The Best And Worst Performing Sectors In 2023

(Click on image to enlarge)

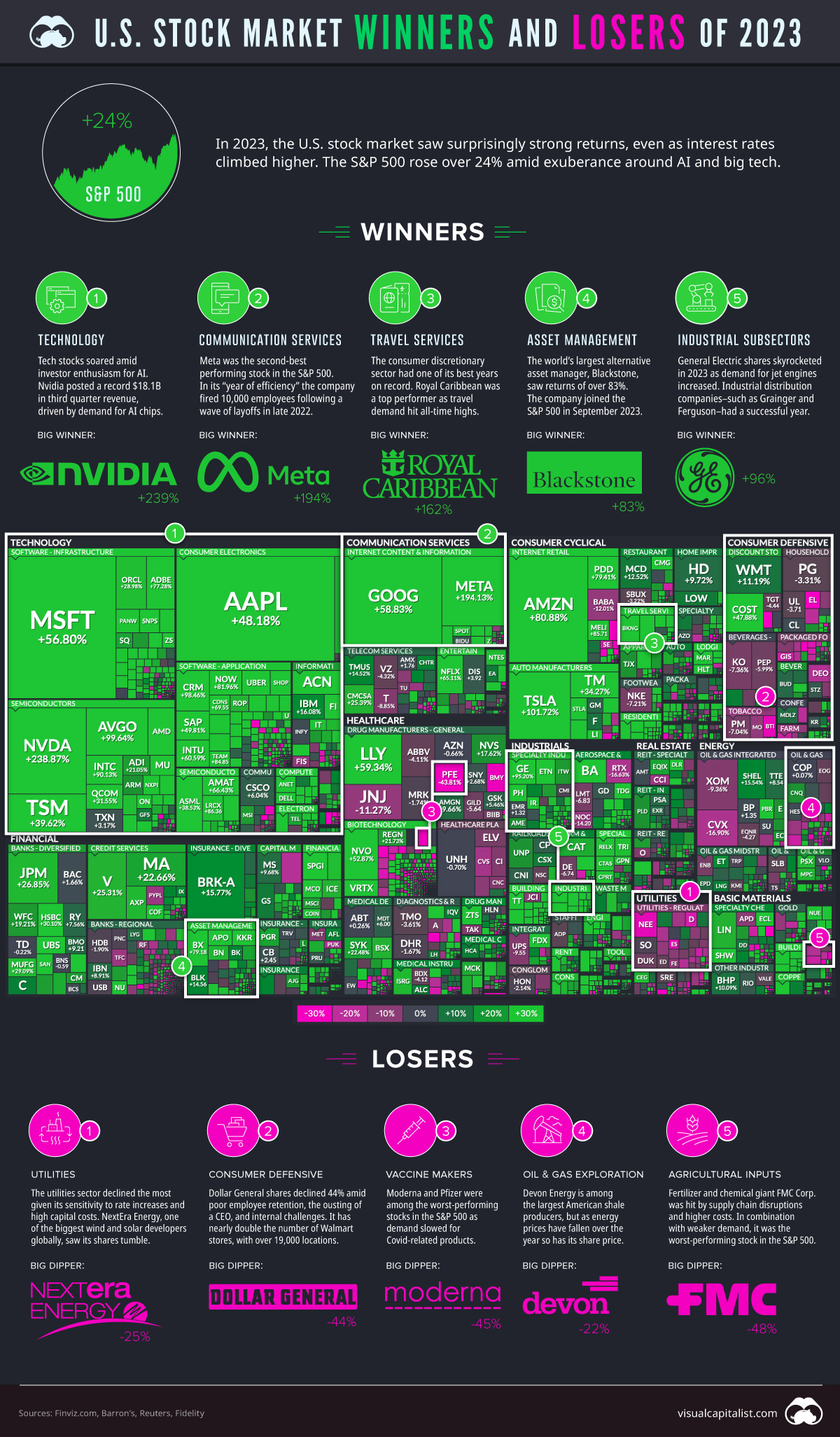

In 2023, the U.S. stock market saw surprisingly strong returns, even as interest rates climbed higher.

The S&P 500 rose over 24% amid exuberance around AI stocks and big tech, lifting returns across the index. Traditionally defensive stocks, on the other hand, declined. Overall the stock market recovered losses from 2022’s plunge, and is now hovering near all-time highs.

The above graphic is an augmented version of the Finviz treemap, showing the best and worst sectors in 2023.

2023 Winners

Several sectors were in the green this year amid solid consumer spending and steady economic growth. Below, we’ll look at some of the strongest performers:

Technology

In a breakthrough year, the promise of AI’s potential catapulted the tech sector to 56% returns.

Chipmaker Nvidia skyrocketed 239% as demand for AI chips accelerated. Apple and Microsoft each had banner years after a dismal 2022. Overall, big tech stocks were responsible for a large share of the S&P 500’s gains.

In fact, the “Magnificent Seven”—made up of Nvidia, Apple, Microsoft, Alphabet, Amazon, Tesla, and Meta—drove an estimated 75% of the market’s returns and together, they cover about 30% of its total value.

Communication Services

As the second-best sector, communication services rallied 54% in 2023. From media and internet companies to telecom and broadband service providers, the sector covers a diverse range of companies—many that may stand to benefit from generative AI.

With 194% gains, Meta was a top performer as advertising revenue improved. At the same time, Netflix (+65%), Alphabet (+59%), and video game publisher Take-Two Interactive (+55%) each saw strong momentum.

Consumer Cyclical/Discretionary

In one of the best years on record, the S&P 500 consumer discretionary sector witnessed over 41% returns. Amazon, Home Depot, and Tesla fall within this sector and each saw at least double-digit returns supported by solid retail sales. Tesla is projected to see record deliveries in 2023.

Cruise-line operator Royal Caribbean was a leading company, with over 162% returns for the year. Record travel demand drove strong performance across both Royal Caribbean and Carnival.

2023 Losers

Unlike cyclical and growth-oriented sectors, defensives did not fare as well. Here are some of the poorest performers of 2023:

Utilities

With -10% returns, utilities declined the most as high interest rates weighed on borrowing costs in the capital-intensive sector.

Not only that, utilities became less attractive as 10-year Treasury yields were higher than utilities dividend yields in 2023—a first in over a decade. In this way, investors looking for income shifted away from the sector.

The good news for utilities is that interest rates are projected to fall over the next several years, according to IMF projections.

Energy

Oil prices declined 10% in 2023, and the sector also ended in the red. Despite OPEC+ production cuts aimed to boost prices, key benchmarks sank 20% from their annual peak.

Devon Energy, one of the largest American shale producers declined 22% and Chevron dropped 14% as oil production and refinery operations missed targets.

Consumer Staples/Defensive

While the consumer staples outperformed in 2022, investors had a different view on it this year. This led to a mixed bag of returns in the sector.

Known for companies that make everyday items, consumer staples covers Coca-Cola, Procter & Gamble, and Walmart. Within the sector, packaged food faced some of the worst declines amid competition from lower-priced products as consumers looked to more affordable options.

What’s Next for 2024?

Whether or not mega cap growth stocks will continue to power the U.S. stock market is anyone’s guess.

While economic signals appear steady, it may be some time yet until interest rates fall to 2%. A second burst of inflation may also resurface if geopolitical tensions get worse. How this all impacts U.S. stock market returns may continue to upend expectations in the post-pandemic era.

More By This Author:

50 Years of Video Game Industry Revenues, By Platform

Charted: Tesla’s Global Sales By Model And Year (2016–2023)

Mapped: How Much Of The World Is Covered By Croplands?

Disclosure: None