Daily Market Outlook - Friday, Feb. 14

Image Source: Pexels

Investors are expressing relief as Donald Trump's proposed reciprocal tariffs signal a potential opening for negotiations. At the same time, luxury brand Hermes is taking center stage, capping off a series of stellar earnings reports across Europe.Asian markets have also shown optimism, buoyed by Wall Street's positive interpretation of U.S. inflation data, which suggests prices are aligning with the Federal Reserve's target range. Chinese tech stocks continued their upward climb, driven by the recent success of homegrown startup DeepSeek. Hong Kong's main index is nearing a four-month high and is on course for its strongest weekly performance since September, marking a five-week winning streak—the longest since 2022. With an impressive 11% gain so far this year, the Hang Seng is emerging as Asia's top-performing major stock market and ranks among the best globally. Meanwhile, Germany's DAX index has surged by 14% this year, hitting a record high on Thursday, further cementing its strong performance.

At the start of the year, rising UK gilt yields were driven by developments in the US market and concerns over fiscal credibility following the UK Budget. These factors raised fears that the significant upcoming gilt issuance could exacerbate the market sell-off. This quarter is projected to see approximately £87bn in gilt issuance, representing 29% of the annual remit and marking the highest quarterly volume for the fiscal year—well above the previous peak of £73bn in Q3. Despite the gilt market's continued sell-off in early January before recovering, the Debt Management Office (DMO) has experienced reasonable and, at times, strong demand for its sales. One way to assess market appetite is by examining the "tail" in conventional gilt auctions—the difference between the average price yield and the lowest accepted yield. So far this quarter, the average tail has remained relatively short for both short- and long-dated gilt auctions. While medium-dated gilt auctions have seen slightly longer tails compared to the other categories, they remain consistent with historical levels observed in previous quarters of this fiscal year. Overall, the market’s appetite has been sufficient to absorb the increased supply, mitigating any significant adverse effects on the secondary market.

Overnight Newswire Updates of Note

- Trump Moves To Impose Reciprocal Tariffs As Soon As April

- PPI Report Points To Softer Fed Inflation Measure Than Feared

- RFK Jr. Confirmed As Donald Trump's Health Secretary

- Trump Prepares To Change US CHIPS Act Conditions, Sources Say

- Number Of UK First-Time Buyers Rose By 20% In 2024

- Apple to Restore TikTok To US App Store Following DoJ Letter

- Arm Secures Meta As First Customer For Ambitious New Chip Project

- Defense Stocks Drop After Trump Says Pentagon Spending Could Be Halved

- HSBC To Unveil $1.5bn Savings As Elhedery’s Restructuring Kicks In

- Trump Says He Won’t Be Meeting Putin in Saudi Arabia Next Week

- Trump Says Russia Should Be Readmitted To G7

- Vance Wields Threat Of Sanctions, Military Action To Push Putin Into Deal

- Netanyahu's Office Denies Reports Of Breakthrough In Ceasefire Crisis

- North Korea May Be Poised To Move ICBMs Into Production, US Says

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- USD/MXN: 20.65 ($343.5m)

- EUR/USD: 1.0500 (EU2.04b), 1.0400 (EU1.7b), 1.0375 (EU1.36b

- USD/JPY: 150.00 ($365m)

- USD/CAD: 1.4375 ($985.2m), 1.4300 ($910.1m), 1.3225 ($440m)

- USD/CNY: 7.3000 ($411m), 7.0500 ($300m)

- GBP/USD: 1.2200 (GBP313.2m)

- EUR/GBP: 0.8330 (EU330.2m)

CFTC Data As Of 7/2/25

- In the latest data release for the week ending on February 4th. The Euro is weighed down by a significant net short position of -58,614 contracts, contrasting with the Japanese Yen's more optimistic stance holding a net long position of 18,768 contracts. The cryptocurrency realm sees Bitcoin riding a wave of positivity with a net long position of 786 contracts. However, the Swiss Franc finds itself in the red with a net short position of -42,258 contracts, while the British Pound struggles with a net short position of -11,323 contracts.

- Equity fund speculators have significantly dialed down their net short position by 69,618 contracts, marking a reassuring dip to 333,211 contracts. Meanwhile, equity fund managers have made a noteworthy adjustment by reducing their net long position by 40,756 contracts, resulting in a total of 920,415 contracts.

