Daily Market Outlook - Monday, July 22

Image Source: Pixabay

Following Joe Biden's withdrawal from the re-election race and his endorsement of Vice President Kamala Harris, the US Dollar depreciated while Treasuries experienced an increase.

In an effort to stimulate economic growth, the People's Bank of China decided to lower a short-term rate for the first time in over a year, resulting in a two basis point decrease in the yield on China's 10-year sovereign note. Foreign ownership in China's second-largest bond market reached a record high of 4.3 trillion yuan ($591 billion) in a single month, marking the tenth consecutive month of increased investment by international investors.Amidst a downturn in the technology sector, Chinese stocks declined, contributing to overall regional losses spanning from Japan to Australia. The decline in Taiwan Semiconductor Manufacturing reached 3.3%.

This week, financial markets will be influenced by the U.S. Federal Reserve's preferred inflation gauge, flash PMIs for major economies, U.S. second-quarter earnings, and the Bank of Canada's rate decision. The Fed will enter a blackout period ahead of its July 30-31 meeting, leading to a lull in major central bank speeches, while the global data calendar is relatively light. In the U.S., the focus will be on Friday's core PCE price index as the Fed considers cutting interest rates due to improved inflation trajectory. Other releases include existing home sales, July S&P Global flash PMIs, trade data and new home sales, durable goods and advance Q2 GDP, personal consumption, and the final reading of the University of Michigan July consumer sentiment and inflation expectations. In Europe, key releases include eurozone flash July consumer confidence and PMIs, German retail sales, and the Ifo survey. The UK's only top-tier data is flash July PMIs. Japan will publish flash PMIs and Tokyo July CPI. The Bank of Canada will meet on Wednesday, with markets pricing in a 92% probability of a 25 basis-point rate cut following a slower-than-expected rise in consumer prices in June..

Overnight Newswire Updates of Note

- Reeves Hints At Above-inflation Public Sector Pay Rise

- UK Ministers Point To Tough Autumn Budget And Possible Tax Rises

- Biden Exits Race, Endorses Harris As She Shores Up Support

- Leading Democratic Donors Swing Behind Kamala Harris

- China Shows Few Signs Of Tilting Economy Toward Consumers In New Plan

- China’s Land Concession Revenue Vulnerable To Downturn

- China Surprises With Cuts To Key Rates To Support Economy

- Imports Plunge, New Zealand Records $669 Million Goods Trade Surplus For June

- Oil Rises As Biden Quits US Race, Blazes Threaten Canadian Wells

- Nvidia Preparing Version Of New Flaghip AI Chip For Chinese Market

- Asia Stocks Skid As China Trims Rates; Biden Bows Out

- VC Firm Lanchi Bets On China AI, Hong Kong Potential After Parting Ways With BlueRun

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0845-50 (1.1BLN), 1.0900 (496M) 1.0925 (616M), 1.0950 (918M)

- EUR/CHF: 0.9650 (272M), 0.9700-10 (1.1BLN)

- GBP/USD: 1.2900 (200M), 1.2930-40 (1.2BLN)

- EUR/GBP: 0.8375 (480M), 0.8415 (400M), 0.8450 (432M), 0.8465-75 (925M)

- AUD/USD: 0.6650-55 (757M), 0.6700 (1BLN). NZD/USD: 0.6095 (330M)

- USD/CAD: 1.3575 (1.7BLN), 1.3700-10 (807M), 1.3805 (391M)

- USD/JPY: 156.00 (531M), 157.30 (415M), 158.00 (2.6BLN), 158.45-50 (789M)

CFTC Data As Of 16/7/24

- Equity fund managers raise S&P 500 CME net long position by 19,908 contracts to 997,340

- Equity fund speculators increase S&P 500 CME net short position by 28,517 contracts to 370,142

