Daily Market Outlook - Friday, June 13

Image Source: Unsplash

Global equity markets rapidly repriced lower overnight as investors turned to safe-haven assets after Israel launched strikes on Iran's nuclear facilities, significantly escalating Middle East tensions. Crude oil prices soared by 9%, marking their steepest increase in over three years. S&P 500 index futures slid 1.6%, while an Asian equities index dropped 1.1%. Treasury yields declined, with the 10-year yield slipping one basis point to 4.34%. Gold prices surged, while cryptocurrencies weakened. The dollar index rebounded 0.4% after an initial dip, buoyed by a shift to safer currencies despite lingering concerns over its long-term stability, following a three-year low reached on Thursday.

Israel conducted overnight strikes targeting Iran’s nuclear programme and its senior leadership, which Israeli officials suggest could extend for several days. This escalation has long been threatened but follows Israel's rejection of the latest US nuclear deal proposal, the International Atomic Energy Agency’s rebuke on Thursday of Iran’s non-compliance and US decision to withdraw diplomatic staff/families from the region earlier in the week. How the conflict now escalates will be critical for markets, which have responded in a fairly measured way so far. The Israeli decision follows years of discussion as to how to deal with Iran’s nuclear threat, but it also follows a period of broader regional conflict. That likely limits military contagion, as most Iranian proxies in the region have already been decapitated/weakened, boiling this conflict down to a war between the two parties. But the task of completely dismantling the Iranian programme is complex, given many facilities are deeply embedded, complicating destruction. In the case of Syria, Israel deployed commandos to enter and destroy sites directly. The tensions would significantly escalate if Iran responds by targeting US assets in the region. It’s worth remembering that the US has already forward deployed heavy bombers to the region. Markets have proved adept at absorbing geopolitical risks recently, and historically, Middle East wars have only had a limited impact on oil prices, beyond the initial knee-jerk response. Oil futures initially surged by more than 12% but have since retreated amid fears that Israel's attack on Iran could trigger severe and lasting repercussions. The energy sector bore the brunt of market reactions, given Iran’s crucial role as a key oil supplier to China and India. Other sectors experienced relatively moderate fluctuations as investors braced for the possibility of a deeper market downturn.

The UK’s April data reveals a £7.03bn trade deficit, with a £16.2bn services surplus and a £23.2bn goods deficit. Goods exports continue to decline in value and volume, driven by weak demand from the EU and China, despite year-to-date growth in US exports. British exporters are underperforming compared to their global peers, partly due to a strong pound and structural issues, while goods sales as a share of GDP have reached new lows. Amid external uncertainties and weak domestic investment, a turnaround seems unlikely soon.

The appeal of EGBs initially centered on German bonds, benefiting from safe-haven status as US Treasuries faced selling pressure post-‘liberation day.’ The 10Y Bund outperformed the T-note by ~50bp, a trend sustained this quarter. Since early April, the broader EGB market has gained momentum, with 10Y BTP, SPGB, and OAT outperforming the Bund by ~20bp, ~7bp, and ~5bp, respectively. Italian sovereign debt has been particularly attractive, driven by non-residents who have amassed a euro-era high of EUR125bn annually. Improved political stability and fiscal outlooks, along with a 2-year high yield pick-up of ~150bp (10Y BTP vs deposit facility rate), continue to draw investor interest.

Aside from Middle East headline risk, today's macro slate features: Eurozone IP and trade data, UK BoE/Ipsos May inflation expectations, and US June preliminary Michigan consumer confidence.

