Daily Market Outlook - Thursday, July 3

Image Source: Unsplash

Asian stock markets saw a modest increase in anticipation of a US jobs report, as investors look for new data following recent indications that Trump's trade war is negatively impacting the US economy. The MSCI Asia Pacific Index rose by 0.2%. In the US, equity-index futures gained after the S&P 500 reached another all-time high on Wednesday, buoyed by Trump's announcement of a trade deal with Vietnam. Other Asian nations are expressing frustration over the challenging discussions with the U.S., partly due to the lack of clarity about the White House's objectives. On Thursday, South Korean President Lee Jae Myung stated that he could not confirm whether tariff negotiations would be finalised by next Tuesday, while Japan has cited national interests as negotiations with the U.S. faced difficulties. Thursday saw muted Treasury yields movement. Yields had increased in the prior session due to significant selling in the UK, where concerns about Chancellor Reeves' future reignited discussions about the nation's fiscal situation. In Japan, there was strong demand for 30-year government bonds at an auction, indicating some progress in addressing volatility in the debt market. These cross-asset movements highlighted a sense of cautious optimism as traders navigate uncertainty ahead of the jobs data, which will influence future interest rate direction. With stock prices at a record high despite heightened trade worries from Trump, investors are closely analysing economic indicators before expanding their portfolios.

Despite Starmer’s assertion last night that Reeves would "be Chancellor for a very long time to come", yesterday’s turbulence in gilt markets and the exchange rate leaves many market participants uneasy about the potential for further volatility. The implications are significant. One immediate concern is that the uncertainty driving higher gilt yields directly erodes fiscal "headroom." By Tuesday’s close, the weighted average conventional gilt yield was 1 basis point lower than the level used in the Spring Statement calculations. However, by the end of yesterday, it had risen 14 basis points higher—effectively consuming approximately £2 billion of the total £10 billion fiscal headroom in a single day. Another key consideration is the potential impact on inflation forecasts. If this episode leaves lingering damage in foreign exchange markets, a weaker pound could push up import costs, thereby increasing inflationary pressures. While it’s challenging to quantify exchange rate precisely pass-through to CPI, the Bank of England’s most recent two-year-ahead CPI forecast stood at 1.9%. It wouldn’t take a substantial shock to push that forecast into above-target territory. More critically, the welfare reform episode has led market participants to discount the likelihood of spending cuts as a viable option for restoring fiscal headroom in the upcoming Autumn Budget. Compounding this, the OBR Forecast Evaluation Report suggests it will be increasingly difficult to sidestep fiscal challenges by relying on the OBR’s traditionally optimistic projections. Such an outcome significantly narrows the scope for market-friendly policy solutions. While discussions around tax increases have become more mainstream, the broader fiscal outlook remains uncertain. The risk of some relaxation in fiscal rules cannot be entirely dismissed by traders and investors, as highlighted by the heatmap. This uncertainty underscores the delicate balancing act policymakers face in maintaining market confidence amidst tightening fiscal constraints.

U.S. employment data has shown a softer trajectory recently, with non-farm payroll growth slowing. For June, the market median forecast is at 105,000, compared to the initially reported 139,000 in May. Notably, there has been a consistent pattern of downward revisions this year, averaging -55,000. This trend appears to be a concern for the Federal Reserve, as indicated by Chair Powell, and a weaker-than-expected result could prompt a more dovish stance ahead of the Fed's meeting at the end of the month. Currently, the market assigns only a 20% probability of a rate cut during that meeting. However, the May JOLTs report offers a more optimistic perspective. The rise in job openings is encouraging, but an even more striking observation is the discrepancy between the JOLTs survey and the establishment survey regarding private sector hiring. While the three-month average for private payroll growth stands at 133,000, the JOLTs measure (hires minus separations) suggests the economy added an impressive 253,000 jobs per month between March and May. This significant gap between the two typically aligned metrics is unusual and warrants attention.

Overnight Headlines

- ECB Officials Question Whether Euro Has Strengthened Too Much

- PBoC Seeks European Lenders’ Advice On Low Interest Rates

- Powell Remains Silent On Future, Complicating Trump’s Fed Search

- Influential Fed Supervision Official Resigns Voluntarily

- June Jobs Report To Reflect Strain From Trump Policies

- Copper Prices Surge As Traders Rush To Beat Trump Tariffs

- US Lifts Chip Design Curbs On China As Part Of Trade Deal

- US-Vietnam Deal Risks China Retaliation, Economists Warn

- Tesla's China EV Sales Rise 3.7% Y/Y To 61,000 Vehicles In June

- BYD Cancels Mexico Plant Over Trump’s Trade War

- Microsoft To Cut 9,000 Jobs Amid Strategic Shift

- Aussie Trade Surplus Hits 5-Year Low As Exports Slump

- Datadog Soars 10% On Inclusion In S&P 500 Index

- Wells Fargo Resumes CLO Buying After Multi-Year Pause

- Oil Slides On Demand Concerns Ahead Of Jobs Data

- Ripple Applies For US Banking License Amid Regulatory Push

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1700 (4.2BLN), 1.1710-20 (1.1BLN), 1.1725 (1.4BLN)

- 1.1750 (2.7BLN), 1.1770-75 (4.5BLN), 1.1800 (8.4BLN), 1.1825 (1.7BLN)

- 1.1850 (2.5BLN), 1.1900 (1.8BLN)...

