The FTSE Finish Line - Friday, Nov. 21

Image Source: Pexels

London's primary stock indexes tumbled sharply on Friday before staging a recovery toward the close, yet the FTSE remains on track for weekly losses as concerns over tech valuations and the Federal Reserve's hawkish stance weighed on global markets. Defence shares also slumped amid signs of potential progress toward peace in Ukraine. The brief surge in global markets on Thursday, driven by Nvidia's upbeat outlook, quickly faded as fears of an AI bubble resurfaced, exacerbated by a mixed U.S. jobs report that cast doubt on potential Fed rate cuts. Both UK stock indexes are poised for steeper weekly losses than those seen in April, when markets were rattled by former President Donald Trump's sweeping tariff announcements. Investors are now focusing on next week's budget presentation, where Finance Minister Rachel Reeves is expected to unveil new tax hikes.

Aerospace and defence stocks dropped 3.2% on Friday, hitting their lowest levels in three months, as investors monitored U.S.-drafted proposals aimed at resolving the Russia-Ukraine conflict. Babcock, the defence and engineering contractor, saw its shares dip 0.7%, despite reporting a 19% rise in first-half profits and projecting further growth for the year. Banking stocks also slipped by 0.7%, with major players HSBC Holdings and Barclays each declining by around 1%. Precious metal miners fell 3.6% as gold prices dropped more than 1%, while industrial metal miners slid 1.7% following copper prices hitting their lowest level in over two weeks. Domestic economic pressures added to the market's woes, with retail sales falling in October amid waning household confidence, and business activity stagnating as November’s PMI weakened. Among individual stock movements, fast-fashion retailer ASOS plunged 8.7% after issuing annual profit forecasts that fell short of analyst expectations.

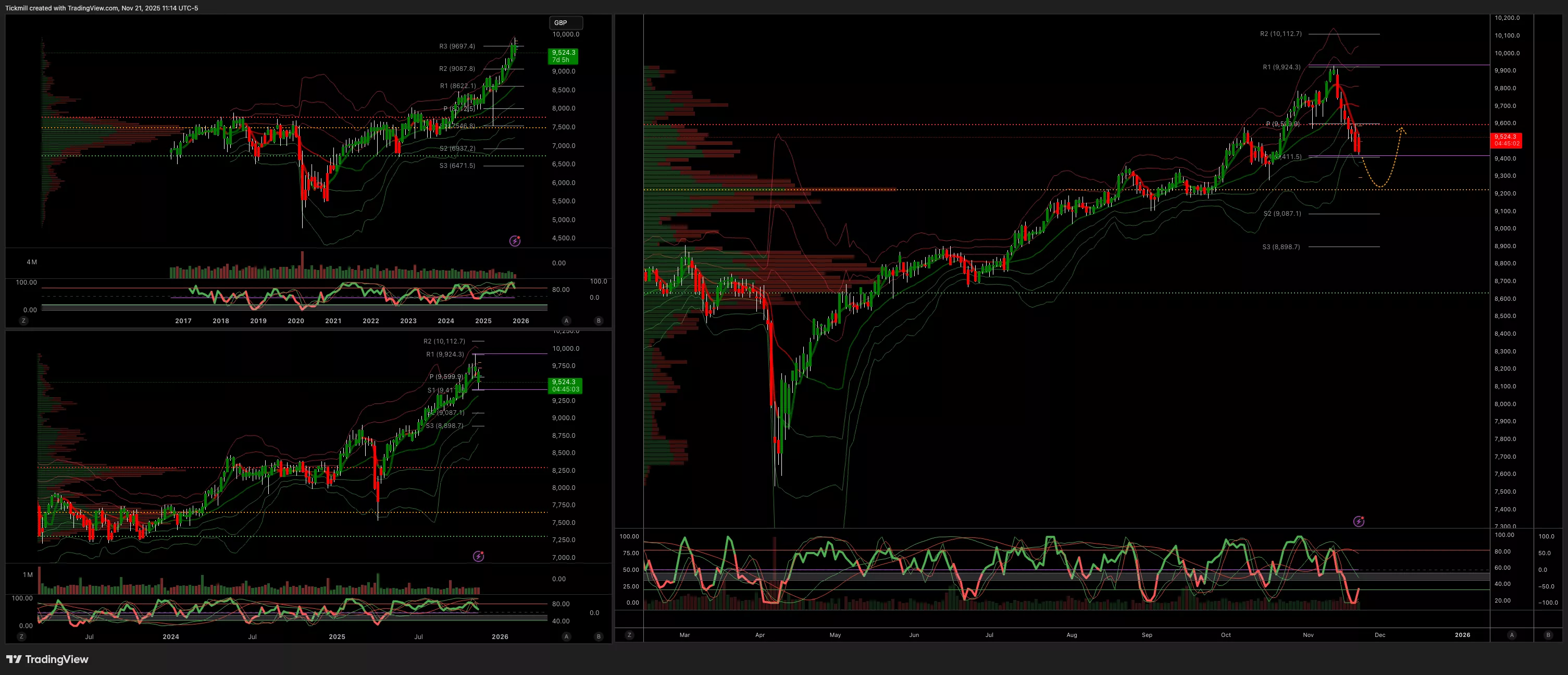

TECHNICAL & TRADE VIEW - FTSE100

- Daily VWAP Bearish

- Weekly VWAP Bullish

- Above 9699 Target 9813

- Below 9541 Target 9356

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Friday, Nov. 21

The FTSE Finish Line - Thursday, Nov. 20

Daily Market Outlook - Thursday, Nov. 20