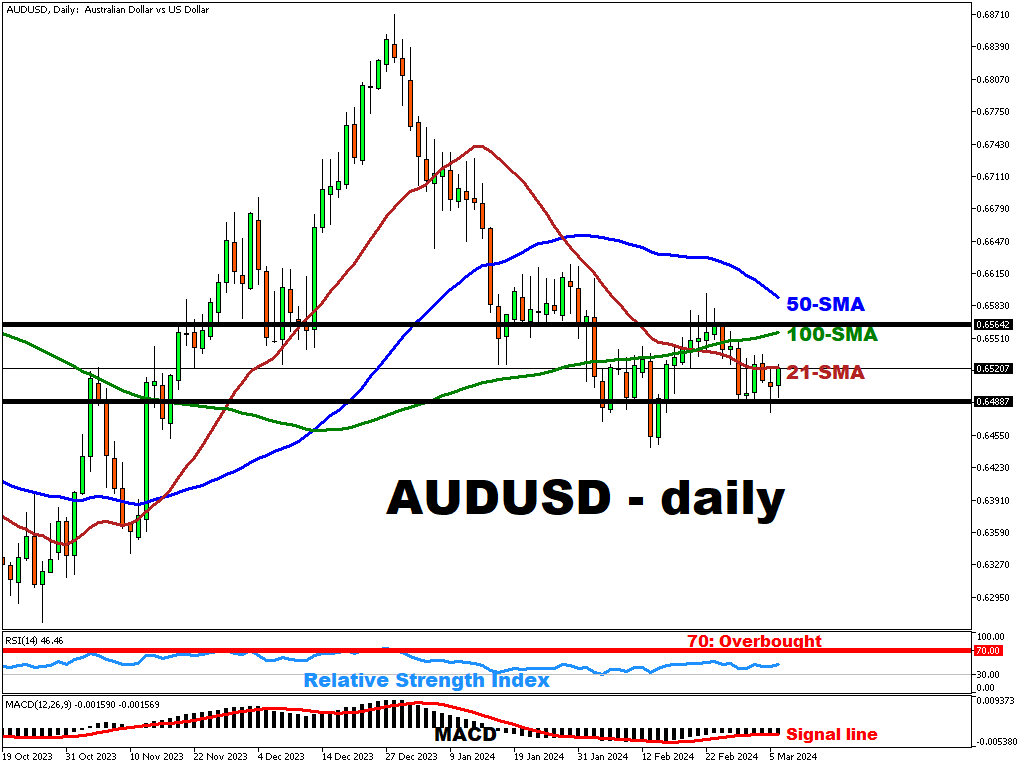

AUDUSD To Close Above 21-Period SMA?

AUDUSD is currently trading below all three key simple moving averages (21, 50 & 100-period SMAs), indicating a potential downtrend.

The relative strength index (RSI) is at 46.48, underscores the markets state of uncertainty as investors await for more catalysts (RSI > 70 – oversold; RSI <30 – overbought).

Moving average convergence/divergence (MACD) is in the negative territory at -0.001590 as well as it’s the signal line (-0.001569), confirming a bearish trend.

Overall, the technicals point towards a potential continuation of the downtrend.

To the upside, the major resistance/target levels are located at 21-period SMA at ~0.652187 (i.e. immediate support) and 100-period SMA at ~0.655684.

To the downside, the potential resistance level is at ~0.648870.

More By This Author:

Bitcoin Near $70,000

Brent Reaches Week's High (~$83/bbl) Amid Neutral US PCE Reading

S&P 500: New All-Time Highs Ahead?

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more