Daily Market Outlook - Friday, Oct. 10

Image Source: Unsplash

The global market rally once again paused as worries mounted over renewed concerns about technology valuations. This week, in the absence of US economic data, the to and fro regarding tech valuations has been the main driver of equity market dynamics, coupled with political developments in Japan. The Japanese Yen faced its steepest weekly decline in a year, even as Sanae Takaichi, Japan's newly appointed ruling-party leader and a staunch advocate for economic stimulus, expressed her opposition to an excessively weak currency. Japan's Finance Minister Katsunobu Kato expressed worries today over the sudden and sharp shifts in the foreign exchange market. Since Takaichi's election over the weekend, the yen has dropped 3.5%, hitting 153 per dollar—its lowest point in eight months. Speculation about a potential revival of Abenomics might soon face a dose of reality. Takaichi is set to meet with her coalition partner on Friday afternoon, raising speculation about potential tensions within the 26-year-old alliance that has been the cornerstone of Japan’s political stability. This morning Japan's Komeito party has decided to part ways with the ruling coalition alongside the LDP which has prompted markets to pare yen bets amidst ongoing political uncertainty heading into the weekend. Asian markets took a hit, echoing declines seen in the U.S., with tech companies dragging down indices in Japan and China. Semiconductor Manufacturing International Corporation (SMIC) dropped 7% after news broke that brokers had slashed its margin financing ratio to zero, citing concerns over inflated valuations. Meanwhile, a key index tracking Chinese tech stocks in Hong Kong seemed headed for its worst weekly performance since early August. Futures tied to equity indices in Europe and the U.S. remained flat. The U.S. Dollar, which had enjoyed a four-day rally pushing it to its highest level since early August, lost ground. The global reserve currency was still on track for its biggest weekly gain since November 2024. Gold extended its losses, while oil prices recorded their sharpest weekly decline. Global equities were on course to drop for the second time in three weeks as investors hit the brakes following a strong rebound from April's lows, triggered by tariff-related market shocks. The meteoric rise of AI-driven tech firms has sparked heated discussions about whether their valuations are outpacing economic fundamentals.

September’s REC report highlighted continued weakness in the UK labour market. Recruitment remained in contraction, alongside weak vacancies and slowing pay growth, with permanent starting salaries barely increasing. Staff availability slightly declined, but overall trends point to persistent sector-wide pressure. With uncertainties around the November budget, hiring conditions are unlikely to improve soon. While lower wage growth may appeal to BoE doves, its impact on broader pay measures and inflation remains uncertain, leaving monetary policy unchanged in the near term.

The September ECB meeting highlighted the balance achieved by the Governing Council, with policy rates at 2% and inflation effectively converged. Moderating wage growth and expected productivity gains supported price stability over the medium term. Uncertainties, mainly from geopolitics and trade, were expected to be offset by easing monetary conditions and increased government spending. Domestic demand remained steady despite manufacturing pressures. Discussions on an insurance cut lacked urgency due to divergent views on price risks. Currency movements were seen as balanced, with limited real effective exchange rate appreciation and uncertainties tied to the US. The Governing Council deemed further easing unlikely unless forward-looking activity indices and external conditions significantly deteriorate.

A shortened week for the US due to Columbus Day on Monday, though its impact is minimal as the government shutdown has already halted the flow of official American data. Normally, we’d expect CPI, PPI, retail sales, and production figures, but none will be released. However, the Beige Book is scheduled for Wednesday. The UK has a busy agenda starting with labour and wage figures on Tuesday. The Bank of England will be closely monitoring for signs of easing pay growth while hoping that labour market weakness remains mild. Risks appear tilted toward stickier wage growth and a decline in private-sector employment. Monthly GDP and industrial production data follow on Thursday. While GDP may find support from services, production remains weak, with Q3 growth likely slower compared to H1’s pace. In the Eurozone, final September CPI data will be released, culminating in the regional report on Friday. ZEW sentiment data on Tuesday is expected to soften, with the focus on whether weaker current conditions dampen optimistic expectations. Eurozone industrial data on Wednesday is also worth noting. With the annual IMF meetings underway, there’s a packed schedule of speakers. The Bank of England lineup includes Bailey (Tue, Sat), Breeden (Wed, Fri), Mann (Mon, Thu), Green (Mon, Fri), Ramsden (Wed), and Pill (Fri). From the ECB, Lagarde and Lane are set to speak on Thursday. While the Fed is less involved in IMF events, expect a steady stream of commentary ahead of its next blackout period starting Saturday.

