Charted: How Major Currencies Did In 2023

(Click on image to enlarge)

The U.S. Dollar Index peaked in fall 2022, the highest it had been in nearly two decades, rising in response to aggressive interest rate hikes.

The index measures the value of the U.S. dollar against a basket of major currencies from six countries. A gain indicates the dollar is appreciating against the basket and vice-versa. The euro is the biggest component on the index and thus sways the index value and return.

In 2023, the U.S. Dollar Index declined off its highs while still maintaining a fairly elevated level as interest rates have stayed steady.

But how have other major currencies fared against the dollar?

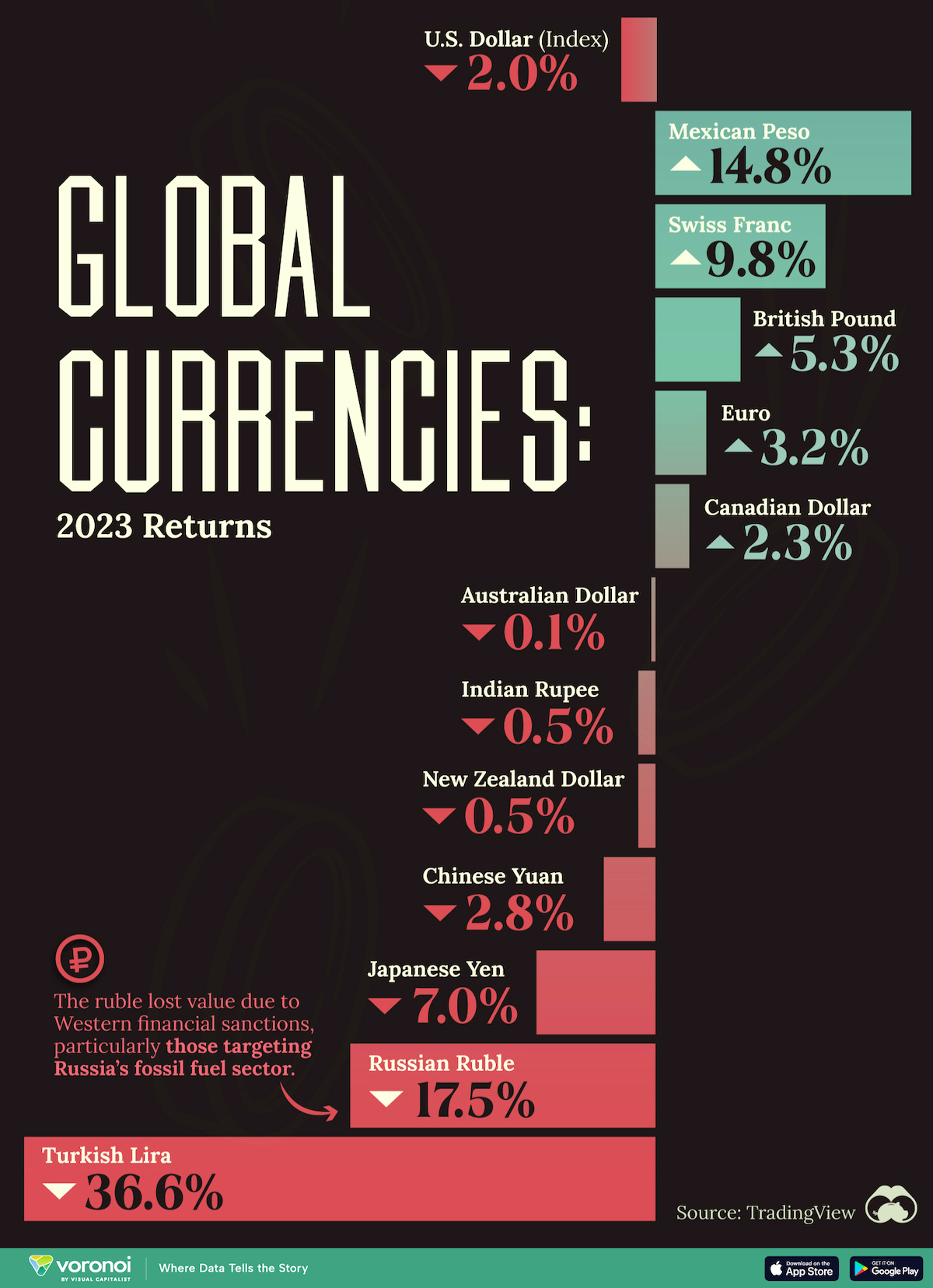

We visualize the returns of 12 currencies against the U.S. dollar, using data from TradingView.

Ranked: Best and Worst Performing Currencies in 2023?

By far, the best performing major currency of 2023 was the Mexican peso, which appreciated nearly 15% against the dollar.

The peso appreciated significantly thanks to aggressive interest rate hikes by its central bank (currently at 11.25%) which pulls money into the country as investors chase better returns.

However, the peso’s continued appreciation could negatively impact the competitiveness of Mexico’s exports. In tandem, Asian imports to the country become cheaper which can hurt the country’s domestic industrial sector.

Here’s how other major currencies performed in 2023.

From across the Atlantic, the Swiss franc, British pound, and euro all gained as well.

Meanwhile, the Japanese yen, while down 7% for 2023 has a much stronger outlook for 2024, with the Bank of Japan likely to raise rates to curb inflation, strengthening the currency.

At the bottom of the list, the Russian ruble and Turkish lira lost nearly one-fifth, and one-third of their value against the dollar, respectively.

The lira has been declining steadily for over a decade now (down 94%) as the country has witnessed several political upheavals that have shaken the economy as well as investor sentiment.

Meanwhile Russia’s economy relies heavily on fossil fuel exports, a sector hit hard by Western sanctions. With fewer buyers for its oil and gas, export revenue has declined, reducing the country’s trade surplus.

More By This Author:

Visualizing 150 Years Of S&P 500 Returns

The Best And Worst Performing Sectors In 2023

50 Years of Video Game Industry Revenues, By Platform

Disclosure: None