- Japanese yen net short position is 151,072 contracts

- British pound net long position is 132,902 contracts

- Euro net long position is 24,749 contracts

- Swiss franc posts net short position of -49,793 contracts

- Bitcoin net short position is -579 contracts

Technical & Trade Views

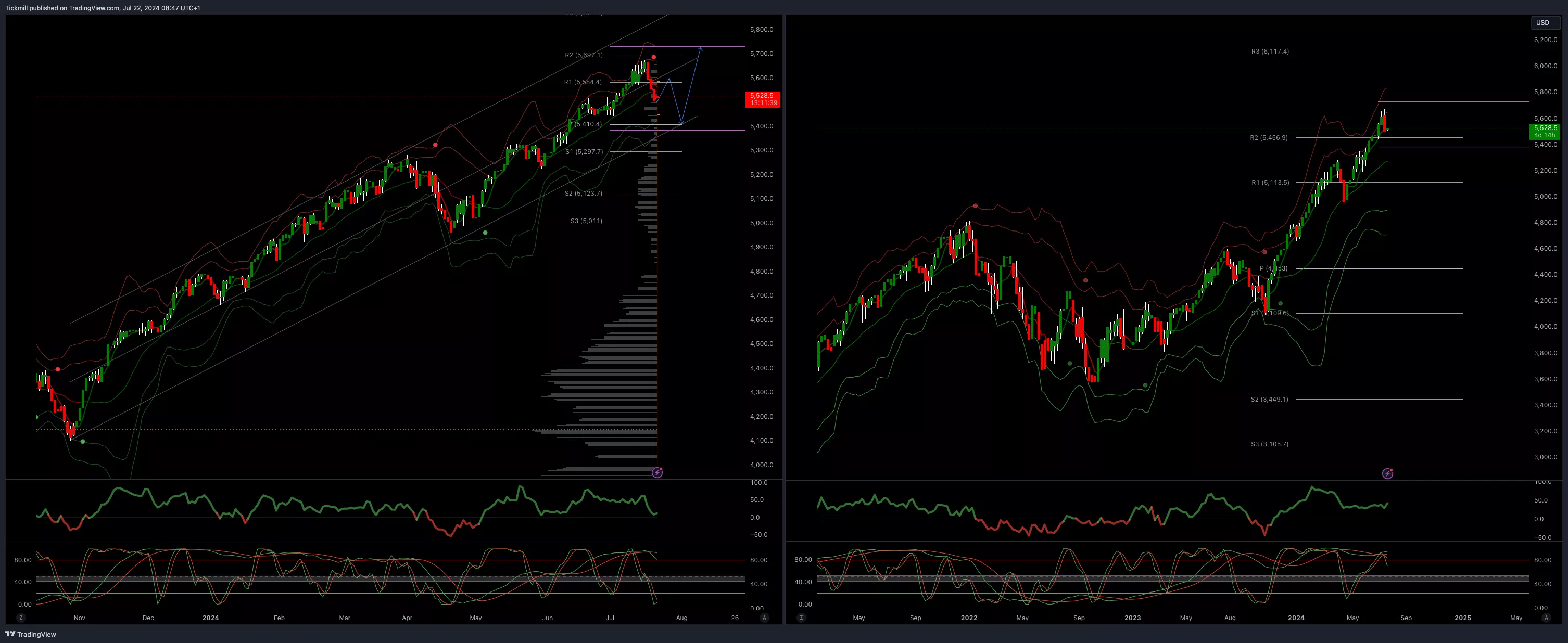

SP500 Bullish Above Bearish Below 5480

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 5475 opens 5450

- Primary support 5400

- Primary objective is 5700

(Click on image to enlarge)