- In Treasury futures, speculators have been quite active. The CBOT US 5-year Treasury futures witnessed a notable surge in net short positions, spiking by 151,611 contracts to sit at 1,927,666 contracts. Similarly, the CBOT US 10-year Treasury futures witnessed a modest uptick in net short positions, increasing by 7,061 contracts to stabilize at 707,703. Moving on to the CBOT US 2-year Treasury futures, speculators have boosted net short positions by 17,065 contracts, bringing the total to 1,218,624 contracts. Additionally, the CBOT US Ultrabond Treasury futures show an uptick in net short positions by 2,024 contracts, resting at 243,616.

- A noteworthy shift has occurred in the CBOT US Treasury bonds futures segment, where speculators have transitioned to a net short position of 4,927 contracts. This marks a stark departure from the 28,584 net long positions reported just a week prior, signifying a notable change in market sentiment and positioning.

Technical & Trade Views

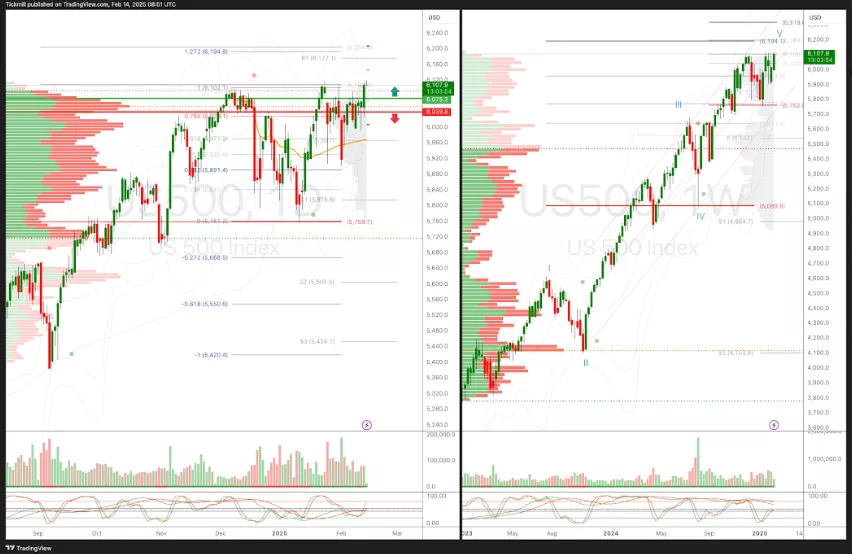

SP500 Pivot 6040

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness Into March 7th

- Long above 6075 target 6195

- Short Below 6045 target 5743

(Click on image to enlarge)

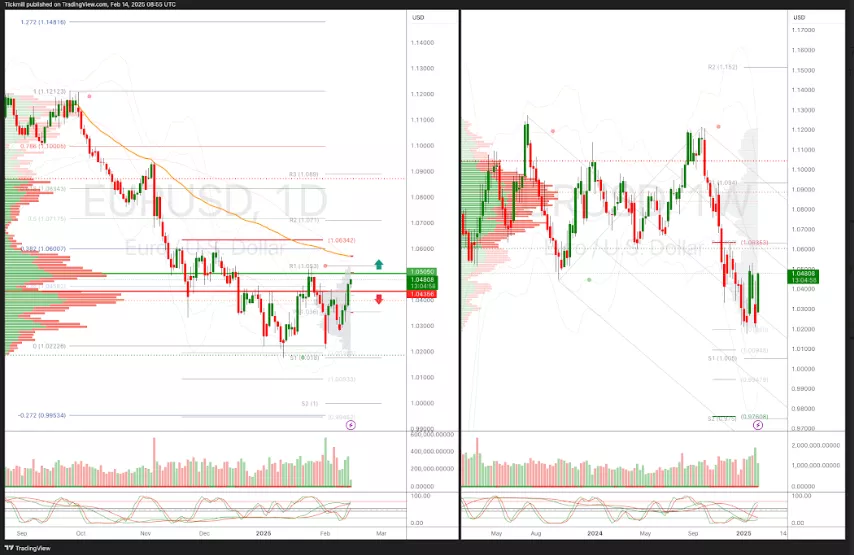

EURUSD Pivot 1.0435

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bearishness into March 30th

- Above 1.0505 target 1.0634

- Below 1.0435 target 0.9758

(Click on image to enlarge)

