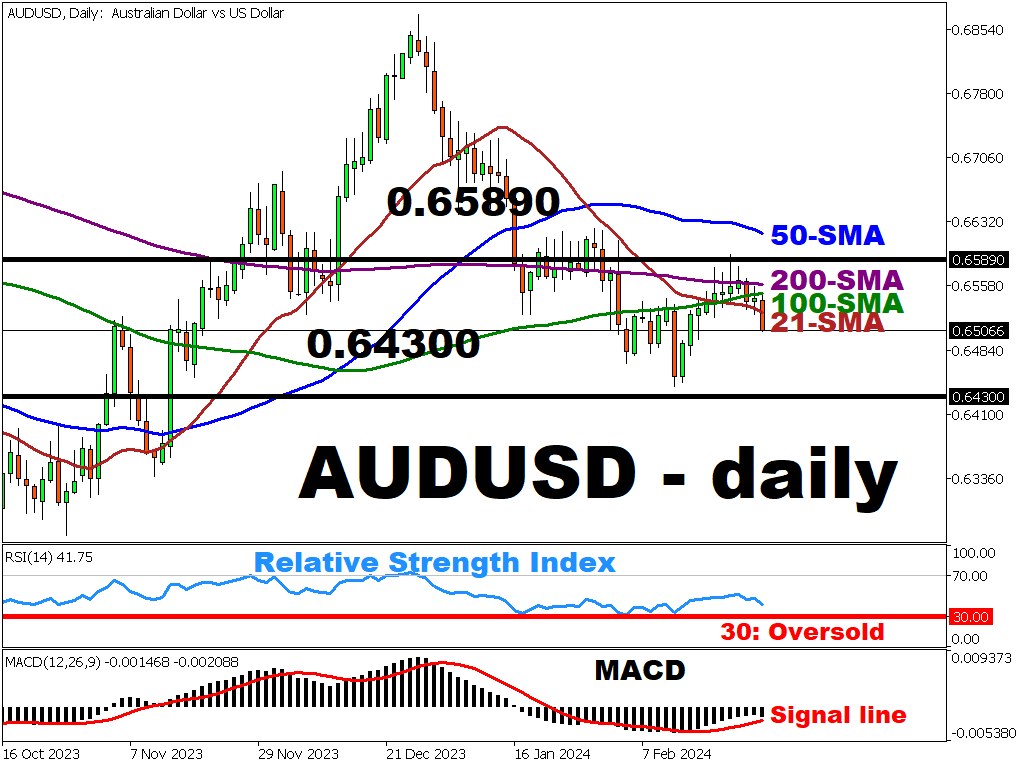

AUDUSD Slid Below 21-Period SMA

The price action is currently consolidated close to short-term and long-term moving averages while the RSI and MACD do not provide strong directional signals.

All four key moving averages (21, 50, 100, and 200-period SMAs) are clustered together, indicating a neutral trend.

The price is currently trading between the short-term (21-period at ~0.652748) and long-term (200-period at ~0.655978) SMAs, further reinforcing the neutral trend.

- To the upside, the potential resistance level is sitting at 100-period SMA (~0.654941), followed by 200-period SMA (~0.655978)

- To the downside the ~0.64859 level could offer support if the selling AUDUSD pressure persists

The RSI is at 42.17, which is considered neutral territory (<30 – oversold, >70 – overbought). This underscores the market’s current state of uncertainty as investors await for more catalysts.

The MACD line (-0.001443) is slightly above the signal line (-0.002085), indicating a weak bullish signal. However, the difference is minor, suggesting a lack of strong momentum.

According to Bloomberg’s FX forecast model, there’s a 73% chance that AUDUSD will trade within the 0.6430 – 0.6589 range over the next 7 days.

Investors are now looking forward to the US PCE inflation reading and AU housing credit & retail sales numbers due Thursday.

- An uptick in the US’ inflation reading may translate in to AUDUSD moving lower

- However, lower-than expected US PCE may contribute to sooner rate cuts which could potentially extend support to the AUDUSD

More By This Author:

Bitcoin Touches Above $57000XAUUSD Bulls Struggle Below 21-Period SMA

USDJPY Consolidates At 150 Psychological Level

Disclaimer: Forecasts which are made in the review constitute the personal view of the author. Commentaries made do not constitute trade recommendations or guidance for working on financial ...

more