Polymarket Eyes NFL Season For USA Return As Prediction Markets Heat Up

Image: Caleb Woods/Unsplash

In a dramatic U-turn following its three-year hiatus, Polymarket has exploded back into the nation’s consciousness as it attempts to seduce NFL fans to use its own unique brand of sports event contracts.

The New York-based crypto prediction market platform successfully launched a nationwide ad campaign last week, which proposed that bettors could join its “waitlist” sign-up that only required a phone number in order to enroll.

Polymarket’s bold ads proactively touted headlines including “Legal football trading is coming to ALL 50 states this fall,” while also specifically targeting states such as Texas, where sports betting is prohibited. In doing so, Polymarket has clearly set its stall out, positioning itself as a federally regulated alternative to traditional sportsbooks, just weeks before the NFL kicks off on Friday, 5 September.

Fresh off the back of its recent acquisition of the federally registered exchange firm QCEX, Polymarket is now able to offer sports contracts overseen by the Commodity Futures Trading Commission (CFTC). The move replicates the same strategy as its biggest competitor, Kalshi, which also classifies its contracts as financial assets as opposed to gambling.

From controversial beginnings to global dominance

Despite a three-year absence from the U.S. market, Polymarket still remains a global powerhouse within the prediction market sector. In fact, recent Google search data shows it has attracted three times more hits than Kalshi over the last 12 months, with social media followings on X and Instagram also remaining larger and more U.S.-centric.

Beyond its expansive footprint, Polymarket’s scale is also striking, following reports by Dune Analytics that the platform has already brokered contracts in excess of $7.74 billion in 2025 alone. Such liquidity certainly underlines its readiness to be able to go toe-to-toe with the established sportsbook ahead of the NFL season, the most wagered-on U.S. market.

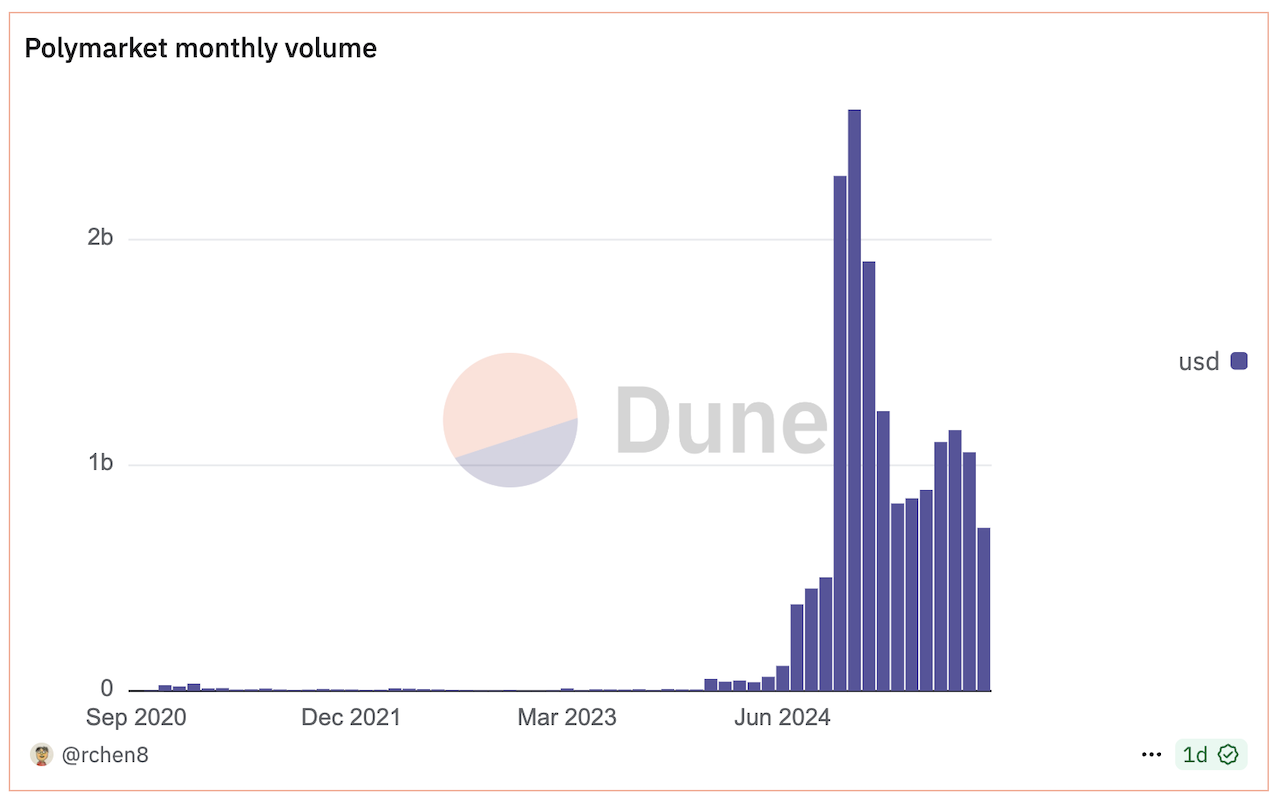

Will Polymarket return to the highs it hit during the 2024 presidential election cycle? Graph from Dune Analytics.

Polymarket’s rise came about following its polarizing 2024 U.S. presidential race event contracts, which saw the firm achieve over $2.5 billion in trading volumes in the crunch month of November. However, in spite of the fallout, the company has seized on the nation’s love of prediction markets and now consistently turns over in excess of $1 billion per month, making it the most lucrative prediction market in the world.

Due to this ongoing success, its more recent run of funding rounds has since seen the firm’s valuation soar to $1 billion, demonstrating that even amid the intense scrutiny prediction markets have faced from U.S. regulators, Polymarket continues to draw unwavering investor confidence.

Rivals crowd the field as prediction market battle intensifies

Nonetheless, competition within the crypto prediction markets is heating up as other entrants eye up the sizable U.S. sector.

These include rivals Robinhood (Nasdaq: HOOD), which recently launched its own NFL and college football prediction contracts, although at present they are locked in a legal battle to re-enter states such as Nevada and New Jersey. Similarly, Kalshi was on the receiving end of its first legislative loss in a Maryland courtroom earlier this month in an attempt to shield itself from state-imposed regulations.

The ongoing legal wranglings also haven’t stopped FanDuel from entering the fray, having recently agreed a deal with CME Group (NASDAQ: CME) providing it access to its prediction markets. This latest partnership reinforces the belief that traditional sportsbooks now also see event contracts as a lucrative avenue for further market growth.

Undoubtedly, by the time the NFL season kicks off, Polymarket, along with counterparts Kalshi, Robinhood, and FanDuel, will all be battling it out to grow their American football user base. With billions of dollars in sports betting contracts up for grabs, the new NFL season could be the ultimate catalyst to witness the U.S. prediction market enter its most dynamic chapter yet.

More By This Author:

Is Intel Stock A Buy After 10% U.S. Government Stake?

Up 85% Since April, Can Nvidia Stock Keep Rising?

Why Are Stablecoin Giants Tether, Circle Developing Blockchains?

Disclaimer: This article is NOT an investment recommendation, please see our disclaimer - Get our 10 ...

more