- EUR/CHF: 0.9340 (285M), 0.9480 (636M)

- GBP/USD: 1.3600 (517M), 1.3650 (314M), 1.3675-80 (421M), 1.3700-05 (340M)

- EUR/GBP: 0.8590 (472M), 0.8640 (523M), 0.8650 (264M)

- AUD/USD: 0.6500 (1BLN), 0.6550 (621M), 0.6600 (1.4BLN)

- NZD/USD: 0.5980 (296M), 0.5995-0.6000 (355M), 0.6025 (318M)

- AUD/NZD: 1.0775 (671M), 1.0825 (409M)

- USD/CAD: 1.3500 (1.1BLN), 1.3600 (2.5BLN), 1.3625-35 (636M),

- 1.3640-45 (525M), 1.3680 (464M), 1.3690-1.3700 (1BLN), 1.3720-25 (1.2BLN)

- USD/JPY: 142.00 (1.5BLN), 142.50 (388M), 143.00 (385M), 143.50 (890M)

- 143.95-144.00 (1.4BLN), 144.25 (640M), 144.50 (1BLN), 145.00 (1.8BLN)

CFTC Positions as of the Week Ending June 27th

- Speculators have raised the net short position in CBOT US 5-year Treasury futures by 20,348 contracts, reaching 2,463,629. They have also reduced the net short position in CBOT US 10-year Treasury futures by 72,768 contracts, bringing it down to 680,131. The net short position for CBOT US 2-year Treasury futures has increased by 63,807 contracts, totaling 1,230,204. In CBOT US UltraBond Treasury futures, the net short position is up by 19,812 contracts, now at 209,526. Additionally, the net short position for CBOT US Treasury bonds futures has increased by 27,610 contracts, amounting to 101,785.

- Equity fund speculators have decreased their net short position in the S&P 500 CME by 50,029 contracts to 269,039, and equity fund managers have lowered their net long position by 1,646 contracts to 841,226.

- The net FX long positions: Japanese yen at 132,277 contracts, Euro at 111,135 contracts, British pound at 34,395 contracts, while the Swiss franc has a net short position of -20,944 contracts and Bitcoin holds a net short position of -2,161 contracts.

Technical & Trade Views

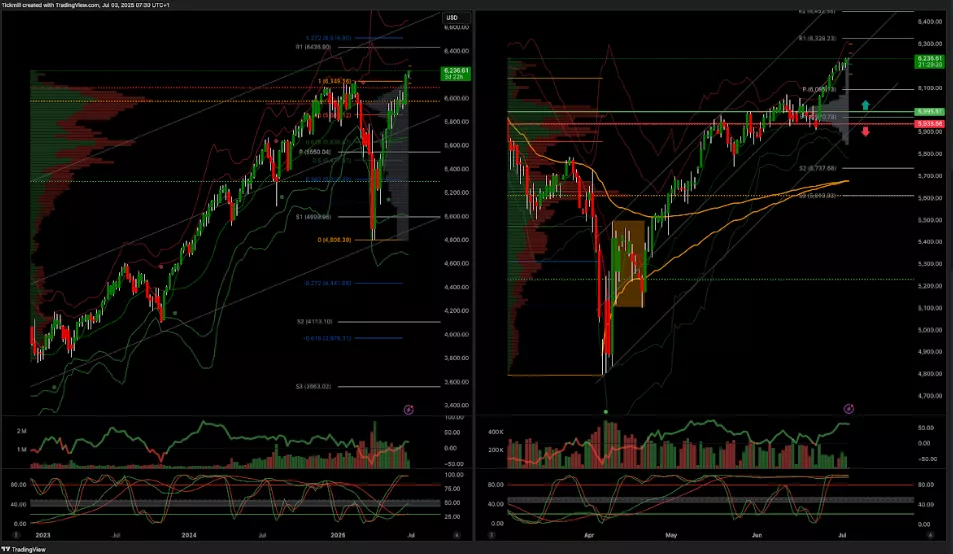

SP500 Pivot 5995

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5995 target 6300

- Below 5938 target 5800

(Click on image to enlarge)

