Daily Market Outlook - Friday, Aug. 23

Image Source: Unsplash

The Asian stock markets are primarily trading lower on Friday, consistent with the generally negative signals from Wall Street overnight. The yen strengthened against the dollar after BOJ Governor Kazuo Ueda struck some hawkish notes before lawmakers during a parliamentary hearing. Treasury yields eased slightly, after having climbed overnight for the first time in five sessions. Gold edged up slightly but was poised for a weekly loss.

Traders are holding off on meaningful positioning in anticipation of the Jackson Hole Economic Symposium, which is scheduled to commence later in the day at the Kansas City Fed. Traders believe that the probability of a rate cut next month has already been factored into the markets. Prior to Powell's remarks, the FedWatch Tool of CME Group predicts a 75.5% likelihood of a quarter point rate cut next month and a 24.5 % likelihood of a half point rate cut.

European stocks are opening on a mixed note Friday as investors await Fed Chair Jerome Powell's Jackson Hole speech later in the day for greater clarity on the timing and pace of possible interest rate cuts this year. Speaking to CNBC from the Fed's annual retreat in Jackson Hole, Wyoming, Philadelphia Federal Reserve President Patrick Harker said the Fed should ease "methodically and signal well in advance." Kansas City Fed President Jeffrey Schmid also leaned toward a cut ahead, noting he does not believe monetary policy is "over-restrictive." Boston Fed President Susan Collins said in an interview with Fox Business that inflation has eased "quite a lot", the labor market is healthy, and a gradual, methodical pace (of interest rate cuts) is likely to be appropriate.

Despite the fact that the dovish July FOMC minutes, in which "several" members suggested that the timing was already appropriate to consider a rate cut, and the consensus of all committee members that a reduction in the Fed funds rate would be appropriate in September (assuming the data continued to move in the expected direction), the market will attempt to parse the speech for any clues as to the path of monetary policy over the remainder of this year. Powell's assessment of hazards beyond that point will be crucial. The board's confidence in inflation's return to target is evident; however, the uncertainty lies in the board's assessment of growth risks, which are exacerbated by a decline of labor market data, and the significance Powell places on these factors in light of the Fed's twin mandate. With a quarter-point rate cut is widely expected. Democrats will be pleased to see the Federal Reserve begin its easing cycle before the presidential election in November, regardless of the size of the reduction. Vice President Kamala Harris has just formally accepted her party's nomination on the final day of the Democratic National Convention.

Overnight Newswire Updates of Note

- Dollar Steady Before Powell Speech; Ueda Aims To Calm Nerves

- BoJ Governor’s First Appearance Since Rout Worries Investors

- Asian Shares Cautious With Powell Focus; Yen Up With BoJ

- Japanese Yen Enters New Era of Volatility

- New Zealand Retail Sales Slide Risks Triple-Dip Recession

- UK Consumer Confidence Near 3-Year High In August

- Euro Zone Business Activity Boosted By Olympics, PMI Shows

- Australian Treasurer Offers RBA Deal To Pass Reforms

- AstraZeneca Threatens UK Vaccine Manufacturing Move To US

- Amazon Faces DC Antitrust Lawsuit, Appeals Court Rules

- Tesla Finance VP Departs Amid Executive Turnover

- Oil Set To End Week Lower On Demand Concerns

- EU Naval Mission Rescues Crew From Oil Tanker Blaze

- US Plans $186M Aid Package To Ukraine

- Bitcoin’s Uptrend Threatened By Looming Stochastics Signal

(Sourced from reliable financial news outlets)

FX Options Expiries For 10am New York Cut

(1BLN+ represents larger expiries, more magnetic when trading within daily ATR)

- EUR/USD: 1.0800 (1.3B), 1.0850 (709M), 1.0900 (681M), 1.0915-20 (714M)

- EUR/USD: 1.0990-1.1000 (1.4B), 1.1050 (674M), 1.1070-80 (933M)

- EUR/USD: 1.1100 (1.2B), 1.1140-50 (933M), 1.1190-1.1200 (670M)

- USD/JPY: 146.00 (626M), 146.20-30 (853M)

- GBP/USD: 1.2635 (250M), 1.2950 (421M), 1.3100 (598M). EUR/GBP: 0.8550 (391M)

- EUR/CHF: 0.9535 (342M), 0.9600 (732M), 0.9640-50 (910M)

- EUR/AUD: 166.50 (350M)

