Daily Market Outlook - Friday, May 9

Image Source: Pexels

Japanese stocks surged on Friday, bolstered by the dollar's rise against the yen after a trade agreement between the U.S. and Britain sparked optimism for progress in tariff negotiations with other nations. Bitcoin climbed to its highest level since January, while U.S. crude oil prices edged higher following a more than 3% jump on Thursday. This increase came after President Donald Trump announced the deal with British Prime Minister Keir Starmer, marking the first trade agreement since Trump implemented a 90-day pause on trade tariffs to encourage negotiations. However, concerns lingered that this limited agreement with London might not serve as a template for broader deals, tempering enthusiasm ahead of the Sino-U.S. trade talks set for Saturday in Switzerland. Mainland blue-chip stocks traded higher, with Hong Kong's Hang Seng Index and Japan's Nikkei also posting gains. The broader Topix rose approximately 1.2%, extending its winning streak to 11 consecutive sessions—the longest since October 2017. Global markets appeared more optimistic about easing trade tensions than they were two weeks ago, when the U.S. administration first signalled a potential de-escalation with China. Still, sentiment surrounding Saturday's U.S.-China discussions in Switzerland remains mixed. The dollar strengthened against the euro, reaching a one-month high, while the safe-haven yen rebounded from a one-month low, likely influenced by a strong statement from Beijing. China's vice foreign affairs minister declared on Friday that while the nation does not seek a trade war, it is prepared to face one. Meanwhile, the yuan slipped to a one-week low in offshore markets. President Trump has hinted at the possibility of reducing the exceptionally high 145% tariffs on Chinese goods, which effectively act as an embargo. However, the White House dismissed a New York Post report suggesting plans to cut these tariffs by more than half, labelling it as mere speculation.

In the UK, the Monetary Policy Committee (MPC) cut interest rates by 25bp to 4.25%, marking the fourth reduction since last August. This move, anticipated by markets and all 51 Bloomberg-polled institutions, came amid uncertainty driven by US tariff announcements. The nine-member committee was divided: two favoured a 50bp cut, two wanted rates unchanged at 4.50%. Despite this split, the MPC maintained its "gradual and careful" approach to further rate reductions, signalling a cautious stance.

Today's macro slate includes a bevy of central bank speakers: BoE's Bailey and Pill, Fed's Kugler, Barr, Goolsbee, and Williams, and ECB's Simkus, and Canada's Employment Report. The key macroeconomic highlight next week is expected to be Tuesday’s US CPI report. Following two consecutive downside surprises, disinflation is likely to ease, with the median forecast predicting a 0.3% month-on-month increase for both headline and core CPI. This scenario would keep the year-on-year rates steady at 2.4% and 2.8%, respectively. However, these figures may carry less weight given the uncertainties surrounding tariff impacts and the upward trend in price components from survey data. Such conditions are likely to keep the Federal Reserve cautious for the foreseeable future. Thursday’s US retail sales report could have a greater influence, particularly in light of declining consumer confidence amid ongoing uncertainties. This report will be released alongside PPI data and weekly jobless claims. On Friday, the preliminary Michigan survey will provide updates on consumer sentiment and inflation expectations. In the UK, Tuesday’s labour market report will come with the usual concerns about data quality. While sentiment remains fragile, it has not yet led to a significant weakening in employment. A continuation of this trend would reinforce the Bank of England's cautious stance. Meanwhile, Thursday’s Q1 GDP data is expected to show a stronger 0.6% quarter-on-quarter growth, as suggested by monthly figures. However, the BoE’s updated Monetary Policy Report indicates stagnation is likely to return in Q2. A busy schedule of BoE speakers will provide further insights into their outlook. The BoE Watchers’ conference on Monday will feature Lombardelli, Greene, Mann, and Taylor, while Pill and Bailey are set to speak on Tuesday, Breeden on Wednesday, and Dhingra on Thursday. On the same day, Fed Chair Powell is also scheduled to deliver remarks.

Overnight Newswire Updates of Note

- Nvidia Modifies H20 Chip For China To Overcome US Export Controls

- Trump, Starmer Herald US-UK Trade Deal, But 10% Duties Remain

- Trump Team Seeks Tariff Cuts, Rare Earths Relief In China Talks

- US Weighs Plan To Slash China Tariffs To As Low As 50% From 145%

- US Sec Lutnick: S. Korea, Japan Deals More Complicated Than UK

- China’s Trade Balance Surplus Shrinks In April Despite Solid Exports

- Chinese Exports To US Slump 21% But Soar To Rest Of Asia, Europe

- Ultralong JGB Yields Face Upward Pressure From Overseas Investors

- Japan’s Megabanks To Remain Buoyed By BoJ’s Plan To Hike Rates

- Global Shift To Bypass The Dollar Is Gaining Momentum In Asia

- XAU Weakens Below $3,300 Mark Amid Easing Trade Tensions

- Shell’s LNG Canada Plans First Exports As Soon As Late June

- Paramount Beats Estimates As Streaming Results Pick Up

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1150 (1BLN), 1.1200 (2.4BLN), 1.1250-60 (2.2BLN)

