Daily Market Outlook - Monday, April 28

Image Source: Pixabay

Asian markets opened the week on a stable footing as investors awaited updates on US trade negotiations with the region and anticipated further Chinese stimulus before making substantial investments. A regional index rose by 0.6%, while S&P 500 futures fell by 0.6%, indicating that the recent four-day surge in US markets might be waning. Gold prices dropped by up to 1.6% as traders sold off positions, suggesting the recent rally in the precious metal has warranted profit taking. Treasuries and the Dollar remained stable, whereas Bitcoin recovered early losses. Investors are closely monitoring any progress in US trade discussions following Trump's assertion that another delay in his planned tariffs is unlikely. Asian export-oriented countries affected by severe US "reciprocal" tariffs are faring better than their Western counterparts in negotiations with the administration. To manage the next stages, the Trump administration has established a framework for discussions with approximately 18 countries, including a template outlining common areas of concern to guide the talks. On Monday, Chinese officials reaffirmed their commitment to enhancing support for employment and the economy, expressing confidence that the government will meet its economic goals this year. The PBOC also signalled its intention to ensure adequate market liquidity and to lower banks' reserve requirements and interest rates in a "timely fashion". This week promises to be quiet on the central bank front following last week's surge of speakers. Federal Reserve officials will begin their media blackout period ahead of the Federal Open Market Committee (FOMC) meeting on May 6-7.

A busy week lies ahead for major economies with several key macroeconomic indicators set to be released. In the US, attention will be on the jobs report, ISM manufacturing index, and PCE inflation data. The Euro Area will focus on the flash CPIs and Q1 GDP figures. In Asia, the spotlight will be on the Bank of Japan meeting and China's April PMIs. Major corporate earnings reports are also expected, featuring results from Apple, Microsoft, Amazon, and Meta.

In the US, significant data releases include the April jobs report on Friday, the ISM manufacturing index on Thursday, and the core PCE for March on Wednesday. Economists predict a payroll increase of 150,000 in April, down from 228,000 in March, with the unemployment rate remaining at 4.2% and hourly earnings growth at 0.3%. Core PCE inflation is expected to rise by 0.1% month-over-month, compared to 0.4% in March. The preliminary Q1 GDP reading, also due Wednesday, is forecasted to show a 1.1% annualised growth, down from 2.4% in Q4 2024. Additional releases include the employment cost index and the ADP private payrolls report on Wednesday, as well as March JOLTS data and the Conference Board’s consumer confidence indicator on Tuesday. Investors will also pay close attention to the Treasury’s updated borrowing estimates on Monday and the refunding announcement on Wednesday.

In Europe, important indicators include flash CPIs, starting with Spain on Tuesday, followed by Germany, France, and Italy on Wednesday, and Eurozone-level indicators on Friday. The Eurozone HICP is expected at 2.09% (core 2.54%), with specific country forecasts of 2.21% for Germany, 0.74% for France, 2.10% for Italy, and 2.06% for Spain. Q1 GDP reports for Germany, France, Italy, and the Eurozone are also due on Wednesday, along with several sentiment indicators such as consumer confidence in Germany and Italy, and the ECB’s consumer expectations survey on Tuesday. In the UK, speeches from Bank of England officials Ramsden, Truran, Bailey, and Lombardelli are planned, but no major macroeconomic data will be released.

In Asia, the Bank of Japan's decision on Thursday is expected to maintain the current monetary policy stance, with Japan's industrial production and retail sales data set for release on Wednesday, markets anticipate a -0.3% month-on-month decline in industrial production for March. Additionally, attention will be on Japan Finance Corporation's latest small business survey on Wednesday and the consumer confidence survey on Thursday, which are expected to reflect sentiment following recent tariff announcements. The second round of US-Japan trade talks is scheduled for next week. In China, the official April PMIs and the Caixin manufacturing index, both due on Wednesday, will be analysed for tariff impacts. Bloomberg's current consensus estimates suggest the official manufacturing gauge may decrease to 49.8 from 50.5 in March, with the non-manufacturing index slightly down to 50.7 from 50.8.

In politics, the federal election in Canada takes place on Monday, President Trump's first 100 days in office are marked on Wednesday in the US, and the UK holds local elections on Thursday.

