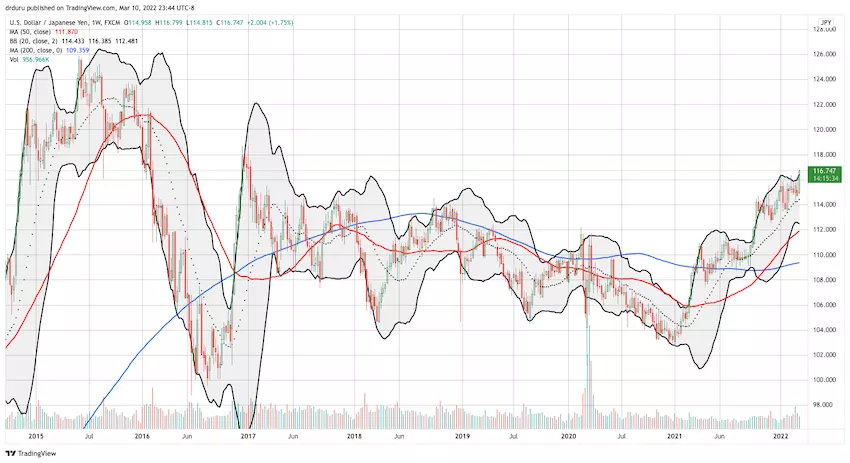

A Time To Exit USD/JPY On A Breakout To 5+ Year Highs

USD/JPY has been a slow and steady grind. As the currency pair experiences a fresh breakout, this time to 5+ year highs, I am taking the opportunity to exit the long trade I described in previous posts. The orderly rise and pullback in USD/JPY leave the potential for a quick pullback from this breakout. Otherwise, I see the nascent signs of a parabolic price run-up, and I prefer to avoid riding those. USD/JPY was last this high in the sharp run-up following the U.S. Presidential election in 2016.

(Click on image to enlarge)

(Click on image to enlarge)

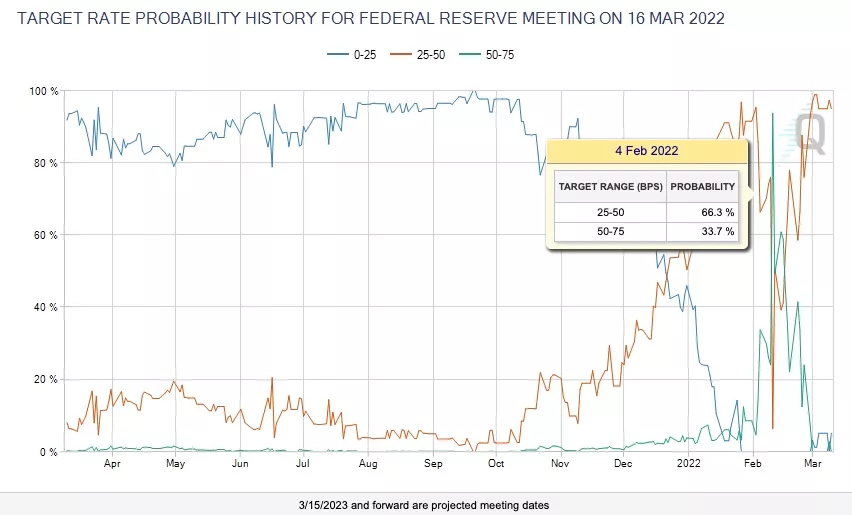

USD/JPY rebounded from its mid-January pullback as expected. However, a sharp turn in rate expectations moderated the policy divergence between the Federal Reserve and the Bank of Japan (BoJ). The technicals plus this divergence motivated my long USD/JPY position. According to the CME FedWatch tool, the odds for a 50 basis point rate hike sharply dropped on February 4th. USD/JPY rode a rebound in those odds but peaked at the last peak for those odds on February 10th. After Russia invaded Ukraine, the market drove the odds down to zero. Now the market fully expects a 25 basis point hike. The positive USD/JPY catalyst switches from policy divergence to the drain Japan may experience on its currency from soaring commodity prices. Japan is a major importer of commodities.

(Click on image to enlarge)

With the Federal Reserve's next meeting looming, I am content to sit on my hands for the USD/JPY trade. I am good waiting for the market's response and proceeding from there.

Be careful out there!

Good advice, I plan to follow it.