Daily Market Outlook - Thursday, Feb. 13

Image Source: Pexels

Asian stocks surged as US-Russia negotiations fuelled optimism for resolving the Ukraine crisis, while a brighter outlook for Chinese markets further boosted risk appetite. The Asian equities index climbed for a second straight day, led by gains in Japan and Hong Kong. European stock futures advanced around 1%, while S&P 500 futures followed suit, however, those gains have reversed to see S&P futures turn negative in the overnight session. Global markets largely shrugged off higher-than-expected US inflation data, which tempered hopes for a rate cut, instead focusing on Trump's peace talks with Russia regarding Ukraine. The Euro strengthened by 0.5% against the Dollar, outperforming several G-10 currencies. This uptick in risk appetite comes after a challenging period for the Asian regional stock index, which lagged behind global peers earlier this year due to Trump's tariff threats, a stronger currency, and limited domestic policy stimulus in China. However, recent progress in AI technology has driven gains in Chinese stocks. Oil prices continued to fall following the US-Russia discussions, reinforcing expectations of reduced risks to Russian supply. Conversely, Asian shipping stocks declined amid concerns over potential drops in freight rates. Investors are closely watching Europe’s response to the ongoing Ukraine war. Analysts predict a complex path ahead, as nations like Britain, France, and Germany, which have provided significant aid, emphasise their necessity in shaping Ukraine's future. Meanwhile, Ukraine faces immense pressure, with demands to cede territory to an aggressor before negotiations even begin—a prospect that offers little optimism.

US January inflation saw a slight uptick, driven primarily by transport costs rather than annual revisions. Headline CPI rose 0.5% m/m (vs. 0.3% expected), and core CPI also increased 0.5% m/m, pushing annual rates to 3.0% and 3.3%, respectively, instead of the anticipated decline. Excluding transport, most categories showed disinflation, with shelter slowing further and January services posting the smallest monthly gain since 2021. Markets reacted with higher yields and risk-off sentiment. Hopes for Fed rate cuts this year appear increasingly unlikely, as Chair Powell emphasised solid growth, a higher neutral rate, and no urgency to reduce rates in his Senate testimony. The Fed's dovish stance remains contingent on potential economic disruptions.

The UK economy ended the year strongly, driven by robust services and a rebound in manufacturing. December GDP rose 0.4% month-on-month, lifting Q4 growth to 0.1%, surpassing the expected -0.1% contraction. Annual growth reached 1.4%, up from 1.0% in Q3. Services saw growth in 11 of 14 subsectors, while manufacturing recovered from November's decline. Despite strong domestic demand, weak business confidence, and the Bank of England’s cautious outlook remain concerns. Inventory accumulation boosted quarterly data, though future revisions may adjust this, and net trade's drag seems overstated. Wage increases have driven nominal GDP gains, leaving the central bank likely to maintain a cautious stance amid labour market pressures and fragile confidence.

Upcoming events on the calendar feature Eurozone industrial production figures, US producer price index (PPI), the ECB Economic Bulletin, and speeches by European Central Bank members Cipollone and Nagel.

Overnight Newswire Updates of Note

- Trump: Will Sign Reciprocal Tariffs Order Soon, Trade War Fears Mount

- Trump Says Putin Agreed To Begin Negotiations To End War In Ukraine

- 75,000 Federal Workers Accept Trump’s Buyout Program

- Putin Invited Trump To Moscow To Discuss Ukraine, Kremlin Says

- Powell: Trump Comments Won't Affect Rate Decisions By The Fed

- Goolsbee: If We Got Multiple CPI Prints Like This Then Then Job Is Not Done

- Bostic: Not Comfortable Cutting Again Until More Clarity On Inflation, Policies

