Daily Market Outlook - Monday, Oct. 13

Image Source: Pixabay

US equity-index futures rose after Trump indicated an openness to a deal with China, boosting morale after markets were unnerved by a rapid escalation in trade tensions. S&P 500 futures climbed by 1.4%, while the Nasdaq 100 saw an even bigger boost, jumping 1.85%. This came after the U.S. government softened its tone following President Trump’s threat of imposing 100% tariffs on China in retaliation for restrictions on Chinese exports. On the bond front, the 10-year U.S. Treasury futures opened higher, and oil prices rose by 1.4%. Meanwhile, silver flirted with record highs as a dramatic short squeeze in London and ongoing trade tensions shook the market. Gold also reached an all-time peak, while cryptocurrencies steadied, and European stock futures hinted at a positive opening. However, Asian markets painted a less optimistic picture. With markets in the region closed during Trump’s Friday remarks, investors reacted negatively when they reopened. Mainland Chinese stocks dropped by 1.8%, and Hong Kong suffered its sharpest intraday decline since early April. Japan, meanwhile, remained on holiday, leaving its bond market quiet. In a surprising twist, Chinese exports surged at their fastest pace in six months, outperforming expectations. This resilience could give Beijing an upper hand in its latest trade standoff with Washington. Across the Atlantic, French President Emmanuel Macron unveiled a new cabinet on Sunday as he and his reappointed Prime Minister, Sébastien Lecornu, face mounting pressure to address France’s deepening political turmoil and finalise a budget. French bond futures responded by opening lower.

Rising trade tensions between the United States and China sent shockwaves through global markets on Friday, hammering stocks, oil, and cryptocurrencies, while prompting investors to seek refuge in safer assets like gold and Treasuries. President Trump’s stern warning of a “massive increase” in tariffs on Chinese goods added fuel to an already volatile week, which had been overshadowed by growing fears of a potential bubble in artificial intelligence stocks. His remarks triggered a sharp sell-off, with the S&P 500 plunging 2.7% and the tech-focused Nasdaq 100 taking an even harder hit, dropping 3.5%. Trump expressed that he saw "no reason" to meet with Chinese President Xi Jinping, pointing to "hostile" export controls as the key issue. His remarks, shared on social media, come amid escalating efforts by both Washington and Beijing to tighten restrictions on technology and material exchanges between the two nations. These developments unfold just weeks before a planned summit of world leaders in Asia. Meanwhile, Friday's sharp market reaction stood out, as recent large drops in risk assets have been relatively rare. Since April's tariff-related selloff, the S&P 500 has staged a strong rebound, fuelled by optimism around AI advancements and hopes for Federal Reserve rate cuts. The index now sits at its highest valuation in 25 years, leaving little room for error or bad news. However, Friday was a rough day for the market, with over 420 S&P 500 stocks declining—marking the index's worst performance since April. Adding to the tension, the VIX volatility index surged to 22, signalling heightened uncertainty among investors. Ethena's innovative yield-generating stablecoin, USDe, faced a temporary hiccup during a turbulent market shake-up that led to record-breaking liquidations. Promoted as a "synthetic dollar" with an appealing 5.5% yield, USDe briefly dropped to 65 cents on Binance, straying from its intended dollar peg. However, the token quickly rebounded, regaining its dollar parity shortly after the initial sell-off.

The week ahead in the U.S. will be a short one due to Columbus Day, though its impact feels minimal as the government shutdown has already reduced official data releases to a trickle. Typically, we’d expect CPI, PPI, retail sales, and production figures, but none of these will be available. However, we will see the Beige Book on Wednesday.

In the UK, it’s shaping up to be a busy week. Labor and wage data on Tuesday will take center stage, with the Bank of England closely monitoring for signs of slowing pay growth while hoping the labor market shows only mild weakness. However, the risks lean toward stickier wage increases and a potential drop in private-sector employment. Thursday brings the release of monthly GDP and industrial production figures. While services may provide some GDP support, industrial production remains sluggish, and overall Q3 growth is likely to lag behind the pace seen in the first half of the year.

Over in the Eurozone, final September CPI data will trickle out, culminating in the regional release on Friday. On Tuesday, the ZEW survey is expected to soften, with attention focused on whether weaker current conditions weigh on more optimistic outlooks. Keep an eye on Eurozone industrial data coming Wednesday as well.