Overnight Newswire Updates of Note

- ECB Prepares For June Cut As Economy Hurt Even If Trade Is Fixed

- ECB’s Kazaks Urges Cautious Steps Even As Growth Outlook Worsens

- Swiss Franc Surge Sparks Bets On Return To Negative Interest Rates

- Germany To Tap Utility Executive Reiche For Economy Minister

- J. Bardella Confirms Far-right Run For President If Le Pen Banned

- Russia 150 Drones In Ukraine; Trump Doubts Putin’s Desire For Peace

- IMF-World Bank Meetings End; Little Progress On Tariffs Amid Worries

- Trump Floats New Income Tax Cut In Bid To Ease Tariffs Bite

- Asia Gains Lead In Race For Interim Deals To Avoid Trump Tariffs

- ASX On Knife-Edge As Investors Wait For Proof That RBA Will Cut Rates

- BoJ To Hit Pause On Rate-hike Path As Economic Risks Mount

- China Seen To Cut RRR And Interest Rates In 2Q

- China’s Industrial Profit Rose In March

- China’s Huawei Develops New AI Chip, Seeking To Match Nvidia

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1250 (3.5BLN), 1.1300 (303M), 1.1400 (625M), 1.1425 (542M)

- USD/CHF: 0.8180 (600M). GBP/USD: 1.3300 (195M)

- AUD/USD: 0.6310 (694M), 0.6385-90 (685M), 0.6400 (262M)

- NZD/USD: 0.6000-05 (630M)

- USD/CAD: 1.3840 (205M), 1.3905 (275M)

- USD/JPY: 142.00 (591M), 144.00 (300M), 145.00 (498M)

- GBP/JPY: 189.50 (1.1BLN)

Barclays is the first to unveil its preliminary model forecasts for month-end FX flow. The model anticipates a robust demand for USD across all leading currencies. This comes in the wake of the 2nd April liberation day, which caused a global risk-off sentiment and a decline in stock markets. Conventional safe havens, such as US Treasuries and the USD, experienced significant declines as well. This situation resulted in an unexpected expansion of U.S. swap spreads and a spike in credit spreads. The trade-weighted USD dropped by 4.6% in April, prompting a rebalancing that drove USD demand

Credit Agricole’s FX Month-End model signals real money USD buying versus corporate GBP selling and EUR buying

CFTC Data As Of 25/4/25

- Speculators in equity funds have boosted their net short position on the S&P 500 CME by 19,828 contracts, reaching a total of 259,476 contracts. In contrast, equity fund managers have increased their net long position on the S&P 500 CME by 2,780 contracts, bringing the total to 807,842 contracts.

- Speculators have also raised their net short position in CBOT US Treasury bonds futures by 6,902 contracts to reach 107,687 contracts, while they increased their net short position in CBOT US Ultrabond Treasury futures by 27,545 contracts, totaling 247,602 contracts.

- Speculators have reduced their net short position in CBOT US 10-year Treasury futures by 31,649 contracts, leading to a revised total of 906,106 contracts. They raised their net short position in CBOT US 5-year Treasury futures by 129,859 contracts, bringing the total to 2,191,434 contracts.

- Speculators increased their net short position in CBOT US 2-year Treasury futures by 43,222 contracts, reaching 1,297,995 contracts. The net long position in Japanese yen stands at 177,814 contracts, while the euro's net long position is 65,028 contracts. The British pound has a net long position of 20,490 contracts. In contrast, the Swiss franc shows a net short position of -25,474 contracts, and the net short position for Bitcoin is -806 contracts..