Overnight Headlines

- Israeli Govt Approves Hostage Deal Setting A Cease-Fire In Gaza

- US Confirms Trade Deal Efforts As Japan Prepares For New Leader

- French ECN Weathering Political Crisis, CenBank: Q3 Growth ~0.3%

- China Launches Customs Crackdown On Nvidia AI Chips

- Intel Begins Making World’s Most Advanced Chips In Arizona

- Samsung Shares Rally On AI And Chip Optimism

- US Imposes Sanctions On China Refinery Over Iran Oil Purchases

- Jane Street Expands Into Physical Gas Market In Trading Push

- UK FMR PM Sunak Takes Microsoft And Anthropic Advisory Jobs

- Levi Strauss Raises FY Outlook After Q3 Sales Beat

- Meta’s Instagram Eyes TV App In New Video Push

- US Treasury Intervenes In Argentina’s Currency Market

- Codelco Posts Worst Monthly Copper Output In Decades

- Federal Prosecutors Open Probe Into First Brands Collapse

- US EV Drivers Gain Record Access To Fast Chargers

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1450 (1.12BLN), 1.1500 -10 (4.63BLN), 1.1515-25 (845M)

- 1.1570-75 (780M), 1.1600 (2.8BLN), 1.1620-25 (1.22BLN)

- 1.1630-40 (713M), 1.1650-60 (3.0BLN), 1.1670-80 (1.32BLN)

- 1.1690-00 (2.92BLN), 1.1705-15 (780M), 1.1520-30 (1.7BLN)

- 1.1740-50 (3.7BLN)

- USD/JPY: 151.00 (336M), 152.20-30 (661M), 152.40-50 (671M)

- 153.00 (243M), 153.15-25 (329M), 153.50 (906M)

- EUR/JPY: 174.00 (210M), 176.00 (330M), 176.50 (200M)

- USD/CHF: 0.7855 (330M), 0.7985 (424M), 0.8000 (263M)

- 0.8015-25 (357M), 0.8100 (452M). EUR/CHF: 0.8265-70 (300M)

- 0.9300 (280M), 0.9370-80 (327M)

- GBP/USD: 1.3260-70 (274M), 1.3285 (200M), 1.3345-50 (380M)

- 1.3400 (1.0BLN), 1.3420-25 (280M), 1.3470 (710M

- EUR/GBP: 0.8750 (216M), 0.6605-15 (1.07BLN)

- NZD/USD: 0.5745-50 (275M). USD/ZAR: 17.00 (315M)

- USD/CAD: 1.4000 (710M), 1.4025 (304M), 1.4100 (375M)

CFTC Positions as of the Week Ending 3/10/25

-

Special Announcement. October 1, 2025: During the shutdown of the federal government, Commitments of Traders Reports will not be published

