Currency Market Rocked By Rising U.S. Dollar: Stock Market Crash & Financial Crisis Ahead?

Currency Market Fluctuating Wildly Thanks to U.S. Dollar

There’s turmoil in the global currency market, and it could get much worse. This could adversely affect the stock market, commodities, and the financial system—and could even lead to defaults.

Here’s a snapshot of what’s been happening.

Since the Federal Reserve started taking a tough stance against inflation and raising its benchmark interest rate, the U.S. dollar started to get attention and move higher. Since the dollar acts as a gravitational force in the global economy, other currencies started to fall.

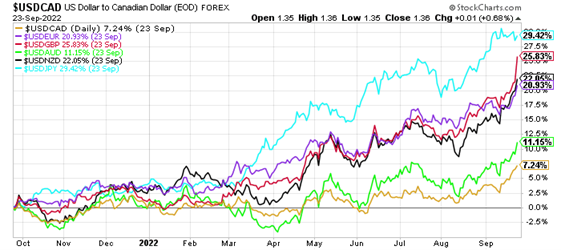

Look at the chart below. It plots the performance of the U.S. dollar compared to other major currencies.

The U.S. dollar has surged by 29.4% against the Japanese yen. Recently, the British pound has collapsed to historic lows; it has gone down by close to 26% against the U.S. dollar. The Australian and New Zealand dollars are both down by more than 20% against the U.S. dollar.

The only two major currencies that aren’t down by much compared to the U.S. dollar are the Canadian dollar and the euro. However, given the headwinds in the eurozone and the Canadian economy, it wouldn’t be surprising to see these two currencies depreciate a bit more.

Chart courtesy of StockCharts.com

The moves in the currency market over the past year haven’t been normal whatsoever. Major currencies tend to be relatively stable; in any given year, a 10% move up or down would be considered huge. So, the recent moves by the yen, the pound, and other currencies shouldn’t be taken lightly.

Most investors don’t have to think much about the currency market on a regular basis, mainly because—the vast majority of the time—currencies aren’t very volatile. But now investors really have to consider what’s happening with currencies.

Profits Could Tumble; Financial System Could Get Stressed

Problems in the currency market could create problems for companies that are traded on the stock market, specifically the ones with global operations. If the companies report in U.S. dollars, wild moves in the currency market could drag their revenues and earnings down, even if their business is growing. This will hurt their stock prices.

Roughly 40% of the sales by S&P 500 companies are derived outside of the U.S., so roughly 40% of their sales could be affected by wild moves in the currency market.

Companies’ financial performance is just one piece of a giant puzzle when it comes to wild moves by currencies. The global financial system can also be significantly affected.

If you had asked strategists, economists, and analysts a year ago about where they thought the value of the yen, the pound, and the euro would be now, the vast majority of them wouldn’t have seen the recent moves coming.

That said, at the end of the second quarter of this year, U.S. banks had derivatives backed by foreign exchange rates with a notional value of close to $42.0 trillion and various maturity dates. (Source: “Quarterly Report on Bank Trading and Derivatives Activities: Second Quarter 2022,” Office of the Comptroller of the Currency, last accessed September 28, 2022.)

When it comes to derivatives, there are two parties involved in a transaction. With wild currency fluctuations, it’s possible that some parties will be on the wrong side of trades. If no one predicted the currency moves we are seeing now, it’s very likely that some banks will be on the wrong side of trades.

Since $42.0 trillion is such a big amount, a small number of derivatives going in the wrong direction could create havoc in the financial system and ultimately have impacts on all sorts of financial markets, be it debt, stock, or commodity.

Those Who Own Debt in Dollars Could Be Hurt

Countries and companies around the world issue debts in U.S. dollars. Since the dollar is a reserve currency, it’s easier to attract investors’ attention when debt is issued in U.S. dollars.

A rising dollar could create many problems for companies and countries that have issued dollar-denominated debt. All of a sudden, they’ll owe more than they did a year ago (depending on where they’re located). For countries, it increases the odds of debt defaults. For companies, it hurts their bottom line and increases the odds of defaults if business isn’t good.

Dear reader, the turmoil in the currency market is probably one of the most underreported stories in the mainstream financial press. But it doesn’t mean investors shouldn’t care. The currency market could increase risks for investment portfolios, so don’t get complacent.

More By This Author:

Is Stock Market at Bottom Already? No, It Could Keep Falling

Inflation, The Federal Reserve, Misconceptions, Problems, & A Brewing Crisis

Black Swan Event - Like Activity In Interest Rate Market: Crisis Brewing?

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more