- Potential Trade War With US Weighed On BoC When It Cut Rates In Jan

- ECB Shouldn’t Cut Hastily As Rates Near Neutral, Nagel Says

- Bank Of England's Pill 'Cautious' About Further Rate Cuts

- Oil Sinks 2% After Trump Calls Putin, Zelenskiy To Discuss End To War

- Chevron Will Lay Off Up To 20% Of Employees, Impacting Up To 9,100

- JPM Chase Begins Layoffs, With More Planned, After Record Profits

- Arab Mediators Scramble To Save Ceasefire As Israel Bolsters Numbers

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/MXN: 20.65 ($343.5m)

- EUR/USD: 1.0500 (EU2.04b), 1.0400 (EU1.7b), 1.0375 (EU1.36b

- USD/JPY: 150.00 ($365m)

- USD/CAD: 1.4375 ($985.2m), 1.4300 ($910.1m), 1.3225 ($440m)

- USD/CNY: 7.3000 ($411m), 7.0500 ($300m)

- GBP/USD: 1.2200 (GBP313.2m)

- EUR/GBP: 0.8330 (EU330.2m)

CFTC Data As Of 7/2/25

- In the latest data release for the week ending on February 4th. The Euro is weighed down by a significant net short position of -58,614 contracts, contrasting with the Japanese Yen's more optimistic stance holding a net long position of 18,768 contracts. The cryptocurrency realm sees Bitcoin riding a wave of positivity with a net long position of 786 contracts. However, the Swiss Franc finds itself in the red with a net short position of -42,258 contracts, while the British Pound struggles with a net short position of -11,323 contracts.

- Equity fund speculators have significantly dialed down their net short position by 69,618 contracts, marking a reassuring dip to 333,211 contracts. Meanwhile, equity fund managers have made a noteworthy adjustment by reducing their net long position by 40,756 contracts, resulting in a total of 920,415 contracts.

- In Treasury futures, speculators have been quite active. The CBOT US 5-year Treasury futures witnessed a notable surge in net short positions, spiking by 151,611 contracts to sit at 1,927,666 contracts. Similarly, the CBOT US 10-year Treasury futures witnessed a modest uptick in net short positions, increasing by 7,061 contracts to stabilize at 707,703. Moving on to the CBOT US 2-year Treasury futures, speculators have boosted net short positions by 17,065 contracts, bringing the total to 1,218,624 contracts. Additionally, the CBOT US Ultrabond Treasury futures show an uptick in net short positions by 2,024 contracts, resting at 243,616.

- A noteworthy shift has occurred in the CBOT US Treasury bonds futures segment, where speculators have transitioned to a net short position of 4,927 contracts. This marks a stark departure from the 28,584 net long positions reported just a week prior, signifying a notable change in market sentiment and positioning.

