As Long As Trump Tweets His Way Randomly Through The Trade War, The Dollar Will Stay Strong

Modern asset-based models are based upon fundamentals such as money stocks, incomes, interest and inflation rates mattering. But the dollar — in which safe assets like Treasuries are denominated — is special in that risk also matters.

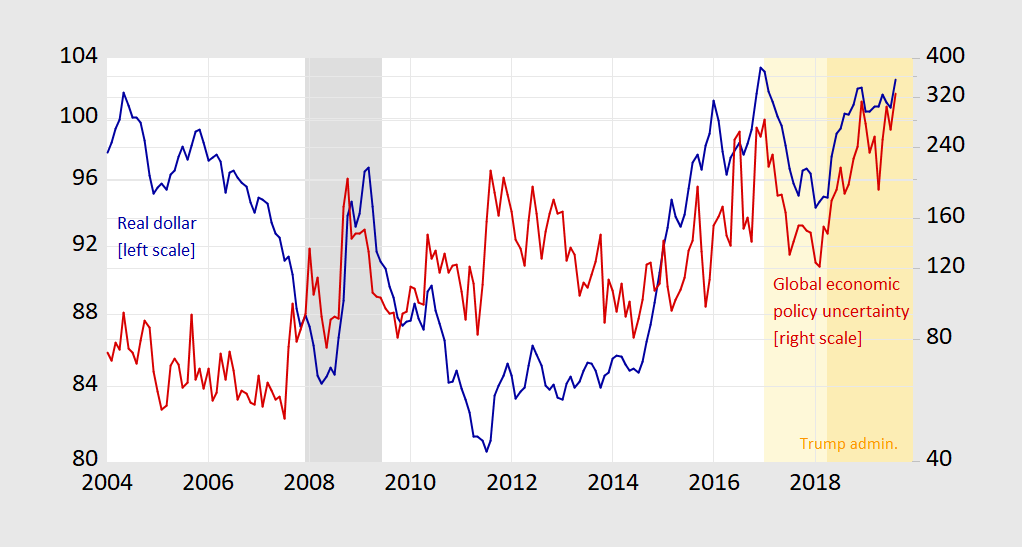

This point is quantitatively described in this post, and illustrated in the below graph:

(Click on image to enlarge)

Figure 1: Real dollar against a broad basket of currencies (blue, left log scale), global economic policy uncertainty (market weights) index (red, right scale). NBER defined recession dates shaded gray; Trump administration shaded light orange; period encompassing US Section 301 actions and retaliation shaded orange. Source: Fed via FRED, policyuncertainty.com, and NBER.

So, let me re-iterate — if Trump wants a weaker dollar and hence smaller trade deficit, he should relent on the trade threats (and last-minute backtracking). The elevated uncertainty accounts for about 12% appreciation of the US dollar.

Disclosure: None.

He is tariff man. He has no chance of changing as long as Wall Street half believes him. Cramer was right about this. Sell into the trade war and crash the market until Trump relents.