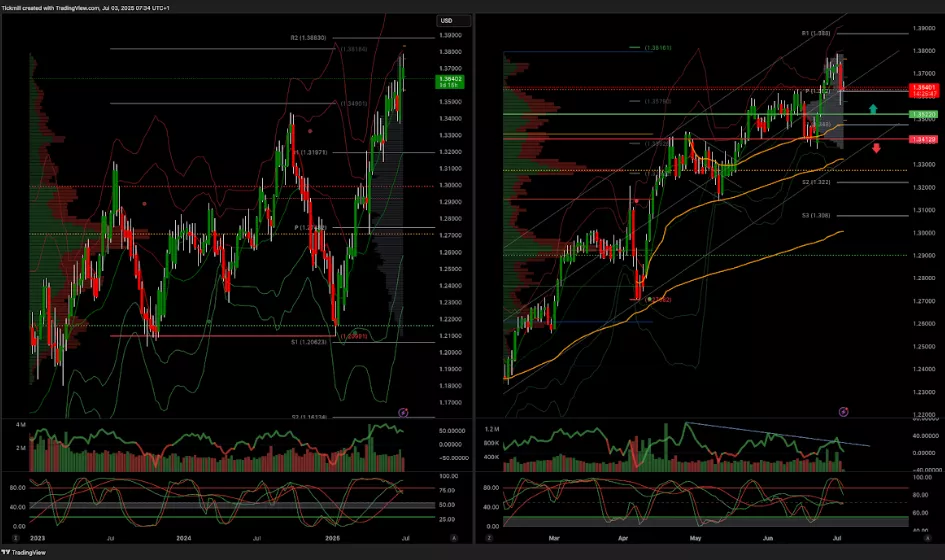

EURUSD Pivot 1.1630

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.1630 target 1.19

- Below 1.1490 target 1.12

(Click on image to enlarge)

GBPUSD Pivot 1.3522

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 1.3522 target 1.38

- Below 1.34 target 1.3270

(Click on image to enlarge)

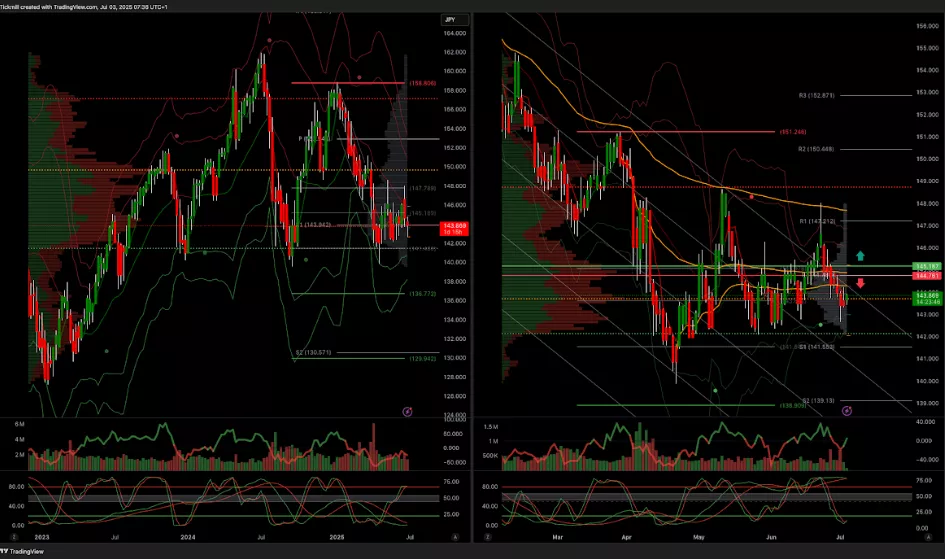

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 145.18 target 147.50

- Below 144.76 target 139

(Click on image to enlarge)

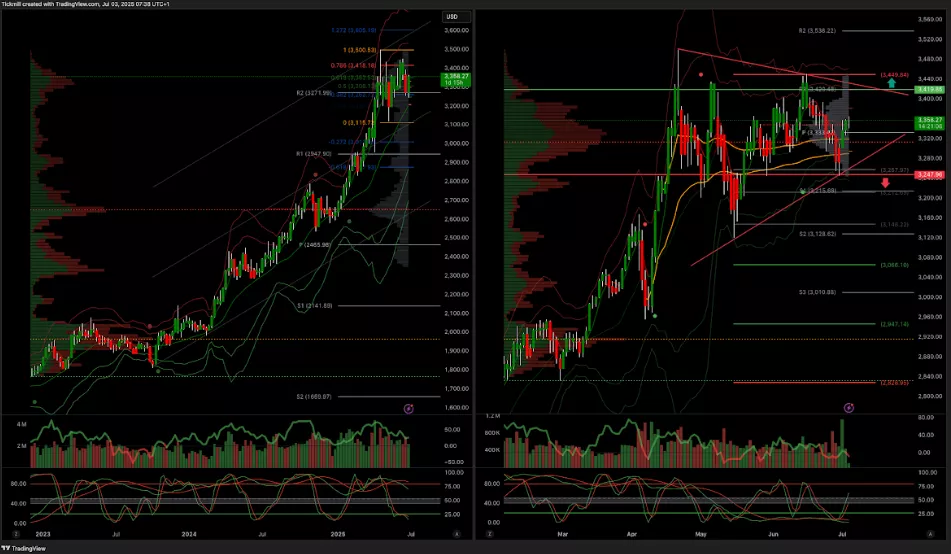

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3420 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

BTCUSD Pivot 105k

- Daily VWAP bullish

- Weekly VWAP bearish

- Above 105k target 118k

- Below 98.3K target 95.5k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Wednesday, July 2

Daily Market Outlook - Tuesday, July 1

S&P 500 Weekly Action Areas & Price Targets - Monday, June 30