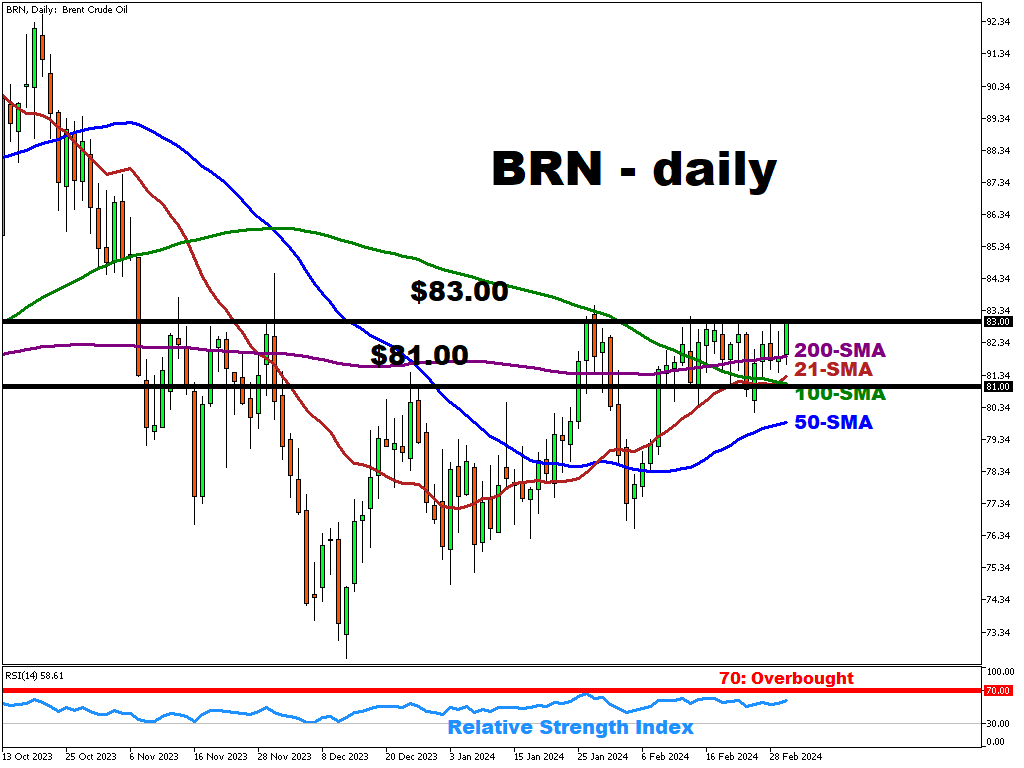

Brent Reaches Week's High (~$83/bbl) Amid Neutral US PCE Reading

Brent crude briefly dipped below its 200-period Simple Moving Average (SMA) of $81.913/bbl on Thursday, March 29th, before rebounding to $83/bbl per barrel following the release of the US Personal Consumption Expenditures (PCE) data.

Despite the PCE data being considered neutral, the market reacted positively, pushing oil prices towards the week’s high.

On the supply side

The upcoming OPEC+ meeting in March is a significant event to watch.

If the group decides to extend its current voluntary production cuts, it could lead to higher Brent prices due to tighter supply in the market.

Conversely, if they decide to abandon the cuts, it could lead to lower prices due to increased supply.

Any sudden developments in geopolitical tensions, particularly in the Middle East, have the potential to disrupt the global oil supply chain and significantly impact oil prices.

On the demand side

The higher-than-expected US crude oil stockpiles reading of 8.4 million barrels (vs forecast – 7.2 million) on February 28th might be interpreted as a sign of weaker demand.

If confirmed further, it could extend downward pressure on oil prices.

The ongoing economic uncertainties in China, impacting its construction and automobile sectors, could lead to lower demand for oil and potentially lower prices.

More By This Author:

S&P 500: New All-Time Highs Ahead?

AUDUSD Slid Below 21-Period SMA

Bitcoin Touches Above $57000

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more