The FTSE Finish Line - Thursday, May 8

Image Source: Unsplash

Britain's main indexes initially climbed on Thursday, with news that U.S. President Donald Trump would announce a trade deal with Britain initially boosting investor sentiment; however, the idea that 10% tariffs will be maintained and that the announcement is more orientated towards a framework agreement lacking concrete details has seen investors quickly book profits in a buy the rumour sell the news trade, with the FTSE 100 now trading negative on the session. The US is set to eliminate tariffs on Range Rovers and other vehicles manufactured in the UK, as part of a trade deal negotiated by Donald Trump, as reported by The Telegraph. This tariff reduction will be effective for a 12-month "temporary arrangement" while both Britain and the United States aim to establish a more comprehensive trade agreement in the near future. In return, the UK and US will lower tariffs on beef imports and exports to nearly zero, although the UK will prohibit the import of hormone-treated beef as part of this arrangement.

The Bank of England has reduced its key interest rate by 0.25 percentage points to 4.25%, amidst an unexpected split among policymakers regarding the decision, influenced by the impact of Trump's tariffs on global economic growth. They have highlighted the considerable uncertainty lying ahead, but by lowering rates, they aim to alleviate pressure on businesses, encourage demand in the economy, and pave the way for recovery.

Single Stock Stories & Broker Updates:

- Metro Bank shares rise 6.3% to 110.8p, their highest since August 2023. The bank reports a profitable first quarter with a significant increase in underlying profit compared to H2 2024 and reaffirms forecasts for 2025-2027. Year-to-date, the stock is up 16.1%.

- Centrica's stock falls 7.9% to 146.4p, making it a top loser on the FTSE 100. The company maintains its annual outlook and plans to increase dividends despite some business pressures. Centrica Energy's full-year profit is expected at the lower end of medium-term projections, with losses from the Energy Storage+ unit anticipated at the higher end of estimates. British Gas Residential Energy faced impacts from warmer Q2 weather, but 2025 profit is projected to meet medium-term targets. The company does not foresee major effects on finances from trade tariffs. Year-to-date, CNA is up about 9.5%.

- IMI shares rise 4.2% to 1,868p, leading FTSE 100. The company is conducting a strategic review of its transport business, representing 8% of 2024 revenue, and maintains FY25 guidance. Despite a 3% drop in Q1 organic revenue from a cyber attack, margins improved. Jefferies considers shares a good value; stock is up 3% YTD.

- Airtel Africa shares fell 5.3% to 161.2p, amid a reported Q1 operating profit drop of 11.1% to $1.46 billion. Revenue declined 0.5% to $4.96 million but grew 21.1% in constant currency. The company plans to list Airtel Money in the first half of 2026 and expects capex of $725 million to $750 million next year. AAF shares have risen about 50% this year.

- Grafton's shares rose 6.6% to 994.8p, with revenue for the first four months increasing 7.8% YoY to £773.1 million. Average daily like-for-like revenue was up 2.7% from last year. The company is on track to meet full-year expectations, with Peel Hunt expressing confidence in Grafton's ability to handle economic and geopolitical challenges. The stock is up approximately 4% year-to-date.

Technical & Trade View

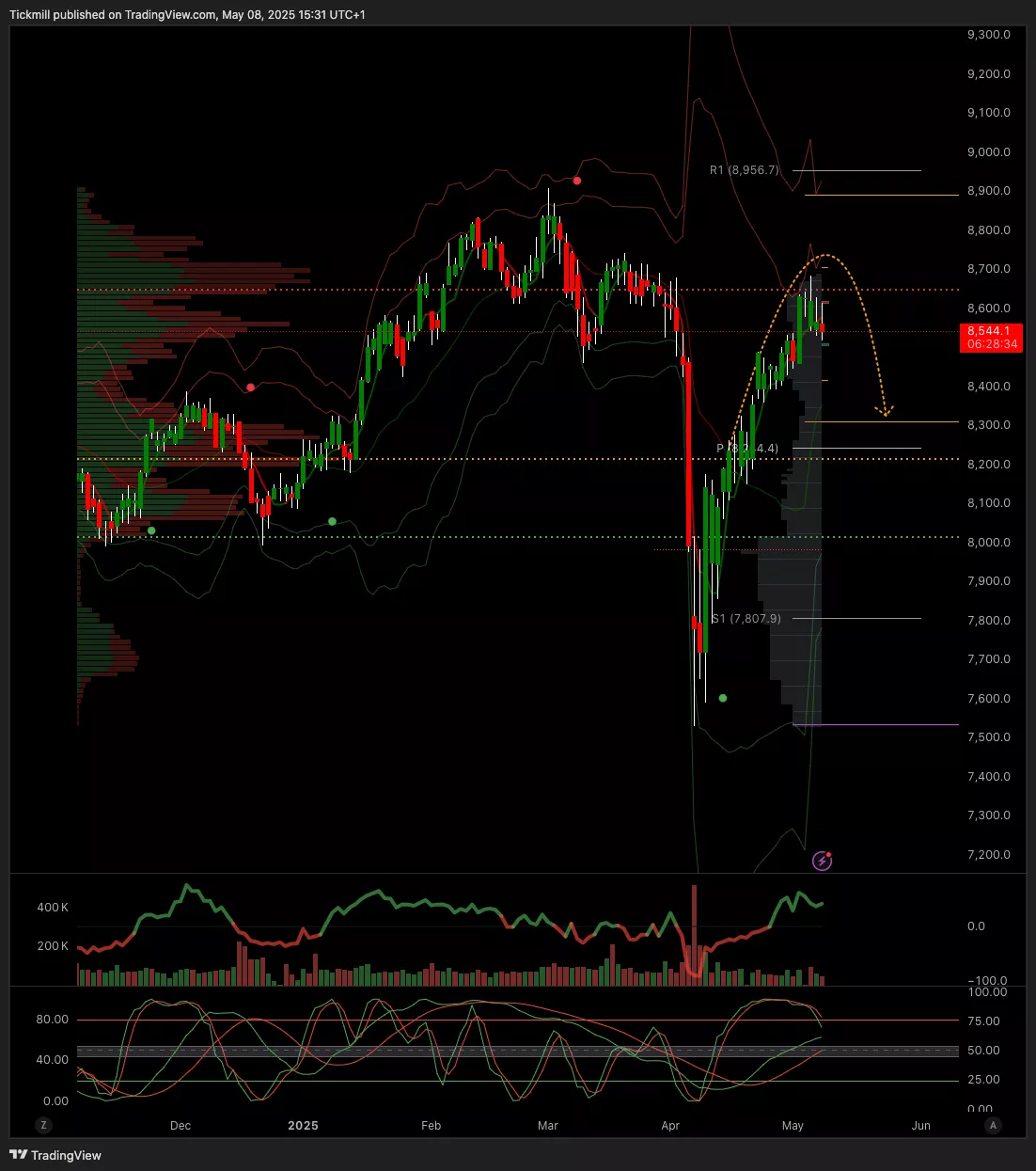

FTSE Bias: Bullish Above Bearish below 8700

- Primary support 8500

- Below 8500 opens 8250

- Primary objective 8300

- Daily VWAP Bearish

- Weekly VWAP Bullish

More By This Author:

Daily Market Outlook - Thursday, May 8The FTSE Finish Line - Wednesday, May 7

Daily Market Outlook - Wednesday, May 7