- 1.1270-80 (2.5BLN), 1.1300 (2.2BLN)

- USD/CHF: 0.8240-50 (400M). EUR/CHF: 0.9425 (350M)

- GBP/USD: 1.3125 (760M), 1.3375 (960M)

- EUR/GBP: 0.8500-10 (500M), 0.8565 (210M), 0.8585 (351M)

- AUD/USD: 0.6350 (461M), 0.6400 (1.2BLN)

- USD/CAD: 1.3845-50 (721M), 1.3890-1.3900 (712M), 1.3940-50 (588M)

- 1.3990-1.4000 (1BLN)

- USD/JPY: 144.50 (600M), 145.00 (2.9BLN), 145.50-55 (1.1BLN), 146.00 (1BLN)

- 147.00 (1.2BLN). EUR/JPY: 161.50 (490M). AUD/JPY: 95.00 (301M)

CFTC Data As Of 2/5/25

- Equity fund managers have increased their net long position in S&P 500 CME by 18,407 contracts, bringing the total to 826,250. Meanwhile, equity fund speculators have reduced their net short position in S&P 500 CME by 10,014 contracts, now totaling 249,462.

- Speculators have also decreased their net short position in CBOT US Treasury Bonds futures by 22,131 contracts, which now stands at 85,556. Conversely, speculators have raised their net short position in CBOT US Ultrabond Treasury futures by 3,792 contracts, reaching 251,394. The net short position in CBOT US 2-year Treasury futures has been trimmed by 91,618 contracts, totaling 1,206,377. Additionally, there has been an increase in the net short position for CBOT US 5-year Treasury futures by 101,110 contracts, now at 2,292,544. Speculators have also cut their net short position in CBOT US 10-year Treasury futures by 34,569 contracts, down to 871,537.

- The net long position for Euro stands at 75,797 contracts, while the Japanese yen's net long position is 179,212 contracts. The Swiss franc holds a net short position of -24,314 contracts, and the British pound has a net long position of 23,959 contracts. Lastly, Bitcoin's net short position is -1,231 contracts.

Technical & Trade Views

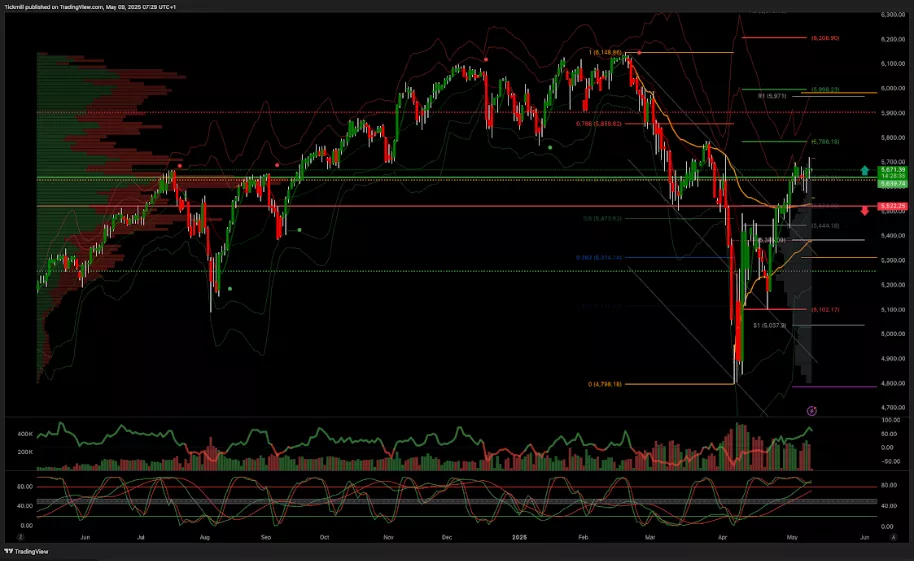

SP500 Pivot 5610

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 5640 target 5790

- Below 5500 target 5385

(Click on image to enlarge)

