Daily Market Outlook - Monday, Nov. 24

Image Source: Pexels

Stocks climbed higher on Friday as traders grew more optimistic about the possibility of the Federal Reserve lowering interest rates next month. Futures tied to the S&P 500 Index saw a 0.6% boost after the index wrapped up a volatile week on a positive note. This upward trend extended into Asian markets, where the MSCI regional stock index gained 0.7%. Hong Kong stocks surged by an impressive 4%, fuelled by Alibaba's main AI app surpassing 10 million downloads within a week of its relaunch. Bitcoin, however, struggled to find its footing as the week began, continuing a prolonged selloff that has put the cryptocurrency on track for its worst monthly performance since 2022. The situation was further subdued by Japan's public holiday on Monday, which meant no cash trading in Treasuries. On the geopolitical front, tensions between China and Japan flared once again, with China addressing a letter to the United Nations in response to ongoing disputes. Meanwhile, Japan's defence minister visited a military base near Taiwan, confirming that plans to deploy missiles to the location were progressing as scheduled. This development comes amid heightened friction between Tokyo and Beijing over the East Asian island. In other global news, U.S. Secretary of State Rubio noted that the November 27th deadline proposed by former President Trump for securing Ukraine's support for a U.S.-backed peace plan might not be set in stone. Rubio suggested that the timeline could extend into the following week. His comments followed U.S.-Ukraine talks held in Geneva on Sunday, which both parties described as steps toward reaching an agreement.

For the UK, the November flash PMIs highlighted two key issues: headcount reductions and margin compression in the service sector. While there was some support from a more optimistic tone in manufacturing, the flash composite index dropped to 50.5 from 52.2 in October, signaling minimal output expansion. The employment index fell sharply by four points to 45.3, suggesting that last month’s increase was an anomaly and that recorded employment losses are likely to continue. According to S&P’s press release, “salary pressures prompted several firms to cut staff.” On pricing, cost pressures remain high due to wages, foreign exchange rates, and goods prices, but subdued demand and heightened competition have significantly weakened pricing power. The resulting margin compression was a notable theme in the euro area PMI surveys as well, though the UK saw a more pronounced gap between input and output prices. Meanwhile, the euro area’s headline activity measure remained relatively strong at 52.4, nearly two points above the UK. Uncertainty surrounding the budget is a potential factor contributing to the UK’s weaker performance this month. This survey data may also influence Governor Bailey’s decision, potentially increasing the likelihood of a rate cut in December.

For UK-focused investors, the much-anticipated Budget is set to be unveiled on Wednesday. Even if gilt sales are revised upward by approximately £10bn for the current fiscal year, as we anticipate, the overall adjustments to the government’s cash requirements over the five-year forecast period compared to March are likely to remain relatively neutral in the central scenario. However, the lingering downside risk for gilts lies in how the Budget is received politically and its implications for the execution of the financial plan. On central bank activity, the Reserve Bank of New Zealand is expected to cut its rate by 25bps to 2.25% on Wednesday. Additionally, the European Central Bank will release the meeting account from its October decision on Thursday, and the Federal Reserve’s Beige Book is due on Wednesday, ahead of its December 10 meeting.In the US, with the government reopening, economic data is gradually resuming, albeit with some delays. September retail sales data (Tuesday) and the durable goods report for the same period (Wednesday) are due, along with the more current November consumer confidence report (Tuesday). However, with the Thanksgiving holiday on Thursday, US news and market activity will likely be concentrated earlier in the week, potentially reducing overall market liquidity. In the eurozone, the week concludes with flash estimates of November inflation from major economies like Germany and France, scheduled for Friday.