Overnight Headlines

- Israel Launches Airstrikes On Iran’s Nuclear Facilities

- China Delays $35B US Chip Merger Amid Trade War

- China’s Car Industry Runs On Empty As Supply Chain Bills Go Unpaid

- Trump Eyes Cold War-Era Powers To Fund Rare-Earth Projects

- Trump: US Will Hold ‘Golden Share’ In US Steel After Nippon Deal

- Fed Seen Resuming Rate Cuts After Softer PPI, Jobless Claims

- Central Banks Are Beginning To Fret About Dollar Swap Lines

- BoJ Sees Inflation Running Hotter Than Expected

- Gold Soars Toward $3,450, Oil Above $75 On Israel-Iran Conflict

- NZ Manufacturing PMI Back In Contraction, May At 47.5

- Meta’s Zuckerberg Lures Scale AI CEO After Investment Stake

- AMD Launches MI350 AI Chips With Open AI Ecosystem Vision

- Adobe Posts Strong Outlook, Touting Traction For AI Tools

- Chime Surges In Nasdaq Debut, Valued At $18.4B

- ESA Seeks €1B For Satellite Network With Military Capabilities

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.1400-05 (2.6BLN), 1.1425-30 (787M), 1.1440 (757M), 1.1485 (875M)

- 1.1500 (1.6BLN), 1.1550 (592M), 1.1600 (581M)

- EUR/CHF: 0.9400 (361M) . EUR/GBP: 0.8475 (1.1BLN)

- GBP/USD: 1.3490-1.3500 (377M), 1.3575(250M)

- AUD/USD: 0.6450 (380M), 0.6500 (450M), 0.6550 (200M), 0.6575 (223M)

- USD/CAD: 1.3595-1.3600 (1BLN), 1.3640 (231M), 1.3740 (350M)

- USD/JPY: 142.00 (570M), 143.00 (415M), 143.85 (300M), 144.00 (1.6BLN)

- 145.75-80 (607M), 145.00 (805M)

CFTC Data As Of 6/6/25

- Speculators have increased their net short position in CBOT US Treasury bonds futures by 48,483 contracts, bringing the total to 102,373. They also reduced their net short position in CBOT US Ultrabond Treasury futures by 5,029 contracts, now totaling 228,443. Additionally, there was a decrease of 64,348 contracts in the net short position for CBOT US 10-year Treasury futures, which now stands at 705,256 contracts. On the other hand, the net short position for CBOT US 5-year Treasury futures increased by 63,299 contracts to reach 2,396,536. The net short position for CBOT US 2-year Treasury futures also grew, rising by 24,022 contracts to 1,143,925.

- Equity fund managers have cut their net long position in the S&P 500 CME by 40,048 contracts, resulting in a total of 814,481 contracts. Conversely, equity fund speculators have raised their net short position on the S&P 500 CME by 27,860 contracts, now at 285,326.

- The net long position for the Japanese yen is at 151,149 contracts, while the euro has a net long position of 82,764 contracts, and the British pound holds a net long position of 35,215 contracts. The Swiss franc is currently at a net short position of -26,066 contracts, and Bitcoin has a net short position of -2,312 contracts.

Technical & Trade Views

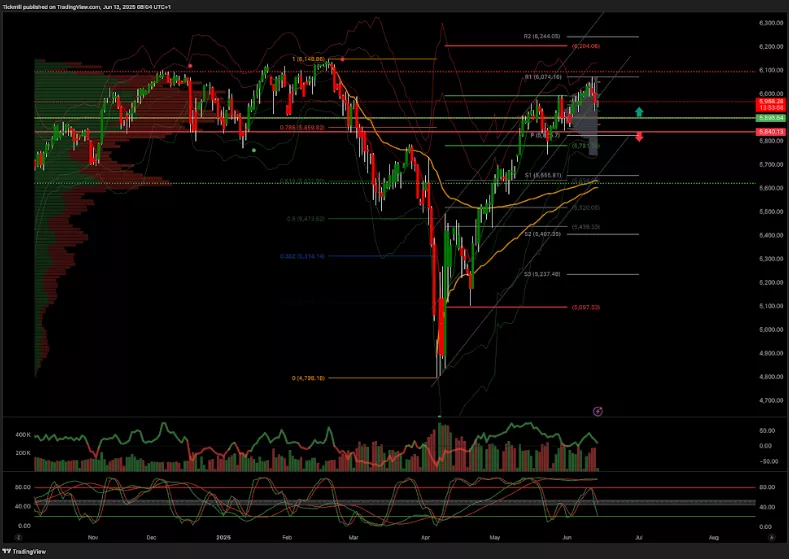

SP500 Pivot 5900

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5900 target 6100

- Below 5800 target 5650

(Click on image to enlarge)

