Check On The Daily Currency Charts Post Holiday

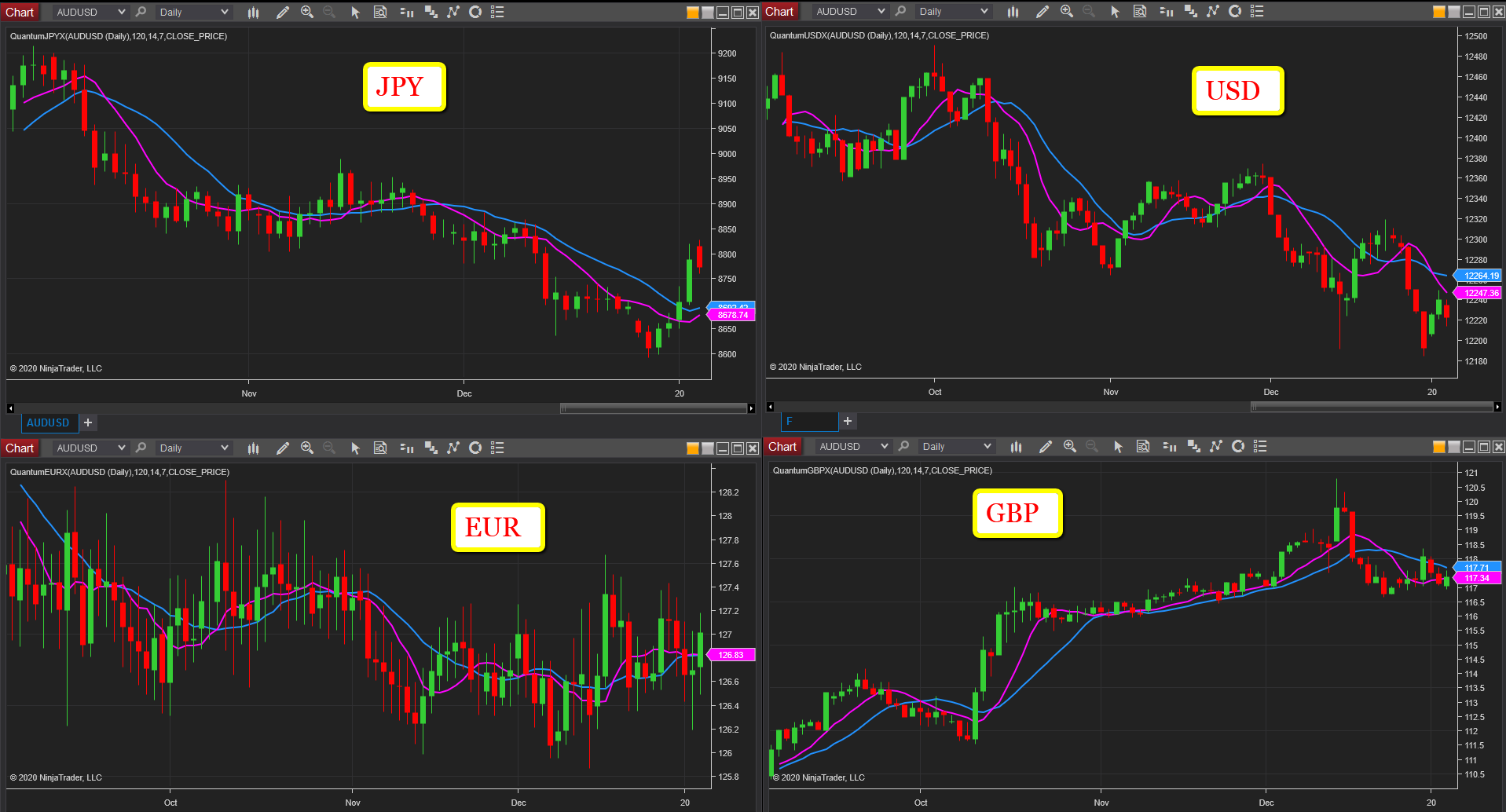

And finally, to start the new year, time to check on the daily charts for the four key currencies of the Japanese yen, the US dollar the euro and the British pound.

Starting with the Japanese yen, the longer term trend has been one of weakness, with the yen selling on risk on sentiment expressed in equity markets. However, as tensions in the Middle East increase, yen buying has been much in evidence across the complex and from a technical perspective, a now have a rally which is running into resistance in the 8820 area. Whether this rally extends further is likely to depend on whether there is an escalation in the Middle East and equity markets weaken in the next few days. But should this not be the case, we can expect to see a resumption of broadly risk on sentiment with a consequent selling of the currency.

For the US dollar, and much the same as for the yen, the longer term sentiment has been bearish, as each attempt to rally is short lived before the trend lower is established once more. Also much like the yen, in the last few days, there has been a flight to safe haven with consequent flows to the currency of first reserve, but in a more muted way and given the technical congestion overhead, this is likely to continue to pressure the US dollar lower.

Moving to the single currency, the sentiment here is evenly weighted between Brexit and the German economy which continues to look fragile.And with no major catalysts ahead, expect to see the euro congest further on the daily chart.

Finally, we come to the British pound which is now settling to a pattern of price action post election and resolution to the Brexit uncertainty, bar the shouting. The spike to 120.80 on election night has now been reversed with the currency settling in the 117 to 118 range as the start of a‘new day’ of life outside the EU dawns. Longer term expect to see the currency rally during the year and move firmly through the 121 area as trade agreements are made and the risk of the ‘sky falling’ recedes.

Disclaimer: Futures, stocks, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in ...

more