As the annual IMF meetings kick off, a packed schedule of speakers awaits. For the Bank of England, appearances include Bailey (Tuesday, Saturday), Breeden (Wednesday, Friday), Mann (Monday, Thursday), Green (Monday, Friday), Ramsden (Wednesday), and Pill (Friday). From the ECB, Lagarde and Lane are set to speak on Thursday. While the Fed’s involvement in IMF events is more limited, expect a steady stream of commentary ahead of the next blackout period, starting Saturday.

Overnight Headlines

- UK Chancellor Looks To Boost Fiscal Buffer At Crunch Budget

- Macron Appoints French Cabinet In New Bid To Quell Crisis

- France’s PM Lecornu Races To Find Budget Path After Comeback

- Germany’s €1.3T Burden Becomes Battleground For Merz

- ECB Is In A ‘Good Place’ On Interest Rates, Vujcic Tells HRT

- Trump, Vance Open Door To China Deal As Trade Spat Drags On

- China Tells US To Back Off On Tariff Threats, Warns Of Retaliation

- China Exports Accelerate As Xi And Trump Raise Stakes In Trade War

- Pentagon Plans $1B Critical Minerals Buy As Tariff War Escalates

- Canada Eyes Sectoral US Trade Deals As Trump Seeks Pre-Election Wins

- Dutch Govt Takes Control Of Chinese-Owned Chipmaker Nexperia

- China’s Wingtech Dives 10% After Dutch Take Control Of Chip Unit

- LG Energy Quarterly Profit Beats Estimates On US Tax Credits

- Silver Extends Gains On Short Squeeze As Gold Rallies To Record

- Wall Street Investment Banking Revenues Poised To Top $9B

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1525-30 (1.3BLN), 1.1570-75 (1.4BLN), 1.1605 (351M)

- 1.1625-35 (1.2BLN), 1.1650 (1.2BLN), 1.1700 (1.1BLN)

- USD/CHF: 0.7900 (426M), 0.7935 (451M)

- EUR/CHF: 0.9325 (2.9BLN)

- EUR/GBP: 0.8675-85 (733M), 0.8700 (220M)

- GBP/USD: 1.3200 (504M), 1.3300 (386M), 1.3325 (220M)

- AUD/USD: 0.6520-25 (411M), 0.6550-55 (1BLN)

- USD/JPY: 151.00 (1.8BLN),152.00 (420M), 152.50 (380M)