- USD/CAD: 1.3450 (518M), 1.3600 (700M), 1.3655 (409M), 1.3690-1.3700 (1.2B)

- USD/CAD: 1.3750-60 (1.2B), 1.3770-75 (740M), 1.3800-05 (1.7B)

CFTC Data As Of 16/8/24

- Japanese Yen net long position is 23,104 contracts

- Euro net long position is 26,983 contracts

- Bitcoin net long position is 395 contracts

- British Pound net long position is 47,812 contracts

- Swiss Franc posts net short position of -21,664 contracts

- Equity fund speculators increase S&P 500 CME net short position by 63,926 contracts to 286,781

- Equity fund managers raise S&P 500 CME net long position by 70,558 contracts to 952,091

Technical & Trade Views

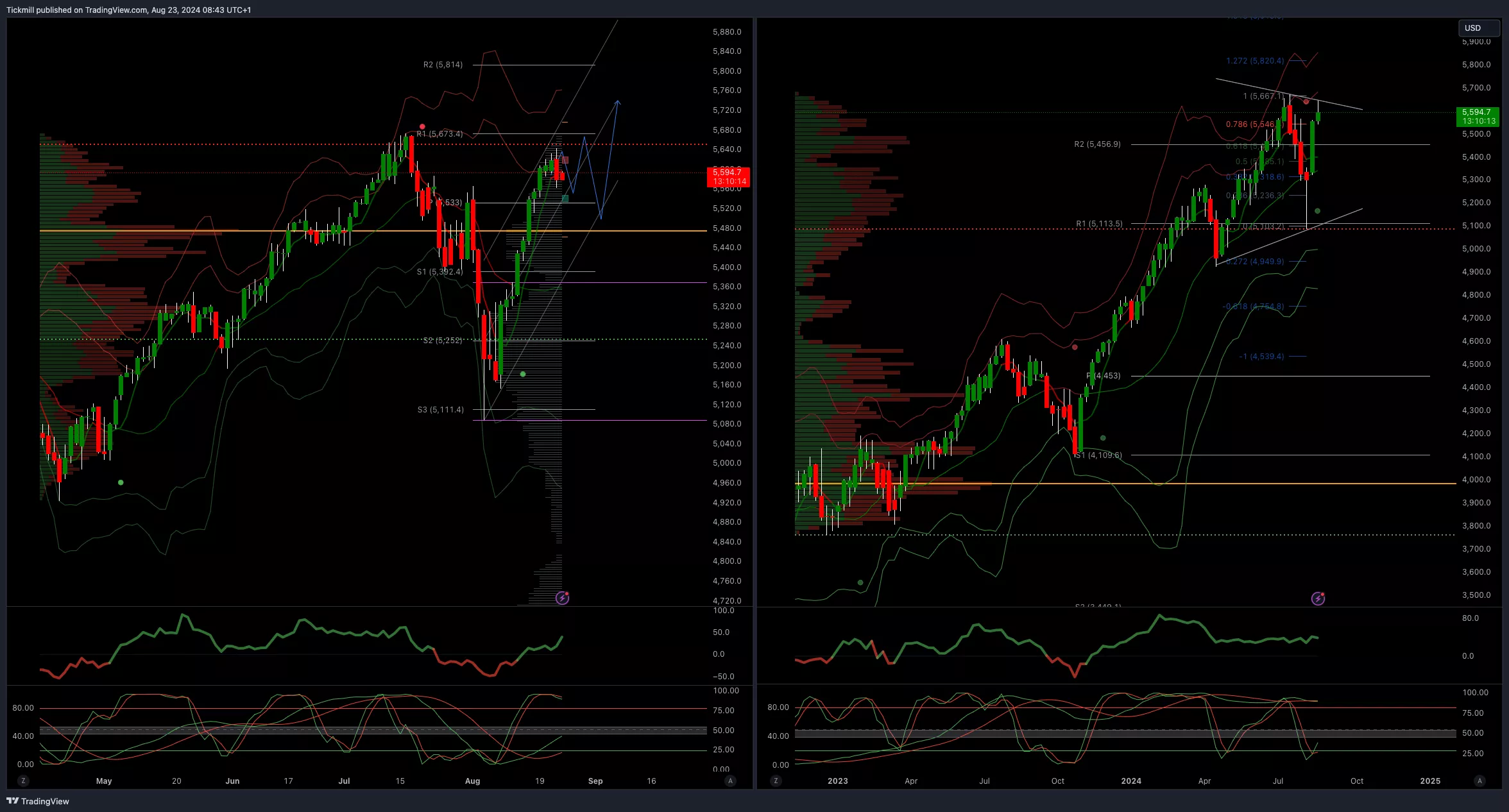

SP500 Bullish Above Bearish Below 5550

- Daily VWAP bearish

- Weekly VWAP bullish

- Above 5470 opens 5670

- Primary support 5480

- Primary objective is 5670

(Click on image to enlarge)