Overnight Headlines

- ECB’s Lagarde Says Monetary Policy Can’t Solve Debt Problems

- Fed’s Collins Sees No ‘Urgency’ For December Rate Cut

- BoJ ‘Close’ To Rate Hike Decision, Policy Board Member Says

- Trump: Ukraine Peace Plan Isn’t Final After Criticism It Favours Russia

- Europe Lays Down Red Lines On Ukraine In Rebuke To Trump Plan

- US And Ukraine Report Progress In Talks On Peace Plan With Russia

- Israel Says It Killed Top Hezbollah Commander In Beirut

- Japan’s Takaichi, India’s Modi Agree On AI, Chip Cooperation

- China’s Li Launches Rare Earth Charm Offensive At G20

- Alibaba’s AI App Hits 10M Downloads In Strong Debut

- Lenovo Stockpiling Memory Chips Amid ‘Unprecedented’ AI Squeeze

- UPS, FedEx Scramble To Restore Networks After Fatal Crash

- UK To Cut Business Energy Bills In Pre-Budget Move

- European Banks Offer Sweeteners As Equity Rally Fades

- Fresh Macquarie Bid Values Qube At $7.5B

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/JPY: 155.00 (1.23BLN), 156.50 (404M). EUR/JPY 170.00 (619M)

- USD/CHF: 0.7925 (450M), 0.7970 (611M), 0.8005 (201M)

- 0.8075 (354M), 0.8105 (298M). EUR/CHF: 0.9230 (224M)

- GBP/USD: 1.2970 (650M), 1.3150 (258M), 1.3250 (287M)

- EUR/GBP: 0.8775 (292M), 0.8800 (418M), 0.8875 (273M)

- AUD/USD: 0.6490-00 (440M), 0.6550-60 (450M)

- USD/CAD: 1.3900 (203M), 1.4045-50 (469M), 1.4200 (200M)

- USD/ZAR: 17.20 (400M), 17.50-55 (593M)

CFTC Positions as of the Week Ending 7/10/25

-

CFTC FX positioning data backlog clears January 20. Data for the week ending September 30 published Wednesday. October 14 data next Tuesday (Nov 25). Upcoming data on December 2, 5, 9, 12, 16, 19, 23, 30, followed by January 6, 9, 13, 16, 20. Normal service resumes January 23.

-

CFTC Positions for the Week Ended October 7th:

-

- S&P 500 CME net short: +20,343 contracts (458,398 total)

-

- S&P 500 CME net long: +9,589 contracts (944,434 total)

-

- CBOT US 5-year Treasury net short: +3,838 contracts (2,267,738 total)

-

- CBOT US 10-year Treasury net short: +48,050 contracts (787,958 total)

-

- CBOT US 2-year Treasury net short: +12,837 contracts (1,219,958 total)

-

- CBOT US UltraBond net short: +7,409 contracts (266,858 total)

-

- CBOT US Treasury bonds net short: -16,378 contracts (62,352 total)