CFTC Positions as of the Week Ending 9/10/25

-

October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

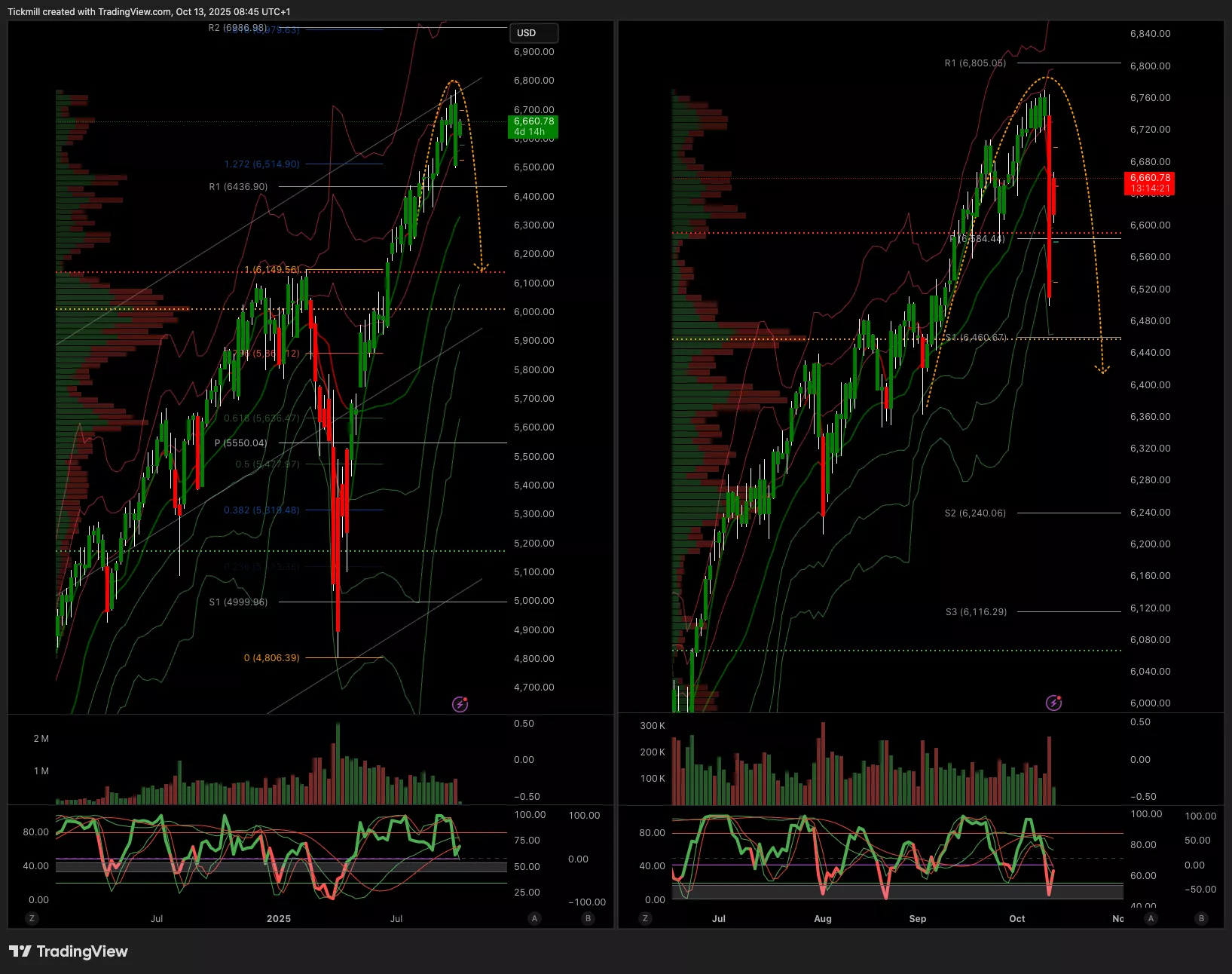

SP500

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 6440 Target 6800

- Below 6700 Target 6400

(Click on image to enlarge)