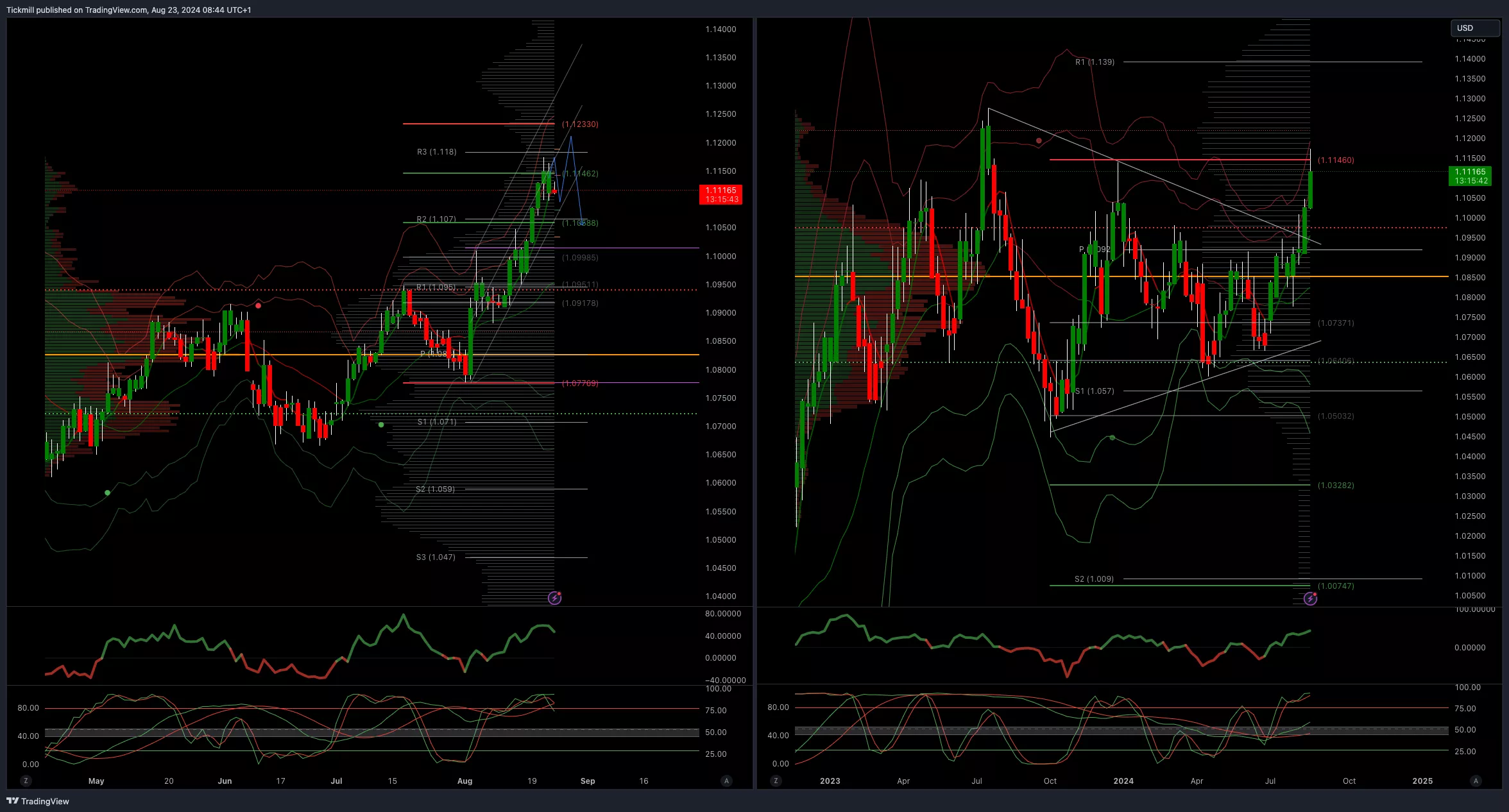

EURUSD Bullish Above Bearish Below 1.10

- Daily VWAP bullish

- Weekly VWAP bullish

- Below 1.10 opens 1.0950

- Primary resistance 1.0981

- Primary objective is 1.1150 - Target Hit New Pattern Emerging

(Click on image to enlarge)