-

- Bitcoin net short: -1,108 contracts

-

- Swiss franc net short: -27,470 contracts

-

- British pound net short: -4,476 contracts

-

- Euro net long: 118,365 contracts

-

- Japanese yen net long: 46,307 contracts

Technical & Trade Views

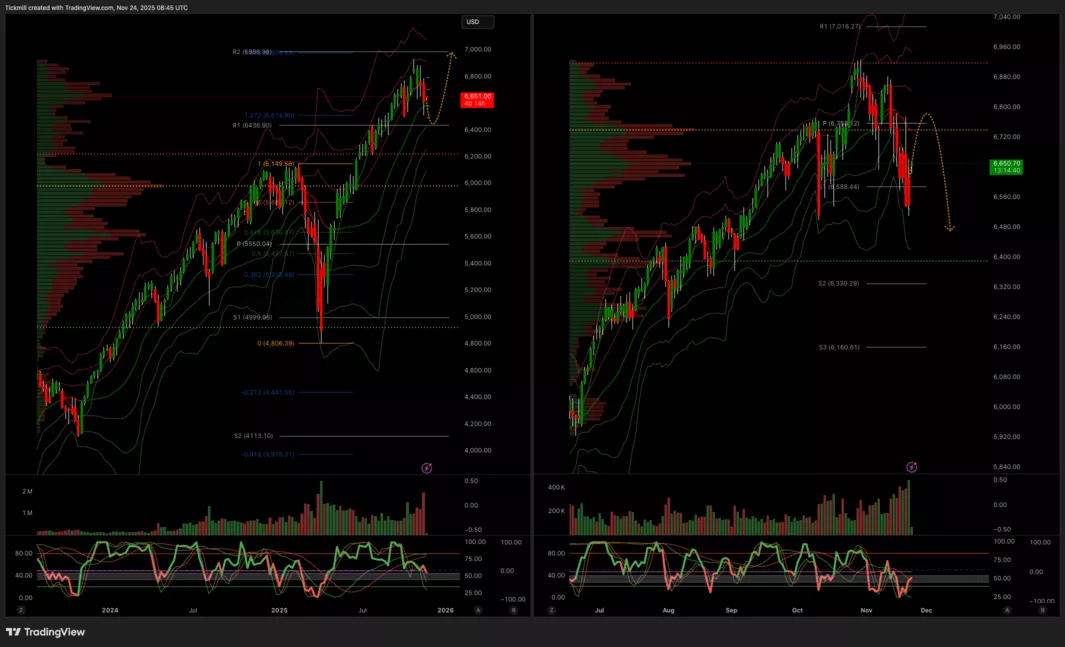

SP500

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 6643 Target 6738

- Below 6612 Target 6527

(Click on image to enlarge)

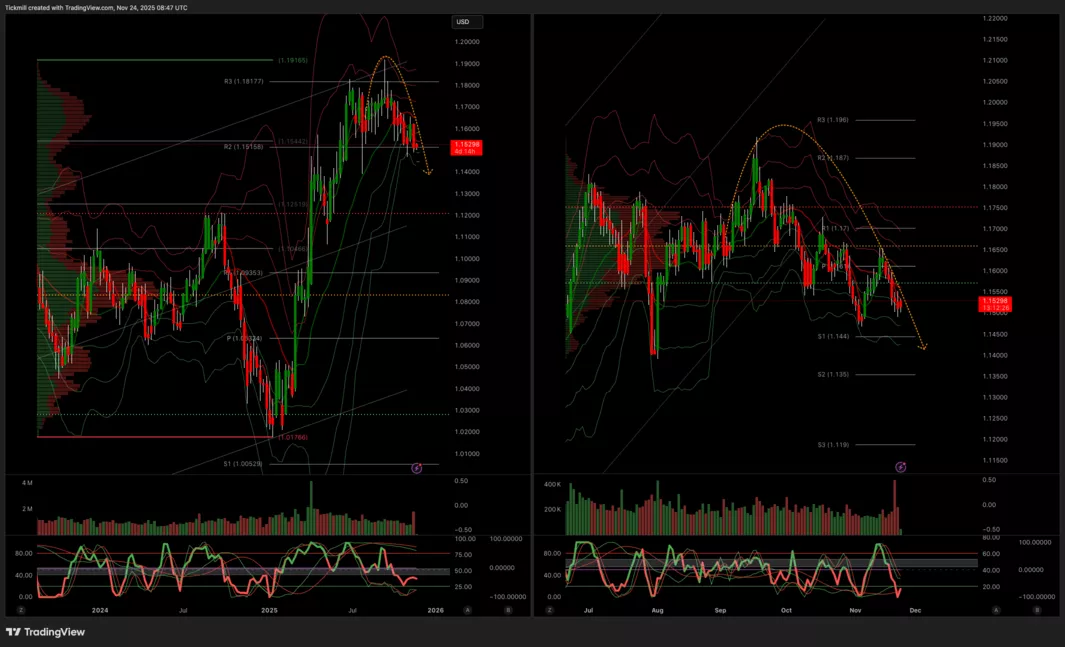

EURUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 1.1577 Target 1.1651

- Below 1.1540 Target 1.1429

(Click on image to enlarge)

