Black Swan Event - Like Activity In Interest Rate Market: Crisis Brewing?

Interest Rates Soar; Odds of Economic Crisis Increase

Now more than ever, it’s important that investors pay attention to what’s happening in the interest rate market. There are seismic events happening, and they could create a significant amount of volatility in the financial markets, if not an outright financial and retirement crisis.

Here’s a little background.

If you asked any mainstream economist or stock picker back in 2020 about where interest rates would be in 2022, it’s very likely they would have said interest rates would remain low for a long time. The economic situation at the time warranted low-interest rates and an easy monetary policy.

Here’s the thing: it wasn’t just the economists and stock pickers who thought interest rates would remain low for a long time. The Federal Reserve also touted this idea. Even in 2021, as inflation started to creep higher, the Fed remained persistent with its idea that interest rates would remain low for a long time.

Fast-forward to 2021. The bond market began to disagree with the narrative that interest rates would remain low for a long time. The yields on bonds started to spike higher, essentially saying that investors expected interest rates to go higher.

This Hasn’t Happened in Bond Market in at Least 40 Years

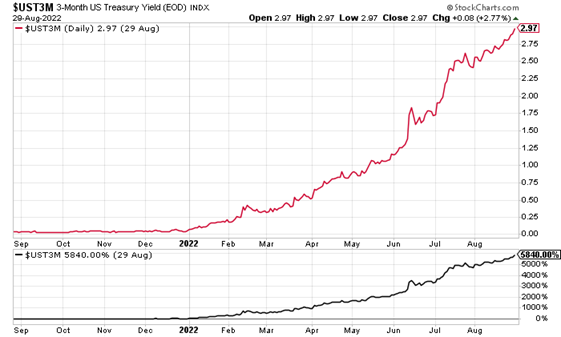

Over the past year, there has been significant damage in the bond market, specifically in the short-term interest rate market. For some perspective, look at the below chart; it plots the yields on three-month U.S. Treasury bonds, also called “T-bills.”

Over the past year, the yield on three-month U.S. Treasury bonds has increased by 5,840%. This isn’t a misprint. Mind you, the vast majority of this increase has happened since the beginning of this year. Year-to-date, the yield on three-month U.S. Treasury bonds has increased by 4,850%. Again, this is not a misprint.

(Click on image to enlarge)

Chart courtesy of StockCharts.com

One could certainly argue that this happened because the Federal Reserve started to increase its benchmark interest rates. Surely, that’s one reason why the yield on three-month U.S. Treasury bonds soared. What’s vital to note is that the increase happened in such a short period.

Over the past 40 years, we haven’t seen anything like this. Yes, the yield on three-month U.S. Treasury bonds has been higher, but the recent percentage change and the speed of the increase are unprecedented. One has to wonder whether this is a sort of black swan event.

Furthermore, if you look at other shorter-term bonds, you’ll see that their yields have surged by a lot as well. Regardless, the three-month Treasury bond is something really worth highlighting.

Financial & Retirement Crises Are Brewing

Why bother looking into all this?

The financial system has become extremely complex over the years. Businesses and financial institutions try to protect themselves from interest rate shocks by buying derivatives. The idea behind derivatives is that they can bring some stability to revenues, generate higher incomes, and so on.

But don’t forget: the current moves in the interest rate market weren’t foreseen by many. One could even argue whether they were anticipated by the Federal Reserve. So, this opens up room for mistakes.

As of the first quarter of 2022, U.S. banks had derivatives with a notional worth of $145.9 trillion. (Source here, Office of the Comptroller of the Currency, last accessed August 30, 2022.)

You also shouldn’t forget that derivatives involve two parties. With this, could there be financial institutions and businesses on the wrong side of interest rates? Even if we assume just five percent of interest rate derivatives are in trouble, it’s still an immense amount of money.

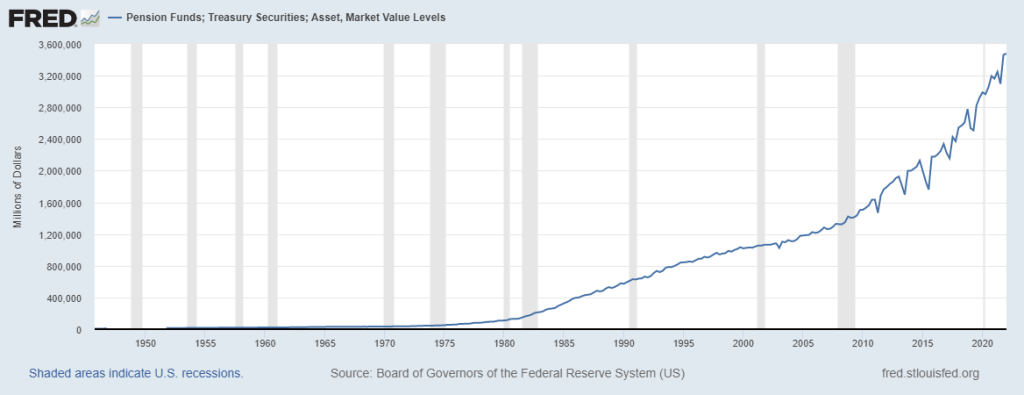

While that’s one aspect, what’s happening in the interest rate market could also have a negative impact on the retirements of many Americans. Consider pension funds; they hold many bonds. Why? Bonds bring consistency and safety to investment portfolios, compared to other types of assets, including stocks.

Look at the chart below; it plots the market value of U.S. Treasury bonds held by pension funds.

(Click on image to enlarge)

(Source here, Federal Reserve Bank of St. Louis, last accessed August 30, 2022.)

Here’s How This Could Turn Into a Retirement Crisis

Pension funds held close to $3.5 trillion worth of U.S. Treasury bonds at the end of the first quarter of 2022. Over the past few months, the prices of U.S. bonds have come down. So, all of a sudden, pension funds could have much lower asset values than they had at the beginning of the year. Plus, the bonds they bought earlier paid almost nothing. This could lead them to adjust their portfolios.

If pension funds panic-sell, they’ll take losses, and this will have direct impacts on the retirements of Americans.

The next few quarters are going to be critical. Investors need to be careful and watch their portfolios closely. Significant losses could be around the corner. Moreover, if there’s a panic in the bond market, it will hit the stock market very quickly.

More By This Author:

Catalyst For $3,000/Ounce Gold Price: Central Banks Buying Gold5 Charts Investors Must Watch: Trouble Brewing In Global Economy

U.S. Dollar Soars: Things Won’t End Well If It Continues To Move Higher

Disclaimer: There is no magic formula to getting rich. Success in investment vehicles with the best prospects for price appreciation can only be achieved through proper and rigorous research and ...

more