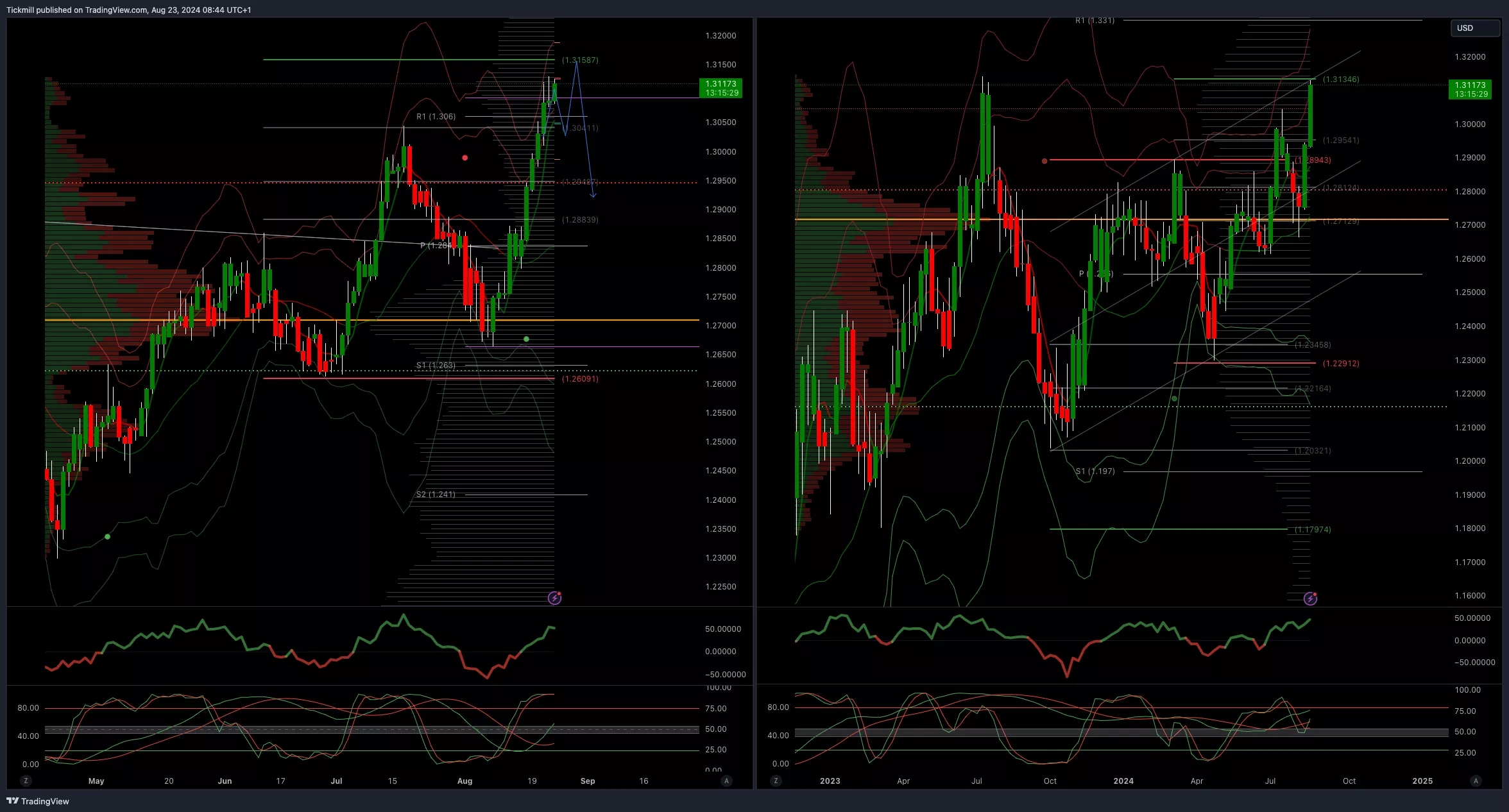

GBPUSD Bullish Above Bearish Below 1.30

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 1.2950 opens 1.2850

- Primary support is 1.2690

- Primary objective 1.3150

(Click on image to enlarge)