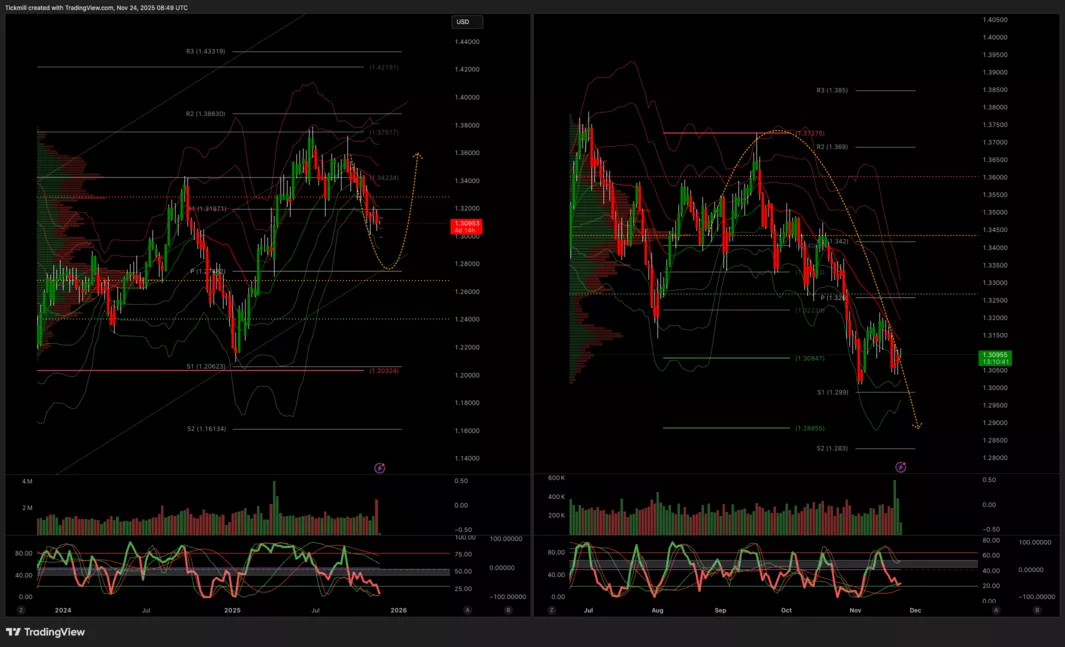

GBPUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 1.3135 Target 1.3192

- Below 1.3089 Target 1.3021

(Click on image to enlarge)

