An Introduction Into Currency Futures

How Does a Currency Futures Contract Work?

A currency futures contract is an agreement to trade a set amount of one currency for that of another for a predetermined price in the future.

This is akin to locking in an exchange rate at a future date.

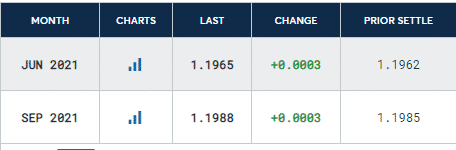

Below we have EUR/USD futures.

We can see that if we wanted to gain exposure to the Euro, we could simply buy a June Futures contract at a rate of 1.1965.

EUR/USD Micro Futures

Source: CME Group

If we buy the contract, we are locking in that exchange rate in the future. We will have to provide 1.

1965 Dollars for every Euro we receive.

As the days pass and the exchange rate changes our position will either make money (if the Euro increases in value against USD) or lose money (if it falls).

To put on this position, we only have to provide an upfront collateral of a few percent of the total position.

This is known as our maintenance margin. It allows us to trade a hundred thousand dollars of currency with as little as a few thousand dollars upfront.

Which Currencies Can I Trade?

There is a vast variety of currency futures available to the retail trader.

The majority of these are against the US Dollar due to its global currency status.

To name some of the most liquid there are the Euro, Swiss Franc, Aussie Dollar, Japanese Yen, Mexican Peso and Canadian Dollar.

In addition, we have futures which are not against the US Dollar which are known as crosses.

One popular one is the Euro/Swiss Franc cross as an example.

If there is no cross available, one can simply create one by buying one contract against the USD and selling the other against USD.

For example, to get a MXN/AUD cross one can buy a Mexican Peso Future while selling an Australian Dollar future.

Easy enough but one issue is the contracts are never the same size so it sometimes can be difficult to get equal exposures.

Using Currency Futures as a Hedging Tool

Currency futures can allow investors to reduce risk in their portfolios.

When investors invest internationally many are unaware of how much risk they are taking on simply due to their currency exposure.

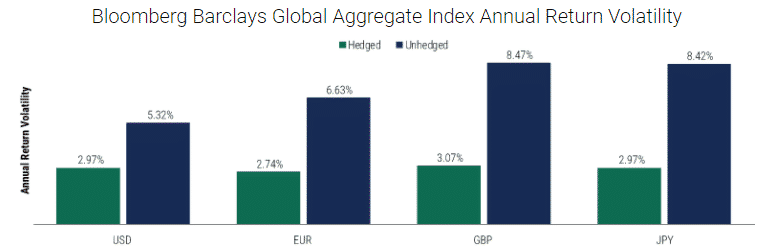

In this example below we have a global aggregate bond portfolio and their corresponding volatilities both hedged and unhedged.

Source: Pinebridge

We can see that across the board currency risk drives additional volatility across these bond portfolios.

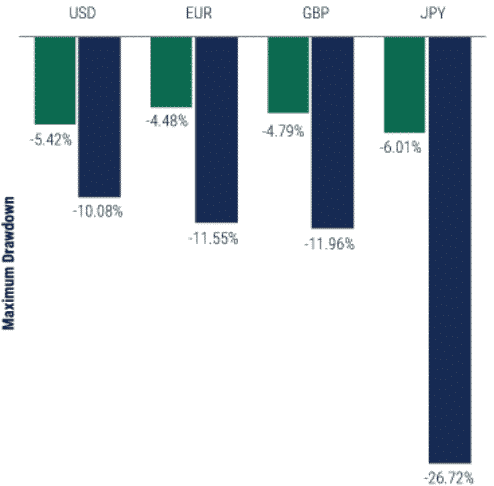

Below we have the drawdowns.

Source: Pinebridge

We can see that both volatility and drawdowns are significantly increased by not hedging currency risk.

Despite this, there are no added returns to leaving currency risk unhedged.

Let’s imagine John is a U.S investor who wants exposure to European Equities. He picks out a list of stocks he likes.

John then transfers his money into Euros and purchases them. In order to remove his currency risk, he sells a Euro Futures contract.

Now he is only exposed to the real returns of the stocks he has purchased and not the changes to the price of the Euro against the USD.