Technical & Trade Views

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

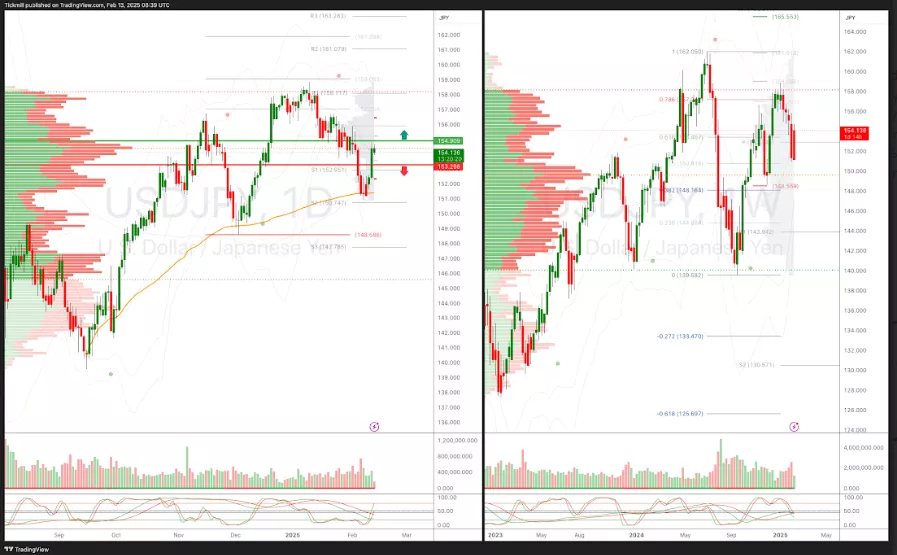

USDJPY Pivot 153.77

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

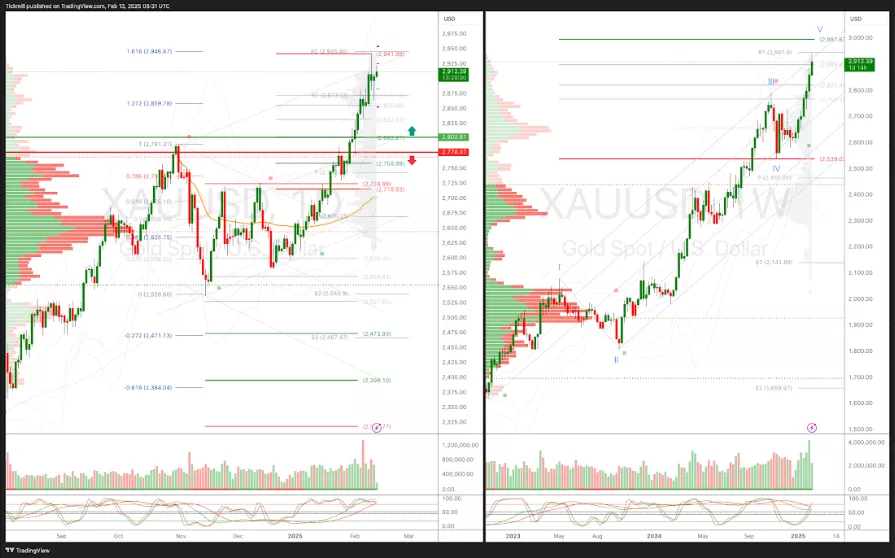

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

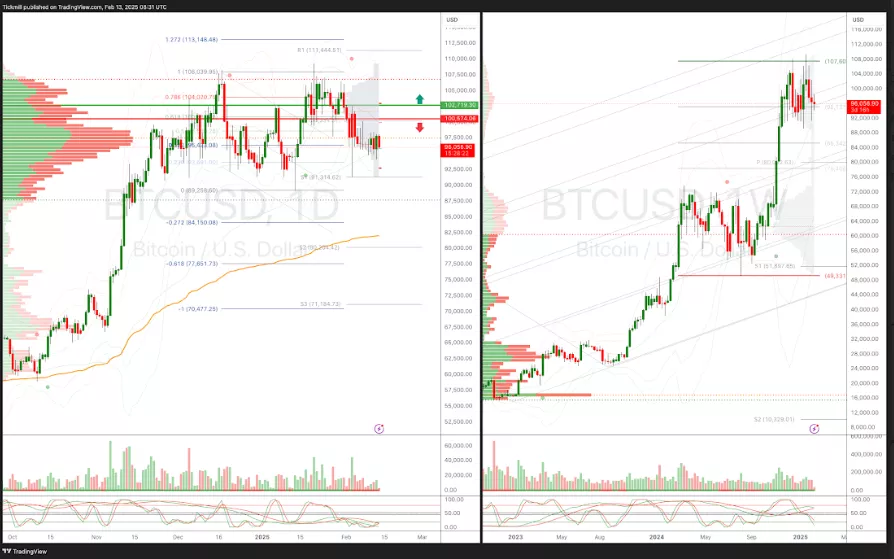

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE Gains As Pound Sinks Ahead Of GDP Data

Daily Market Outlook - Wednesday, Feb. 12

FTSE Retreats From All-Time Highs AS Tariff Concerns Persist