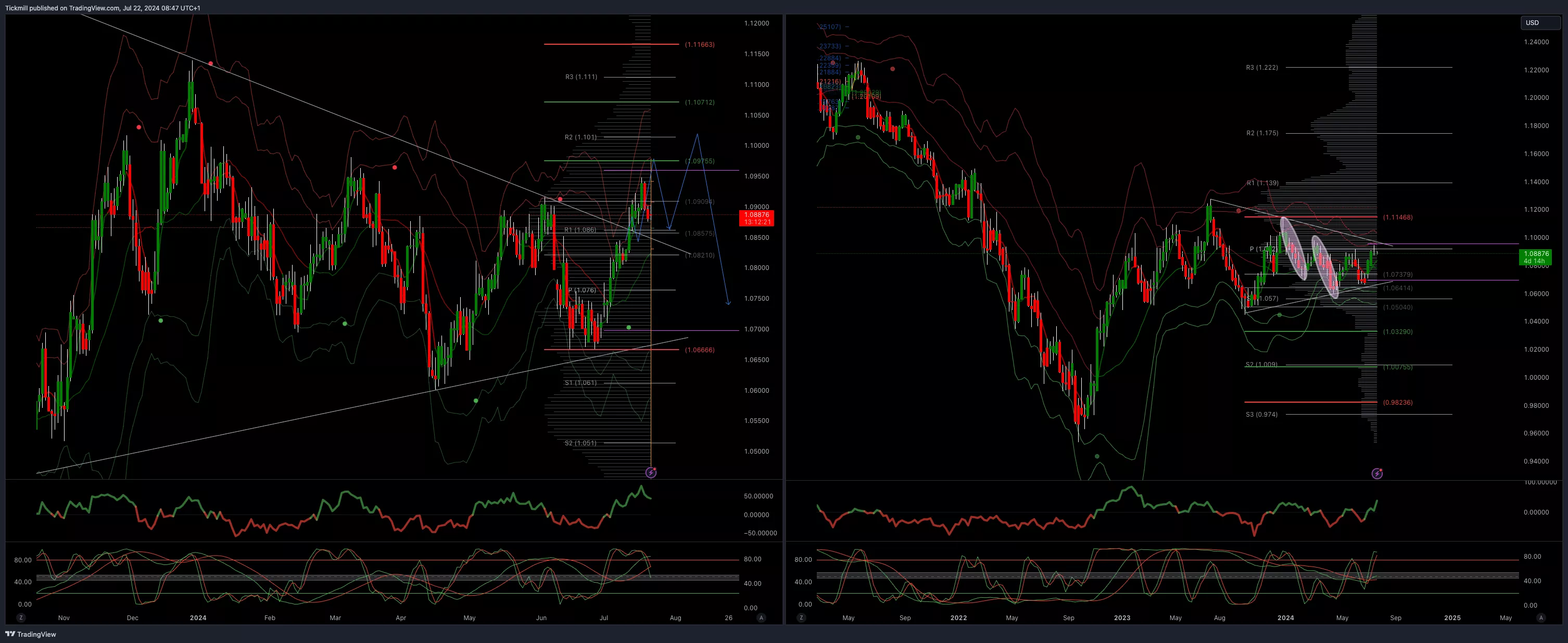

EURUSD Bullish Above Bearish Below 1.09

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.880 opens 1.0940

- Primary resistance 1.0981

- Primary objective is 1.0750

(Click on image to enlarge)

