AUD/USD Forecast: Can Aussie Get Up Above 0.70 After Retail Sales Miss?

Australian Dollar Fundamental Backdrop

The Australian dollar latched on to higher commodity prices in early trading with major export prices pushing higher after yesterday’s Federal Reserve interest rate decision. The 75bps hike was largely dismissed by markets as focus shifted to Fed Chair Jerome Powell and his comments around a more cautious and data-centric approach resulting in a pullback in U.S. Treasury yields leaving the U.S. dollar weaker across the board.

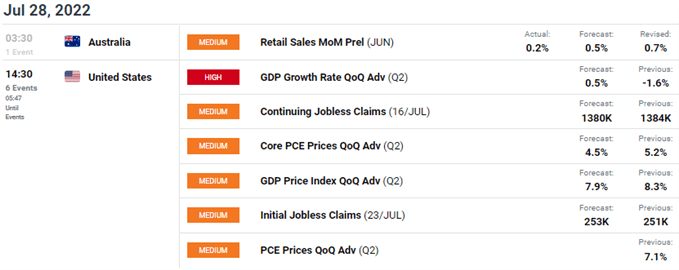

The commodities complex this morning has really dominated the landscape for AUD bulls particularly after a poor showing on the retail sales front (see economic calendar below) which hit fresh lows for 2022. The highlight for today comes from U.S. GDP which may confirm a technical recession should the actual print fall below zero and the 1Q2022 figure is not revised higher. Initial jobless claims data is forecasted to come in higher than the previous week and could heighten recessionary fears should this trend continue.

Economic Calendar

Source: DailyFX economic calendar

AUD/USD Technical Analysis

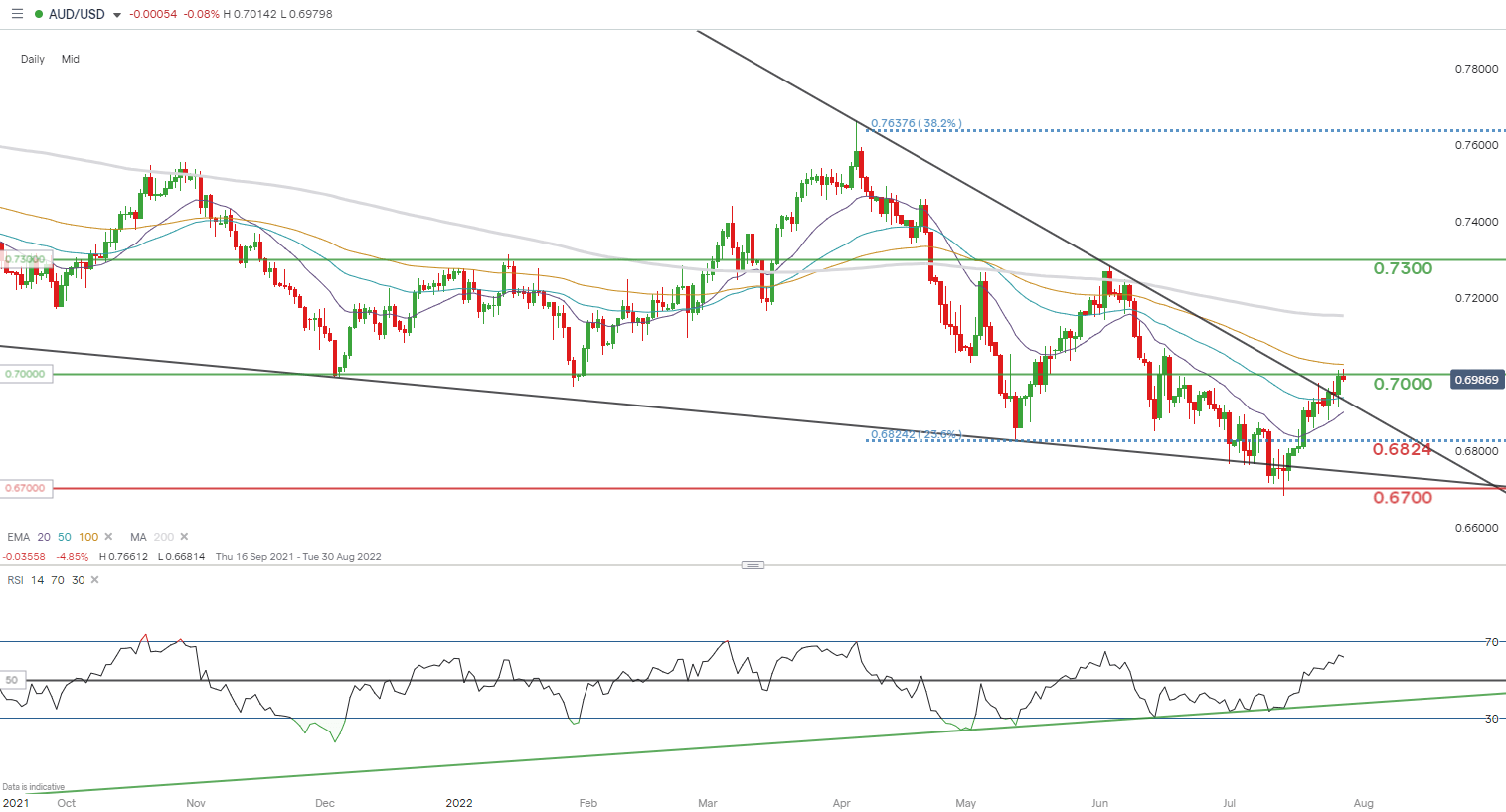

AUD/USD Daily Chart

(Click on image to enlarge)

Chart prepared by Warren Venketas, IG

Daily AUD/USD price action is tracking fundamental news with Aussie bulls pushing up against the key area of confluence around the 0.7000 psychological resistance zone. For me, the falling wedge breakout yesterday is not complete until we see a daily candle close above 0.7000. I would exercise caution up until that point as we await further fundamental guidance.

Key resistance levels:

- 100-day EMA (yellow)

- 0.7000

Key support levels:

- 50-day EMA (blue)

- 20-day EMA (purple)

- 0.6824 (23.6% Fibonacci)

IG Client Sentiment Data: Bullish

IGCS shows retail traders are currently LONG on AUD/USD, with 54% of traders currently holding long positions. At DailyFX we typically take a contrarian view to crowd sentiment however, recent changes in long and short positioning results in a short-term upside bias.

More By This Author:

S&P 500 Rallies to Six-Week-Highs, US Dollar Sinks to Support on FOMC

Rand Dollar News: USD/ZAR Falls Below 17.00 Ahead of Fed Decision Day

Coinbase Shares Slump As SEC Regulatory Noose Tightens

Disclosure: See the full disclosure for DailyFX here.