A Perfect Storm Is In The Making For The U.S. Economy

Image Source: Pexels

While all eyes are on the declining equity markets, far more important developments are taking place in the debt and currency markets. These developments reveal a storm is brewing not far off US financial shores. The financial markets are sending warning signals about the consequences of President Trump’s ambitions to remake the world trading order. Headlines in the financial press call readers attention to capital wars, as the primacy of the US financial system and the USD are no longer assured. The trade war has direct bearing on the future of international investment as never before experienced in the post-WW2 years.

Consider the most recent financial developments, just in the past two months:

- Tariffs still dominate the financial markets, with the S&P down 14% since the start of the year. Trump has put a 90-day hold on a new round of tariffs applied to its trading partners. However, China remains the exception with 145% tariffs on its shipments to the U.S. If this is just a stay of execution, then American importers remain under a huge rain cloud that threatens the going concern of millions of small and medium US businesses. Granted, Trump has walked back many tariffs on selective trading partners, such as Mexico and Canada, the on/off nature of trade decisions does nothing more than add to uncertainty.

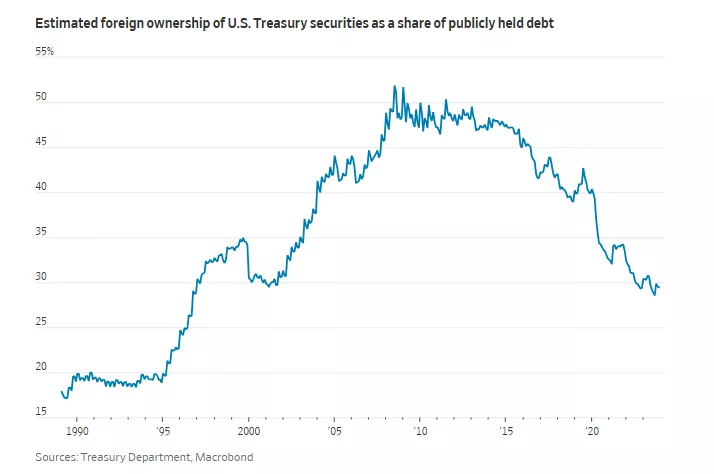

- The US Treasury market is losing its credibility as nations sell US assets.Normally, a sell off in the equity markets results in a flight to safety as investors purchase US government debt, long considered the safest of all investment vehicles. Lead by China and Japan, foreign investors have unloaded long-held positions of US public debt. Now that the U.S. is no longer viewed as a dependable trading partner, foreign investors have bought in Swiss francs, Japanese yen, euros and increasing into gold.

- The USD index just hit its lowest point since Feb 2022 and has lost 10% against its major trading partners since Trump took office in January. The USD slide reflects worldwide sentiment as to the wisdom of the US tariff policy.

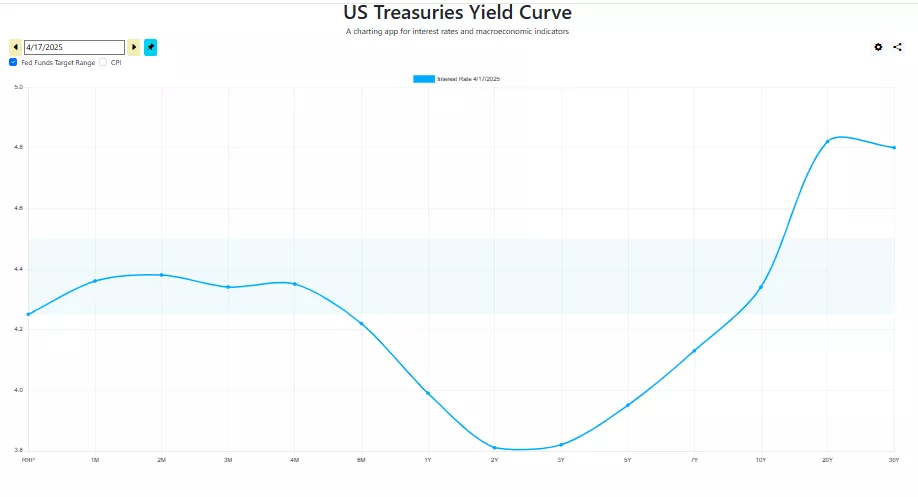

- The brutal sell -off in the long end of the yield curve reflects the understandable fear of bondholders towards inflation- induced tariffs. Investors have not witnessed such a rapid back up in yields since 1987, a year that featured a sudden and steep decline in equities. Historically, credit events featuring sudden increases in yields are a harbinger of subsequent deep declines in equity prices.

(Click on image to enlarge)

More By This Author:

The Slide In The U.S. Dollar Threatens Its World DominanceUncertainty Dominates The Decision Making At The Bank Of Canada

Trump’s Assault On The Canada-US Bilateral Trade Continues In Full Swing