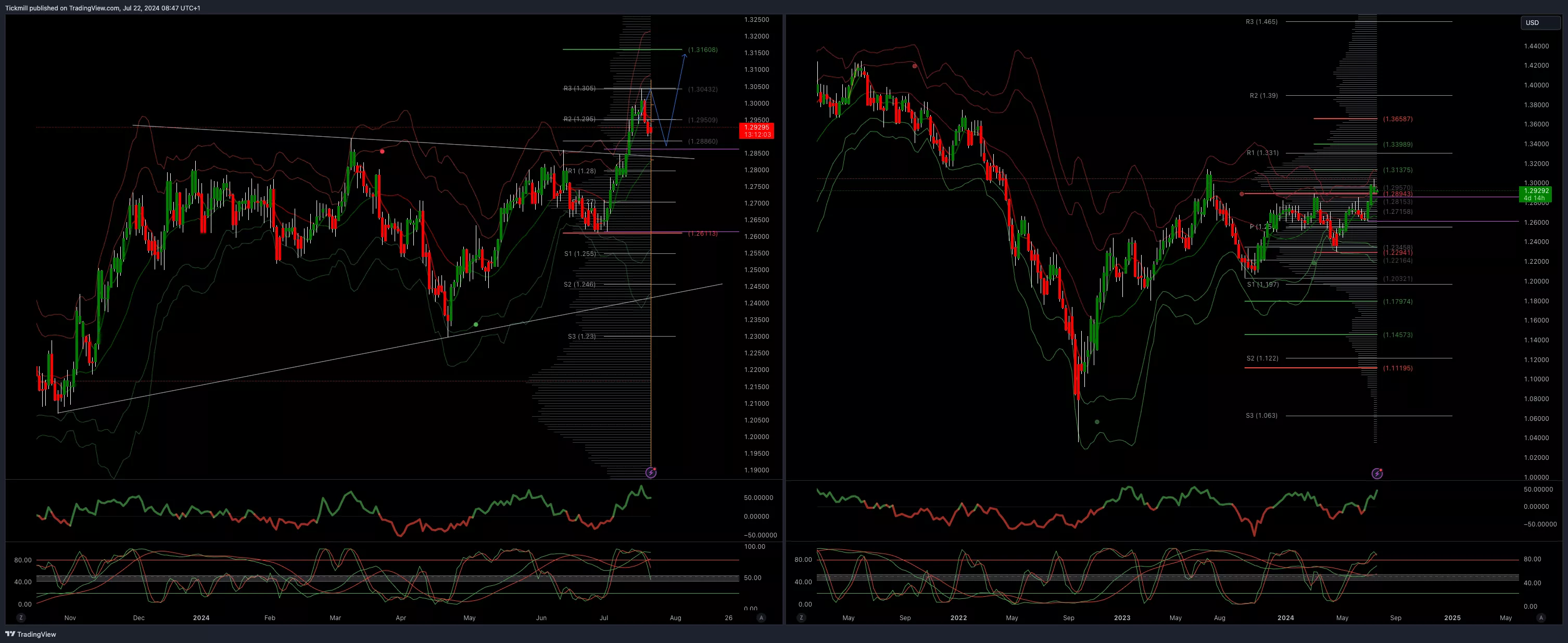

GBPUSD Bullish Above Bearish Below 1.29

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 1.2670 opens 1.2450

- Primary support is 1.2690

- Primary objective 1.3137/60

(Click on image to enlarge)

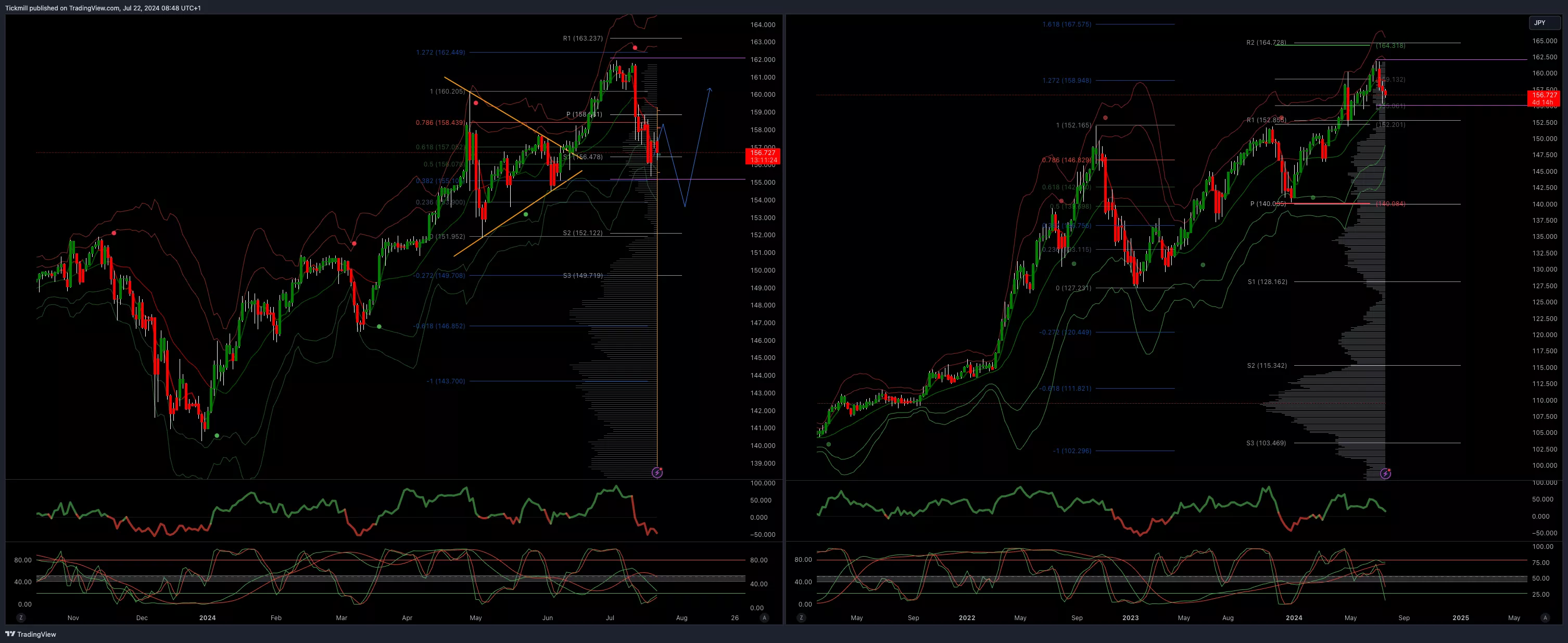

USDJPY Bullish Above Bearish Below 156

- Daily VWAP bearish

- Weekly VWAP bearish

- Below 156 opens 153

- Primary support 152

- Primary objective is 164

(Click on image to enlarge)

XAUUSD Bullish Above Bearish Below 2345

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

BTCUSD Bullish Above Bearish below 62000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 67000 opens 70000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Closing The Week In The Red Amidst Global Tech Outage

Daily Market Outlook - Friday, July 19

FTSE Posts Best Returns In Two Months