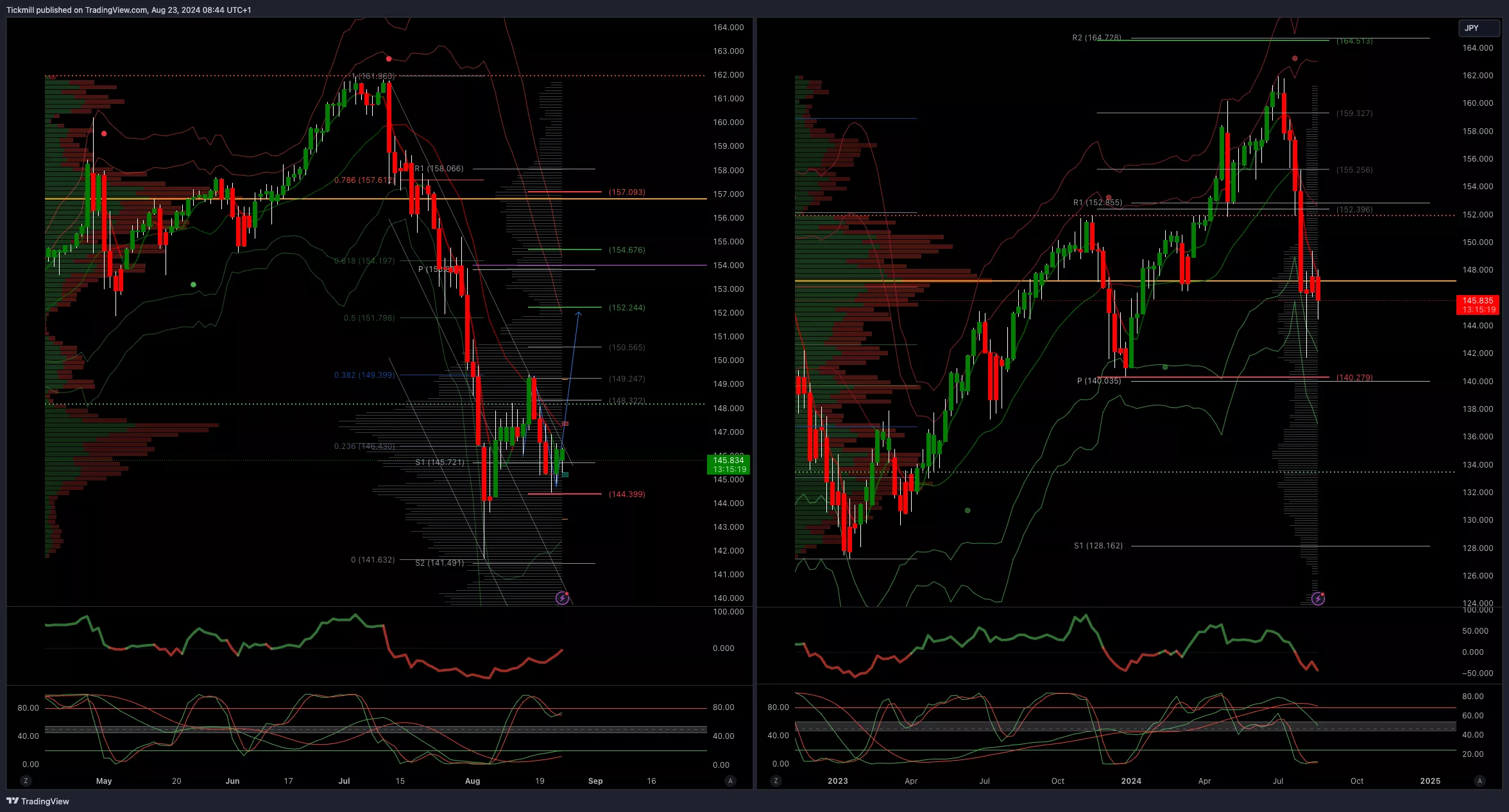

USDJPY Bullish Above Bearish Below 149

- Daily VWAP bullish

- Weekly VWAP bearish

- Below 145 opens 144

- Primary support 140

- Primary objective is 151.80

(Click on image to enlarge)