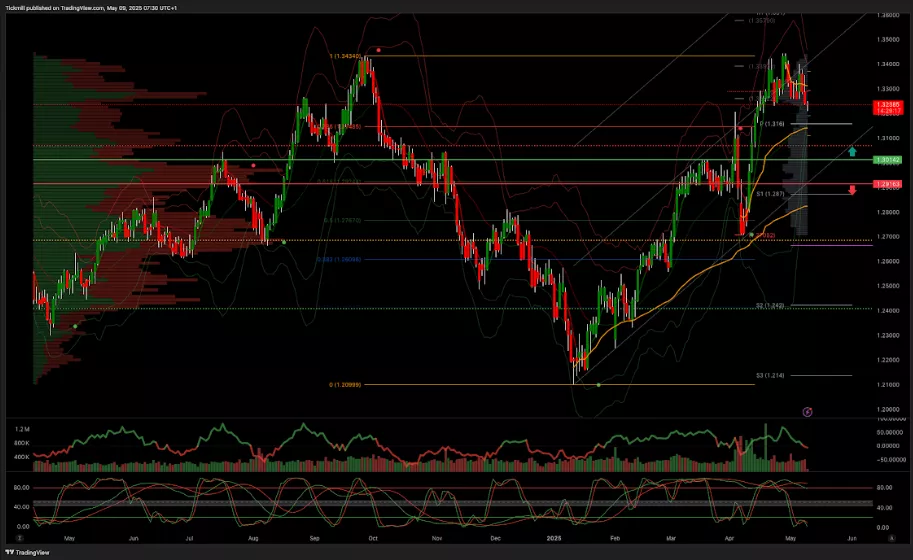

EURUSD Pivot 1.11

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.12 target 1.19

- Below 1.1070 target 1.0945

(Click on image to enlarge)

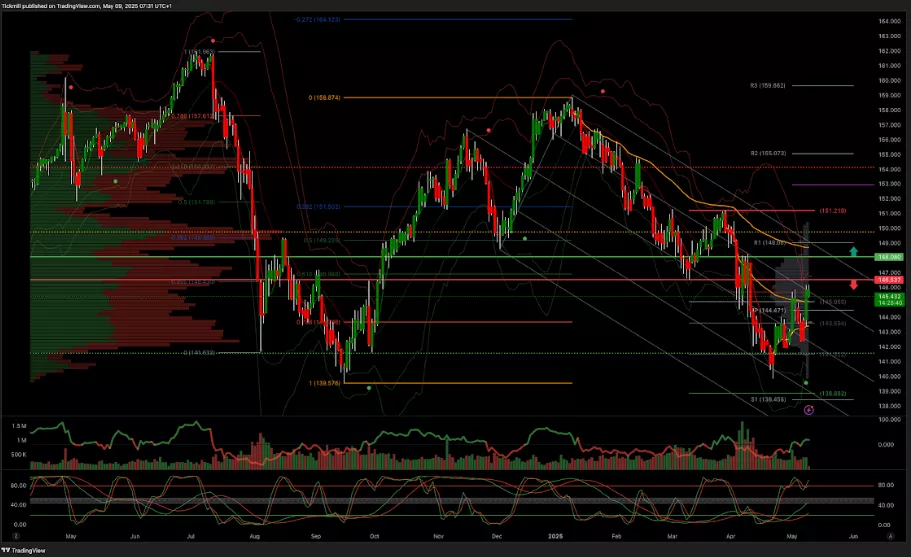

GBPUSD Pivot 1.28

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.29 target 1.27

(Click on image to enlarge)

USDJPY Pivot 147.70

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.52 target 153.80

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3100

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 3200 target 3640

- Below 3000 target 2950

(Click on image to enlarge)

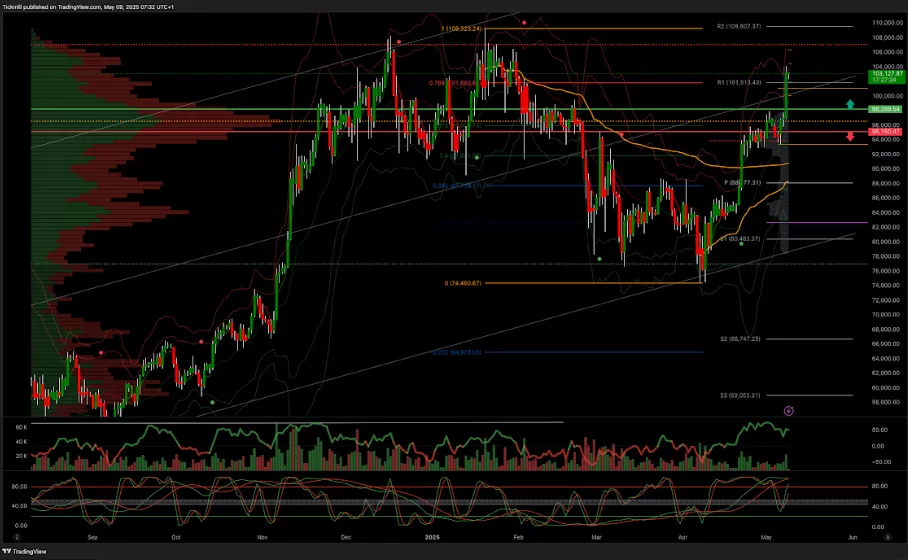

BTCUSD Pivot 96.7k

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 97k target 105k

- Below 95k target 65k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Thursday, May 8

Daily Market Outlook - Thursday, May 8

The FTSE Finish Line - Wednesday, May 7