Technical & Trade Views

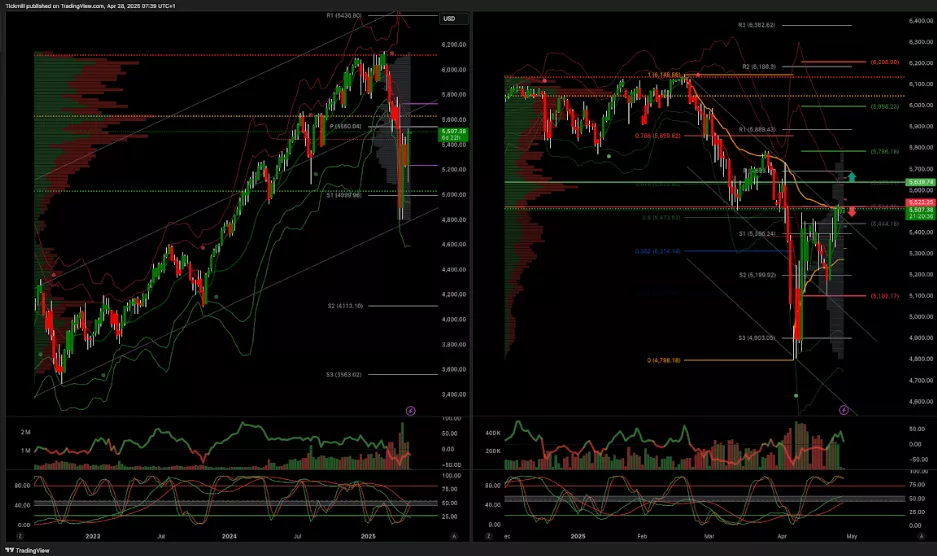

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 5640 target 5790

- Below 5500 target 5385

(Click on image to enlarge)

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into the end of April

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

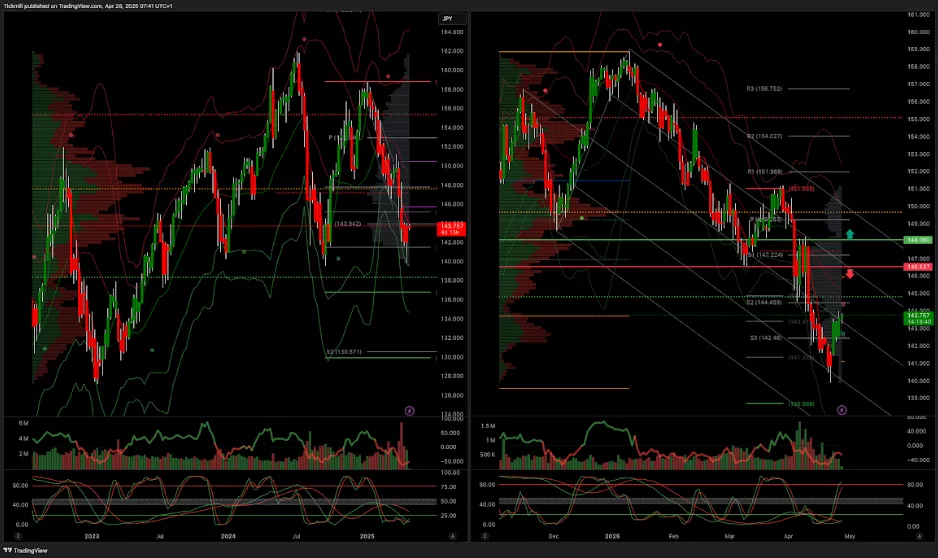

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into early May

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

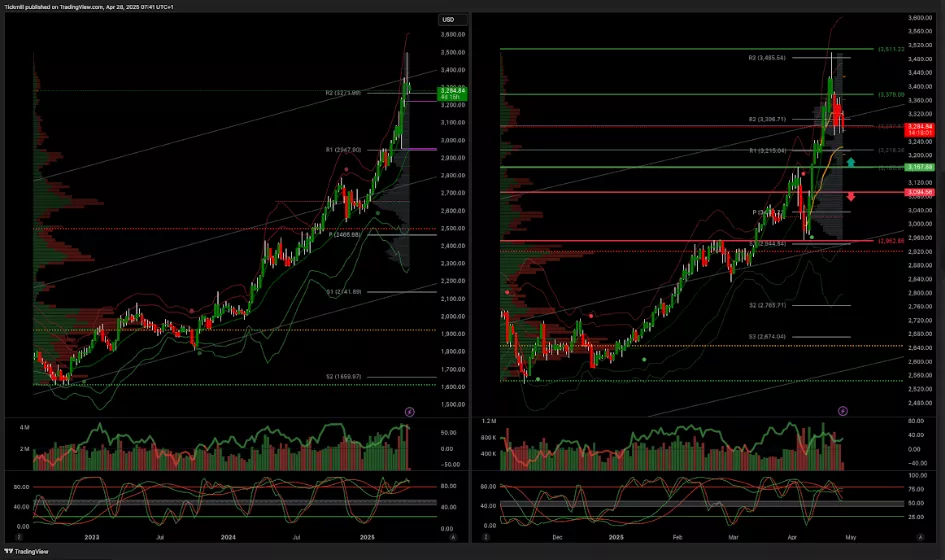

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Seasonality suggests bearishness into mid/late April

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bullishness into late April

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Friday, April 25

Daily Market Outlook - Friday, April 25

The FTSE Finish Line - Thursday, April 24