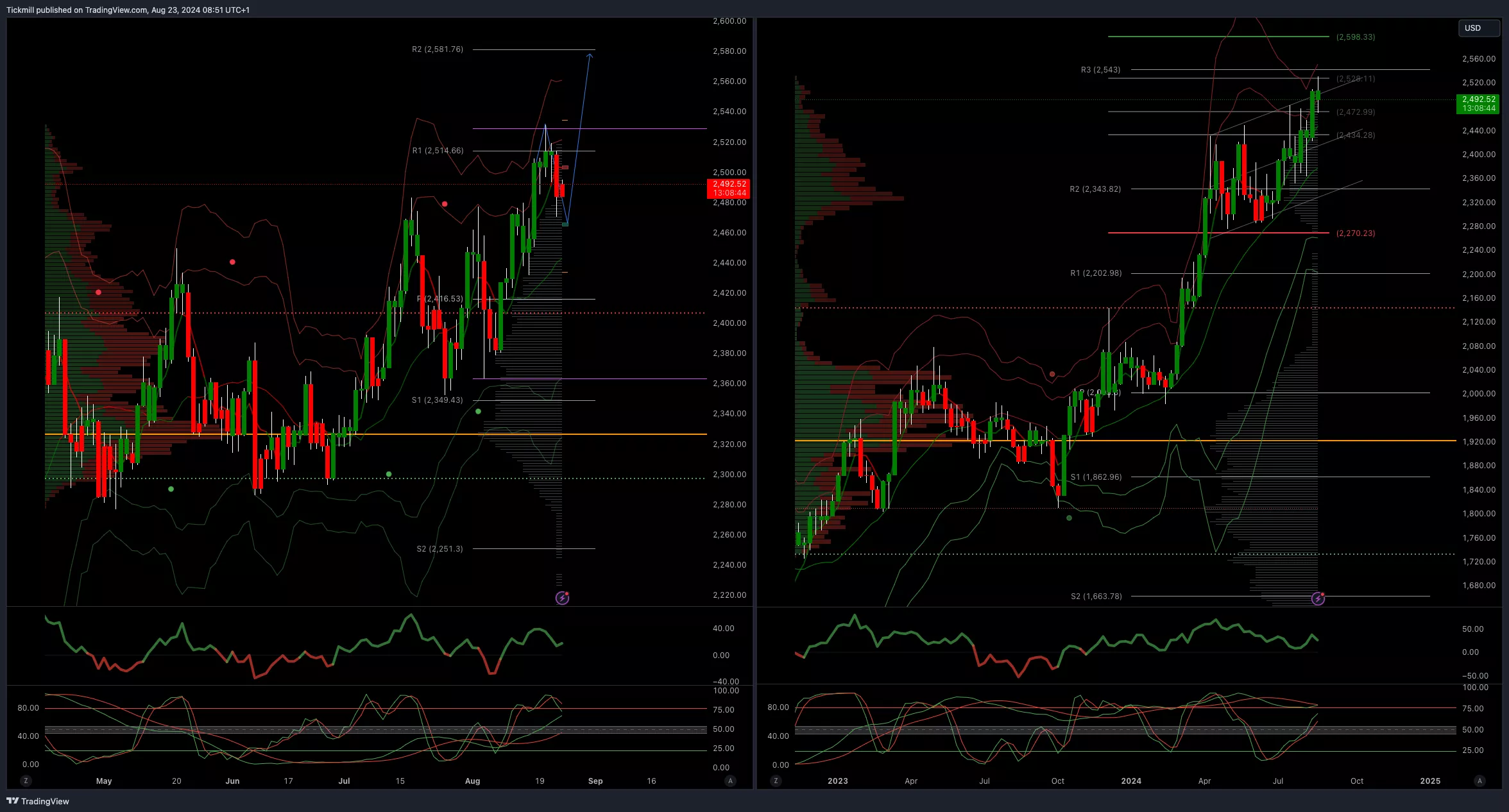

XAUUSD Bullish Above Bearish Below 2480

- Daily VWAP bearish

- Weekly VWAP bullish

- Below 2400 opens 2330

- Primary support 2300

- Primary objective is 2598

(Click on image to enlarge)

BTCUSD Bullish Above Bearish Below 58000

- Daily VWAP bearish

- Weekly VWAP bearish

- Above 61000 opens 68000

- Primary support is 50000

- Primary objective is 70000

(Click on image to enlarge)

More By This Author:

FTSE Flatlining Again, JD Sports Shines In A Slow Summer Tape

Daily Market Outlook - Thursday, Aug. 22

FTSE Flatlining Ahead Of Central Banker Conclave In Jackson Hole