Crypto Is No Longer A Non-Correlated Asset

Market Musings

- Crypto is in official bear market mode. Bitcoin briefly fell below $27,000 on Thursday. As of this writing, it’s down around 43% on the year and down about 60% from its all-time high of $67,802 last November. Ethereum dropped to close to $1,748 on Thursday. That’s down about 64% from its all-time high of just over $4,812 last November and down about 53% on the year.

- Altcoins are getting pummeled as well. Aave is down around 57% on the year. Helium is down about 68% on the year.

- The crypto markets are largely tracking with the overall stock markets right now. And the FUD (fear, uncertainty, and doubt) over interest rates, inflation, and the economy that’s driving the equity markets down is spilling over into crypto.

What Vin Is Thinking About

The short-term outlook isn’t good. Investors are spooked. And they’re treating crypto as a risk asset instead of a hedge. If it makes anyone feel better, spot gold prices have been plunging since last July and are down since March of 2022.

(Click on image to enlarge)

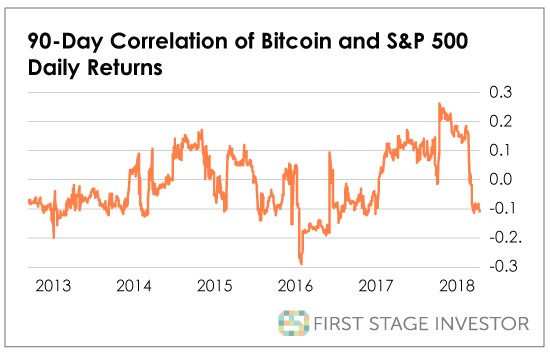

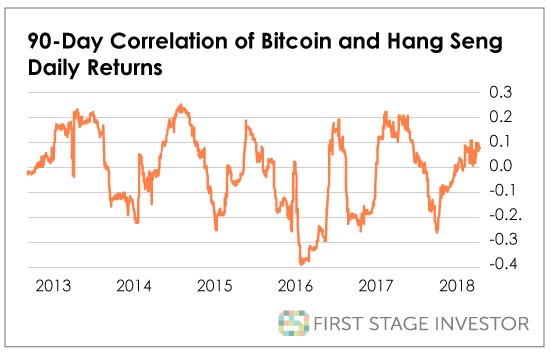

Crypto is supposed to be a non-correlated asset. In fact, we studied bitcoin’s correlation with the broader stock markets in 2018 for our First Stage Investor members. Here’s what we found.

Strong correlations begin at roughly 0.5. As you can see, bitcoin prices and stock market prices were not correlated in 2018. Fast forward to 2022 and bitcoin — at least when the equity markets are in turmoil — tends to reflect the broader markets.

The evolving nature of crypto investors and the crypto markets — which I wrote about last week — partially explains this shift (I’ll explore other factors in the future).

With turmoil in equities, more crypto flowing into exchanges for the purpose of selling AND 60% of bitcoin wallets seeing unrealized losses according to Glassnode, investors can look for prices to continue their downward trend.

And Finally…

You’ve probably never heard of Terra (UST). Honestly, I wish I had never heard of Terra. But we need to talk about Terra.

If the Riddler was trying to describe Terra, he’d ask, “when is a stablecoin not stable?”

Terra is what’s known as an algorithmic stablecoin. One UST is supposed to equal $1. Terra maintains that parity through its algorithm and burning or minting luna (rather than holding U.S. dollars and other assets in reserve).

Terra appears to work when the markets are relatively stable. But hey, this is crypto. The real test is when markets aren’t stable. And this is where Terra falls short. It turns out Terra can be “decoupled” from the dollar. For example, Terra traded for $0.69 on May 9 and $0.72 on May 10. And as of this writing, it’s trading for about $0.19! Ruh roh.

An unstable stablecoin is a problem. Last week, the Luna Foundation Guard (LFG), which runs Terra, bought about $1.5 billion worth of bitcoin. That raised LFG’s BTC reserves to $3.5 billion. LFG is lending $750 million in bitcoin and $750 million luna to trading firms to stabilize UST. And The Block is reporting that the foundation is trying to raise more than $1 billion from investors to help shore up UST.

LFG’s plan to save UST is not working. If UST continues to struggle maintaining its peg to the dollar, LFG might have to liquidate some of its bitcoin reserves to keep UST afloat. That could drive bitcoin’s price down even further. And luna, which had a market cap of more than $41 billion on April 5 and was trading for more than $118, now has a market cap of $58 million and is trading for less than a penny.

A (potentially) destabilizing stablecoin. What will they think of next?

If you want more research like this, sign up for First Stage Investor today