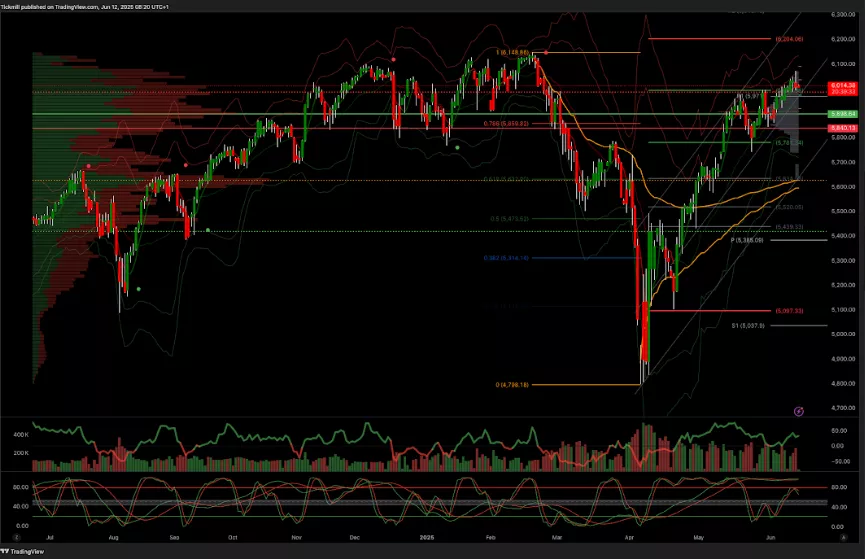

SP500 Pivot 5900

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5650

(Click on image to enlarge)

EURUSD Pivot 1.12

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Wednesday, June 11

The FTSE Finish Line - Tuesday, June 10

Daily Market Outlook - Tuesday, June 10