EURUSD Pivot 1.12

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 1.11 target 1.19

- Below 1.11 target 1.0950

(Click on image to enlarge)

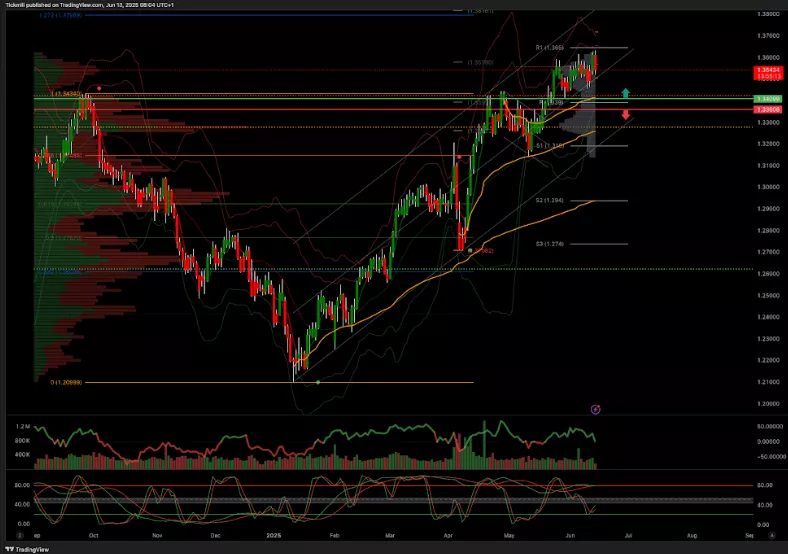

GBPUSD Pivot 1.34

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 1.34 target 1.38

- Below 1.3350 target 1.32

(Click on image to enlarge)

USDJPY Pivot 147

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 147.10 target 148.26

- Below 146.53 target 139

(Click on image to enlarge)

XAUUSD Pivot 3365

- Daily VWAP bullish

- Weekly VWAP bullish

- Above 3410 target 3600

- Below 3240 target 3000

(Click on image to enlarge)

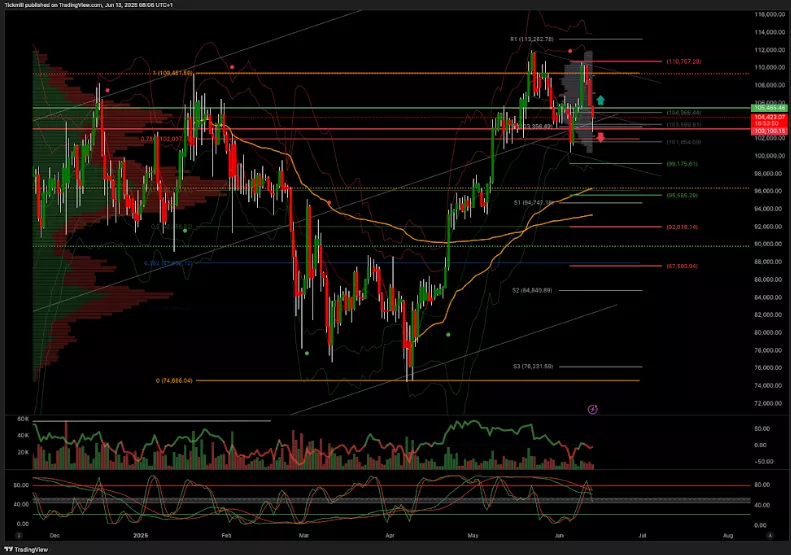

BTCUSD Pivot 105k

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 105k target 118k

- Below 103k target 100k

(Click on image to enlarge)

More By This Author:

The FTSE Finish Line - Thursday, June 6

Daily Market Outlook - Thursday, June 12

The FTSE Finish Line - Wednesday, June 11