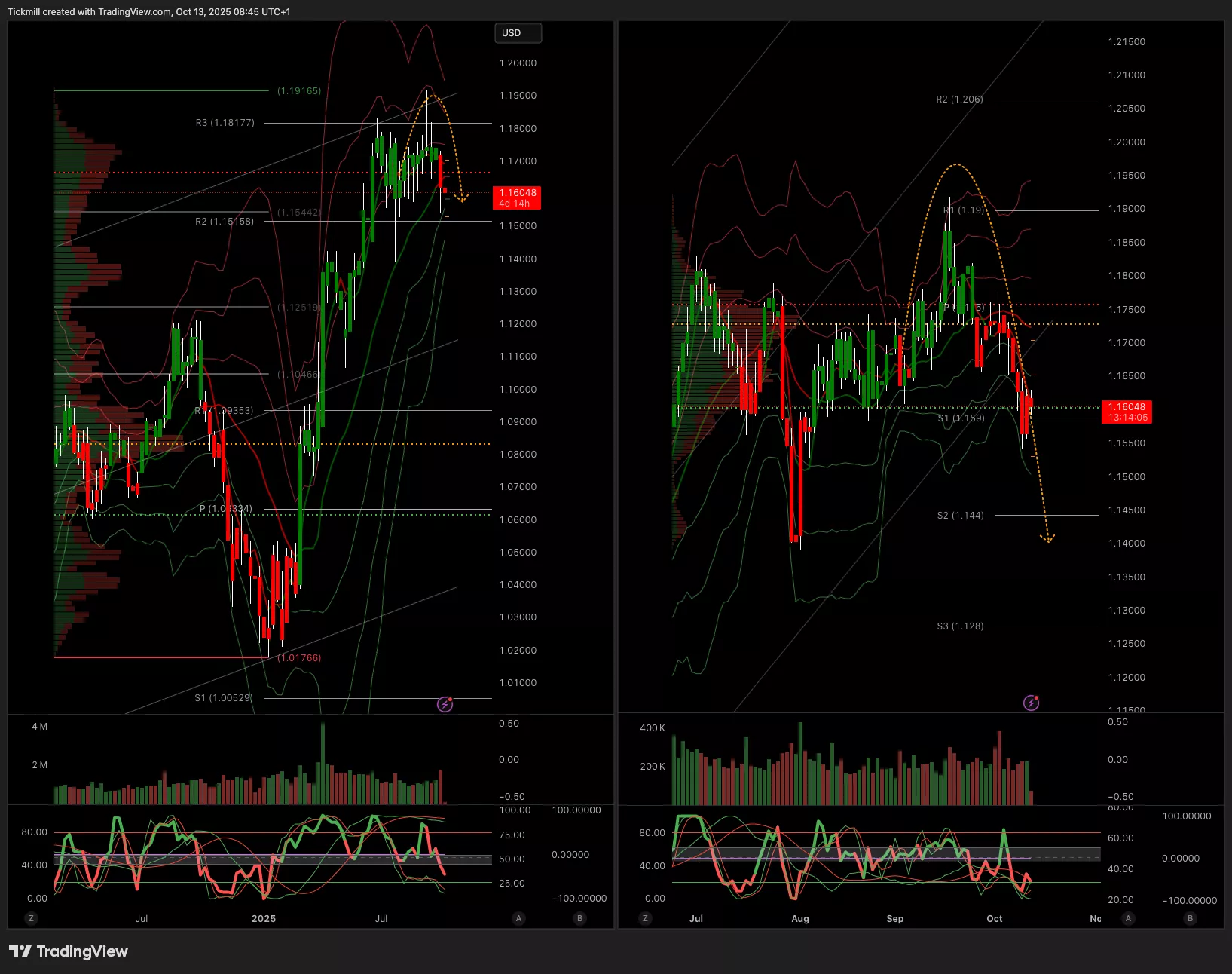

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.17 Target 1.14

- Above 1.1750 Target 1.1850

(Click on image to enlarge)