Technical & Trade Views

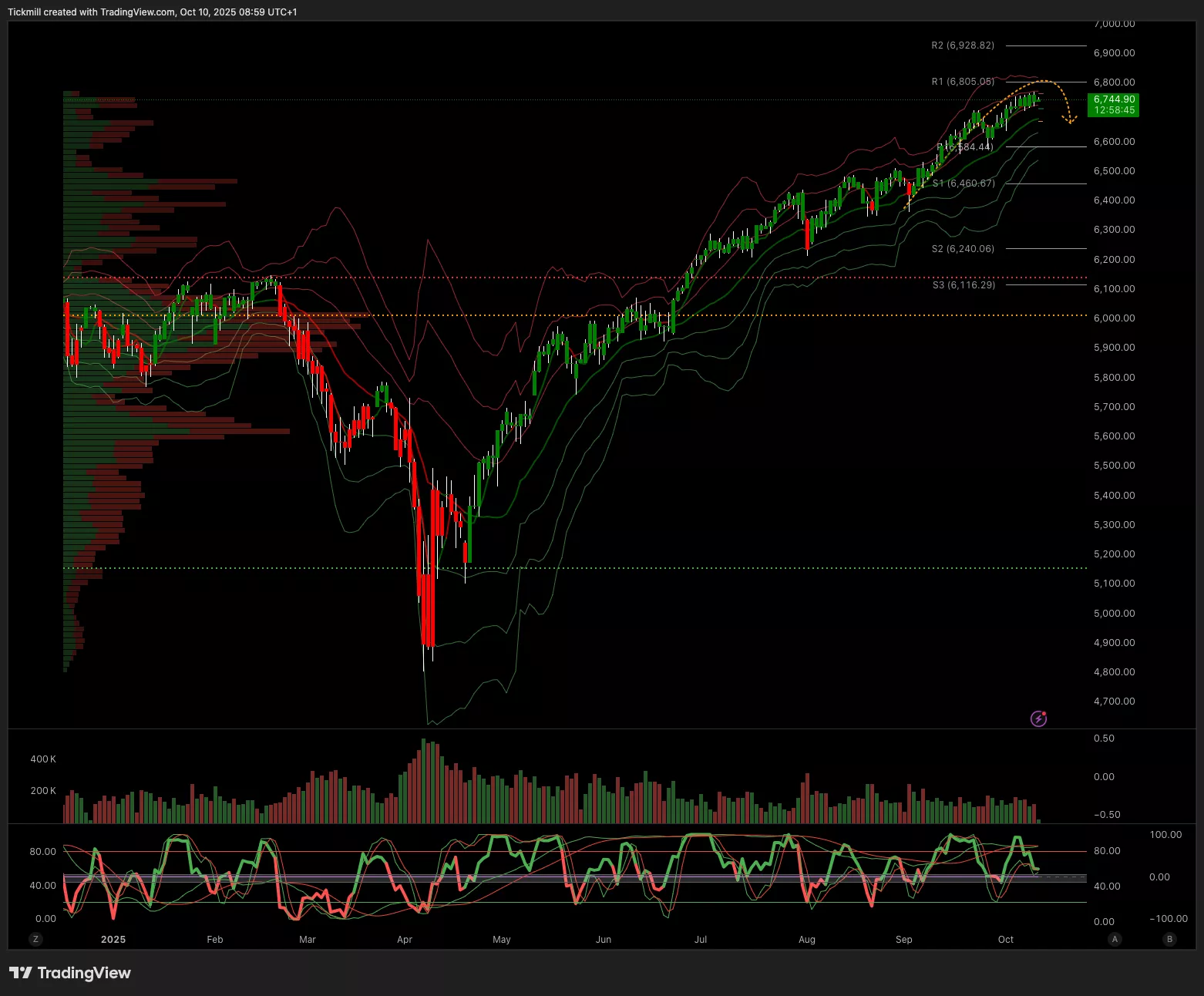

SP500

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 6440 Target 6800

- Below 6700 Target 6630

(Click on image to enlarge)

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 1.1750 Target 1.1580

- Above 1.1750 Target 1.1850

(Click on image to enlarge)