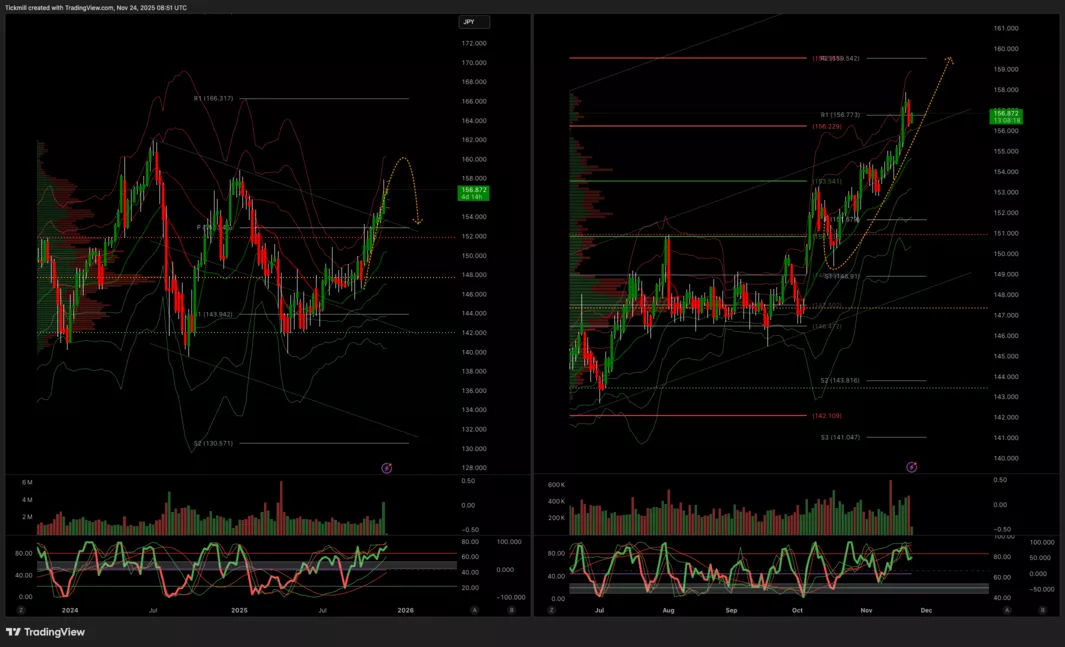

USDJPY

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 155.06 Target 157.04

- Below 153.72 Target 150.40

(Click on image to enlarge)

XAUUSD

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 4071 Target 4121

- Below 4050 Target 3980

(Click on image to enlarge)

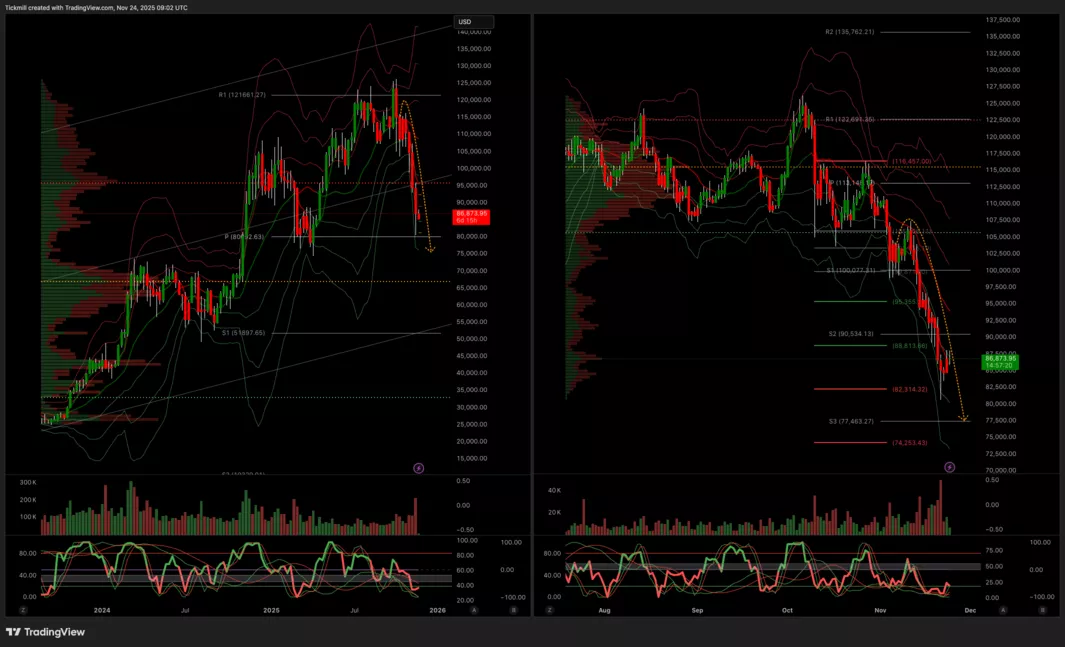

BTCUSD

- Daily VWAP Bearish

- Weekly VWAP Bearish

- Above 87.1k Target 94k

- Below 85.8k Target 80.2k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, Nov. 21

Daily Market Outlook - Friday, Nov. 21

The FTSE Finish Line - Thursday, Nov. 20