FTSE Posts Best Returns In Two Months

Image Source: Pexels

London stocks saw an increase on Thursday as a variety of corporate earnings reports were released. Despite a slowdown in British wage growth, the levels remained high enough to potentially impact the Bank of England's inflation target. The FTSE 100 index rose by 0.47%, marking its best performance in two months, while the FTSE 250 index also saw anincrease. Data indicated a 5.7% growth in average weekly earnings, excluding bonuses, compared to the previous year, potentially influencing the BoE's decision on interest rates. The odds of an interest rate cut next month rose to 39.1% following this data release. Additionally, inflation held at 2%, surpassing expectations of 1.9% in June. Energy shares and Frasers experienced notable gains, while Diploma Plc and Dunelm Group faced declines and increases respectively. AJ Bell also reported positive growth, with a 20% rise in third-quarter assets under administration. The investment banking and brokerage sector reached its highest levels in over four years, trading 1.8% higher.

Dunelm, a UK-based homeware retailer, has seen a 5.6% increase in its shares, reaching the highest level since August 18, 2023. This makes it the top gainer on the FTSE Mid 250 Index. The company has announced an upbeat annual profit forecast, expecting it to be slightly higher than the market consensus. Additionally, Dunelm anticipates its annual gross margin to be approximately 170 basis points higher than the previous year, attributed to lower freight rates. Analysts are predicting an annual pretax profit of around 200 million pounds ($260.14 million). Prior to this increase, the stock had risen by 4% this year.

Frasers experienced a 7.6% increase in its shares, becoming the top gainer on the blue-chip FTSE 100 index. The sportswear and apparel retailer anticipates an adjusted pre-tax profit for the fiscal year to be between 575 million and 625 million pounds ($747.3 million), which is at the top end of analyst consensus for the year ended April 28. The company is focused on its "elevation strategy," which involves investing in flagship stores and online operations, as well as strengthening ties with brands like Nike, Adidas, and The North Face. Despite a ~10% decrease in stock value so far this year, the company remains optimistic about its annual profit outlook.

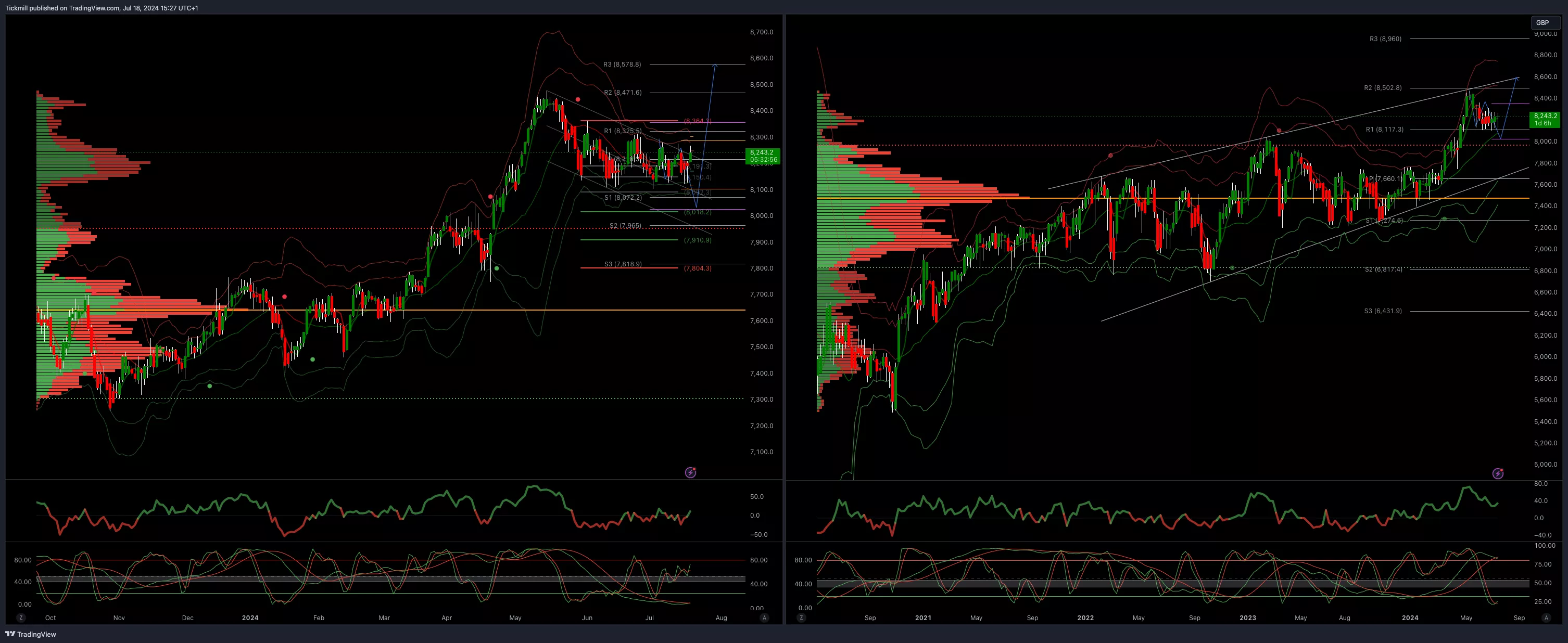

FTSE Bias: Bullish Above Bearish below 8225

- Above 8363 opens 8500

- Primary support 8000

- Primary objective 8023

- 5 Day VWAP bullish

- 20 Day VWAP bullish

(Click on image to enlarge)

More By This Author:

Daily Market Outlook - Thursday, July 18FTSE Flatlining As Sticky Inflation Data Weighs On Rate Cut Hopes

Daily Market Outlook - Wednesday, July 17