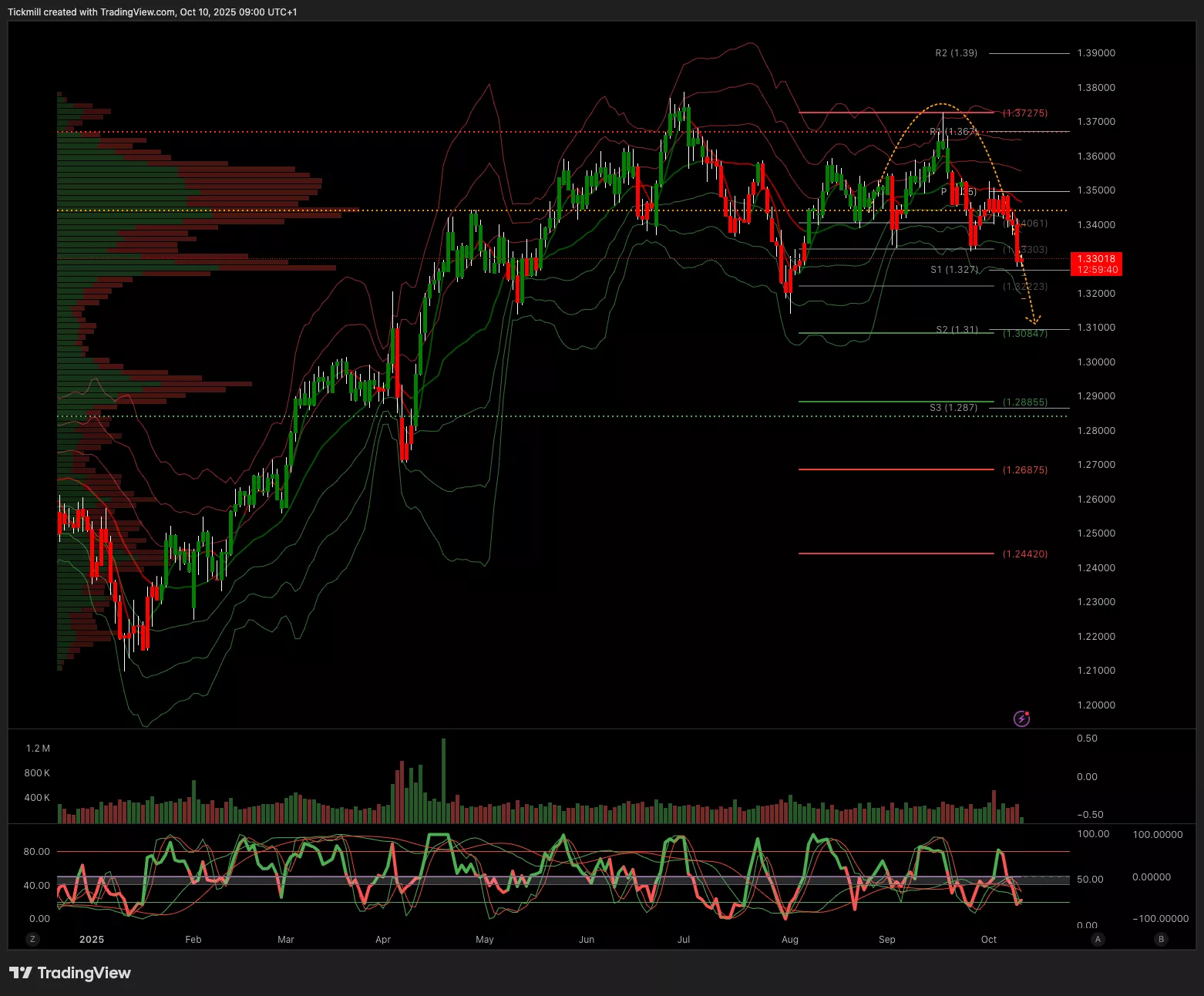

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Below 1.34 Target 1.31

- Above 1.35 Target 1.3580

(Click on image to enlarge)

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Below 150 Trgaet 148.5

- Above 151 Target 154

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 4000 Target 4120

- Below 3850 Target 3770

(Click on image to enlarge)

BTCUSD

- Daily VWAP Bullish

- Weekly VWAP Bullish

- Above 122k Target 126k

- Below 122k Target 120k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Thursday, Oct. 9

Daily Market Outlook - Wednesday, Oct. 8

The FTSE Finish Line - Tuesday, Oct. 7