He has lowered his risk without sacrificing returns!

A Real World Example

Trader A recently moved from Ireland to the United Kingdom.

He had just bought a new home in London while selling his home in Ireland.

He would be receiving Euros for his Irish home but have to pay Pounds for his new home in London.

The issue was he had to wait for the funds to enter his account from the sale of his house in Ireland for the London home’s down payment.

So, in the meantime, if the euro fell 10% against the pound, he wouldn’t be able to afford the home in London at all.

He spent the month fretting about the exchange rate (with some justification as the rate went against him).

Ultimately the purchase went through, but he would have been able to sleep a lot easier had he simply bought Pound Euro Futures to lock in the exchange rate.

This would require him to simply post 10,000 Euros of collateral to guarantee forex rates wouldn’t affect him being able to afford his new home.

Currency Futures and the Carry Trade

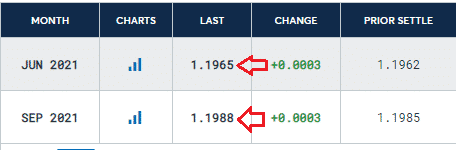

Let’s return to the original Euro/USD Futures contracts.

Did you notice something strange about it?

We can see that the price of the September Euro Future is higher than the June one. What is going on here?

This is not an error.

The value of the Euro is worth more in September than it is in June.

Why?

These differentials are due to the different interest rates across currencies. Is there a way to take advantage of this and make money?

Absolutely.

One can buy futures in a high-yielding currency against a low-yielding currency and collect the “carry” between the currencies.

This means you can make money even if the exchange rates stay the same! Of course, if the rates move against you, you will still lose money.

If you want to generate returns using the carry trade, picking high-yielding currencies for example the Mexican Peso or South African Rand to maximize carry is a good start.

The issue is with low global interest rates.

This has caused some experts to hail the “death of the carry trade” so be prepared for limited options.

A further complication is that high-yielding currencies tend to depreciate against low-yielding currencies so your final profitability on a carry trade may be a lot smaller than originally planned.

Are Currency Futures the Same as Forex?

No, but they are similar.

Forex trading involves trading the currency immediately while currency futures are trading a currency at a future date.

Both are highly similar and can be used to benefit or hedge against fluctuating currency prices.

The advantage of Forex is you are trading the world’s most liquid market.

While currency futures are very liquid, they still can’t compare with forex.

So, if you plan on speculating on the change of the Euro over the next 5 minutes to a few days forex is the way to go.

In contrast, to protect against future moves or hedge a portfolio over the longer term it is better done with currency futures.

I Only Invest in my Local Currency, are Currency Futures for Me?

Imagine a U.S Investor who is long the S&P 500 (SPY), Long Term Treasuries (TLT), and Gold (GLD).

Can currency futures still hedge their portfolio?

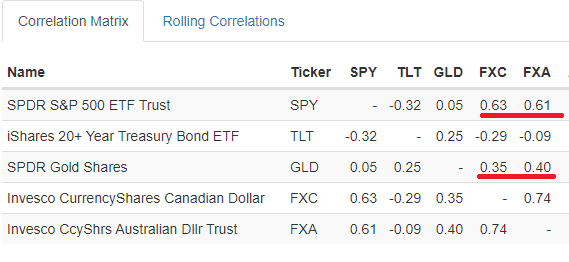

Below I have run a correlation matrix adding the Canadian Dollar (FXC) and Australian Dollar (FXA).

We can see that both currencies have a strong correlation to the S&P 500 and also gold.

All while having only a small correlation to bonds.

Since rates are around equal selling currency futures on the Australian Dollar or Canadian Dollar could potentially decrease portfolio volatility without sacrificing returns.

Of course, this trade depends on these correlations holding true in the future. If they do it is a lot cheaper than buying puts.

You can also make bearish bets by using defensive currencies.

An example being Ray Dalio who famously bet big on the Japanese Yen before the financial crisis of 2008.

Concluding Remarks

Currency futures can offer great potential for speculation, portfolio hedging and as a risk diversifier.

They provide unique exposure and leverage which can help both balance risks and take directional bets.

Despite being passed over by most retail traders they are definitely worth a second look in portfolio development.