Consumer Inflation Is Thoroughly Contained

The October CPI report confirmed yet again what I have been saying for months: except for fictitious shelter, both headline and core inflation are well within what should be the Fed’s comfort zone.

Headline inflation (blue in the first two graphs below) was unchanged in October (thank you, a renewed decline in gas prices!) and was up 3.2% YoY. Core inflation less food and energy (red) increased 0.2% and was up 4.0% YoY.

Shelter, which is 1/3rd of the headline index, and 40% of core, increased 0.3% for the month - still the 2nd lowest increase in over 2 years - and was up 6.7% YoY. More importantly, CPI ex-shelter (gold) was *down* -0.1% for the month, and up only 1.5% YoY.

We don’t have the October read yet from the Atlanta Fed, but as of September 2021, “sticky” CPI ex-food, energy, and shelter (gray) was up 2.9 YoY, and will probably be lower for October. [I will update once it is reported later this morning]

Here’s the month-over-month look:

(Click on image to enlarge)

And here’s the YoY look:

(Click on image to enlarge)

Parenthetically, several weeks ago the Apartment List National Rent Index shows a YoY decline for the 3rd month in a row through October:

(Click on image to enlarge)

Since fictitious shelter lags the change in both house prices and apartment rents by 12 months or more, here’s the update of the YoY% change in the Case Shiller housing index vs. Owner’s Equivalent Rent:

(Click on image to enlarge)

OER rose more slowly than house prices and is coming down more slowly as well, but I expect the rate of decline to pick up a bit in the months ahead.

Aside from shelter, the only significant categories up 4.0% or higher YoY were food away from home (restaurants), up 0.4% for the month and up 5.4% YoY (vs. 6.0% last month), and transportation services (auto insurance and repairs), up 0.8% for the month and up 9.2% YoY (vs. 9.1% last month). Here’s the YoY trend in both:

(Click on image to enlarge)

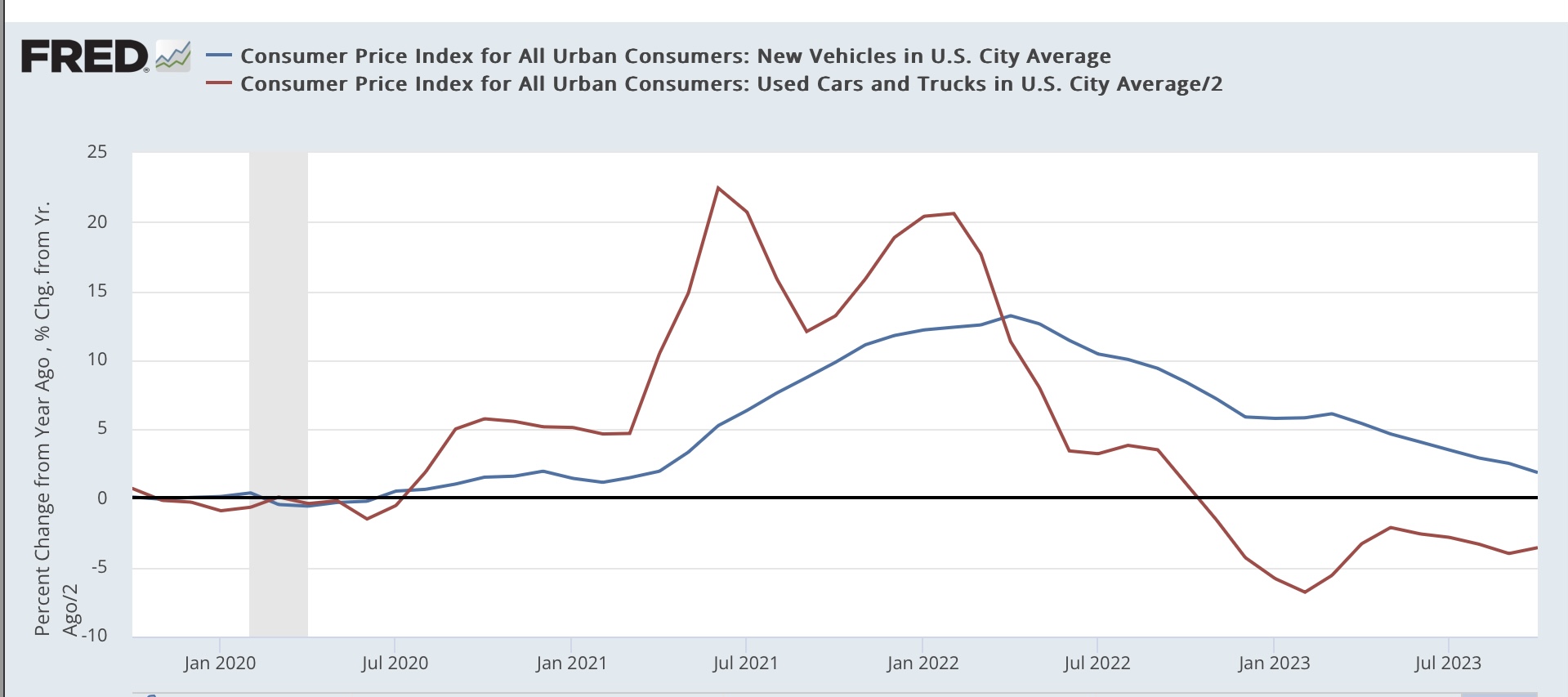

The former problem children of new vehicle prices actually *declined* -0.1% in September, and used vehicle prices (/2 for scale in the graph below) continued their cliff-diving, down -0.8%. YoY they are up 1.9% and down -7.1%, respectively:

(Click on image to enlarge)

The bottom line is, except for the lagging index of shelter, and vehicle insurance and repairs, inflation is well-contained. And if shelter were calculated realistically, headline inflation would only be up 1.8%, and core inflation up about 1.2%. We know where shelter inflation is heading because rents and house prices are already there. So the only remaining question is what happens to other prices, like gas, in the next 6 to 12 months.

More By This Author:

Why Biden Is In Trouble About The Economy?

Consumption Leads (Longer Term) Unemployment, Too

Initial Claims Continue Tame YoY

Disclaimer: This blog contains opinions and observations. It is not professional advice in any way, shape or form and should not be construed that way. In other words, buyer beware.