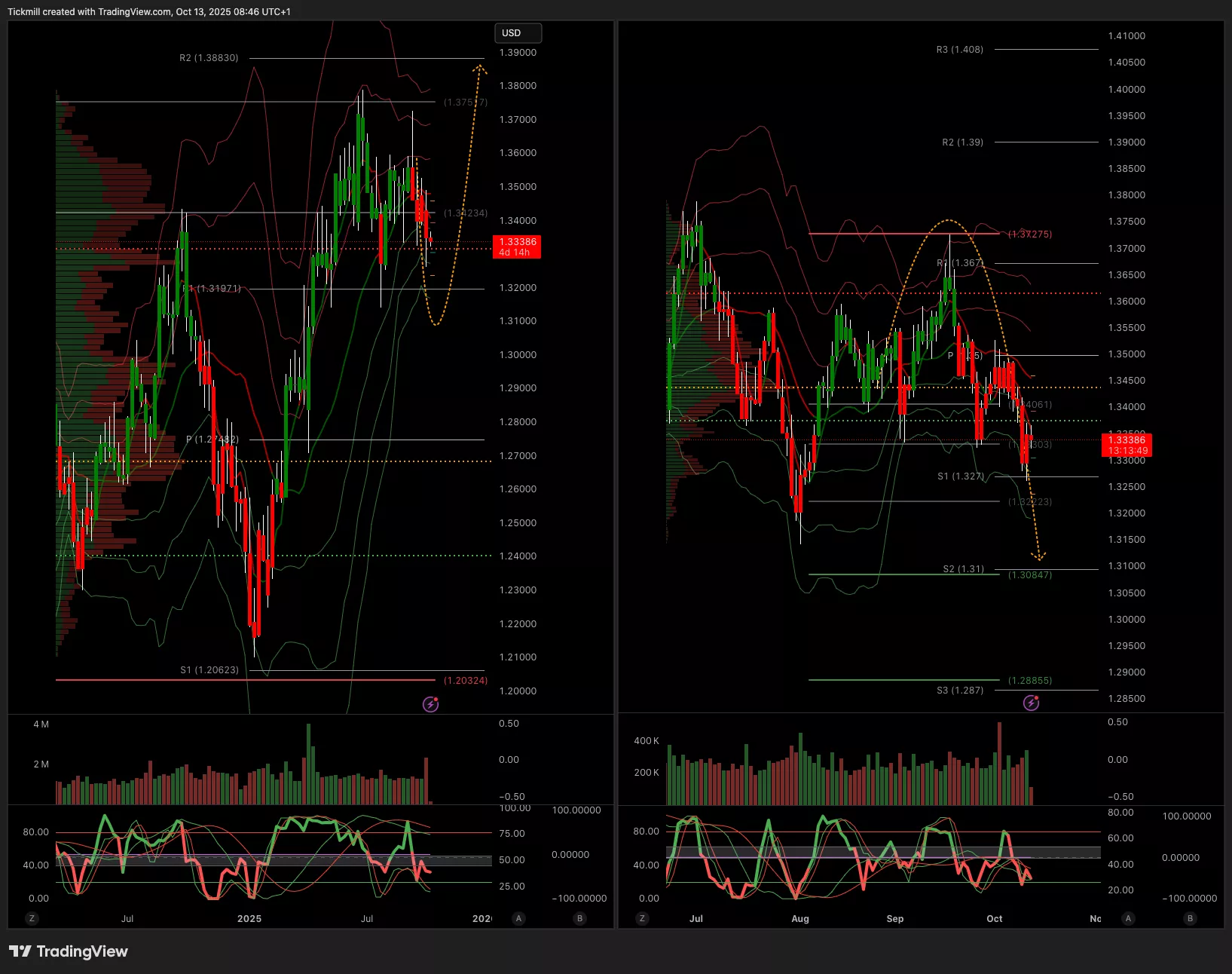

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.34 Target 1.31

- Above 1.35 Target 1.3580

(Click on image to enlarge)

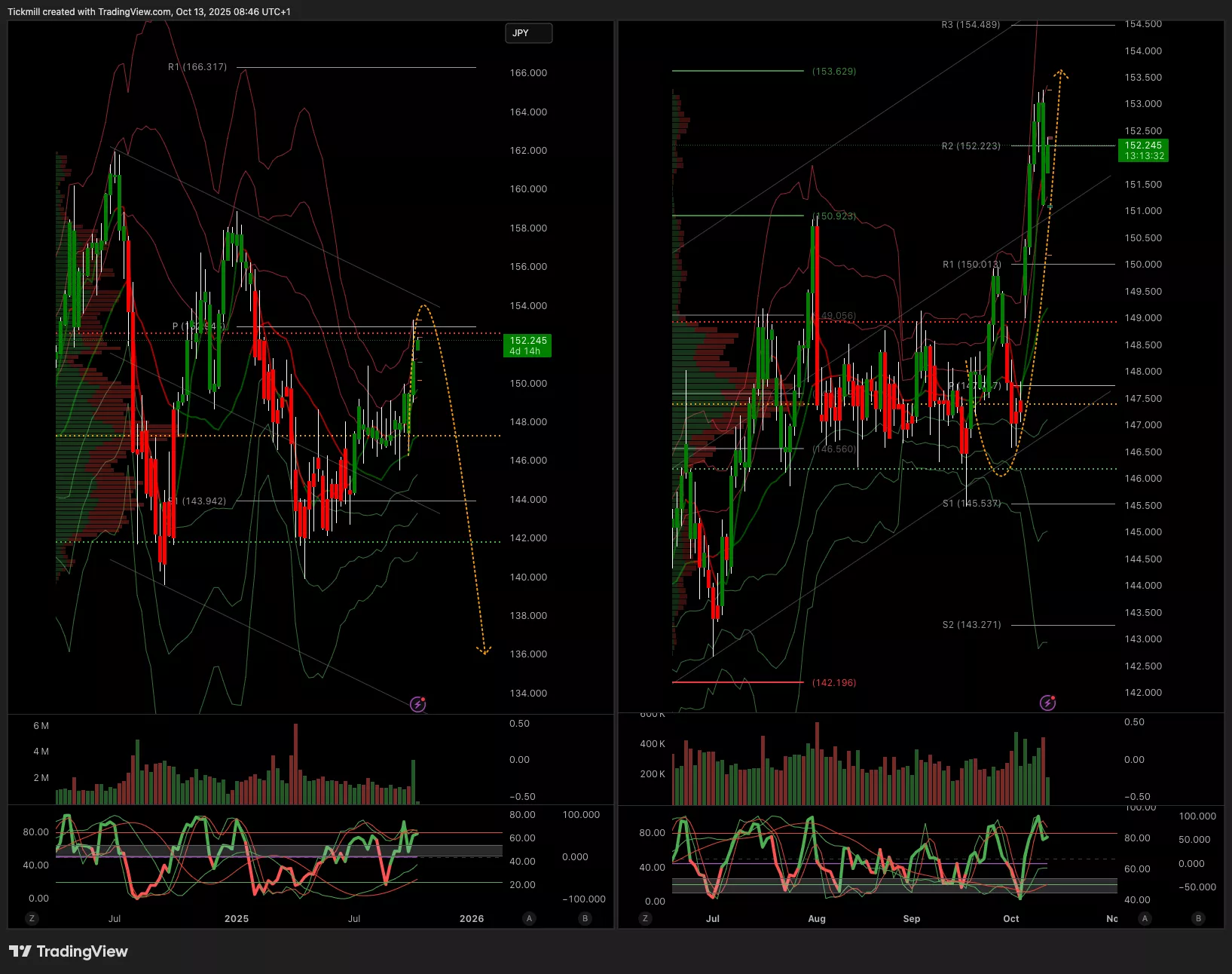

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 150 Trgaet 148.5

- Above 151 Target 154

(Click on image to enlarge)