GBPUSD Pivot 1.2614

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests bearishness into March 10th

- Above 1.2685 target 1.2812

- Below 1.2615 target 1.1878

(Click on image to enlarge)

USDJPY Pivot 153.77

- Daily VWAP bullish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 1.5377 target 165.50

- Below 152.41 target 150

(Click on image to enlarge)

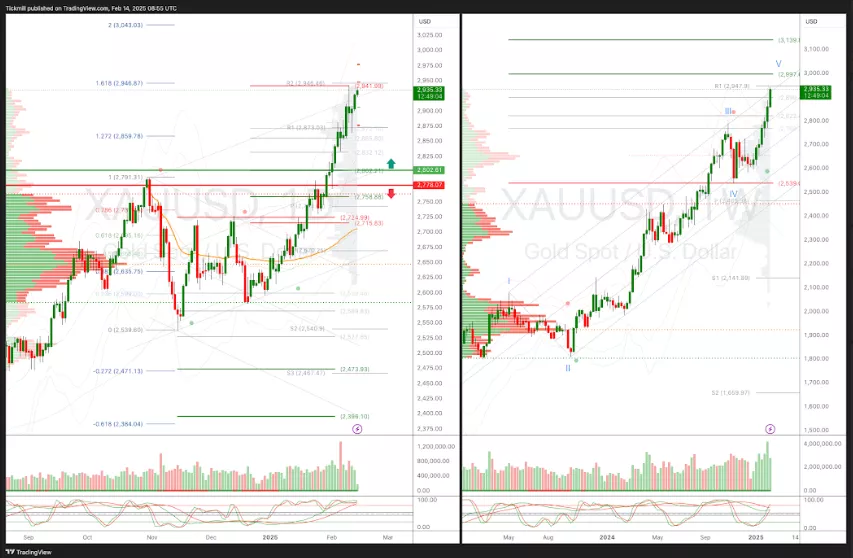

XAUUSD Pivot 2692

- Daily VWAP bullish

- Weekly VWAP bullish

- Seasonality suggests volatile bullishness into Feb 22nd

- Above 2725 target 2997

- Below 2692 target 2475

(Click on image to enlarge)

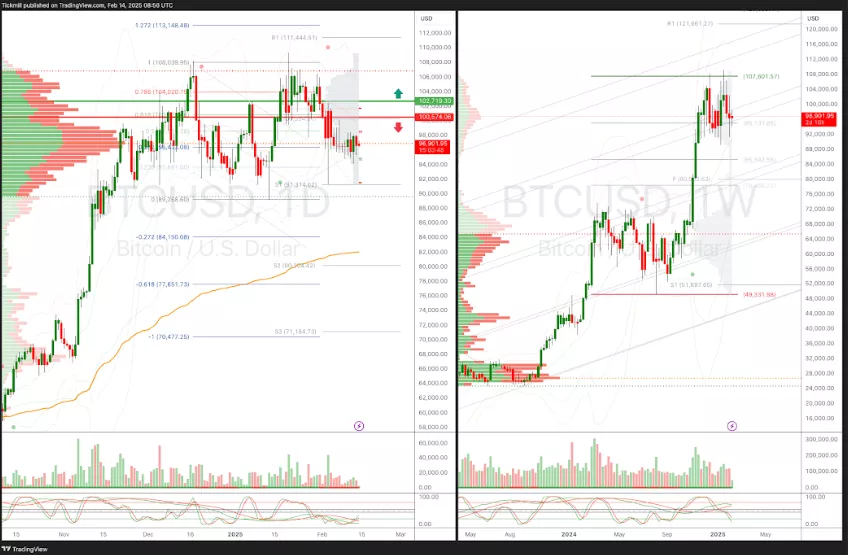

BTCUSD Pivot 101,960

- Daily VWAP bearish

- Weekly VWAP bearish

- Seasonality suggests bullishness into Apr 9th

- Above 104,020 target 110,000

- Below 101,942 target 86,266

(Click on image to enlarge)

More By This Author:

FTSE In The Red As Heavyweight Profit Taking Weighs

Daily Market Outlook - Thursday, Feb. 13

FTSE Gains As Pound Sinks Ahead Of GDP Data