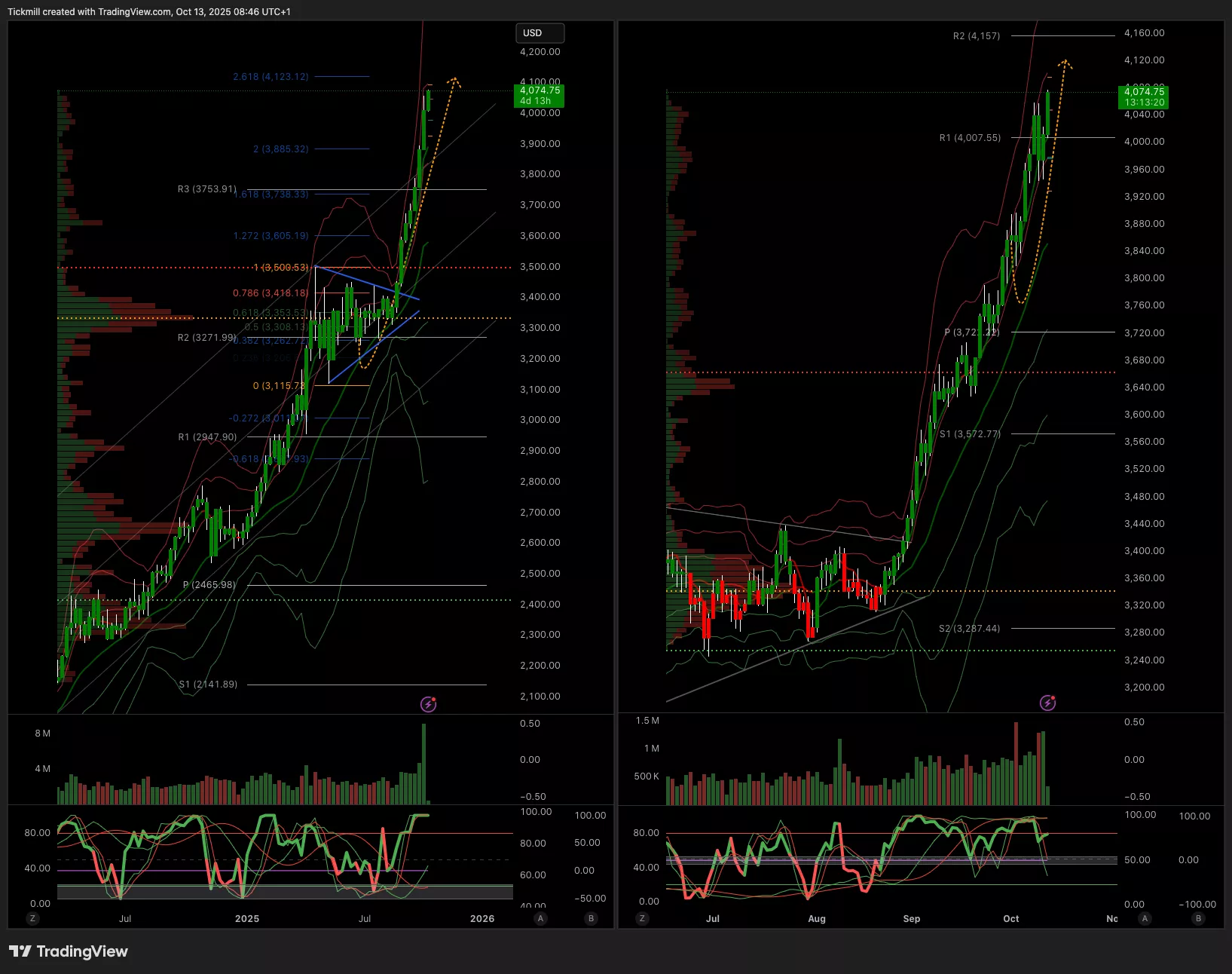

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4000 Target 4120

- Below 3850 Target 3770

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 106k Target 118k

- Below 105k Target 100k

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Oct. 10

The FTSE Finish Line - Thursday, Oct. 9

Daily Market Outlook - Wednesday, Oct. 8